ImmunoGen, Inc. (IMGN)

Price:

31.23 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Regeneron Pharmaceuticals, Inc.

VALUE SCORE:

6

2nd position

ADMA Biologics, Inc.

VALUE SCORE:

11

The best

Genmab A/S

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

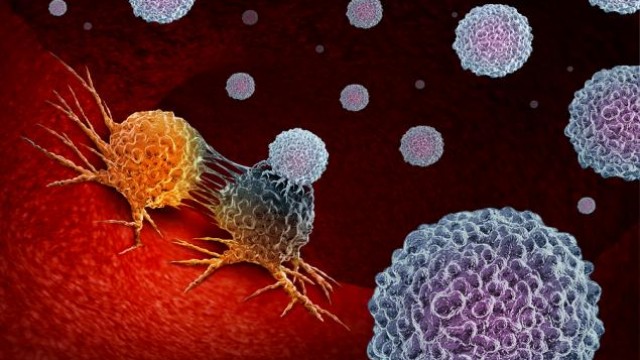

ImmunoGen, Inc., a clinical-stage biotechnology company, develops antibody-drug conjugate (ADC) therapies to treat cancer. The company's product candidates include mirvetuximab soravtansine, an ADC targeting folate-receptor alpha (FRa), which is in Phase III clinical trial for the treatment of platinum-resistant ovarian cancer; and Pivekimab sunirine, a CD123-targeting ADC that is in Phase II clinical trial for treating acute myeloid leukemia and blastic plasmacytoid dendritic cell neoplasm. Its preclinical programs include IMGC936, an ADC in co-development with MacroGenics, Inc.; and IMGN151, an anti FRa product candidate. The company has collaborations with Roche; Amgen/Oxford BioTherapeutics; Bayer HealthCare AG; Eli Lilly and Company; Novartis Institutes for BioMedical Research, Inc.; CytomX Therapeutics, Inc.; Fusion Pharmaceuticals Inc.; Debiopharm International SA; and MacroGenics, Inc. ImmunoGen, Inc. was founded in 1980 and is headquartered in Waltham, Massachusetts.

NEWS

Antibody Drug Conjugates Market Size is Expected to Reach USD 25.38 Billion by 2033, Growing at a CAGR of 8.84%: Straits Research

globenewswire.com

2025-01-22 11:05:00The global antibody drug conjugates market size was valued at USD 11.84 billion in 2024 and is projected to reach from USD 12.89 billion in 2025 to USD 25.38 billion by 2033, growing at a CAGR of 8.84% during the forecast period (2025-2033). The global antibody drug conjugates market size was valued at USD 11.84 billion in 2024 and is projected to reach from USD 12.89 billion in 2025 to USD 25.38 billion by 2033, growing at a CAGR of 8.84% during the forecast period (2025-2033).

AbbVie Cuts Its Guidance on ImmunoGen Deal

investopedia.com

2024-02-12 12:20:52Drug maker AbbVie (ABBV) is lowering its current quarter guidance because of costs related to its acquisition of ImmunoGen.

AbbVie's stock dips premarket after it lowers Q1 guidance to reflect dilutive impact of ImmunoGen deal close

marketwatch.com

2024-02-12 07:51:00AbbVie Inc.'s stock ABBV, -0.41% fell 0.5% early Monday, after the drug company lowered its first-quarter guidance to reflect the dilutive impact of its closure of the acquisition of ImmunoGen. The company said it now expects first-quarter per-share earnings to range from $2.26 to $2.30, down from prior guidance of $2.30 to $2.34, including a 4 cent per share dilutive impact from the Immunogen deal.

AbbVie Completes Acquisition of ImmunoGen

prnewswire.com

2024-02-12 07:37:00Adds flagship antibody-drug conjugate (ADC) ELAHERE® (mirvetuximab soravtansine-gynx) for folate receptor-alpha (FRα) positive platinum-resistant ovarian cancer (PROC) to AbbVie's portfolio ImmunoGen's pipeline complements AbbVie's existing oncology pipeline with potential to be transformative across multiple solid tumors and hematologic malignancies ImmunoGen's late-stage development programs for ELAHERE provide opportunity to expand into earlier lines of therapy and additional patient populations AbbVie reaffirms previously issued 2024 full-year adjusted diluted EPS guidance range of $11.05-$11.25 which now includes a $0.42 per share dilutive impact related to the ImmunoGen acquisition and the pending Cerevel Therapeutics acquisition AbbVie updates previously issued 2024 first-quarter adjusted diluted EPS guidance range from $2.30-$2.34 to $2.26-$2.30 which now includes a $0.04 per share dilutive impact related to the ImmunoGen acquisition NORTH CHICAGO, Ill. , Feb. 12, 2024 /PRNewswire/ -- AbbVie (NYSE: ABBV) announced today that it has completed its acquisition of ImmunoGen (NASDAQ: IMGN).

Is ImmunoGen (IMGN) Outperforming Other Medical Stocks This Year?

zacks.com

2024-02-09 10:40:25Here is how ImmunoGen (IMGN) and Achilles Therapeutics PLC Sponsored ADR (ACHL) have performed compared to their sector so far this year.

ImmunoGen (IMGN) Soars 5.7%: Is Further Upside Left in the Stock?

zacks.com

2024-02-09 07:01:07ImmunoGen (IMGN) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

7 Russell 2000 Stocks to Buy for the Next Bull Run: February 2024

investorplace.com

2024-02-06 14:38:48As 2023 wrapped up, Russell 2000 stocks, mirroring the dynamics of small-to-mid-cap companies, showed resilience, outperforming their initial stance. The iShares Russell 2000 ETF (NYSEARCA: IWM ), a key barometer for these stocks, boasts over $60 billion in assets and a robust daily trading volume surpassing 40 million, setting an impressive stage for these agile market players.

ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

businesswire.com

2024-02-01 16:30:00WALTHAM, Mass.--(BUSINESS WIRE)--ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4).

How ImmunoGen (IMGN) Stock Stands Out in a Strong Industry

zacks.com

2024-01-09 09:01:16ImmunoGen (IMGN) has seen solid earnings estimate revision activity over the past two month, and belongs to a strong industry as well.

Cramer names biopharma companies to watch as industry mergers start to pile up

cnbc.com

2024-01-05 19:02:09CNBC's Jim Cramer pointed out the numerous mergers and acquisitions across the biopharma industry.

All You Need to Know About ImmunoGen (IMGN) Rating Upgrade to Strong Buy

zacks.com

2024-01-04 13:32:26ImmunoGen (IMGN) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Best Momentum Stocks to Buy for January 4th

zacks.com

2024-01-04 11:17:22IMGN and GTLB made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on January 4, 2024.

New Strong Buy Stocks for January 4th

zacks.com

2024-01-04 08:17:13IMGN, GTLB, FNWD, BL and TMHC have been added to the Zacks Rank #1 (Strong Buy) List on January 4, 2024.

ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

businesswire.com

2024-01-03 16:30:00WALTHAM, Mass.--(BUSINESS WIRE)--ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4).

AbbVie's Recent ImmunoGen Acquisition Looks Brilliant: Here's Why

fool.com

2023-12-26 08:30:00AbbVie needs to diversify its drug portfolio because of the loss of exclusive rights to Humira. The recent acquisition of ImmunoGen fills several needs and comes at an excellent time.

3 Stocks at the Forefront of Medical Innovation

investorplace.com

2023-12-25 20:23:09Innovation in the medical world is undoubtedly a fundamental pillar in the development of humanity. There are great companies within the biotech sector doing wonderful work, research, and developments, not only to attack important diseases but also to prevent them.

No data to display

Antibody Drug Conjugates Market Size is Expected to Reach USD 25.38 Billion by 2033, Growing at a CAGR of 8.84%: Straits Research

globenewswire.com

2025-01-22 11:05:00The global antibody drug conjugates market size was valued at USD 11.84 billion in 2024 and is projected to reach from USD 12.89 billion in 2025 to USD 25.38 billion by 2033, growing at a CAGR of 8.84% during the forecast period (2025-2033). The global antibody drug conjugates market size was valued at USD 11.84 billion in 2024 and is projected to reach from USD 12.89 billion in 2025 to USD 25.38 billion by 2033, growing at a CAGR of 8.84% during the forecast period (2025-2033).

AbbVie Cuts Its Guidance on ImmunoGen Deal

investopedia.com

2024-02-12 12:20:52Drug maker AbbVie (ABBV) is lowering its current quarter guidance because of costs related to its acquisition of ImmunoGen.

AbbVie's stock dips premarket after it lowers Q1 guidance to reflect dilutive impact of ImmunoGen deal close

marketwatch.com

2024-02-12 07:51:00AbbVie Inc.'s stock ABBV, -0.41% fell 0.5% early Monday, after the drug company lowered its first-quarter guidance to reflect the dilutive impact of its closure of the acquisition of ImmunoGen. The company said it now expects first-quarter per-share earnings to range from $2.26 to $2.30, down from prior guidance of $2.30 to $2.34, including a 4 cent per share dilutive impact from the Immunogen deal.

AbbVie Completes Acquisition of ImmunoGen

prnewswire.com

2024-02-12 07:37:00Adds flagship antibody-drug conjugate (ADC) ELAHERE® (mirvetuximab soravtansine-gynx) for folate receptor-alpha (FRα) positive platinum-resistant ovarian cancer (PROC) to AbbVie's portfolio ImmunoGen's pipeline complements AbbVie's existing oncology pipeline with potential to be transformative across multiple solid tumors and hematologic malignancies ImmunoGen's late-stage development programs for ELAHERE provide opportunity to expand into earlier lines of therapy and additional patient populations AbbVie reaffirms previously issued 2024 full-year adjusted diluted EPS guidance range of $11.05-$11.25 which now includes a $0.42 per share dilutive impact related to the ImmunoGen acquisition and the pending Cerevel Therapeutics acquisition AbbVie updates previously issued 2024 first-quarter adjusted diluted EPS guidance range from $2.30-$2.34 to $2.26-$2.30 which now includes a $0.04 per share dilutive impact related to the ImmunoGen acquisition NORTH CHICAGO, Ill. , Feb. 12, 2024 /PRNewswire/ -- AbbVie (NYSE: ABBV) announced today that it has completed its acquisition of ImmunoGen (NASDAQ: IMGN).

Is ImmunoGen (IMGN) Outperforming Other Medical Stocks This Year?

zacks.com

2024-02-09 10:40:25Here is how ImmunoGen (IMGN) and Achilles Therapeutics PLC Sponsored ADR (ACHL) have performed compared to their sector so far this year.

ImmunoGen (IMGN) Soars 5.7%: Is Further Upside Left in the Stock?

zacks.com

2024-02-09 07:01:07ImmunoGen (IMGN) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

7 Russell 2000 Stocks to Buy for the Next Bull Run: February 2024

investorplace.com

2024-02-06 14:38:48As 2023 wrapped up, Russell 2000 stocks, mirroring the dynamics of small-to-mid-cap companies, showed resilience, outperforming their initial stance. The iShares Russell 2000 ETF (NYSEARCA: IWM ), a key barometer for these stocks, boasts over $60 billion in assets and a robust daily trading volume surpassing 40 million, setting an impressive stage for these agile market players.

ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

businesswire.com

2024-02-01 16:30:00WALTHAM, Mass.--(BUSINESS WIRE)--ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4).

How ImmunoGen (IMGN) Stock Stands Out in a Strong Industry

zacks.com

2024-01-09 09:01:16ImmunoGen (IMGN) has seen solid earnings estimate revision activity over the past two month, and belongs to a strong industry as well.

Cramer names biopharma companies to watch as industry mergers start to pile up

cnbc.com

2024-01-05 19:02:09CNBC's Jim Cramer pointed out the numerous mergers and acquisitions across the biopharma industry.

All You Need to Know About ImmunoGen (IMGN) Rating Upgrade to Strong Buy

zacks.com

2024-01-04 13:32:26ImmunoGen (IMGN) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Best Momentum Stocks to Buy for January 4th

zacks.com

2024-01-04 11:17:22IMGN and GTLB made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on January 4, 2024.

New Strong Buy Stocks for January 4th

zacks.com

2024-01-04 08:17:13IMGN, GTLB, FNWD, BL and TMHC have been added to the Zacks Rank #1 (Strong Buy) List on January 4, 2024.

ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

businesswire.com

2024-01-03 16:30:00WALTHAM, Mass.--(BUSINESS WIRE)--ImmunoGen Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4).

AbbVie's Recent ImmunoGen Acquisition Looks Brilliant: Here's Why

fool.com

2023-12-26 08:30:00AbbVie needs to diversify its drug portfolio because of the loss of exclusive rights to Humira. The recent acquisition of ImmunoGen fills several needs and comes at an excellent time.

3 Stocks at the Forefront of Medical Innovation

investorplace.com

2023-12-25 20:23:09Innovation in the medical world is undoubtedly a fundamental pillar in the development of humanity. There are great companies within the biotech sector doing wonderful work, research, and developments, not only to attack important diseases but also to prevent them.