First Internet Bancorp - Fixed- (INBKZ)

Price:

24.46 USD

( - -0.08 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Grupo Financiero Galicia S.A.

VALUE SCORE:

8

2nd position

The First Bancorp, Inc.

VALUE SCORE:

14

The best

Bank OZK

VALUE SCORE:

14

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

First Internet Bancorp engages in the provision of online commercial and retail banking products and services. It offers first-lien residential mortgage loans, consumer loans and credit cards & CRE loans in Indiana and other parts of the midwest in the form of office, retail, industrial, and multifamily loans, with credit tenant lease financing. The company was founded on September 15, 2005 and is headquartered in Indianapolis, IN.

NEWS

First Internet Bancorp – Fixed- (NASDAQ:INBKZ) Shares Down 0.2% – Here’s Why

defenseworld.net

2026-01-22 03:33:05First Internet Bancorp - Fixed- (NASDAQ: INBKZ - Get Free Report) shares were down 0.2% during mid-day trading on Wednesday. The stock traded as low as $24.58 and last traded at $24.70. Approximately 3,350 shares were traded during mid-day trading, an increase of 10% from the average daily volume of 3,046 shares. The stock had

First Internet Bancorp – Fixed- (NASDAQ:INBKZ) Trading Up 0% – Still a Buy?

defenseworld.net

2025-12-27 02:26:55First Internet Bancorp - Fixed- (NASDAQ: INBKZ - Get Free Report) shares were up 0% on Friday. The company traded as high as $24.85 and last traded at $24.7450. Approximately 6,090 shares were traded during mid-day trading, an increase of 129% from the average daily volume of 2,664 shares. The stock had previously closed at

First Internet Bancorp – Fixed- (NASDAQ:INBKZ) Shares Up 0.1% – Should You Buy?

defenseworld.net

2025-11-06 03:38:48First Internet Bancorp - Fixed- (NASDAQ: INBKZ - Get Free Report) shares traded up 0.1% during trading on Wednesday. The stock traded as high as $24.70 and last traded at $24.6250. 4,121 shares traded hands during trading, an increase of 51% from the average session volume of 2,730 shares. The stock had previously closed at

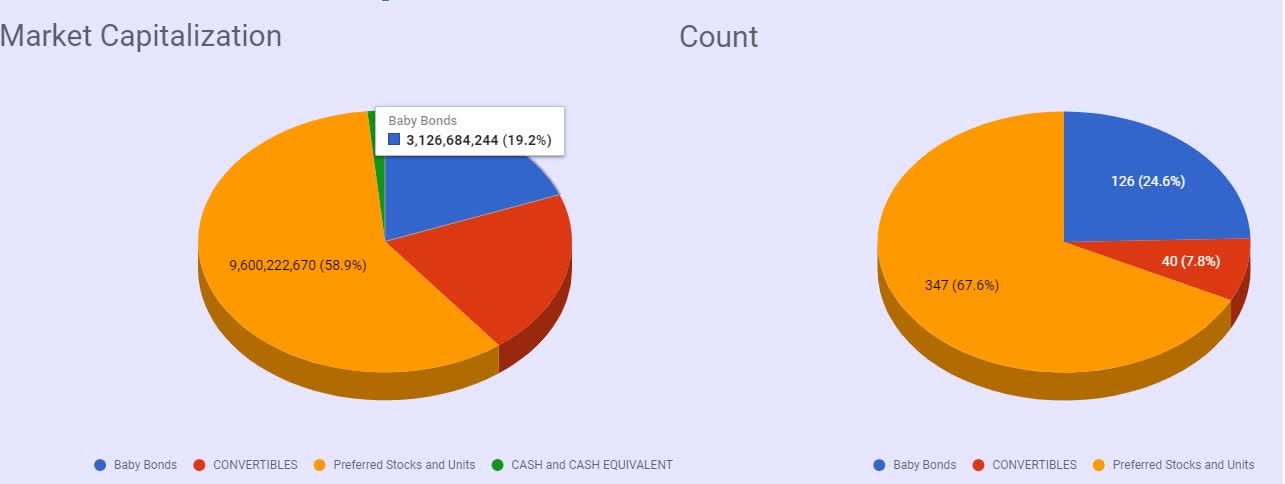

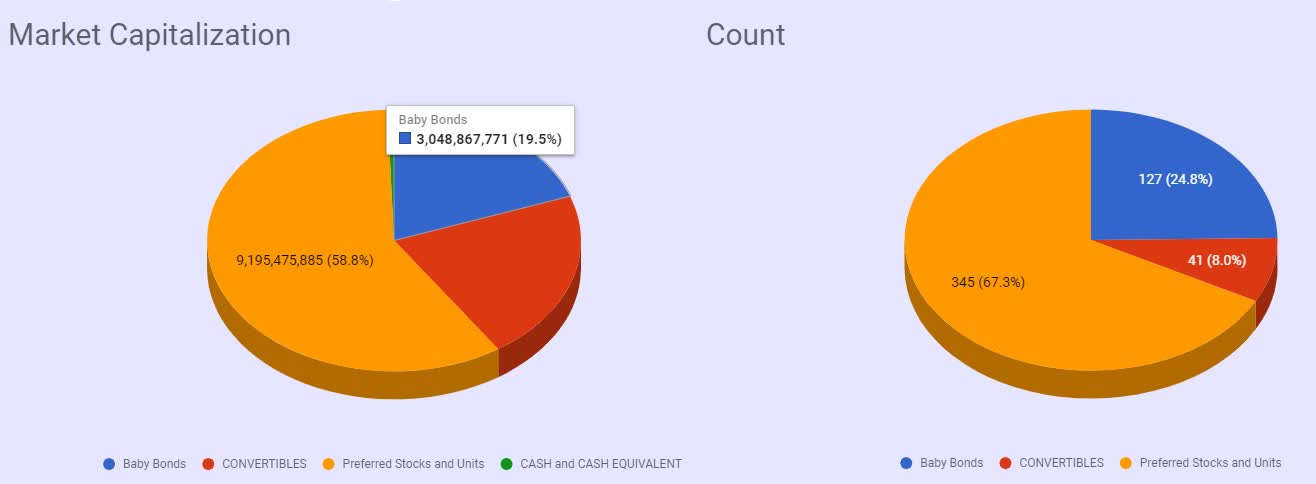

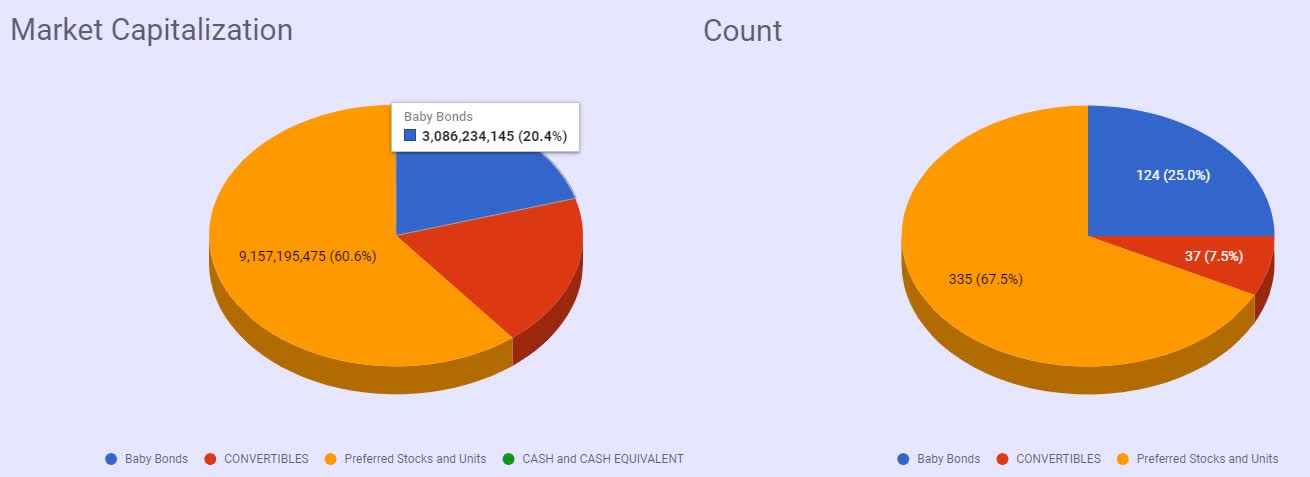

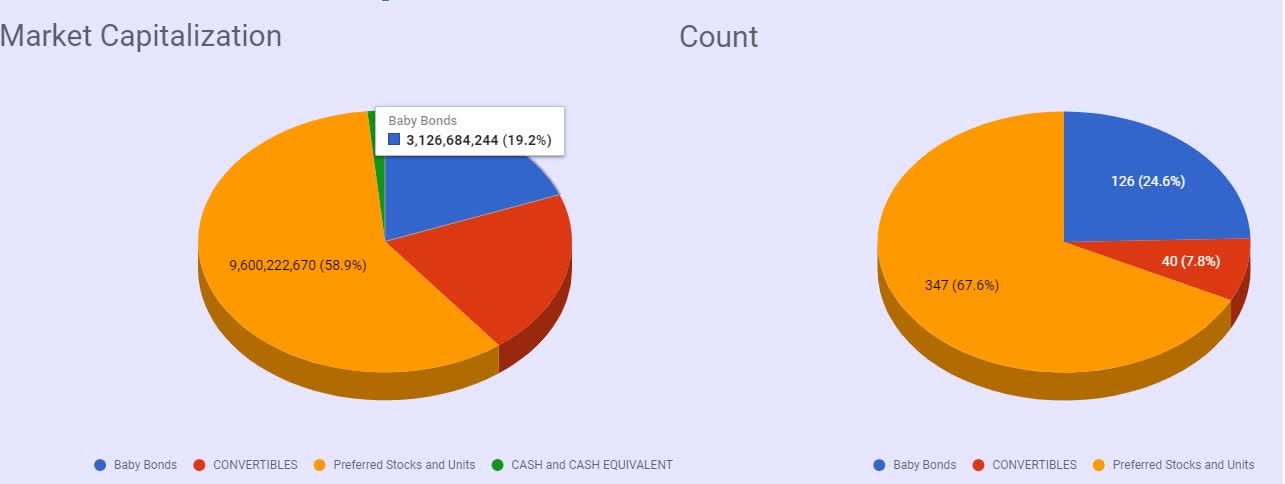

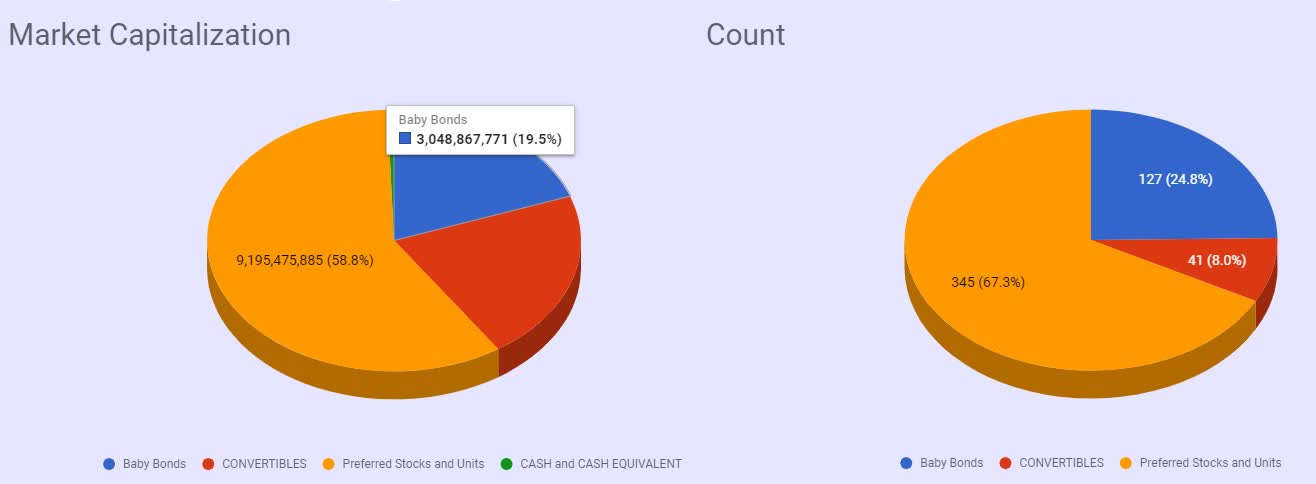

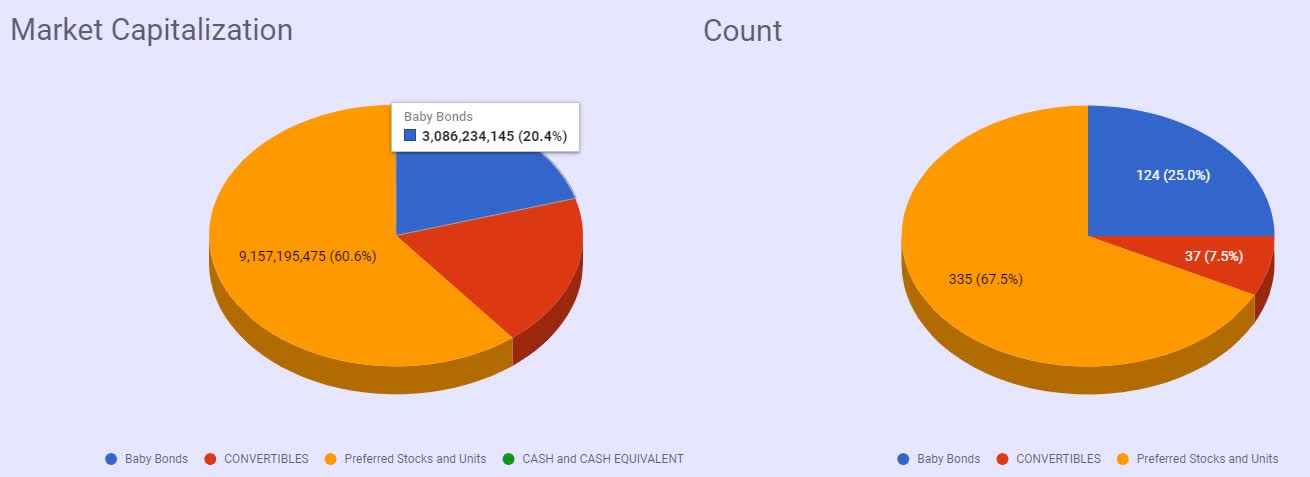

Baby Bonds Complete Review

seekingalpha.com

2020-08-19 22:51:21A review of all baby bonds. All the baby bonds sorted in categories.

First Internet Bancorp (INBK) CEO David Becker on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-23 20:42:05First Internet Bancorp (NASDAQ:INBK) Q2 2020 Earnings Conference Call July 23, 2020, 12:00 PM ET Company Participants Larry Clark - IR, Financial Profiles Incorporated David Becker - Chairman, President and CEO Ken Lovik - EVP and CFO Conference Call Participants Michael Perito - KBW Nathan Race - Piper Sandler John Rodis - Janney Presentation Operator Good day and welcome to the First Internet Bancorp's Earnings Conference Call for the Second Quarter of 2020.

First Internet Bancorp 2020 Q2 - Results - Earnings Call Presentation

seekingalpha.com

2020-07-23 11:02:31The following slide deck was published by First Internet Bancorp in conjunction with their 2020 Q2 earnings call.

Baby Bonds Complete Review

seekingalpha.com

2020-07-22 13:29:13A review of all baby bonds. All the baby bonds sorted in categories.

Baby Bonds Complete Review

seekingalpha.com

2020-06-17 15:22:58A review of all baby bonds. All the baby bonds sorted in categories. What has changed during the past month?

First Internet Bancorp – Fixed- (NASDAQ:INBKZ) Shares Down 0.2% – Here’s Why

defenseworld.net

2026-01-22 03:33:05First Internet Bancorp - Fixed- (NASDAQ: INBKZ - Get Free Report) shares were down 0.2% during mid-day trading on Wednesday. The stock traded as low as $24.58 and last traded at $24.70. Approximately 3,350 shares were traded during mid-day trading, an increase of 10% from the average daily volume of 3,046 shares. The stock had

First Internet Bancorp – Fixed- (NASDAQ:INBKZ) Trading Up 0% – Still a Buy?

defenseworld.net

2025-12-27 02:26:55First Internet Bancorp - Fixed- (NASDAQ: INBKZ - Get Free Report) shares were up 0% on Friday. The company traded as high as $24.85 and last traded at $24.7450. Approximately 6,090 shares were traded during mid-day trading, an increase of 129% from the average daily volume of 2,664 shares. The stock had previously closed at

First Internet Bancorp – Fixed- (NASDAQ:INBKZ) Shares Up 0.1% – Should You Buy?

defenseworld.net

2025-11-06 03:38:48First Internet Bancorp - Fixed- (NASDAQ: INBKZ - Get Free Report) shares traded up 0.1% during trading on Wednesday. The stock traded as high as $24.70 and last traded at $24.6250. 4,121 shares traded hands during trading, an increase of 51% from the average session volume of 2,730 shares. The stock had previously closed at

Baby Bonds Complete Review

seekingalpha.com

2020-08-19 22:51:21A review of all baby bonds. All the baby bonds sorted in categories.

First Internet Bancorp (INBK) CEO David Becker on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-23 20:42:05First Internet Bancorp (NASDAQ:INBK) Q2 2020 Earnings Conference Call July 23, 2020, 12:00 PM ET Company Participants Larry Clark - IR, Financial Profiles Incorporated David Becker - Chairman, President and CEO Ken Lovik - EVP and CFO Conference Call Participants Michael Perito - KBW Nathan Race - Piper Sandler John Rodis - Janney Presentation Operator Good day and welcome to the First Internet Bancorp's Earnings Conference Call for the Second Quarter of 2020.

First Internet Bancorp 2020 Q2 - Results - Earnings Call Presentation

seekingalpha.com

2020-07-23 11:02:31The following slide deck was published by First Internet Bancorp in conjunction with their 2020 Q2 earnings call.

Baby Bonds Complete Review

seekingalpha.com

2020-07-22 13:29:13A review of all baby bonds. All the baby bonds sorted in categories.

Baby Bonds Complete Review

seekingalpha.com

2020-06-17 15:22:58A review of all baby bonds. All the baby bonds sorted in categories. What has changed during the past month?