Invesco Quality Municipal Income Trust (IQI)

Price:

9.90 USD

( - -0.02 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Nuveen Quality Municipal Income Fund

VALUE SCORE:

4

2nd position

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

The best

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Invesco Quality Municipal Income Trust is a closed-ended fixed income mutual fund launched by Invesco Ltd. The fund is co-managed by Invesco Advisers, Inc., INVESCO Asset Management Deutschland GmbH, INVESCO Asset Management Limited, INVESCO Asset Management (Japan) Limited, Invesco Hong Kong Limited, INVESCO Senior Secured Management, Inc., and Invesco Canada Ltd. It invests in the fixed income markets of the United States. The fund primarily invests in investment grade municipal securities which include municipal bonds, municipal notes, and municipal commercial paper. It employs fundamental analysis with bottom-up security selection approach to create its portfolio. The fund was previously known as Morgan Stanley Quality Municipal Income Trust. Invesco Quality Municipal Income Trust was formed on September 29, 1992 and is domiciled in the United States.

NEWS

IQI: Further Discount Narrowing With Friendlier Rate Environment

seekingalpha.com

2025-09-21 04:01:07Invesco Quality Municipal Income Trust has benefited from easing Treasury yields and a narrowing discount, though it's now less attractively valued. IQI's leveraged structure and high-quality, diversified muni bond portfolio position it to outperform in a declining rate environment, due to significant interest rate sensitivity. Distribution coverage remains weak, but anticipated Fed rate cuts could improve net investment income, and the current payout seems likely to continue despite the shortfall.

WINVEST GROUP SUBSIDIARY IQI MEDIA PARTNERS WITH BIOCALTH TO DRIVE DIRECT-TO-CONSUMER SALES

prnewswire.com

2025-08-22 08:00:00RENO, Nev. , Aug. 22, 2025 /PRNewswire/ -- Winvest Group Limited (OTCQB: WNLV) ("Winvest"), an investment holding company with diverse media, entertainment, and technology portfolios, is pleased to announced that its subsidiary IQI Media Inc. has partnered with BioCalth International Inc., a world leader in the development of proprietary health supplements, to help BioCalth grow its direct-to-consumer sales. The two companies have entered into a content management agreement with profit-sharing incentives that they hope will lead to a long-term relationship marked by increased revenue and brand recognition for BioCalth.

WINVEST GROUP LIMITED SUBSIDIARY IQI MEDIA PREPARES TO TACKLE HOLLYWOOD'S STREAMING CHAOS WITH LAUNCHRR

prnewswire.com

2025-06-18 09:00:00RENO, Nev. , June 18, 2025 /PRNewswire/ -- Winvest Group Limited (OTCQB: WNLV) ("Winvest"), an investment holding company with diverse media, entertainment, and technology portfolios, is pleased to announce that its Los Angeles-based subsidiary IQI Media Inc. is getting closer to offering late Q2 beta demos of Launchrr, its proprietary Software as a Service (SaaS) solution for the film and television industry. "Hollywood has a well-known resistance to change, but Launchrr is designed to break through by addressing the industry's most pressing paint points," said Khiow Hui Lim, Founder of IQI Media and Chief Strategy Officer at Winvest.

IQI: Discount Narrowing Drives Results On The Back Of Increased Distribution

seekingalpha.com

2025-05-22 12:25:16IQI offers tax-free income through investment-grade municipal bonds, a usually less exciting area of the investment world, but CEFs add leverage and discount/premium considerations. The fund's discount narrowed due to a significant distribution increase last year, but current distributions aren't fully supported by income generation. For that reason, it has become more of a combination of tax-free and tax-deferred distributions, through classifications of return of capital in the payout.

Three ‘Hidden' 12.5% Dividends To Buy Now (Before Rates Drop)

forbes.com

2025-02-15 13:22:00No two ways about it: This stock market is getting twitchy, and it's (frankly beyond) time for all investors to take it seriously.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-12-02 12:00:00ATLANTA , Dec. 2, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. EX-DATE RECORD DATE REINVEST DATE PAYABLE DATE 12/17/2024 12/17/2024 12/31/2024 12/31/2024 Name of Closed-EndManagement Investment Company Ticker MonthlyDividend Per Share ChangeFrom PriorDistribution % ChangeFrom PriorDistribution Invesco Advantage Municipal Income Trust II VKI $0.05591 - - Invesco Bond Fund VBF $0.08501 +0.0110 +15 % Invesco California Value Municipal Income Trust VCV $0.06461 - - Invesco Municipal Income Opportunities Trust OIA $0.0291 - - Invesco Municipal Opportunity Trust VMO $0.06251 - - Invesco Municipal Trust VKQ $0.06281 - - Invesco Pennsylvania Value Municipal Income Trust VPV $0.06671 - - Invesco Quality Municipal Income Trust IQI $0.06311 - - Invesco Trust for Investment Grade Municipals VGM $0.06461 - - Invesco Trust for Investment Grade New York Municipals VTN $0.06851 - - Invesco Value Municipal Income Trust IIM $0.07711 - - 1 A portion of this distribution is estimated to be from a return of principal rather than net income.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-11-01 12:00:00ATLANTA , Nov. 1, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. EX-DATE RECORD DATE REINVEST DATE PAYABLE DATE 11/15/2024 11/15/2024 11/29/2024 11/29/2024 Name of Closed-EndManagement Investment Company Ticker MonthlyDividend Per Share ChangeFrom PriorDistribution % ChangeFrom PriorDistribution Invesco Advantage Municipal Income Trust II VKI $0.05591 - - Invesco Bond Fund VBF $0.07401 - - Invesco California Value Municipal Income Trust VCV $0.06461 - - Invesco High Income 2024 Target Term Fund IHTA $0.0200 - - Invesco Municipal Income Opportunities Trust OIA $0.0291 - - Invesco Municipal Opportunity Trust VMO $0.06251 - - Invesco Municipal Trust VKQ $0.06281 - - Invesco Pennsylvania Value Municipal Income Trust VPV $0.06671 - - Invesco Quality Municipal Income Trust IQI $0.06311 - - Invesco Trust for Investment Grade Municipals VGM $0.06461 - - Invesco Trust for Investment Grade New York Municipals VTN $0.06851 - - Invesco Value Municipal Income Trust IIM $0.07711 - - 1 A portion of this distribution is estimated to be from a return of principal rather than net income.

Invesco Closed-End Funds Announce Increased Distribution Rates for All Investment Grade Municipal Bond Closed-End Funds and Declare Dividends

prnewswire.com

2024-09-03 12:15:00ATLANTA , Sept. 3, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends.

Invesco Closed-End Funds Announce Increased Distribution Rates for All Investment Grade Municipal Bond Closed-End Funds and Declare Dividends

prnewswire.com

2024-08-01 12:00:00ATLANTA , Aug. 1, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. EX-DATE RECORD DATE REINVEST DATE PAYABLE DATE 8/16/2024 8/16/2024 8/30/2024 8/30/2024 Name of Closed-EndManagement Investment Company Ticker MonthlyDividend Per Share ChangeFrom PriorDistribution % ChangeFrom PriorDistribution Invesco Advantage Municipal Income Trust II VKI $0.05591 - - Invesco Bond Fund VBF $0.0715 - - Invesco California Value Municipal Income Trust VCV $0.06461 - - Invesco High Income 2024 Target Term Fund IHTA $0.0200 -0.0130 -39 % Invesco Municipal Income Opportunities Trust OIA $0.02911 - - Invesco Municipal Opportunity Trust VMO $0.06251 - - Invesco Municipal Trust VKQ $0.06281 - - Invesco Pennsylvania Value Municipal Income Trust VPV $0.06671 - - Invesco Quality Municipal Income Trust IQI $0.06311 - - Invesco Trust for Investment Grade Municipals VGM $0.06461 - - Invesco Trust for Investment Grade New York Municipals VTN $0.06851 - - Invesco Value Municipal Income Trust IIM $0.07711 - - 1 A portion of this distribution is estimated to be from a return of principal rather than net income.

Invesco Closed-End Funds Announce Increased Distribution Rates for All Investment Grade Municipal Bond Closed-End Funds and Declare Dividends

prnewswire.com

2024-05-23 12:15:00ATLANTA , May 23, 2024 /PRNewswire/ -- The Board of Trustees authorized several Invesco closed-end funds to declare dividends. This action includes an increase in the distribution rate for all investment grade municipal bond closed-end funds.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-04-01 12:15:00ATLANTA , April 1, 2024 /PRNewswire/ -- Today, the Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. Several leveraged municipal closed-end funds have announced distribution rate increases of between 9% and 23% to deliver higher monthly cash flows to shareholders.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-01-29 13:30:00ATLANTA , Jan. 29, 2024 /PRNewswire/ -- Today, the Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. Several leveraged municipal closed-end funds have announced distribution rate increases of between 9% and 23% to deliver higher monthly cash flows to shareholders.

Invesco Advisers Announces Portfolio Management Changes for Invesco Municipal Closed-End Funds

prnewswire.com

2023-06-08 09:15:00ATLANTA , June 8, 2023 /PRNewswire/ -- Invesco Advisers, Inc., a subsidiary of Invesco Ltd. (NYSE: IVZ), announced today portfolio management changes for the following Invesco closed-end municipal funds (the "Funds"): Invesco Advantage Municipal Income Trust II (NYSE American: VKI) Invesco California Value Municipal Income Trust (NYSE: VCV) Invesco Municipal Income Opportunities Trust (NYSE: OIA) Invesco Municipal Opportunity Trust (NYSE: VMO) Invesco Municipal Trust (NYSE: VKQ) Invesco Pennsylvania Value Municipal Income Trust (NYSE: VPV) Invesco Quality Municipal Income Trust (NYSE: IQI) Invesco Trust for Investment Grade Municipals (NYSE: VGM) Invesco Trust for Investment Grade New York Municipals (NYSE: VTN) Invesco Value Municipal Income Trust (NYSE: IIM) Effective June 30, 2023, the following individuals are jointly and primarily responsible for the day-to-day management of Invesco Advantage Municipal Income Trust II, Invesco Municipal Opportunity Trust, Invesco Municipal Trust, Invesco Quality Municipal Income Trust, Invesco Trust for Investment Grade Municipals and Invesco Value Municipal Income Trust's portfolio: Mark Paris, Portfolio Manager, who has been associated with Invesco and/or its affiliates since 2010.

IIM And IQI: High-Quality Muni Funds, But Leverage Adds Volatility And Risks

seekingalpha.com

2023-05-02 16:23:54IIM and IQI are leveraged municipal bond closed-end funds. This leverage meant sharper downside moves when rates were rising, but it could also mean sharper upside moves if rates reverse lower.

5 Top Yielding Companies With Low Price-Earnings Ratios

gurufocus.com

2020-10-27 12:30:09As of Oct. 27, the GuruFocus All-in-One Screener, a Premium feature, found that the following companies have low price-earnings ratios and are owned by gurus. While some of them are great value investments, others may need to be researched more carefully, according to the discounted cash flow calculator.

Weekly Closed-End Fund Roundup: August 30, 2020

seekingalpha.com

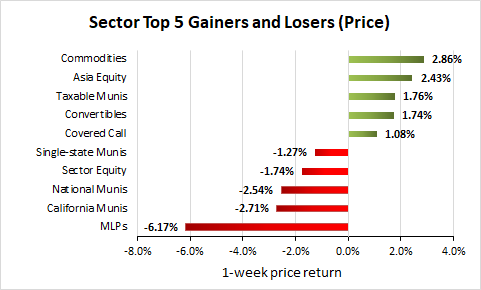

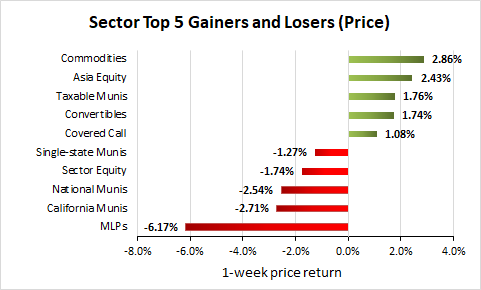

2020-09-09 08:15:0713 out of 23 CEF sectors positive on price and 16 out of 23 sectors positive on NAV last week. Commodities lead while MLPs lag.

IQI: Further Discount Narrowing With Friendlier Rate Environment

seekingalpha.com

2025-09-21 04:01:07Invesco Quality Municipal Income Trust has benefited from easing Treasury yields and a narrowing discount, though it's now less attractively valued. IQI's leveraged structure and high-quality, diversified muni bond portfolio position it to outperform in a declining rate environment, due to significant interest rate sensitivity. Distribution coverage remains weak, but anticipated Fed rate cuts could improve net investment income, and the current payout seems likely to continue despite the shortfall.

WINVEST GROUP SUBSIDIARY IQI MEDIA PARTNERS WITH BIOCALTH TO DRIVE DIRECT-TO-CONSUMER SALES

prnewswire.com

2025-08-22 08:00:00RENO, Nev. , Aug. 22, 2025 /PRNewswire/ -- Winvest Group Limited (OTCQB: WNLV) ("Winvest"), an investment holding company with diverse media, entertainment, and technology portfolios, is pleased to announced that its subsidiary IQI Media Inc. has partnered with BioCalth International Inc., a world leader in the development of proprietary health supplements, to help BioCalth grow its direct-to-consumer sales. The two companies have entered into a content management agreement with profit-sharing incentives that they hope will lead to a long-term relationship marked by increased revenue and brand recognition for BioCalth.

WINVEST GROUP LIMITED SUBSIDIARY IQI MEDIA PREPARES TO TACKLE HOLLYWOOD'S STREAMING CHAOS WITH LAUNCHRR

prnewswire.com

2025-06-18 09:00:00RENO, Nev. , June 18, 2025 /PRNewswire/ -- Winvest Group Limited (OTCQB: WNLV) ("Winvest"), an investment holding company with diverse media, entertainment, and technology portfolios, is pleased to announce that its Los Angeles-based subsidiary IQI Media Inc. is getting closer to offering late Q2 beta demos of Launchrr, its proprietary Software as a Service (SaaS) solution for the film and television industry. "Hollywood has a well-known resistance to change, but Launchrr is designed to break through by addressing the industry's most pressing paint points," said Khiow Hui Lim, Founder of IQI Media and Chief Strategy Officer at Winvest.

IQI: Discount Narrowing Drives Results On The Back Of Increased Distribution

seekingalpha.com

2025-05-22 12:25:16IQI offers tax-free income through investment-grade municipal bonds, a usually less exciting area of the investment world, but CEFs add leverage and discount/premium considerations. The fund's discount narrowed due to a significant distribution increase last year, but current distributions aren't fully supported by income generation. For that reason, it has become more of a combination of tax-free and tax-deferred distributions, through classifications of return of capital in the payout.

Three ‘Hidden' 12.5% Dividends To Buy Now (Before Rates Drop)

forbes.com

2025-02-15 13:22:00No two ways about it: This stock market is getting twitchy, and it's (frankly beyond) time for all investors to take it seriously.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-12-02 12:00:00ATLANTA , Dec. 2, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. EX-DATE RECORD DATE REINVEST DATE PAYABLE DATE 12/17/2024 12/17/2024 12/31/2024 12/31/2024 Name of Closed-EndManagement Investment Company Ticker MonthlyDividend Per Share ChangeFrom PriorDistribution % ChangeFrom PriorDistribution Invesco Advantage Municipal Income Trust II VKI $0.05591 - - Invesco Bond Fund VBF $0.08501 +0.0110 +15 % Invesco California Value Municipal Income Trust VCV $0.06461 - - Invesco Municipal Income Opportunities Trust OIA $0.0291 - - Invesco Municipal Opportunity Trust VMO $0.06251 - - Invesco Municipal Trust VKQ $0.06281 - - Invesco Pennsylvania Value Municipal Income Trust VPV $0.06671 - - Invesco Quality Municipal Income Trust IQI $0.06311 - - Invesco Trust for Investment Grade Municipals VGM $0.06461 - - Invesco Trust for Investment Grade New York Municipals VTN $0.06851 - - Invesco Value Municipal Income Trust IIM $0.07711 - - 1 A portion of this distribution is estimated to be from a return of principal rather than net income.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-11-01 12:00:00ATLANTA , Nov. 1, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. EX-DATE RECORD DATE REINVEST DATE PAYABLE DATE 11/15/2024 11/15/2024 11/29/2024 11/29/2024 Name of Closed-EndManagement Investment Company Ticker MonthlyDividend Per Share ChangeFrom PriorDistribution % ChangeFrom PriorDistribution Invesco Advantage Municipal Income Trust II VKI $0.05591 - - Invesco Bond Fund VBF $0.07401 - - Invesco California Value Municipal Income Trust VCV $0.06461 - - Invesco High Income 2024 Target Term Fund IHTA $0.0200 - - Invesco Municipal Income Opportunities Trust OIA $0.0291 - - Invesco Municipal Opportunity Trust VMO $0.06251 - - Invesco Municipal Trust VKQ $0.06281 - - Invesco Pennsylvania Value Municipal Income Trust VPV $0.06671 - - Invesco Quality Municipal Income Trust IQI $0.06311 - - Invesco Trust for Investment Grade Municipals VGM $0.06461 - - Invesco Trust for Investment Grade New York Municipals VTN $0.06851 - - Invesco Value Municipal Income Trust IIM $0.07711 - - 1 A portion of this distribution is estimated to be from a return of principal rather than net income.

Invesco Closed-End Funds Announce Increased Distribution Rates for All Investment Grade Municipal Bond Closed-End Funds and Declare Dividends

prnewswire.com

2024-09-03 12:15:00ATLANTA , Sept. 3, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends.

Invesco Closed-End Funds Announce Increased Distribution Rates for All Investment Grade Municipal Bond Closed-End Funds and Declare Dividends

prnewswire.com

2024-08-01 12:00:00ATLANTA , Aug. 1, 2024 /PRNewswire/ -- The Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. EX-DATE RECORD DATE REINVEST DATE PAYABLE DATE 8/16/2024 8/16/2024 8/30/2024 8/30/2024 Name of Closed-EndManagement Investment Company Ticker MonthlyDividend Per Share ChangeFrom PriorDistribution % ChangeFrom PriorDistribution Invesco Advantage Municipal Income Trust II VKI $0.05591 - - Invesco Bond Fund VBF $0.0715 - - Invesco California Value Municipal Income Trust VCV $0.06461 - - Invesco High Income 2024 Target Term Fund IHTA $0.0200 -0.0130 -39 % Invesco Municipal Income Opportunities Trust OIA $0.02911 - - Invesco Municipal Opportunity Trust VMO $0.06251 - - Invesco Municipal Trust VKQ $0.06281 - - Invesco Pennsylvania Value Municipal Income Trust VPV $0.06671 - - Invesco Quality Municipal Income Trust IQI $0.06311 - - Invesco Trust for Investment Grade Municipals VGM $0.06461 - - Invesco Trust for Investment Grade New York Municipals VTN $0.06851 - - Invesco Value Municipal Income Trust IIM $0.07711 - - 1 A portion of this distribution is estimated to be from a return of principal rather than net income.

Invesco Closed-End Funds Announce Increased Distribution Rates for All Investment Grade Municipal Bond Closed-End Funds and Declare Dividends

prnewswire.com

2024-05-23 12:15:00ATLANTA , May 23, 2024 /PRNewswire/ -- The Board of Trustees authorized several Invesco closed-end funds to declare dividends. This action includes an increase in the distribution rate for all investment grade municipal bond closed-end funds.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-04-01 12:15:00ATLANTA , April 1, 2024 /PRNewswire/ -- Today, the Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. Several leveraged municipal closed-end funds have announced distribution rate increases of between 9% and 23% to deliver higher monthly cash flows to shareholders.

Invesco Closed-End Funds Declare Dividends

prnewswire.com

2024-01-29 13:30:00ATLANTA , Jan. 29, 2024 /PRNewswire/ -- Today, the Board of Trustees of each of the Invesco closed-end funds listed below declared dividends. Several leveraged municipal closed-end funds have announced distribution rate increases of between 9% and 23% to deliver higher monthly cash flows to shareholders.

Invesco Advisers Announces Portfolio Management Changes for Invesco Municipal Closed-End Funds

prnewswire.com

2023-06-08 09:15:00ATLANTA , June 8, 2023 /PRNewswire/ -- Invesco Advisers, Inc., a subsidiary of Invesco Ltd. (NYSE: IVZ), announced today portfolio management changes for the following Invesco closed-end municipal funds (the "Funds"): Invesco Advantage Municipal Income Trust II (NYSE American: VKI) Invesco California Value Municipal Income Trust (NYSE: VCV) Invesco Municipal Income Opportunities Trust (NYSE: OIA) Invesco Municipal Opportunity Trust (NYSE: VMO) Invesco Municipal Trust (NYSE: VKQ) Invesco Pennsylvania Value Municipal Income Trust (NYSE: VPV) Invesco Quality Municipal Income Trust (NYSE: IQI) Invesco Trust for Investment Grade Municipals (NYSE: VGM) Invesco Trust for Investment Grade New York Municipals (NYSE: VTN) Invesco Value Municipal Income Trust (NYSE: IIM) Effective June 30, 2023, the following individuals are jointly and primarily responsible for the day-to-day management of Invesco Advantage Municipal Income Trust II, Invesco Municipal Opportunity Trust, Invesco Municipal Trust, Invesco Quality Municipal Income Trust, Invesco Trust for Investment Grade Municipals and Invesco Value Municipal Income Trust's portfolio: Mark Paris, Portfolio Manager, who has been associated with Invesco and/or its affiliates since 2010.

IIM And IQI: High-Quality Muni Funds, But Leverage Adds Volatility And Risks

seekingalpha.com

2023-05-02 16:23:54IIM and IQI are leveraged municipal bond closed-end funds. This leverage meant sharper downside moves when rates were rising, but it could also mean sharper upside moves if rates reverse lower.

5 Top Yielding Companies With Low Price-Earnings Ratios

gurufocus.com

2020-10-27 12:30:09As of Oct. 27, the GuruFocus All-in-One Screener, a Premium feature, found that the following companies have low price-earnings ratios and are owned by gurus. While some of them are great value investments, others may need to be researched more carefully, according to the discounted cash flow calculator.

Weekly Closed-End Fund Roundup: August 30, 2020

seekingalpha.com

2020-09-09 08:15:0713 out of 23 CEF sectors positive on price and 16 out of 23 sectors positive on NAV last week. Commodities lead while MLPs lag.