Intel Corporation (INTC)

Price:

37.82 USD

( - -1.69 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Advanced Micro Devices, Inc.

VALUE SCORE:

6

2nd position

Axcelis Technologies, Inc.

VALUE SCORE:

10

The best

ACM Research, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Intel Corporation engages in the design, manufacture, and sale of computer products and technologies worldwide. The company operates through CCG, DCG, IOTG, Mobileye, NSG, PSG, and All Other segments. It offers platform products, such as central processing units and chipsets, and system-on-chip and multichip packages; and non-platform or adjacent products, including accelerators, boards and systems, connectivity products, graphics, and memory and storage products. The company also provides high-performance compute solutions for targeted verticals and embedded applications for retail, industrial, and healthcare markets; and solutions for assisted and autonomous driving comprising compute platforms, computer vision and machine learning-based sensing, mapping and localization, driving policy, and active sensors. In addition, it offers workload-optimized platforms and related products for cloud service providers, enterprise and government, and communications service providers. The company serves original equipment manufacturers, original design manufacturers, and cloud service providers. Intel Corporation has a strategic partnership with MILA to develop and apply advances in artificial intelligence methods for enhancing the search in the space of drugs. The company was incorporated in 1968 and is headquartered in Santa Clara, California.

NEWS

Intel: This Is The Comeback Of A Lifetime

seekingalpha.com

2025-12-15 00:00:02Intel is executing a strong turnaround, with Q3 results exceeding expectations and a ~60% stock rally since September. Intel's client computing and foundry businesses are gaining momentum, driven by new CPU launches and strategic partnerships, notably with Nvidia. Risks remain from delayed fab construction, macroeconomic headwinds, and competition from TSMC, but management's revised strategy is improving outlook.

Intel Draws Scrutiny After Testing Chip Tools Linked to China

gurufocus.com

2025-12-12 11:07:00Intel Corp. (INTC, Financials) is under new pressure after reports surfaced that it tested chipmaking equipment from ACM Research, a supplier whose overseas uni

NVDA, INTC and AMD Forecast – Chips Looking for Momentum After Broadcom Concerns

fxempire.com

2025-12-12 08:54:20Semiconductor stocks show mixed but constructive action into Friday, with Nvidia consolidating, Intel supported on pullbacks, and AMD stabilizing despite cautious AI guidance. Overall momentum favors buying dips across the group.

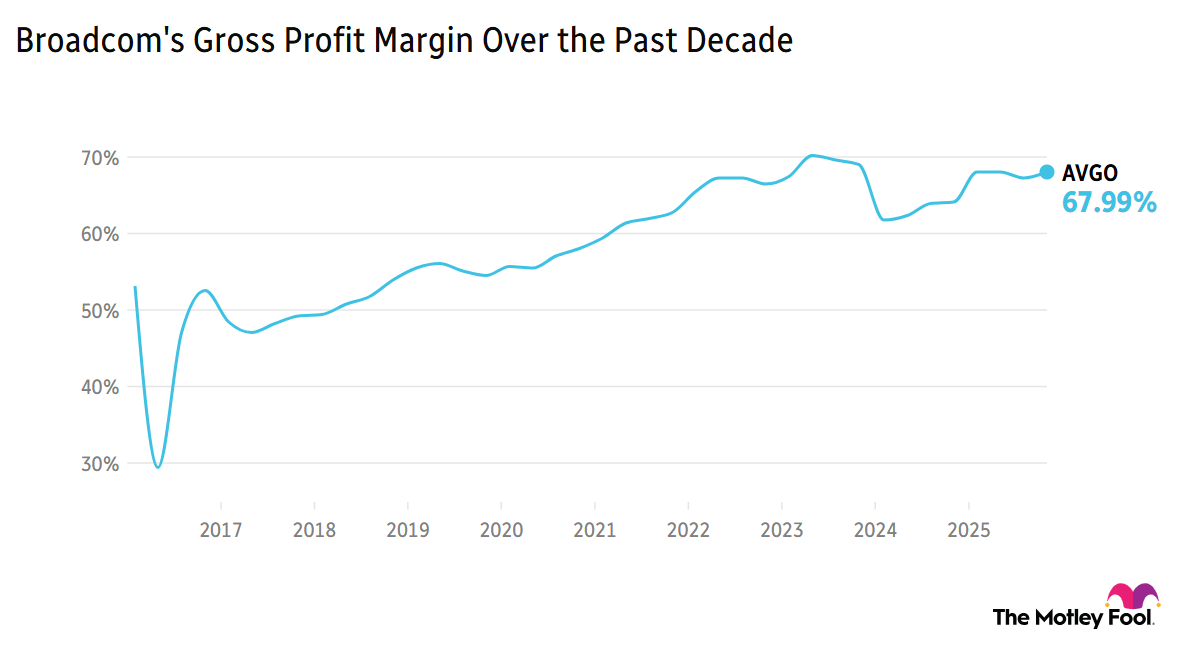

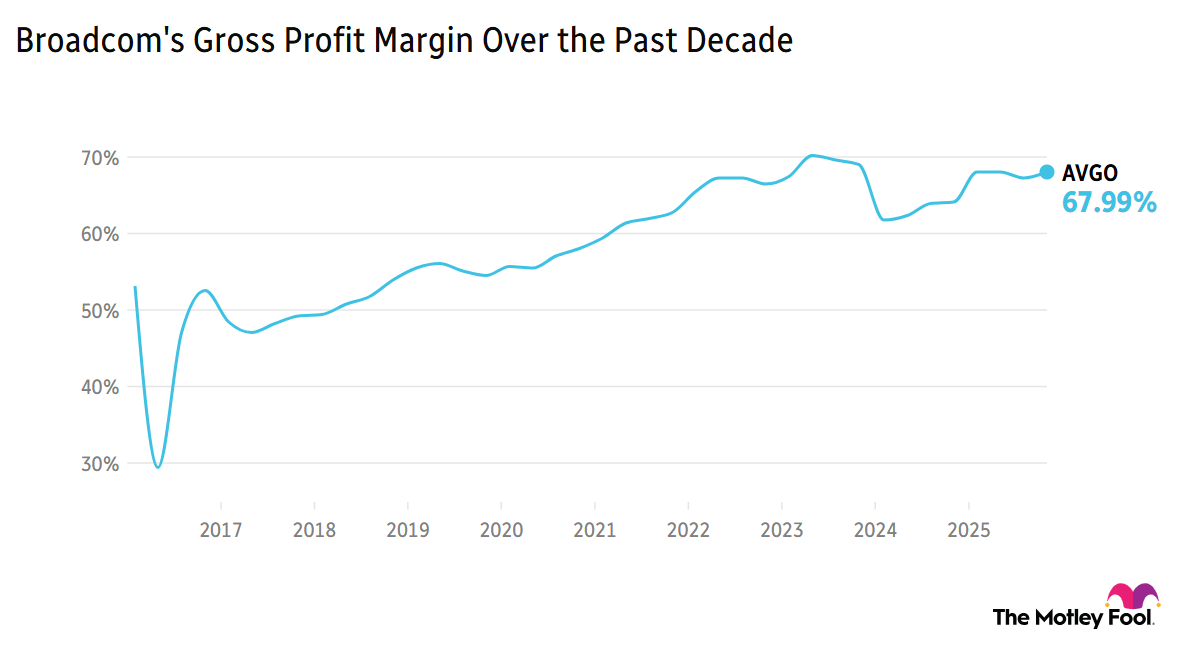

Breakfast News: Broadcom Guides Lower

fool.com

2025-12-12 07:30:00Broadcom feels the heat of AI expectations, LULU soars over 10% on strong results, and more

Intel's Chip Ambitions Stir Alarm Over China-Linked Tech

feeds.benzinga.com

2025-12-12 07:05:43Intel Corp (NASDAQ: INTC) tested chipmaking tools this year from ACM Research Inc (NASDAQ: ACMR), despite U.S. sanctions concerns.

Intel Tested Chipmaking Tools From Firm With Sanctioned China Units

gurufocus.com

2025-12-12 06:52:00Intel (INTC, Financials) has tested chipmaking tools this year from ACM Research, a semiconductor equipment maker with deep ties to China and overseas units tar

Why Are Luminar Technologies (LAZR) Shares Trending?

feeds.benzinga.com

2025-12-12 01:43:05Luminar Technologies shares are trending after CEO Paul Ricci had 69,431 Class A shares withheld to cover tax obligations.

Exclusive: Intel has tested chipmaking tools from firm with sanctioned China unit, sources say

reuters.com

2025-12-12 01:01:56Chipmaker Intel , has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by U.S. sanctions, according to two sources with direct knowledge of the matter.

Intel (INTC) Stock Slides as Market Rises: Facts to Know Before You Trade

zacks.com

2025-12-11 18:46:25In the latest trading session, Intel (INTC) closed at $39.51, marking a -3.11% move from the previous day.

How Intel Stock Can Jump 50%

forbes.com

2025-12-11 12:40:03Intel has seen incredible rallies, with several occurrences of gains exceeding 30% within a two-month period. Significantly, the years 2011 and 2024 witnessed substantial surges, including two rallies that jumped more than 50% in short order.

INTC vs. PINS: Which Tech Stock Deserves a Spot in Your Portfolio?

zacks.com

2025-12-11 10:36:09Intel's AI-driven turnaround and strong funding edge out Pinterest's ad growth, making it the better portfolio pick for now.

Intel's Growth Inflection Is Real

seekingalpha.com

2025-12-11 09:45:23Intel Corporation has more than doubled since my January 2025 upgrade, dramatically outperforming Nvidia and Advanced Micro Devices as its long-awaited turnaround finally shows up in the numbers. INTC's turnaround is driven by strong segment performance, margin improvement, and foundry business momentum, supporting sustained bullishness into next year. Massive cash inflows from U.S. government, SoftBank, Nvidia, Altera and Mobileye plus $4.3B of debt paydown have de‑risked the INTC balance sheet and eased leverage worries.

Intel Faces Conflict Questions Over CEO Tan's Dealmaking

gurufocus.com

2025-12-11 06:49:00Intel (INTC, Financials) is under fire for alleged conflicts of interest following allegations that CEO Lip-Bu Tan's venture interests overlapped with AI and se

Intel Stock Is Falling -- CEO Faces Scrutiny Over AI Chip Deals

gurufocus.com

2025-12-11 06:21:00Intel (INTC) shares dipped about 2% in premarket trading on Wednesday as scrutiny mounts over CEO Lip-Bu Tan's role in potential deals benefiting him personally

BCS Private Wealth Management Inc. Makes New $348,000 Investment in Intel Corporation $INTC

defenseworld.net

2025-12-11 04:20:52BCS Private Wealth Management Inc. purchased a new stake in shares of Intel Corporation (NASDAQ: INTC) during the second quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 15,536 shares of the chip maker's stock, valued at approximately $348,000. Several other large investors have also recently

Intel CEO Lip-Bu Tan Faces Scrutiny Over Multi-Billion Dollar AI Deals That Boosted His Own Venture Portfolio: Report

feeds.benzinga.com

2025-12-10 22:08:34Intel CEO Lip-Bu Tan is facing scrutiny over AI chip deals that may benefit his personal venture investments, while his industry connections and dealmaking have also helped boost Intel's stock and secure major investments from Nvidia and SoftBank.

Intel: This Is The Comeback Of A Lifetime

seekingalpha.com

2025-12-15 00:00:02Intel is executing a strong turnaround, with Q3 results exceeding expectations and a ~60% stock rally since September. Intel's client computing and foundry businesses are gaining momentum, driven by new CPU launches and strategic partnerships, notably with Nvidia. Risks remain from delayed fab construction, macroeconomic headwinds, and competition from TSMC, but management's revised strategy is improving outlook.

Intel Draws Scrutiny After Testing Chip Tools Linked to China

gurufocus.com

2025-12-12 11:07:00Intel Corp. (INTC, Financials) is under new pressure after reports surfaced that it tested chipmaking equipment from ACM Research, a supplier whose overseas uni

NVDA, INTC and AMD Forecast – Chips Looking for Momentum After Broadcom Concerns

fxempire.com

2025-12-12 08:54:20Semiconductor stocks show mixed but constructive action into Friday, with Nvidia consolidating, Intel supported on pullbacks, and AMD stabilizing despite cautious AI guidance. Overall momentum favors buying dips across the group.

Breakfast News: Broadcom Guides Lower

fool.com

2025-12-12 07:30:00Broadcom feels the heat of AI expectations, LULU soars over 10% on strong results, and more

Intel's Chip Ambitions Stir Alarm Over China-Linked Tech

feeds.benzinga.com

2025-12-12 07:05:43Intel Corp (NASDAQ: INTC) tested chipmaking tools this year from ACM Research Inc (NASDAQ: ACMR), despite U.S. sanctions concerns.

Intel Tested Chipmaking Tools From Firm With Sanctioned China Units

gurufocus.com

2025-12-12 06:52:00Intel (INTC, Financials) has tested chipmaking tools this year from ACM Research, a semiconductor equipment maker with deep ties to China and overseas units tar

Why Are Luminar Technologies (LAZR) Shares Trending?

feeds.benzinga.com

2025-12-12 01:43:05Luminar Technologies shares are trending after CEO Paul Ricci had 69,431 Class A shares withheld to cover tax obligations.

Exclusive: Intel has tested chipmaking tools from firm with sanctioned China unit, sources say

reuters.com

2025-12-12 01:01:56Chipmaker Intel , has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by U.S. sanctions, according to two sources with direct knowledge of the matter.

Intel (INTC) Stock Slides as Market Rises: Facts to Know Before You Trade

zacks.com

2025-12-11 18:46:25In the latest trading session, Intel (INTC) closed at $39.51, marking a -3.11% move from the previous day.

How Intel Stock Can Jump 50%

forbes.com

2025-12-11 12:40:03Intel has seen incredible rallies, with several occurrences of gains exceeding 30% within a two-month period. Significantly, the years 2011 and 2024 witnessed substantial surges, including two rallies that jumped more than 50% in short order.

INTC vs. PINS: Which Tech Stock Deserves a Spot in Your Portfolio?

zacks.com

2025-12-11 10:36:09Intel's AI-driven turnaround and strong funding edge out Pinterest's ad growth, making it the better portfolio pick for now.

Intel's Growth Inflection Is Real

seekingalpha.com

2025-12-11 09:45:23Intel Corporation has more than doubled since my January 2025 upgrade, dramatically outperforming Nvidia and Advanced Micro Devices as its long-awaited turnaround finally shows up in the numbers. INTC's turnaround is driven by strong segment performance, margin improvement, and foundry business momentum, supporting sustained bullishness into next year. Massive cash inflows from U.S. government, SoftBank, Nvidia, Altera and Mobileye plus $4.3B of debt paydown have de‑risked the INTC balance sheet and eased leverage worries.

Intel Faces Conflict Questions Over CEO Tan's Dealmaking

gurufocus.com

2025-12-11 06:49:00Intel (INTC, Financials) is under fire for alleged conflicts of interest following allegations that CEO Lip-Bu Tan's venture interests overlapped with AI and se

Intel Stock Is Falling -- CEO Faces Scrutiny Over AI Chip Deals

gurufocus.com

2025-12-11 06:21:00Intel (INTC) shares dipped about 2% in premarket trading on Wednesday as scrutiny mounts over CEO Lip-Bu Tan's role in potential deals benefiting him personally

BCS Private Wealth Management Inc. Makes New $348,000 Investment in Intel Corporation $INTC

defenseworld.net

2025-12-11 04:20:52BCS Private Wealth Management Inc. purchased a new stake in shares of Intel Corporation (NASDAQ: INTC) during the second quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 15,536 shares of the chip maker's stock, valued at approximately $348,000. Several other large investors have also recently

Intel CEO Lip-Bu Tan Faces Scrutiny Over Multi-Billion Dollar AI Deals That Boosted His Own Venture Portfolio: Report

feeds.benzinga.com

2025-12-10 22:08:34Intel CEO Lip-Bu Tan is facing scrutiny over AI chip deals that may benefit his personal venture investments, while his industry connections and dealmaking have also helped boost Intel's stock and secure major investments from Nvidia and SoftBank.