International Seaways, Inc. (INSW)

Price:

48.55 USD

( - -0.36 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Tsakos Energy Navigation Limited

VALUE SCORE:

10

2nd position

DHT Holdings, Inc.

VALUE SCORE:

12

The best

Western Midstream Partners, LP

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

International Seaways, Inc. owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade. It operates in two segments, Crude Tankers and Product Carriers. As of December 31, 2021, the company owned and operated a fleet of 83 vessels, which include 12 chartered-in vessels, as well as had ownership interests in two floating storage and offloading service vessels. It serves independent and state-owned oil companies, oil traders, refinery operators, and international government entities. The company was formerly known as OSG International, Inc. and changed its name to International Seaways, Inc. in October 2016. International Seaways, Inc. was incorporated in 1999 and is headquartered in New York, New York.

NEWS

Market Today: Fed Cut Looms, Nvidia's China Shift, Target's SoHo Push, OpenAI Taps Slack CEO

gurufocus.com

2025-12-09 17:34:00Stock News Fed set for âhawkish cut': Goldman Sachs (GS) and other Wall Street desks expect the Federal Reserve to deliver a third straight 25 bps rate cut wh

First Look: Paramount's WBD bid, IBM-Confluent, Boeing-Spirit

gurufocus.com

2025-12-09 07:37:00Stock News Paramount goes hostile for WBD: Paramount Skydance (PSKY) launched a hostile, all-cash $30-per-share offer for Warner Bros. Discovery (WBD), valuing

Financial Survey: International Seaways (NYSE:INSW) and Nippon Yusen Kabushiki Kaisha (OTCMKTS:NPNYY)

defenseworld.net

2025-11-30 01:46:59International Seaways (NYSE: INSW - Get Free Report) and Nippon Yusen Kabushiki Kaisha (OTCMKTS:NPNYY - Get Free Report) are both transportation companies, but which is the superior investment? We will contrast the two businesses based on the strength of their risk, valuation, institutional ownership, earnings, dividends, analyst recommendations and profitability. Analyst Ratings This is a summary

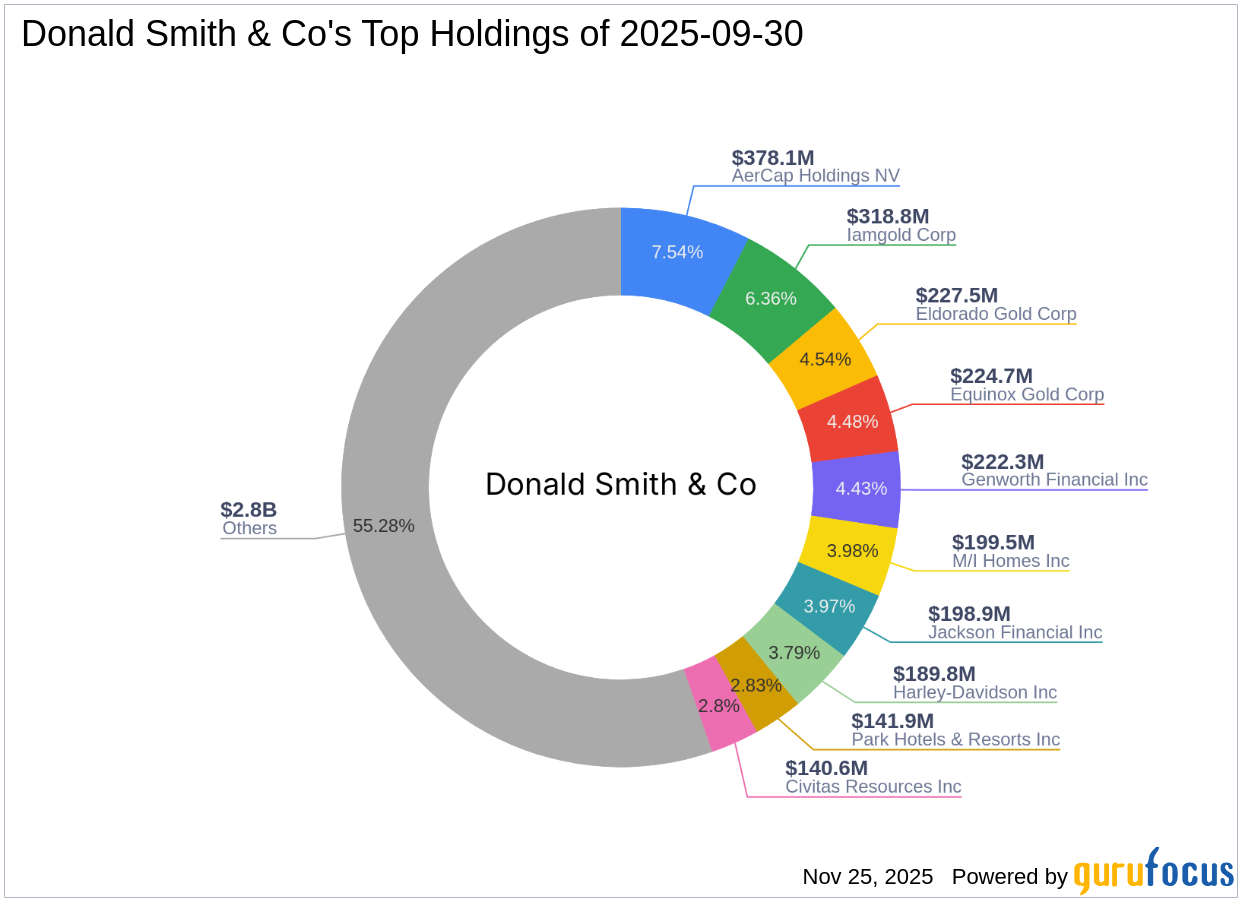

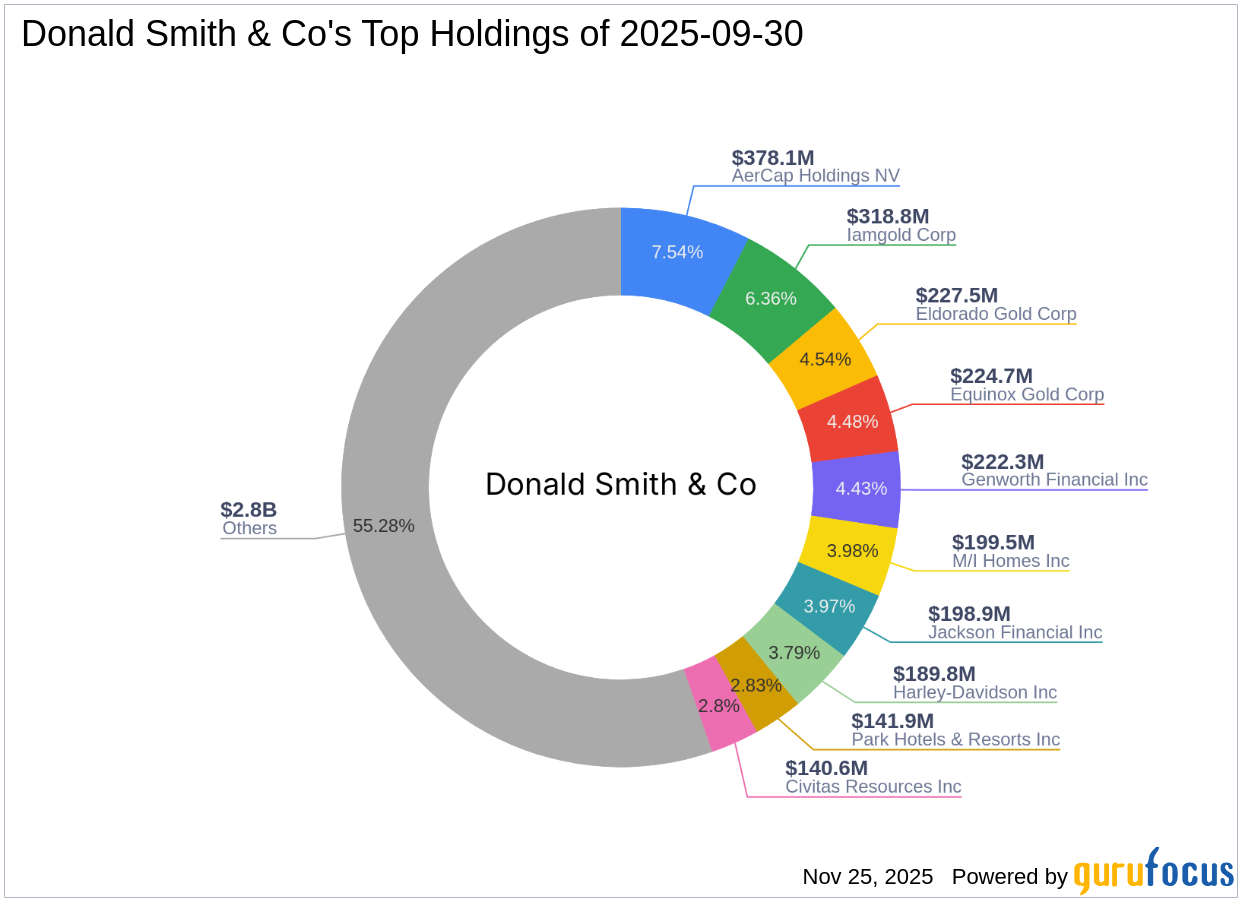

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Financial Survey: International Seaways (NYSE:INSW) vs. Ultrapetrol (Bahamas) (OTCMKTS:ULTRF)

defenseworld.net

2025-11-18 02:00:56Ultrapetrol (Bahamas) (OTCMKTS:ULTRF - Get Free Report) and International Seaways (NYSE: INSW - Get Free Report) are both transportation companies, but which is the superior stock? We will contrast the two companies based on the strength of their earnings, analyst recommendations, institutional ownership, profitability, valuation, dividends and risk. Profitability This table compares Ultrapetrol (Bahamas) and International

Here are Tuesday's Top Wall Street Analyst Research Calls: Coreweave, Instacart, Qorvo, Robinhood Markets, Skyworks Solutions, Viasat and More

247wallst.com

2025-11-11 08:06:46The futures are trading mixed after a massive bounce-back rally on Monday across Wall Street, which saw all the major indices trade higher, with the NASDAQ closing up 2.27% at 23,554.

Are You Looking for a Top Momentum Pick? Why International Seaways (INSW) is a Great Choice

zacks.com

2025-11-10 13:03:42Does International Seaways (INSW) have what it takes to be a top stock pick for momentum investors? Let's find out.

Wall Street Week Ahead

seekingalpha.com

2025-11-09 06:38:18Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

International Seaways, Inc. (INSW) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-07 04:16:11International Seaways, Inc. ( INSW ) Q3 2025 Earnings Call November 6, 2025 9:00 AM EST Company Participants James Small - Chief Administrative Officer, Senior VP, General Counsel & Secretary Lois Zabrocky - President, CEO & Director Jeffrey Pribor - Senior VP & CFO Derek Solon - Senior VP & Chief Commercial Officer Conference Call Participants Omar Nokta - Jefferies LLC, Research Division Christopher Robertson - Deutsche Bank AG, Research Division Presentation Operator Hello, everyone, and welcome to the International Seaways Third Quarter 2025 Earnings Conference Call. My name is Carla, and I will be coordinating your call today.

International Seaways (INSW) Q3 Earnings and Revenues Beat Estimates

zacks.com

2025-11-06 09:01:15International Seaways (INSW) came out with quarterly earnings of $1.15 per share, beating the Zacks Consensus Estimate of $0.91 per share. This compares to earnings of $1.57 per share a year ago.

International Seaways Reports Third Quarter 2025 Results

businesswire.com

2025-11-06 06:45:00NEW YORK--(BUSINESS WIRE)--International Seaways, Inc. (NYSE: INSW) (the “Company,” “Seaways,” or “INSW”), one of the largest tanker companies worldwide providing energy transportation services for crude oil and petroleum products, today reported results for the third quarter 2025. HIGHLIGHTS & RECENT DEVELOPMENTS Quarterly Results: Net income for the third quarter of 2025 was $71 million, or $1.42 per diluted share. Adjusted net income(1), defined as net income excluding special items, for.

Analysts Estimate International Seaways (INSW) to Report a Decline in Earnings: What to Look Out for

zacks.com

2025-10-30 11:07:07International Seaways (INSW) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Are Investors Undervaluing International Seaways (INSW) Right Now?

zacks.com

2025-10-28 10:41:11Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Is the Options Market Predicting a Spike in International Seaways Stock?

zacks.com

2025-10-27 09:46:05Investors need to pay close attention to INSW stock based on the movements in the options market lately.

International Seaways to Announce Third Quarter 2025 Results on November 6, 2025

businesswire.com

2025-10-22 17:00:00NEW YORK--(BUSINESS WIRE)--International Seaways, Inc. (NYSE: INSW) (the “Company” or “INSW”) announced today that it plans to release third quarter 2025 results before market open on Thursday, November 6, 2025. The Company will host a conference call for investors at 9:00 a.m. Eastern Time (“ET”) on the same day. Conference Call Details: Date: Thursday, November 6, 2025 Time 9:00 AM ET Dial-in Numbers US: +1 (833) 470-1428 International: +1 (929) 526-1599 Conference ID 750591 A liv.

Will International Seaways (INSW) Beat Estimates Again in Its Next Earnings Report?

zacks.com

2025-10-20 13:10:46International Seaways (INSW) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Market Today: Fed Cut Looms, Nvidia's China Shift, Target's SoHo Push, OpenAI Taps Slack CEO

gurufocus.com

2025-12-09 17:34:00Stock News Fed set for âhawkish cut': Goldman Sachs (GS) and other Wall Street desks expect the Federal Reserve to deliver a third straight 25 bps rate cut wh

First Look: Paramount's WBD bid, IBM-Confluent, Boeing-Spirit

gurufocus.com

2025-12-09 07:37:00Stock News Paramount goes hostile for WBD: Paramount Skydance (PSKY) launched a hostile, all-cash $30-per-share offer for Warner Bros. Discovery (WBD), valuing

Financial Survey: International Seaways (NYSE:INSW) and Nippon Yusen Kabushiki Kaisha (OTCMKTS:NPNYY)

defenseworld.net

2025-11-30 01:46:59International Seaways (NYSE: INSW - Get Free Report) and Nippon Yusen Kabushiki Kaisha (OTCMKTS:NPNYY - Get Free Report) are both transportation companies, but which is the superior investment? We will contrast the two businesses based on the strength of their risk, valuation, institutional ownership, earnings, dividends, analyst recommendations and profitability. Analyst Ratings This is a summary

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Financial Survey: International Seaways (NYSE:INSW) vs. Ultrapetrol (Bahamas) (OTCMKTS:ULTRF)

defenseworld.net

2025-11-18 02:00:56Ultrapetrol (Bahamas) (OTCMKTS:ULTRF - Get Free Report) and International Seaways (NYSE: INSW - Get Free Report) are both transportation companies, but which is the superior stock? We will contrast the two companies based on the strength of their earnings, analyst recommendations, institutional ownership, profitability, valuation, dividends and risk. Profitability This table compares Ultrapetrol (Bahamas) and International

Here are Tuesday's Top Wall Street Analyst Research Calls: Coreweave, Instacart, Qorvo, Robinhood Markets, Skyworks Solutions, Viasat and More

247wallst.com

2025-11-11 08:06:46The futures are trading mixed after a massive bounce-back rally on Monday across Wall Street, which saw all the major indices trade higher, with the NASDAQ closing up 2.27% at 23,554.

Are You Looking for a Top Momentum Pick? Why International Seaways (INSW) is a Great Choice

zacks.com

2025-11-10 13:03:42Does International Seaways (INSW) have what it takes to be a top stock pick for momentum investors? Let's find out.

Wall Street Week Ahead

seekingalpha.com

2025-11-09 06:38:18Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

International Seaways, Inc. (INSW) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-07 04:16:11International Seaways, Inc. ( INSW ) Q3 2025 Earnings Call November 6, 2025 9:00 AM EST Company Participants James Small - Chief Administrative Officer, Senior VP, General Counsel & Secretary Lois Zabrocky - President, CEO & Director Jeffrey Pribor - Senior VP & CFO Derek Solon - Senior VP & Chief Commercial Officer Conference Call Participants Omar Nokta - Jefferies LLC, Research Division Christopher Robertson - Deutsche Bank AG, Research Division Presentation Operator Hello, everyone, and welcome to the International Seaways Third Quarter 2025 Earnings Conference Call. My name is Carla, and I will be coordinating your call today.

International Seaways (INSW) Q3 Earnings and Revenues Beat Estimates

zacks.com

2025-11-06 09:01:15International Seaways (INSW) came out with quarterly earnings of $1.15 per share, beating the Zacks Consensus Estimate of $0.91 per share. This compares to earnings of $1.57 per share a year ago.

International Seaways Reports Third Quarter 2025 Results

businesswire.com

2025-11-06 06:45:00NEW YORK--(BUSINESS WIRE)--International Seaways, Inc. (NYSE: INSW) (the “Company,” “Seaways,” or “INSW”), one of the largest tanker companies worldwide providing energy transportation services for crude oil and petroleum products, today reported results for the third quarter 2025. HIGHLIGHTS & RECENT DEVELOPMENTS Quarterly Results: Net income for the third quarter of 2025 was $71 million, or $1.42 per diluted share. Adjusted net income(1), defined as net income excluding special items, for.

Analysts Estimate International Seaways (INSW) to Report a Decline in Earnings: What to Look Out for

zacks.com

2025-10-30 11:07:07International Seaways (INSW) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Are Investors Undervaluing International Seaways (INSW) Right Now?

zacks.com

2025-10-28 10:41:11Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Is the Options Market Predicting a Spike in International Seaways Stock?

zacks.com

2025-10-27 09:46:05Investors need to pay close attention to INSW stock based on the movements in the options market lately.

International Seaways to Announce Third Quarter 2025 Results on November 6, 2025

businesswire.com

2025-10-22 17:00:00NEW YORK--(BUSINESS WIRE)--International Seaways, Inc. (NYSE: INSW) (the “Company” or “INSW”) announced today that it plans to release third quarter 2025 results before market open on Thursday, November 6, 2025. The Company will host a conference call for investors at 9:00 a.m. Eastern Time (“ET”) on the same day. Conference Call Details: Date: Thursday, November 6, 2025 Time 9:00 AM ET Dial-in Numbers US: +1 (833) 470-1428 International: +1 (929) 526-1599 Conference ID 750591 A liv.

Will International Seaways (INSW) Beat Estimates Again in Its Next Earnings Report?

zacks.com

2025-10-20 13:10:46International Seaways (INSW) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.