Inogen, Inc. (INGN)

Price:

6.10 USD

( - -0.34 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Align Technology, Inc.

VALUE SCORE:

6

2nd position

UFP Technologies, Inc.

VALUE SCORE:

10

The best

Viemed Healthcare, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

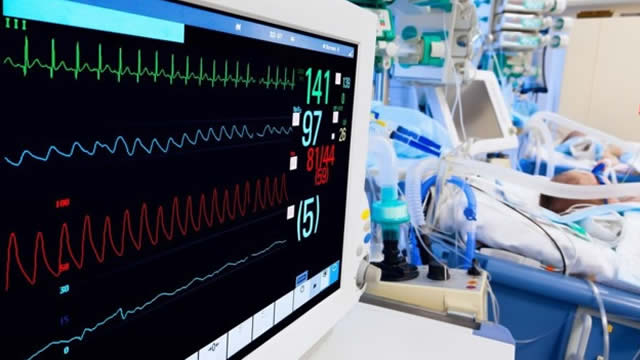

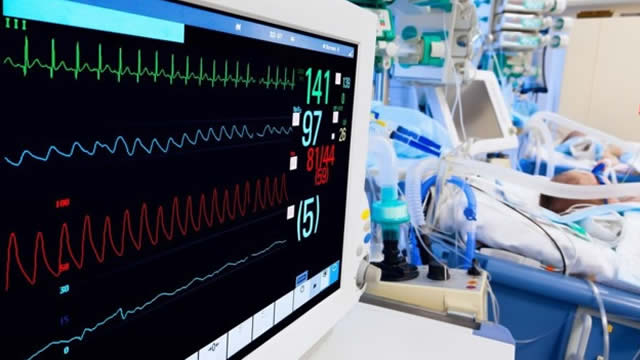

Inogen, Inc., a medical technology company, develops, manufactures, and markets portable oxygen concentrators to patients, physicians and other clinicians, and third-party payors in the United States and internationally. Its oxygen concentrators are used to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. The company offers Inogen One, a portable device that concentrate the air around the patient to provide a single source of supplemental oxygen; Inogen At Home stationary oxygen concentrators; Inogen Tidal Assist Ventilators, as well as related accessories. The company also rents its products directly to patients. Inogen, Inc. was incorporated in 2001 and is headquartered in Goleta, California.

NEWS

Inogen Stock Dips Despite Q4 Earnings Beat, Revenues Up Y/Y

zacks.com

2026-02-25 13:50:12INGN posts narrower Q4 loss and 2% revenue rise, but shares dip as U.S. sales and rentals weaken despite international strength.

Inogen, Inc. (INGN) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-02-24 21:07:51Inogen, Inc. (INGN) Q4 2025 Earnings Call Transcript

Inogen (INGN) Reports Q4 Loss, Misses Revenue Estimates

zacks.com

2026-02-24 20:31:40Inogen (INGN) came out with a quarterly loss of $0.26 per share versus the Zacks Consensus Estimate of a loss of $0.36. This compares to a loss of $0.41 per share a year ago.

Inogen Announces Fourth Quarter and Full Year 2025 Financial Results and Provides 2026 Financial Outlook

businesswire.com

2026-02-24 16:05:00BEVERLY, Mass.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen Announces Fourth Quarter and Full Year 2025 Financial Results and Provides 2026 Financial Outlook.

Inogen Announces $30 Million Share Repurchase Program

businesswire.com

2026-02-24 16:00:00BEVERLY, Mass.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen Announces $30 Million Share Repurchase Program.

Inogen (INGN) May Report Negative Earnings: Know the Trend Ahead of Next Week's Release

zacks.com

2026-02-17 11:01:31Inogen (INGN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Inogen (INGN) Soars 6.6%: Is Further Upside Left in the Stock?

zacks.com

2026-02-12 08:11:14Inogen (INGN) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

Comparing Glaukos (NYSE:GKOS) & Inogen (NASDAQ:INGN)

defenseworld.net

2026-02-12 02:59:00Glaukos (NYSE: GKOS - Get Free Report) and Inogen (NASDAQ: INGN - Get Free Report) are both medical companies, but which is the superior investment? We will contrast the two businesses based on the strength of their valuation, analyst recommendations, institutional ownership, earnings, dividends, profitability and risk. Valuation and Earnings This table compares Glaukos and Inogen"s revenue,

Inogen (INGN) Loses 10.0% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

zacks.com

2026-02-10 10:35:18The heavy selling pressure might have exhausted for Inogen (INGN) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

zacks.com

2026-02-02 10:55:49INGN looks poised as Q3 revenue rises 4%, POC demand grows and valuation is low, despite seasonal softness.

Inogen Announces Preliminary Revenue Results for Fourth Quarter and Full-Year 2025

businesswire.com

2026-01-12 08:30:00GOLETA, Calif.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen to Announce Fourth Quarter and Full Year 2025 Financial Results on February 24, 2026.

INGN Stock Gains Post Latest Launch to Expand Respiratory Care Suite

zacks.com

2026-01-08 10:51:26Inogen launches Aurora CPAP masks to expand its respiratory care suite and enter the growing sleep apnea market.

Inogen Announces the Launch of Aurora CPAP Masks for Obstructive Sleep Apnea in the United States

businesswire.com

2026-01-07 08:30:00GOLETA, Calif.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen Announces the Launch of Aurora CPAP Masks for Obstructive Sleep Apnea in the United States.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

zacks.com

2026-01-02 09:35:17INGN gains momentum from rising POC demand, new product launches and strong Q3 sales, even as competition and forex swings temper near-term growth.

3 MedTech Innovators Shaping Healthcare in 2026: AVAH, INGN & CCLD

zacks.com

2025-12-19 09:46:09AVAH, INGN & CCLD show how home care, portable oxygen tech and cloud healthcare IT are reshaping care delivery and efficiency into 2026.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

zacks.com

2025-12-05 10:06:06INGN gains momentum from rising POC demand, new product launches and strong Q3 sales, even as competition and forex swings temper near-term growth.

No data to display

Inogen Stock Dips Despite Q4 Earnings Beat, Revenues Up Y/Y

zacks.com

2026-02-25 13:50:12INGN posts narrower Q4 loss and 2% revenue rise, but shares dip as U.S. sales and rentals weaken despite international strength.

Inogen, Inc. (INGN) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-02-24 21:07:51Inogen, Inc. (INGN) Q4 2025 Earnings Call Transcript

Inogen (INGN) Reports Q4 Loss, Misses Revenue Estimates

zacks.com

2026-02-24 20:31:40Inogen (INGN) came out with a quarterly loss of $0.26 per share versus the Zacks Consensus Estimate of a loss of $0.36. This compares to a loss of $0.41 per share a year ago.

Inogen Announces Fourth Quarter and Full Year 2025 Financial Results and Provides 2026 Financial Outlook

businesswire.com

2026-02-24 16:05:00BEVERLY, Mass.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen Announces Fourth Quarter and Full Year 2025 Financial Results and Provides 2026 Financial Outlook.

Inogen Announces $30 Million Share Repurchase Program

businesswire.com

2026-02-24 16:00:00BEVERLY, Mass.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen Announces $30 Million Share Repurchase Program.

Inogen (INGN) May Report Negative Earnings: Know the Trend Ahead of Next Week's Release

zacks.com

2026-02-17 11:01:31Inogen (INGN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Inogen (INGN) Soars 6.6%: Is Further Upside Left in the Stock?

zacks.com

2026-02-12 08:11:14Inogen (INGN) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

Comparing Glaukos (NYSE:GKOS) & Inogen (NASDAQ:INGN)

defenseworld.net

2026-02-12 02:59:00Glaukos (NYSE: GKOS - Get Free Report) and Inogen (NASDAQ: INGN - Get Free Report) are both medical companies, but which is the superior investment? We will contrast the two businesses based on the strength of their valuation, analyst recommendations, institutional ownership, earnings, dividends, profitability and risk. Valuation and Earnings This table compares Glaukos and Inogen"s revenue,

Inogen (INGN) Loses 10.0% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

zacks.com

2026-02-10 10:35:18The heavy selling pressure might have exhausted for Inogen (INGN) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

zacks.com

2026-02-02 10:55:49INGN looks poised as Q3 revenue rises 4%, POC demand grows and valuation is low, despite seasonal softness.

Inogen Announces Preliminary Revenue Results for Fourth Quarter and Full-Year 2025

businesswire.com

2026-01-12 08:30:00GOLETA, Calif.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen to Announce Fourth Quarter and Full Year 2025 Financial Results on February 24, 2026.

INGN Stock Gains Post Latest Launch to Expand Respiratory Care Suite

zacks.com

2026-01-08 10:51:26Inogen launches Aurora CPAP masks to expand its respiratory care suite and enter the growing sleep apnea market.

Inogen Announces the Launch of Aurora CPAP Masks for Obstructive Sleep Apnea in the United States

businesswire.com

2026-01-07 08:30:00GOLETA, Calif.--(BUSINESS WIRE)---- $INGN #AirwayClearance--Inogen Announces the Launch of Aurora CPAP Masks for Obstructive Sleep Apnea in the United States.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

zacks.com

2026-01-02 09:35:17INGN gains momentum from rising POC demand, new product launches and strong Q3 sales, even as competition and forex swings temper near-term growth.

3 MedTech Innovators Shaping Healthcare in 2026: AVAH, INGN & CCLD

zacks.com

2025-12-19 09:46:09AVAH, INGN & CCLD show how home care, portable oxygen tech and cloud healthcare IT are reshaping care delivery and efficiency into 2026.

Here's Why You Should Add Inogen Stock to Your Portfolio Now

zacks.com

2025-12-05 10:06:06INGN gains momentum from rising POC demand, new product launches and strong Q3 sales, even as competition and forex swings temper near-term growth.