The Interpublic Group of Companies, Inc. (IPG)

Price:

24.57 USD

( - -0.49 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Emerald Holding, Inc.

VALUE SCORE:

0

2nd position

Boston Omaha Corporation

VALUE SCORE:

8

The best

Townsquare Media, Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

The Interpublic Group of Companies, Inc. provides advertising and marketing services worldwide. It operates in two segments, Integrated Agency Networks (IAN) and IPG DXTRA. The company offers consumer advertising, digital marketing, communications planning and media buying, public relations, and specialized communications disciplines, as well as data science services. It also provides various diversified services, including meeting and event production, sports and entertainment marketing, corporate and brand identity, and strategic marketing consulting. The company was formerly known as McCann-Erickson Incorporated and changed its name to The Interpublic Group of Companies, Inc. in January 1961. The Interpublic Group of Companies, Inc. was founded in 1902 and is headquartered in New York, New York.

NEWS

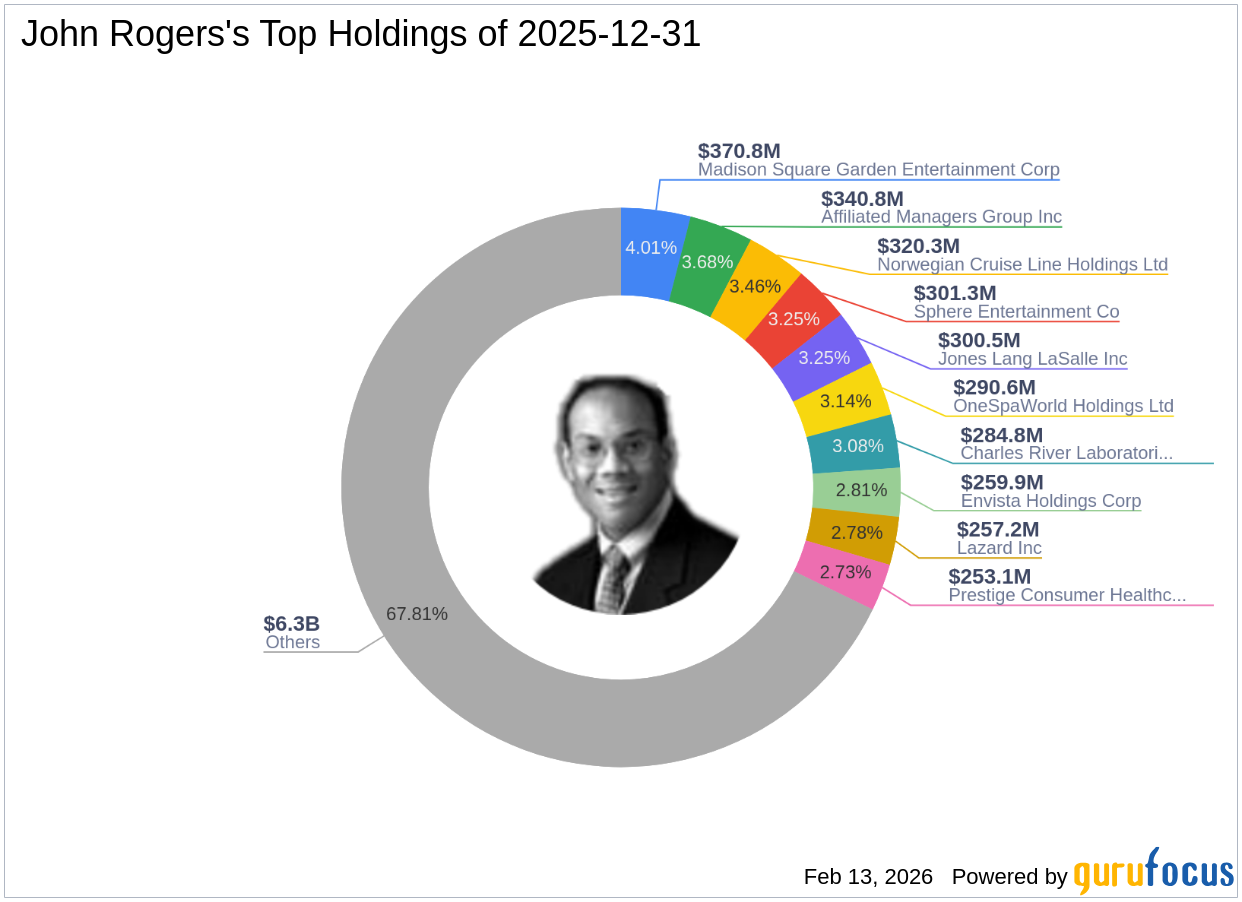

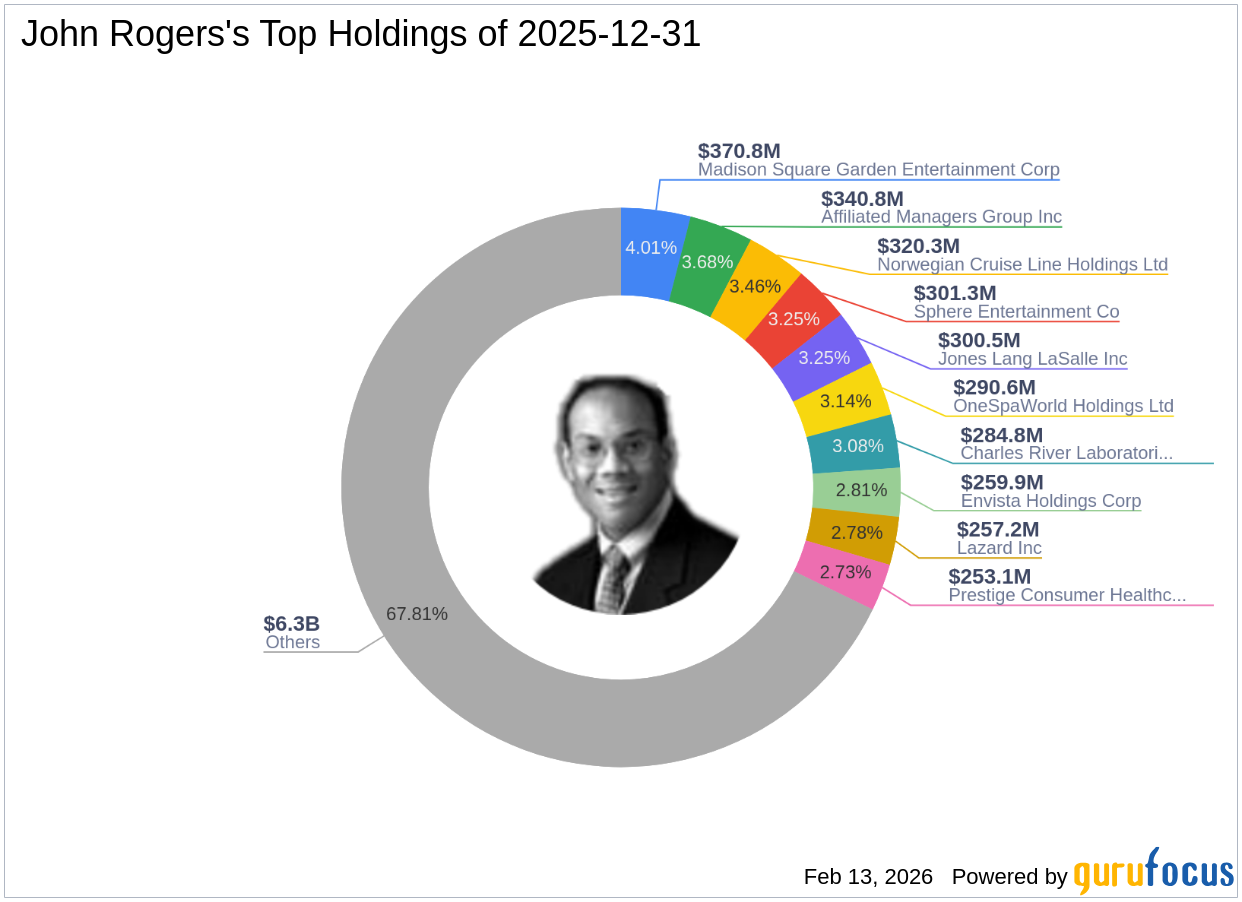

John Rogers' Strategic Moves: Sphere Entertainment Co Sees Significant Reduction

gurufocus.com

2026-02-13 14:00:00Exploring the Fourth Quarter 2025 13F Filing John Rogers (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing insigh

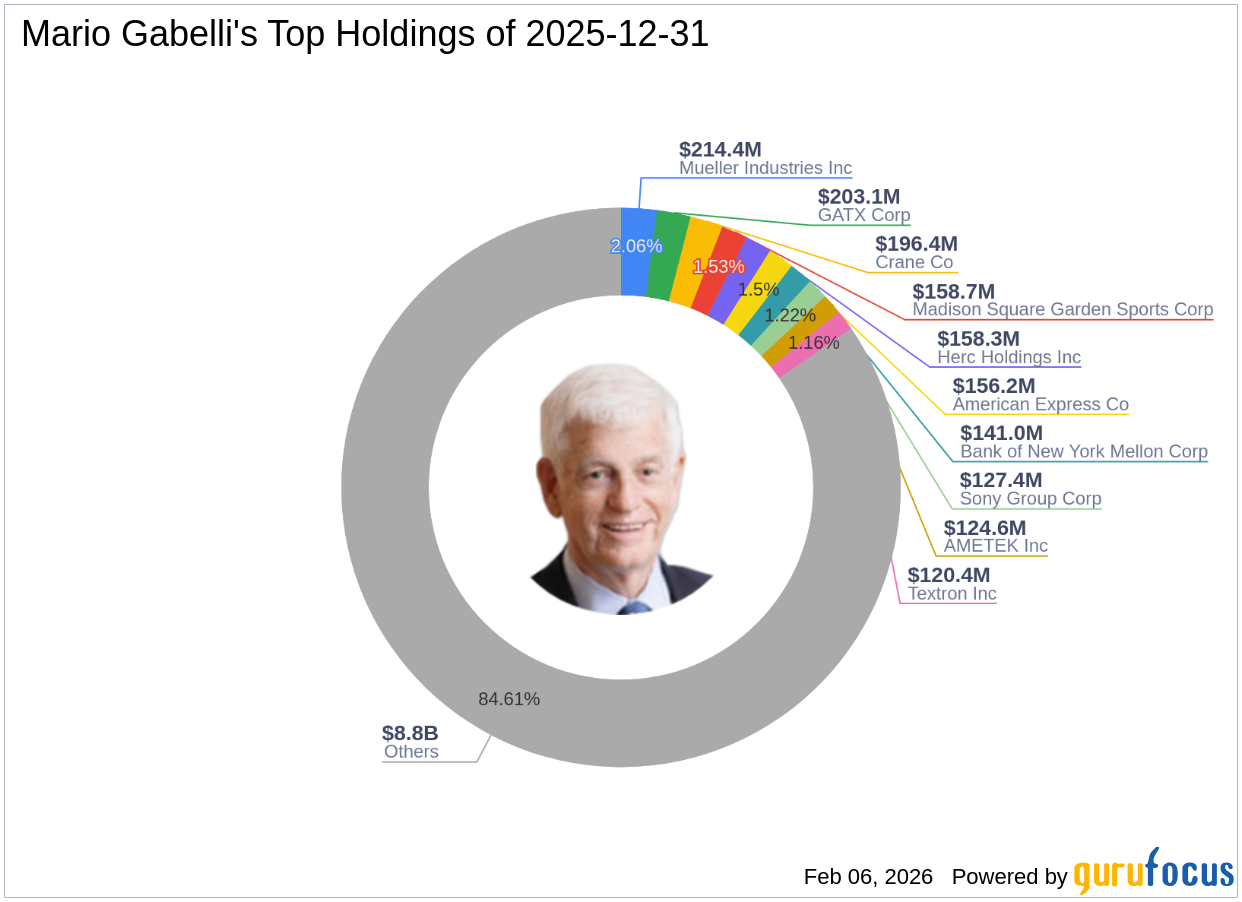

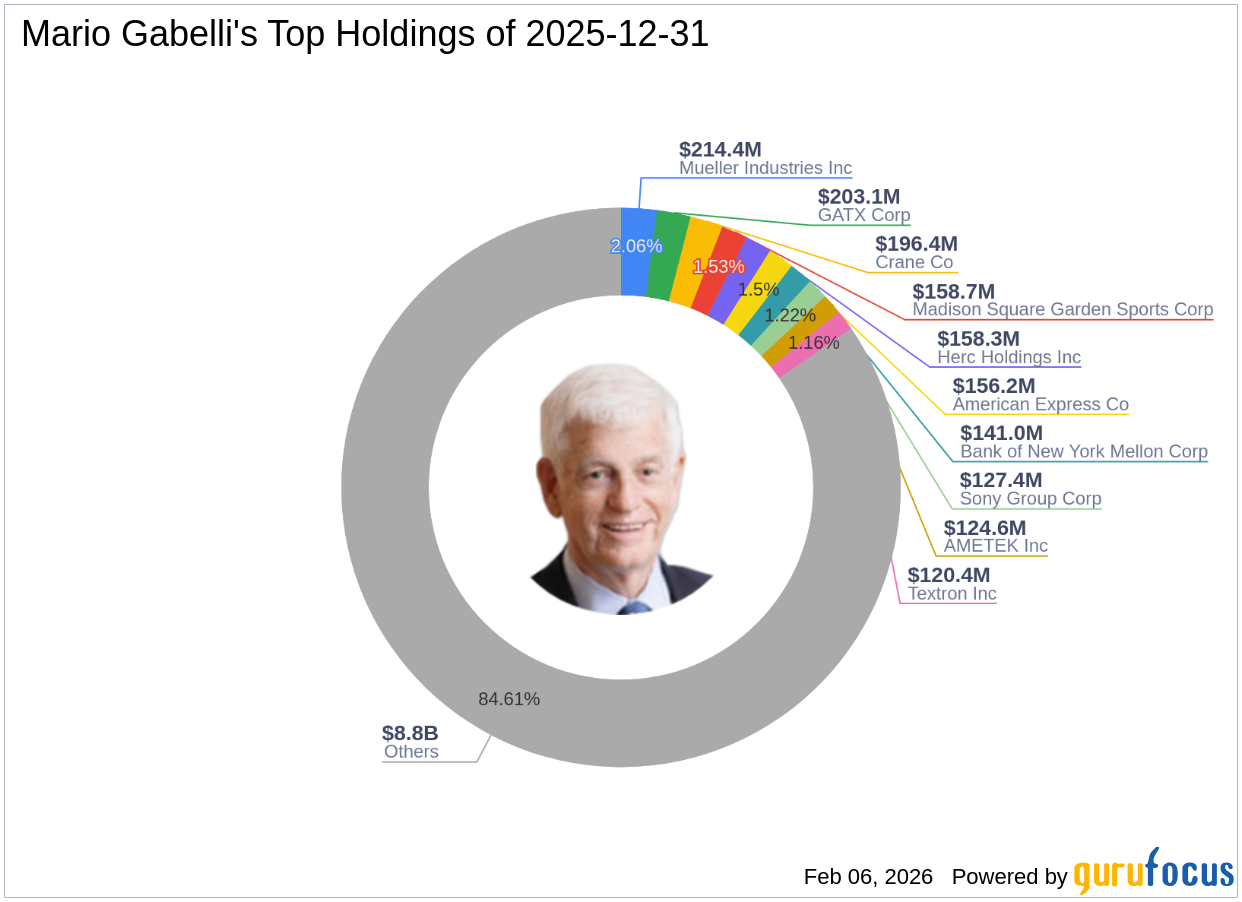

Mueller Industries Inc: A Key Focus in Mario Gabelli's Latest 13F Filing

gurufocus.com

2026-02-06 17:05:00Insights into Mario Gabelli (Trades, Portfolio)'s Investment Moves in Q4 2025 Mario Gabelli (Trades, Portfolio) recently submitted the 13F filing for the fourt

Nisa Investment Advisors LLC Boosts Stock Position in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2026-01-12 05:54:59Nisa Investment Advisors LLC increased its holdings in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 201.8% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 148,152 shares of the business services provider's stock after purchasing an additional 99,057

Interpublic Group of Companies, Inc. (The) $IPG Stock Position Decreased by Corient Private Wealth LLC

defenseworld.net

2025-12-24 03:48:50Corient Private Wealth LLC lowered its stake in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 24.5% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 83,932 shares of the business services provider's stock after selling 27,250 shares during the

Board of the Pension Protection Fund Takes $670,000 Position in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-20 04:30:48Board of the Pension Protection Fund acquired a new position in shares of Interpublic Group of Companies, Inc. (The) (NYSE: IPG) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 24,000 shares of the business services provider's stock, valued at approximately $670,000.

Interpublic Group of Companies, Inc. (The) (NYSE:IPG) Given Consensus Rating of “Hold” by Brokerages

defenseworld.net

2025-12-17 04:42:45Shares of Interpublic Group of Companies, Inc. (The) (NYSE: IPG - Get Free Report) have earned an average recommendation of "Hold" from the eight ratings firms that are presently covering the company, MarketBeat reports. Five research analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The

Cerity Partners LLC Grows Holdings in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-12 04:22:52Cerity Partners LLC raised its position in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 11.8% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 317,586 shares of the business services provider's stock after buying an additional 33,471

Gabelli Funds LLC Raises Stake in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-10 04:30:49Gabelli Funds LLC increased its stake in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 23.9% in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 259,675 shares of the business services provider's stock after purchasing an additional 50,075 shares during

Ariel Investments LLC Has $77.86 Million Stock Position in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-10 03:28:54Ariel Investments LLC lessened its holdings in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 39.7% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 3,180,658 shares of the business services provider's stock after selling 2,096,499 shares during

Critical Contrast: Interpublic Group of Companies (NYSE:IPG) vs. Mastermind (OTCMKTS:MMND)

defenseworld.net

2025-12-08 01:28:50Interpublic Group of Companies (NYSE: IPG - Get Free Report) and Mastermind (OTCMKTS:MMND - Get Free Report) are both business services companies, but which is the superior business? We will contrast the two companies based on the strength of their earnings, profitability, valuation, institutional ownership, analyst recommendations, risk and dividends. Risk and Volatility Interpublic Group of

Hsbc Holdings PLC Sells 156,345 Shares of Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-03 04:56:42Hsbc Holdings PLC lowered its stake in shares of Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 14.9% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 891,455 shares of the business services provider's stock after selling 156,345 shares during the quarter.

Omnicom to cut over 4,000 jobs and shutter legacy ad agencies after IPG acquisition

fastcompany.com

2025-12-01 15:07:50Omnicom said on Monday it will lay off more than 4,000 employees and fold several well-known advertising agency brands after its $13 billion acquisition of rival Interpublic Group.

Omnicom's CEO breaks down his plan to beat rivals in AI after the ad giant's blockbuster $9 billion IPG deal

businessinsider.com

2025-12-01 13:57:27Omnicom recently closed a $9 billion acquisition of IPG, creating the largest ad agency company. In an interview with Business Insider, Omnicom's leadership team outlined its strategy.

Ad giant Omnicom says its mega-merger with IPG will lead to 4,000 job cuts

businessinsider.com

2025-12-01 10:09:18Omnicom's $9 billion merger with Interpublic Group will result in about 4,000 job cuts. The merger creates the world's largest advertising agency group with $25 billion in revenue.

Omnicom to cut 4,000 jobs, shut several agencies after IPG takeover, FT reports

reuters.com

2025-12-01 07:50:21Omnicom will lay off more than 4,000 employees and fold several well-known advertising agency brands after its $13.5 billion acquisition of rival Interpublic Group, the Financial Times reported on Monday, citing an interview with company executives.

Omnicom Closes Acquisition Of Interpublic In $13B Deal Creating World's Largest Advertising Firm

deadline.com

2025-11-26 18:10:00Omnicom has closed its acquisition of rival Interpublic in an all-stock deal reshaping the advertising and marketing sectors and creating the world's largest ad holding company. The combined company, with a pro forma combined revenue in excess of $25 billion, will trade under the OMC ticker symbol on the New York Stock Exchange.

John Rogers' Strategic Moves: Sphere Entertainment Co Sees Significant Reduction

gurufocus.com

2026-02-13 14:00:00Exploring the Fourth Quarter 2025 13F Filing John Rogers (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing insigh

Mueller Industries Inc: A Key Focus in Mario Gabelli's Latest 13F Filing

gurufocus.com

2026-02-06 17:05:00Insights into Mario Gabelli (Trades, Portfolio)'s Investment Moves in Q4 2025 Mario Gabelli (Trades, Portfolio) recently submitted the 13F filing for the fourt

Nisa Investment Advisors LLC Boosts Stock Position in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2026-01-12 05:54:59Nisa Investment Advisors LLC increased its holdings in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 201.8% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 148,152 shares of the business services provider's stock after purchasing an additional 99,057

Interpublic Group of Companies, Inc. (The) $IPG Stock Position Decreased by Corient Private Wealth LLC

defenseworld.net

2025-12-24 03:48:50Corient Private Wealth LLC lowered its stake in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 24.5% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 83,932 shares of the business services provider's stock after selling 27,250 shares during the

Board of the Pension Protection Fund Takes $670,000 Position in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-20 04:30:48Board of the Pension Protection Fund acquired a new position in shares of Interpublic Group of Companies, Inc. (The) (NYSE: IPG) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 24,000 shares of the business services provider's stock, valued at approximately $670,000.

Interpublic Group of Companies, Inc. (The) (NYSE:IPG) Given Consensus Rating of “Hold” by Brokerages

defenseworld.net

2025-12-17 04:42:45Shares of Interpublic Group of Companies, Inc. (The) (NYSE: IPG - Get Free Report) have earned an average recommendation of "Hold" from the eight ratings firms that are presently covering the company, MarketBeat reports. Five research analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The

Cerity Partners LLC Grows Holdings in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-12 04:22:52Cerity Partners LLC raised its position in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 11.8% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 317,586 shares of the business services provider's stock after buying an additional 33,471

Gabelli Funds LLC Raises Stake in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-10 04:30:49Gabelli Funds LLC increased its stake in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 23.9% in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 259,675 shares of the business services provider's stock after purchasing an additional 50,075 shares during

Ariel Investments LLC Has $77.86 Million Stock Position in Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-10 03:28:54Ariel Investments LLC lessened its holdings in Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 39.7% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 3,180,658 shares of the business services provider's stock after selling 2,096,499 shares during

Critical Contrast: Interpublic Group of Companies (NYSE:IPG) vs. Mastermind (OTCMKTS:MMND)

defenseworld.net

2025-12-08 01:28:50Interpublic Group of Companies (NYSE: IPG - Get Free Report) and Mastermind (OTCMKTS:MMND - Get Free Report) are both business services companies, but which is the superior business? We will contrast the two companies based on the strength of their earnings, profitability, valuation, institutional ownership, analyst recommendations, risk and dividends. Risk and Volatility Interpublic Group of

Hsbc Holdings PLC Sells 156,345 Shares of Interpublic Group of Companies, Inc. (The) $IPG

defenseworld.net

2025-12-03 04:56:42Hsbc Holdings PLC lowered its stake in shares of Interpublic Group of Companies, Inc. (The) (NYSE: IPG) by 14.9% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 891,455 shares of the business services provider's stock after selling 156,345 shares during the quarter.

Omnicom to cut over 4,000 jobs and shutter legacy ad agencies after IPG acquisition

fastcompany.com

2025-12-01 15:07:50Omnicom said on Monday it will lay off more than 4,000 employees and fold several well-known advertising agency brands after its $13 billion acquisition of rival Interpublic Group.

Omnicom's CEO breaks down his plan to beat rivals in AI after the ad giant's blockbuster $9 billion IPG deal

businessinsider.com

2025-12-01 13:57:27Omnicom recently closed a $9 billion acquisition of IPG, creating the largest ad agency company. In an interview with Business Insider, Omnicom's leadership team outlined its strategy.

Ad giant Omnicom says its mega-merger with IPG will lead to 4,000 job cuts

businessinsider.com

2025-12-01 10:09:18Omnicom's $9 billion merger with Interpublic Group will result in about 4,000 job cuts. The merger creates the world's largest advertising agency group with $25 billion in revenue.

Omnicom to cut 4,000 jobs, shut several agencies after IPG takeover, FT reports

reuters.com

2025-12-01 07:50:21Omnicom will lay off more than 4,000 employees and fold several well-known advertising agency brands after its $13.5 billion acquisition of rival Interpublic Group, the Financial Times reported on Monday, citing an interview with company executives.

Omnicom Closes Acquisition Of Interpublic In $13B Deal Creating World's Largest Advertising Firm

deadline.com

2025-11-26 18:10:00Omnicom has closed its acquisition of rival Interpublic in an all-stock deal reshaping the advertising and marketing sectors and creating the world's largest ad holding company. The combined company, with a pro forma combined revenue in excess of $25 billion, will trade under the OMC ticker symbol on the New York Stock Exchange.