iShares International Treasury Bond ETF (IGOV)

Price:

42.59 USD

( - -0.02 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Vanguard Total Bond Market Index Fund

VALUE SCORE:

7

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund will invest at least 80% of its assets in the component securities of the underlying index and will invest at least 90% of its assets in fixed income securities of the types included in the underlying index. The underlying index measures the performance of fixed-rate, local currency, investment-grade, sovereign bonds from certain developed markets. The fund is non-diversified.

NEWS

IGOV: A Sneaky, Effective Way To Profit From U.S. Dollar Weakness

seekingalpha.com

2025-06-09 05:22:06IGOV offers diversified exposure to high-quality, non-US government bonds, providing a hedge against US economic and currency risks. Despite a low dividend yield, IGOV's appeal lies in its broad international bond holdings and strong credit quality, with one-third rated higher than US Treasuries. The ETF acts as an alternative to foreign currency ETFs, benefiting from recent negative correlation with the US Dollar and potential for further upside.

Following Morgan Stanley? Tap These ETFs

zacks.com

2023-06-08 15:23:04Morgan Stanley is bullish on equities in Japan, Taiwan and South Korea and suggest an overweight position in developed-market government bonds, including long-dated Treasuries, and the dollar.

4 Safe ETFs to Invest to Counter Global Financial Market Crisis

zacks.com

2023-03-14 09:58:05Global financial market crisis is likely to trigger a risk-off sentiment. These ETFs may thus gain ahead.

BlackRock Sees More Volatility Ahead: ETF Strategies to Follow

zacks.com

2022-07-22 14:04:03According to strategists at BlackRock Inc., stock volatility will remain rife in the coming days.

Weak Growth, Inflation Outlook Help Lift International Bond ETFs

etftrends.com

2021-08-02 17:34:44Eurozone government bonds have been rising in recent weeks on fears of a slowdown in Europe. Fixed income investors can also diversify with the strengthening global debt markets through international bond exchange traded funds.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

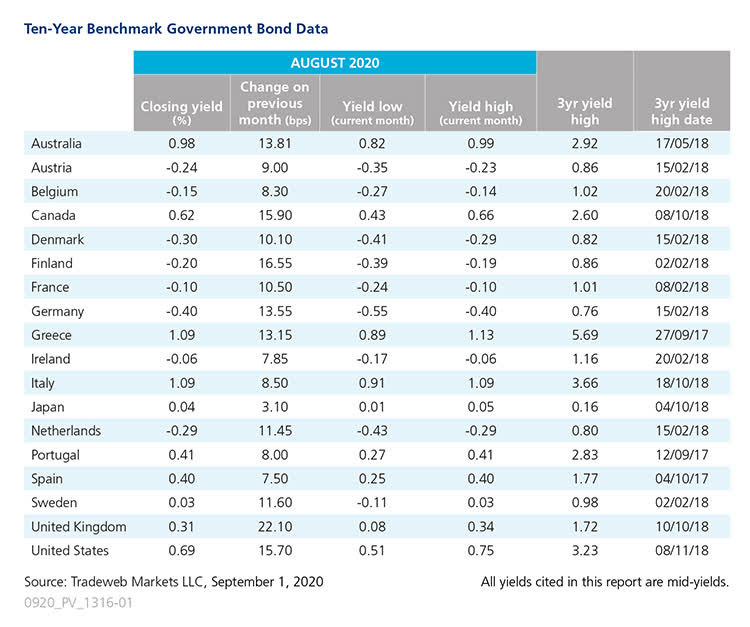

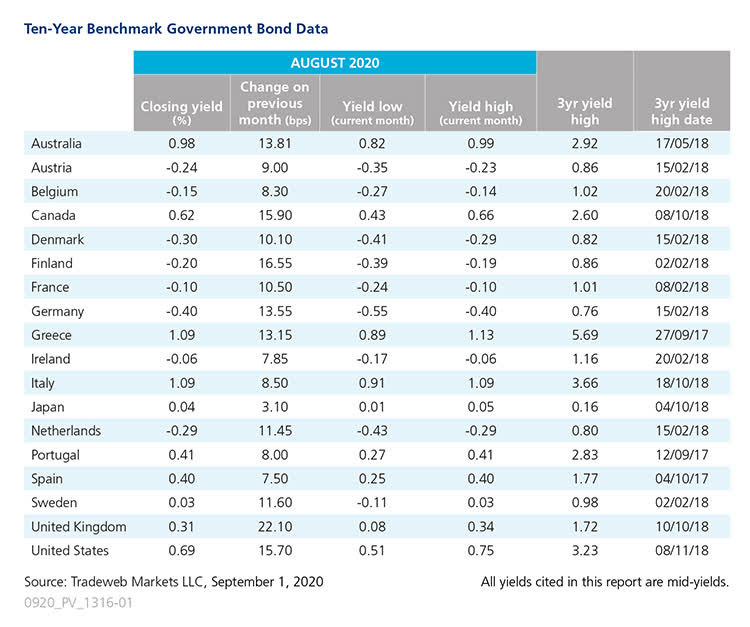

Tradeweb Government Bond Update - August 2020

seekingalpha.com

2020-09-09 08:15:51After months of plummeting yields, 10-year government bonds experienced a sell-off in August. The yield on Finland's 10-year benchmark note saw the largest increase of 16.5 basis points, ending the month at -0.20%.

Rates: Lower For Longer

seekingalpha.com

2020-08-30 09:52:20We anticipated the next downturn would mark a further step toward loose monetary policy, piloting toward zero or negative interest rates and more asset purchases.

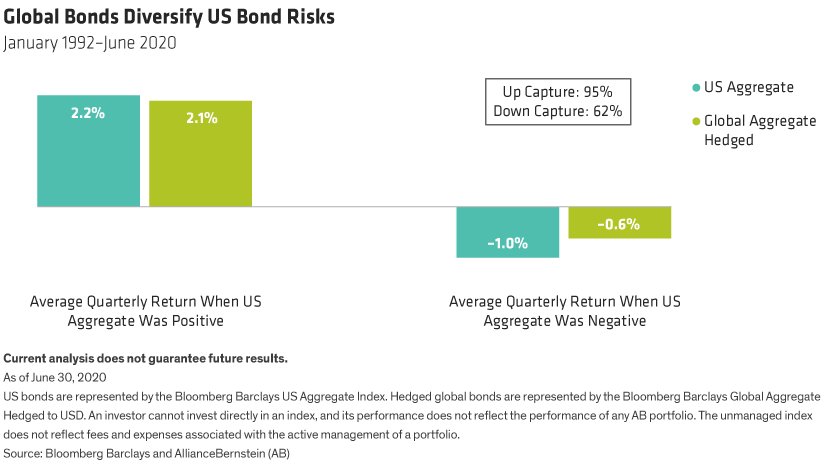

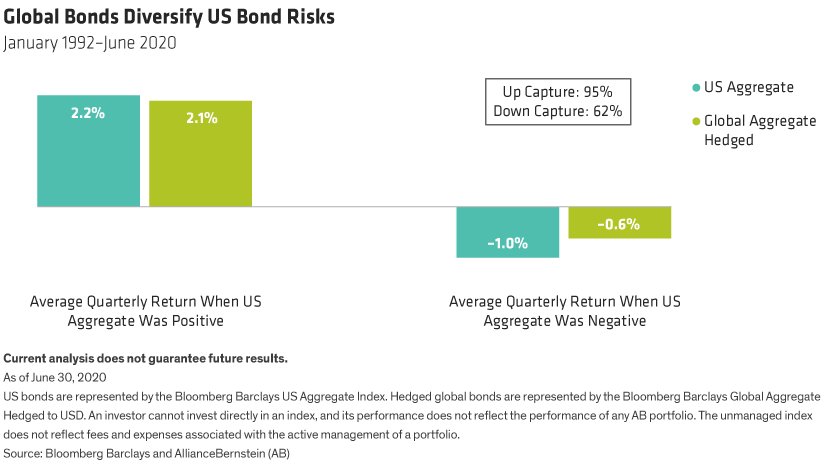

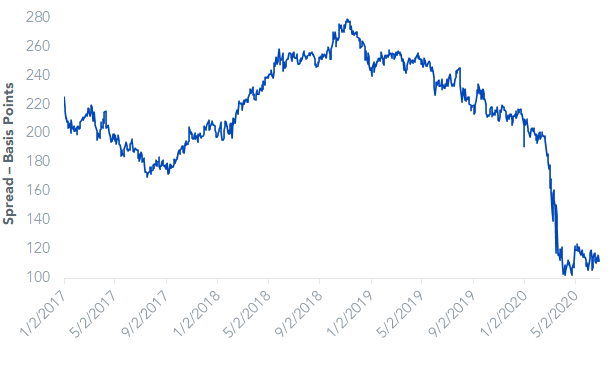

Don't Shun Global Bonds

seekingalpha.com

2020-08-27 05:42:04The global bond market is less volatile and supplies bigger diversification benefits than the US bond market.

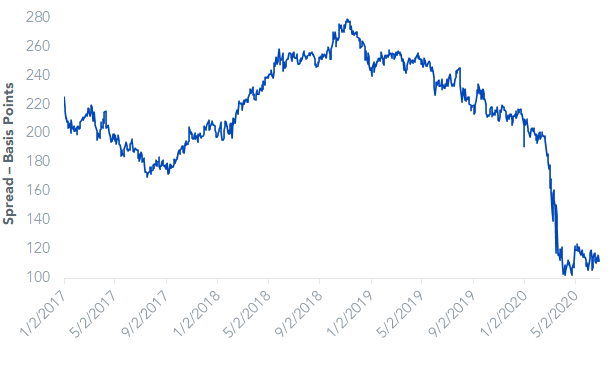

The Relentless Hunt For Yield

seekingalpha.com

2020-07-28 09:21:5060% of all global yields are now less than 1.00% and 86% of all global yields are now less than 2.00% according to the Financial Times.

Global Debt Outlook Q3 2020: Evaluating The 4 Ps (Pandemic, Policy, Pricing, And Portfolios)

seekingalpha.com

2020-07-23 10:18:27Risk and liquidity premia have largely been removed from assets such as US investment grade, the European periphery, and emerging market rates.

The World Is Drowning In Debt

seekingalpha.com

2020-07-23 03:56:54The enormous increase in public spending during the coronavirus crisis and the fall in output will lead to a global government debt figure close to 105 percent of GDP.

Jens Van 't Klooster On ECB Bond Purchasing And The Myth Of Central Bank Neutrality

seekingalpha.com

2020-07-19 08:06:14Jens Van 't Klooster is a postdoctoral fellow at KU Leuven and is also a member of the research group, A New Normative Framework for Financial Debt at the University of Amsterdam.

Capital Markets Weekly: Emerging Market Issuers Continue Pushing Debt Maturity Threshold

seekingalpha.com

2020-07-19 07:02:58Among this week's highlights indicating emerging market focus on accessing long-term debt are a 30-year issue for the Emirate of Sharjah and plans by Brazilian petrochemical company Braskem to raise hybrid debt, following recent perpetual sales by Emirates NBD, Banorte and DP World.

U.S. Treasuries Watch: Thinking Globally

seekingalpha.com

2020-07-02 07:07:22There have been some interesting developments overseas that have been largely ignored in market commentary and that got me thinking globally. Negative governmen

No data to display

IGOV: A Sneaky, Effective Way To Profit From U.S. Dollar Weakness

seekingalpha.com

2025-06-09 05:22:06IGOV offers diversified exposure to high-quality, non-US government bonds, providing a hedge against US economic and currency risks. Despite a low dividend yield, IGOV's appeal lies in its broad international bond holdings and strong credit quality, with one-third rated higher than US Treasuries. The ETF acts as an alternative to foreign currency ETFs, benefiting from recent negative correlation with the US Dollar and potential for further upside.

Following Morgan Stanley? Tap These ETFs

zacks.com

2023-06-08 15:23:04Morgan Stanley is bullish on equities in Japan, Taiwan and South Korea and suggest an overweight position in developed-market government bonds, including long-dated Treasuries, and the dollar.

4 Safe ETFs to Invest to Counter Global Financial Market Crisis

zacks.com

2023-03-14 09:58:05Global financial market crisis is likely to trigger a risk-off sentiment. These ETFs may thus gain ahead.

BlackRock Sees More Volatility Ahead: ETF Strategies to Follow

zacks.com

2022-07-22 14:04:03According to strategists at BlackRock Inc., stock volatility will remain rife in the coming days.

Weak Growth, Inflation Outlook Help Lift International Bond ETFs

etftrends.com

2021-08-02 17:34:44Eurozone government bonds have been rising in recent weeks on fears of a slowdown in Europe. Fixed income investors can also diversify with the strengthening global debt markets through international bond exchange traded funds.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

Tradeweb Government Bond Update - August 2020

seekingalpha.com

2020-09-09 08:15:51After months of plummeting yields, 10-year government bonds experienced a sell-off in August. The yield on Finland's 10-year benchmark note saw the largest increase of 16.5 basis points, ending the month at -0.20%.

Rates: Lower For Longer

seekingalpha.com

2020-08-30 09:52:20We anticipated the next downturn would mark a further step toward loose monetary policy, piloting toward zero or negative interest rates and more asset purchases.

Don't Shun Global Bonds

seekingalpha.com

2020-08-27 05:42:04The global bond market is less volatile and supplies bigger diversification benefits than the US bond market.

The Relentless Hunt For Yield

seekingalpha.com

2020-07-28 09:21:5060% of all global yields are now less than 1.00% and 86% of all global yields are now less than 2.00% according to the Financial Times.

Global Debt Outlook Q3 2020: Evaluating The 4 Ps (Pandemic, Policy, Pricing, And Portfolios)

seekingalpha.com

2020-07-23 10:18:27Risk and liquidity premia have largely been removed from assets such as US investment grade, the European periphery, and emerging market rates.

The World Is Drowning In Debt

seekingalpha.com

2020-07-23 03:56:54The enormous increase in public spending during the coronavirus crisis and the fall in output will lead to a global government debt figure close to 105 percent of GDP.

Jens Van 't Klooster On ECB Bond Purchasing And The Myth Of Central Bank Neutrality

seekingalpha.com

2020-07-19 08:06:14Jens Van 't Klooster is a postdoctoral fellow at KU Leuven and is also a member of the research group, A New Normative Framework for Financial Debt at the University of Amsterdam.

Capital Markets Weekly: Emerging Market Issuers Continue Pushing Debt Maturity Threshold

seekingalpha.com

2020-07-19 07:02:58Among this week's highlights indicating emerging market focus on accessing long-term debt are a 30-year issue for the Emirate of Sharjah and plans by Brazilian petrochemical company Braskem to raise hybrid debt, following recent perpetual sales by Emirates NBD, Banorte and DP World.

U.S. Treasuries Watch: Thinking Globally

seekingalpha.com

2020-07-02 07:07:22There have been some interesting developments overseas that have been largely ignored in market commentary and that got me thinking globally. Negative governmen