iShares Core MSCI Total International Stock ETF (IXUS)

Price:

84.89 USD

( - -0.61 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index. The index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging markets countries, excluding the United States.

NEWS

Bank of New York Mellon Corp Buys 9,799 Shares of iShares Core MSCI Total International Stock ETF $IXUS

defenseworld.net

2025-11-19 03:40:47Bank of New York Mellon Corp boosted its stake in iShares Core MSCI Total International Stock ETF (NASDAQ: IXUS) by 6.5% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 159,965 shares of the company's stock after purchasing an

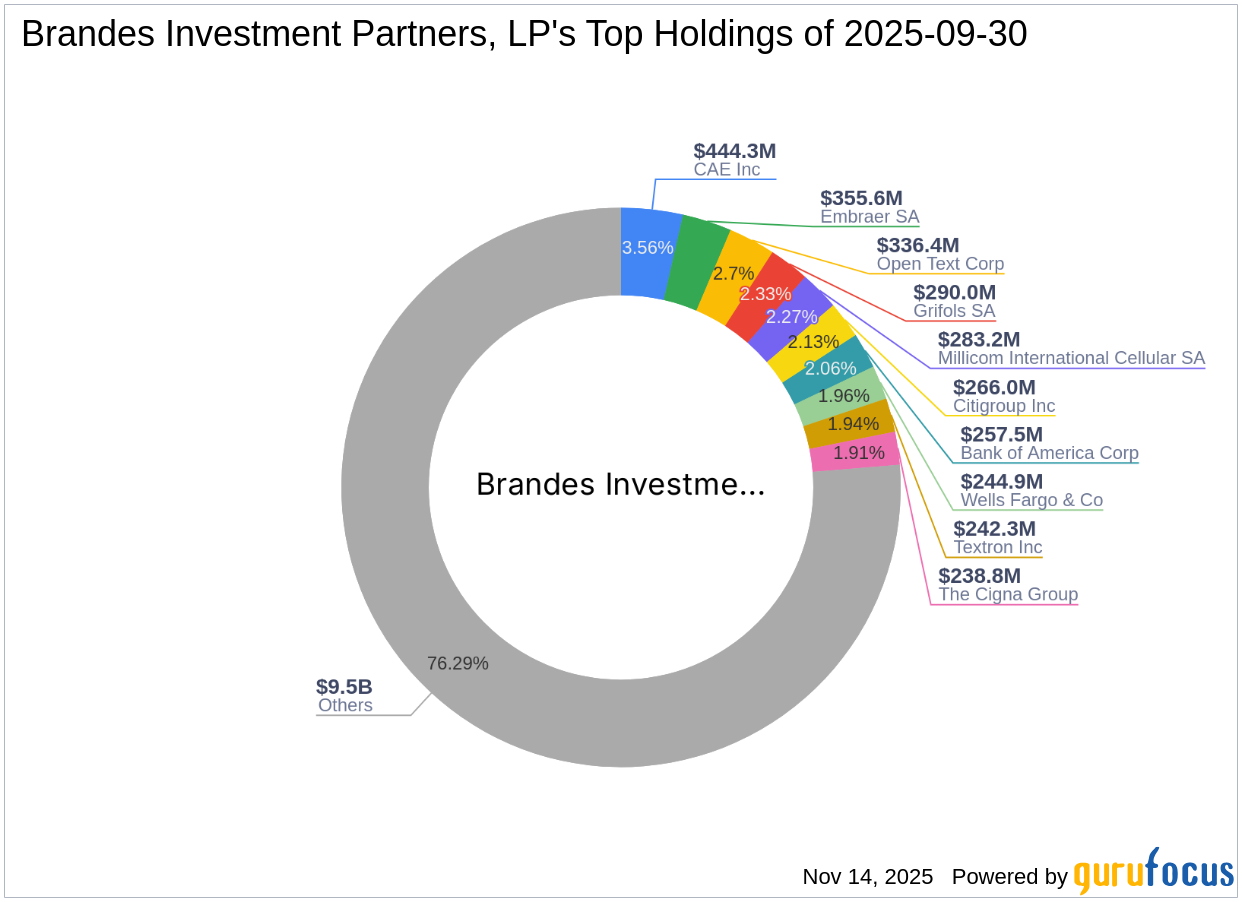

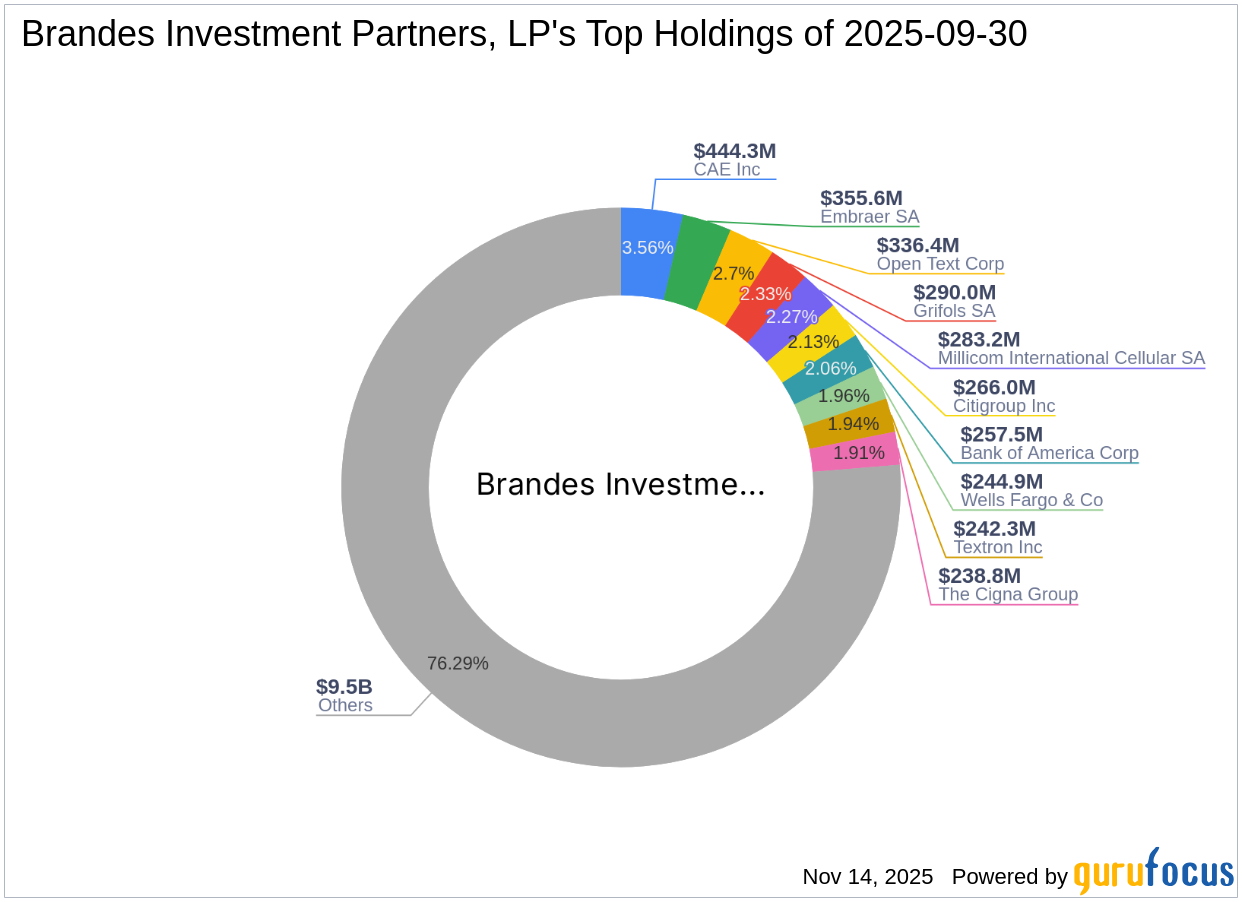

Brandes Investment Partners, LP Significantly Reduces Vanguard Value ETF by 99.61%

gurufocus.com

2025-11-14 13:01:00Exploring the Strategic Moves of Brandes Investment Partners, LP (Trades, Portfolio) in Q3 2025 Brandes Investment Partners, LP (Trades, Portfolio) recently su

Here's Why One Fund Invested $38 Million in an International Stock ETF

fool.com

2025-10-23 20:41:30Adventist Health System West added 462,368 shares of IXUS valued at an estimated $38.2 million in the third quarter. The position accounts for 6.2% of reportable 13F assets under management.

Catalyst Private Wealth Sells $3 Million Worth of iShares Core MSCI Total International Stock ETF (IXUS)

fool.com

2025-10-21 13:02:46Catalyst Private Wealth, LLC reported in a recent SEC filing dated October 7, 2025, that it reduced its holding in the iShares Trust - iShares Core MSCI Total International Stock ETF (IXUS -0.74%) by 37,829 shares. The estimated transaction value was $3.01 million.

Lineweaver Wealth Fully Exits $11.8 Million Stake in International Stock ETF

fool.com

2025-10-13 12:39:04Lineweaver Wealth Advisors fully exited its stake in the iShares Core MSCI Total International Stock ETF (IXUS 1.61%), according to an SEC filing on Friday, in an estimated $11.8 million trade.

IXUS Vs. IQLT: Why Selectivity Matters In International Investing

seekingalpha.com

2025-09-30 03:11:41iShares Core MSCI Total International Stock ETF provides extremely broad international exposure at a very low cost but sacrifices quality by including thousands of weaker companies. IXUS's wide breadth dilutes returns, as many international firms lag U.S. peers in both growth and profitability. In contrast, quality-screened ETFs like IQLT concentrate on high-ROE, low-leverage companies, resulting in stronger returns, faster recoveries from drawdowns, and better long-term compounding despite higher valuation multiples.

IXUS: Delayed Tariff Blowback Possible

seekingalpha.com

2025-09-28 21:00:12The iShares Core MSCI Total International Stock ETF faces macroeconomic headwinds due to global trade tensions and deflationary risks, especially in China. IXUS's heavy exposure to export-led economies and cyclical sectors increases vulnerability to tariffs, protectionism, and weakening global demand. Tariffs should be dealing a delayed blow. It's just bad to remove a group of people from the viable market for often quite commodified products. Ex-US has clear risks.

IXUS: International Stocks Now 8 Turns Cheaper Than The S&P 500

seekingalpha.com

2025-07-11 11:00:00I maintain a buy rating on IXUS, driven by strong year-to-date momentum and attractive valuations versus the S&P 500. IXUS offers broad international diversification, low expenses, a higher yield, and a favorable PEG ratio, making it a compelling core holding. Technical analysis confirms a long-term breakout with bullish momentum, though some resistance and seasonal caution are warranted.

5 Most-Loved ETFs of Last Week

zacks.com

2025-05-06 11:15:42VOO, IBIT, IXUS, IQLT and USHY emerge as the most loved ETFs of last week.

IXUS: A 9% Total Return Expected In The Long Term

seekingalpha.com

2025-04-29 15:03:08The iShares Core MSCI Total International Stock ETF invests in both developed and emerging markets outside the United States. The ETF has had a strong start to 2025, benefitting from attractive valuations and a weak US dollar. Recent IXUS dividend growth has been particularly strong, at 8.43%, but I only expect dividends to increase by 6% in the long term.

IXUS: Fair Valuation And Macroeconomic Environment Turning Favorable

seekingalpha.com

2024-10-14 23:28:41iShares Core MSCI Total International Stock ETF, with a low expense ratio of 0.07%, holds 4,500 international stocks and benefits from receding global inflation and rate cuts by major central banks. Despite underperforming due to low tech exposure, IXUS is poised for growth with a favorable macroeconomic environment and a weakening U.S. dollar. The global composite PMI and consensus earnings growth for IXUS stocks are improving, indicating a stronger economic outlook and higher earnings in 2025 and 2026.

IXUS: A Cheap Way To Add International Exposure

seekingalpha.com

2024-07-22 11:47:53The iShares Core MSCI Total International Stock ETF tracks large, mid, and small capitalization companies outside the United States. IXUS has underperformed the Vanguard Total Stock Market ETF both in 2024 and over the past three years. This has resulted in IXUS offering a significantly higher earnings and dividend yield compared to the VTI.

Want a Well-Rounded Retirement Portfolio? Invest in These 4 ETFs in 2024

fool.com

2024-01-02 07:01:00The S&P 500 and Russell 2000 are the primary benchmarks for large-cap and small-cap stocks. A broad international ETF should include companies from developed and emerging markets.

IXUS: A Case For Longer-Term Positioning But Questionable Now

seekingalpha.com

2023-10-25 13:35:06iShares Core MSCI Total International Stock ETF offers diversification with global equities outside the US. IXUS tracks the MSCI ACWI ex USA IMI index, providing exposure to large-cap, mid-cap, and small-cap non-US equities. The ETF has a highly diversified portfolio with over 4,000 stocks, but caution is advised due to potential risks in the current global economic backdrop.

VettaFi Voices On: International Investing's Revival

etftrends.com

2023-08-11 20:25:46There's been more talk lately about aiming for diversification through international investing, which wasn't a major topic of discussion for a while.

The S&P 500 Is a Megacap Tech Fund. Where to Invest Instead.

barrons.com

2023-07-07 01:30:00To capture the market's full potential return, investment strategists recommend adding exposure to international markets, value stocks, and small- and mid-cap companies.

No data to display

Bank of New York Mellon Corp Buys 9,799 Shares of iShares Core MSCI Total International Stock ETF $IXUS

defenseworld.net

2025-11-19 03:40:47Bank of New York Mellon Corp boosted its stake in iShares Core MSCI Total International Stock ETF (NASDAQ: IXUS) by 6.5% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 159,965 shares of the company's stock after purchasing an

Brandes Investment Partners, LP Significantly Reduces Vanguard Value ETF by 99.61%

gurufocus.com

2025-11-14 13:01:00Exploring the Strategic Moves of Brandes Investment Partners, LP (Trades, Portfolio) in Q3 2025 Brandes Investment Partners, LP (Trades, Portfolio) recently su

Here's Why One Fund Invested $38 Million in an International Stock ETF

fool.com

2025-10-23 20:41:30Adventist Health System West added 462,368 shares of IXUS valued at an estimated $38.2 million in the third quarter. The position accounts for 6.2% of reportable 13F assets under management.

Catalyst Private Wealth Sells $3 Million Worth of iShares Core MSCI Total International Stock ETF (IXUS)

fool.com

2025-10-21 13:02:46Catalyst Private Wealth, LLC reported in a recent SEC filing dated October 7, 2025, that it reduced its holding in the iShares Trust - iShares Core MSCI Total International Stock ETF (IXUS -0.74%) by 37,829 shares. The estimated transaction value was $3.01 million.

Lineweaver Wealth Fully Exits $11.8 Million Stake in International Stock ETF

fool.com

2025-10-13 12:39:04Lineweaver Wealth Advisors fully exited its stake in the iShares Core MSCI Total International Stock ETF (IXUS 1.61%), according to an SEC filing on Friday, in an estimated $11.8 million trade.

IXUS Vs. IQLT: Why Selectivity Matters In International Investing

seekingalpha.com

2025-09-30 03:11:41iShares Core MSCI Total International Stock ETF provides extremely broad international exposure at a very low cost but sacrifices quality by including thousands of weaker companies. IXUS's wide breadth dilutes returns, as many international firms lag U.S. peers in both growth and profitability. In contrast, quality-screened ETFs like IQLT concentrate on high-ROE, low-leverage companies, resulting in stronger returns, faster recoveries from drawdowns, and better long-term compounding despite higher valuation multiples.

IXUS: Delayed Tariff Blowback Possible

seekingalpha.com

2025-09-28 21:00:12The iShares Core MSCI Total International Stock ETF faces macroeconomic headwinds due to global trade tensions and deflationary risks, especially in China. IXUS's heavy exposure to export-led economies and cyclical sectors increases vulnerability to tariffs, protectionism, and weakening global demand. Tariffs should be dealing a delayed blow. It's just bad to remove a group of people from the viable market for often quite commodified products. Ex-US has clear risks.

IXUS: International Stocks Now 8 Turns Cheaper Than The S&P 500

seekingalpha.com

2025-07-11 11:00:00I maintain a buy rating on IXUS, driven by strong year-to-date momentum and attractive valuations versus the S&P 500. IXUS offers broad international diversification, low expenses, a higher yield, and a favorable PEG ratio, making it a compelling core holding. Technical analysis confirms a long-term breakout with bullish momentum, though some resistance and seasonal caution are warranted.

5 Most-Loved ETFs of Last Week

zacks.com

2025-05-06 11:15:42VOO, IBIT, IXUS, IQLT and USHY emerge as the most loved ETFs of last week.

IXUS: A 9% Total Return Expected In The Long Term

seekingalpha.com

2025-04-29 15:03:08The iShares Core MSCI Total International Stock ETF invests in both developed and emerging markets outside the United States. The ETF has had a strong start to 2025, benefitting from attractive valuations and a weak US dollar. Recent IXUS dividend growth has been particularly strong, at 8.43%, but I only expect dividends to increase by 6% in the long term.

IXUS: Fair Valuation And Macroeconomic Environment Turning Favorable

seekingalpha.com

2024-10-14 23:28:41iShares Core MSCI Total International Stock ETF, with a low expense ratio of 0.07%, holds 4,500 international stocks and benefits from receding global inflation and rate cuts by major central banks. Despite underperforming due to low tech exposure, IXUS is poised for growth with a favorable macroeconomic environment and a weakening U.S. dollar. The global composite PMI and consensus earnings growth for IXUS stocks are improving, indicating a stronger economic outlook and higher earnings in 2025 and 2026.

IXUS: A Cheap Way To Add International Exposure

seekingalpha.com

2024-07-22 11:47:53The iShares Core MSCI Total International Stock ETF tracks large, mid, and small capitalization companies outside the United States. IXUS has underperformed the Vanguard Total Stock Market ETF both in 2024 and over the past three years. This has resulted in IXUS offering a significantly higher earnings and dividend yield compared to the VTI.

Want a Well-Rounded Retirement Portfolio? Invest in These 4 ETFs in 2024

fool.com

2024-01-02 07:01:00The S&P 500 and Russell 2000 are the primary benchmarks for large-cap and small-cap stocks. A broad international ETF should include companies from developed and emerging markets.

IXUS: A Case For Longer-Term Positioning But Questionable Now

seekingalpha.com

2023-10-25 13:35:06iShares Core MSCI Total International Stock ETF offers diversification with global equities outside the US. IXUS tracks the MSCI ACWI ex USA IMI index, providing exposure to large-cap, mid-cap, and small-cap non-US equities. The ETF has a highly diversified portfolio with over 4,000 stocks, but caution is advised due to potential risks in the current global economic backdrop.

VettaFi Voices On: International Investing's Revival

etftrends.com

2023-08-11 20:25:46There's been more talk lately about aiming for diversification through international investing, which wasn't a major topic of discussion for a while.

The S&P 500 Is a Megacap Tech Fund. Where to Invest Instead.

barrons.com

2023-07-07 01:30:00To capture the market's full potential return, investment strategists recommend adding exposure to international markets, value stocks, and small- and mid-cap companies.