iShares 1-3 Year International Treasury Bond ETF (ISHG)

Price:

75.57 USD

( - -0.41 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Credit Suisse X-Links Gold Shares Covered Call ETN

VALUE SCORE:

9

2nd position

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

The best

Chicago Atlantic BDC, Inc.

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund will invest at least 80% of its assets in the component securities of the underlying index, and it will invest at least 90% of its assets in fixed income securities of the types included in the underlying index that BFA believes will help the fund track the underlying index. The index is the performance of fixed-rate, local currency, investment-grade, sovereign bonds from certain developed markets. The fund is non-diversified.

NEWS

ISHG: A Useful Dollar Hedge For U.S. Investors

seekingalpha.com

2025-06-16 09:44:43ISHG is best used as a hedge against a significant decline in the US dollar, not as a core money-making investment. The ETF offers low credit and interest rate risk, but its long-term performance has been poor in nominal and real terms. Its value lies in insurance for USD-based investors worried about currency risk, providing positive carry unlike other FX hedges.

Is It Time to Load Up on Bond ETFs?

marketbeat.com

2025-05-02 07:32:33U.S. Treasury yields remain elevated after a spike following President Trump's tariff announcements earlier this year. With long-term Treasury yields still close to multi-year highs, investors are tempted to pivot away from stocks in favor of the bond market at this time.

3 Strong Performing Bond ETFs That Look Overseas

etftrends.com

2025-04-24 07:47:46Bond ETFs are in demand in 2025. With less than a third of the year complete, the industry has gathered $110 billion of net inflows.

6 ETFs Showing Great Resilience Amid Market Sell-Offs

zacks.com

2025-04-11 09:30:37U.S. stocks have been witnessing massive sell-offs this month due to trade tensions. However, these ETFs survived the bloodbath.

Is A Steepening Yield Curve in the Cards? ETFs to Benefit

zacks.com

2023-09-06 14:17:06As wage growth slows down, many analysts noted that the Fed may have to decrease borrowing costs to prevent tightening of the real rate or inflation-adjusted policy rate.

SHY Vs. ISHG Bond ETFs For When The Economy Slows Further

seekingalpha.com

2023-09-06 07:55:02As the odds of a global economic slowdown grow, bond ETFs are an interesting potential investing opportunity, if well-timed to coincide with central banks lowering interest rates. The SHY ETF offers bond exposure with no currency exchange risks/rewards involved, while the ISHG bond ETF offers exposure to bonds denominated predominantly in euros. Uncertain global macroeconomic situation and potential negative surprises make bonds worth considering, but timing is crucial.

Capital Markets Weekly: Emerging Market Issuers Continue Pushing Debt Maturity Threshold

seekingalpha.com

2020-07-19 07:02:58Among this week's highlights indicating emerging market focus on accessing long-term debt are a 30-year issue for the Emirate of Sharjah and plans by Brazilian petrochemical company Braskem to raise hybrid debt, following recent perpetual sales by Emirates NBD, Banorte and DP World.

No Longer Superheroes? Twilight Of The Bonds

seekingalpha.com

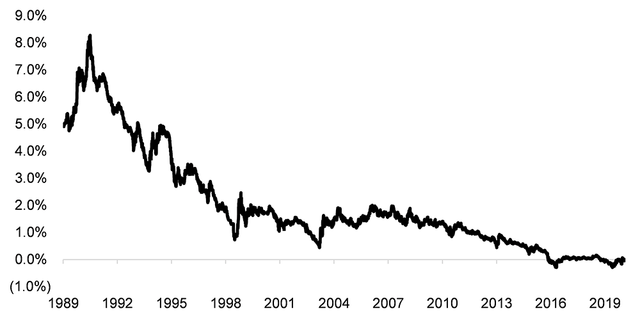

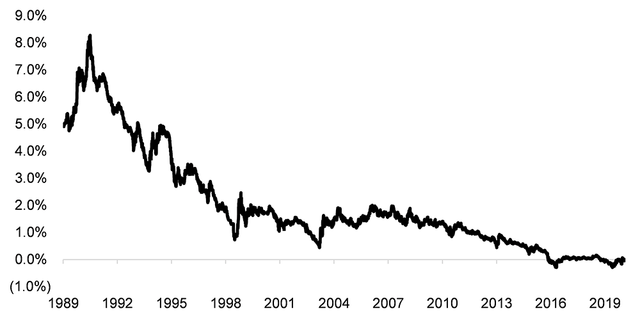

2020-06-22 07:21:09Over the last 40 years, bonds were the superheroes of investment portfolios. They generated high risk-adjusted returns given steadily declining yields and were

No data to display

ISHG: A Useful Dollar Hedge For U.S. Investors

seekingalpha.com

2025-06-16 09:44:43ISHG is best used as a hedge against a significant decline in the US dollar, not as a core money-making investment. The ETF offers low credit and interest rate risk, but its long-term performance has been poor in nominal and real terms. Its value lies in insurance for USD-based investors worried about currency risk, providing positive carry unlike other FX hedges.

Is It Time to Load Up on Bond ETFs?

marketbeat.com

2025-05-02 07:32:33U.S. Treasury yields remain elevated after a spike following President Trump's tariff announcements earlier this year. With long-term Treasury yields still close to multi-year highs, investors are tempted to pivot away from stocks in favor of the bond market at this time.

3 Strong Performing Bond ETFs That Look Overseas

etftrends.com

2025-04-24 07:47:46Bond ETFs are in demand in 2025. With less than a third of the year complete, the industry has gathered $110 billion of net inflows.

6 ETFs Showing Great Resilience Amid Market Sell-Offs

zacks.com

2025-04-11 09:30:37U.S. stocks have been witnessing massive sell-offs this month due to trade tensions. However, these ETFs survived the bloodbath.

Is A Steepening Yield Curve in the Cards? ETFs to Benefit

zacks.com

2023-09-06 14:17:06As wage growth slows down, many analysts noted that the Fed may have to decrease borrowing costs to prevent tightening of the real rate or inflation-adjusted policy rate.

SHY Vs. ISHG Bond ETFs For When The Economy Slows Further

seekingalpha.com

2023-09-06 07:55:02As the odds of a global economic slowdown grow, bond ETFs are an interesting potential investing opportunity, if well-timed to coincide with central banks lowering interest rates. The SHY ETF offers bond exposure with no currency exchange risks/rewards involved, while the ISHG bond ETF offers exposure to bonds denominated predominantly in euros. Uncertain global macroeconomic situation and potential negative surprises make bonds worth considering, but timing is crucial.

Capital Markets Weekly: Emerging Market Issuers Continue Pushing Debt Maturity Threshold

seekingalpha.com

2020-07-19 07:02:58Among this week's highlights indicating emerging market focus on accessing long-term debt are a 30-year issue for the Emirate of Sharjah and plans by Brazilian petrochemical company Braskem to raise hybrid debt, following recent perpetual sales by Emirates NBD, Banorte and DP World.

No Longer Superheroes? Twilight Of The Bonds

seekingalpha.com

2020-06-22 07:21:09Over the last 40 years, bonds were the superheroes of investment portfolios. They generated high risk-adjusted returns given steadily declining yields and were