iShares International Developed Real Estate ETF (IFGL)

Price:

25.49 USD

( + 0.30 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

ProShares UltraShort Nasdaq Biotechnology

VALUE SCORE:

9

2nd position

SuRo Capital Corp.

VALUE SCORE:

13

The best

SuRo Capital Corp. 6.00% Notes due 2026

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index. The underlying index measures the stock performance of companies engaged in the ownership and development of real estate markets in developed countries (except for the United States) as defined by FTSE EPRA/NAREIT.

NEWS

The Rate-Cut REIT Revival

seekingalpha.com

2025-09-15 09:00:00Three years of persistent rate-driven pressure on the residential and commercial real estate market appears to finally be abating - and not a moment too soon. REITs were hit by a "triple whammy" of rate-related headwinds: higher borrowing costs directly squeezed profitability, eroded the relative appeal of REIT dividends, and made it near-impossible to grow accretively. Since the Fed's initial rate hike in March 2022, REITs have lagged the S&P 500 by a whopping 55 percentage points, nearly 3x the magnitude of underperformance seen in the GFC.

Canadian REITs: Higher Yield Up North

seekingalpha.com

2024-09-27 09:00:00For income-focused investors willing to venture outside the United States, Canadian REITs offer appealing qualities as a potential portfolio diversifier alongside their larger and more established U.S. peers. Canadian REITs, on average, offer higher monthly dividend yields and trade at lower P/FFO multiples compared to their U.S. counterparts, but typically have weaker balance sheets with higher debt ratios. In this report, we take a quick look at 30 Canadian REITs and break down the industry on a sector-by-sector level. We also take a deep dive into H&R REIT.

Listed Real Estate: Searching For Positive Signals While Reviewing The Case For REITs

seekingalpha.com

2023-11-29 06:30:00REIT index performance can be a leading indicator for the asset class as a whole. Our latest Asset Allocation recorded a strong quarter for listed real estate, showing signs of long-awaited resurgence. REITs send encouraging signals. A deeper analysis of sectoral returns since the Great Financial Crisis reveals no clear pattern, vindicating broad sectoral exposure.

Industrial REITs: We Love Logistics

seekingalpha.com

2023-05-05 10:00:00No slowdown here. After the worst year of performance on record in 2022, Industrial REITs have rebounded this year after earnings results showed a surprising re-strengthening of property-level fundamentals. Recent earnings results showed that demand continues to substantially outpace available supply. Rent growth reaccelerated in early-2023, with rental spreads averaging over 40%, while occupancy rates climbed to fresh record.

Storage Wars

seekingalpha.com

2023-04-14 10:30:00Storage REITs are the best-performing property sector this year after lagging in late 2022, lifted by surprisingly solid earnings results and a thawing of the previously icy-cold housing market. Storage demand is driven largely by housing activity – specifically, home sales and rental market turnover - and the recent moderation in mortgage rates has eased concern of a deepening housing recession.

Apartment REITs: Tracking For Soft Landing

seekingalpha.com

2023-02-23 10:00:00Apartment REITs were the second-worst-performing property sector in 2022 - barely outperforming the troubled office sector - despite delivering a record year of operating performance highlighted by 20% FFO growth. Following two years of historic rent growth, there is little doubt that growth will moderate over the coming quarters. Market consensus sees a "hard landing" with rising vacancies and declining rents.

Storage REITs: Downsized Demand

seekingalpha.com

2023-01-27 10:00:00Despite delivering the strongest earnings growth of any property sector in 2022, Self-Storage REITs have stumbled of late amid a post-pandemic demand normalization and pressure from elevated supply growth. Storage demand is driven largely by housing activity – specifically home sales and rental market turnover. Rental market turnover finished 2022 near historic-lows while home sales also dipped to decade-lows.

Industrial REITs: Shortages Become Gluts

seekingalpha.com

2023-01-18 10:00:00Pressured by global recession concerns, Industrial REITs dipped by 30% in 2022 - the sector's worst year on record- snapping a seven-year streak of outperformance over the broader REIT Index. The frenzied investment in logistics space clashed with already-tight supply, fueling an incredible surge in rent growth across logistics and warehouse properties. Market rents have soared 50% since early 2021.

Timber REITs: Renewable Dividends

seekingalpha.com

2021-12-10 10:30:00Across the land, there are few better inflation hedges than land itself. Timber REITs own nearly 30 million acres of land, more acreage than the smallest U.S. five states combined. Truly an "organic growth" sector, Timber REITs - which were initially slammed at the outside of the pandemic - have come roaring back to life over the last twelve months.

Mall REITs: Only The Strong Shall Survive

seekingalpha.com

2021-05-20 14:02:21Despite reporting record-low occupancy rates and rental rate spreads, mall REITs have been the best-performing property sector this year, riding the vaccine-driven reopening rotation to gains of more than 40%.

Weak Dollar? Hedge With High Dividends, Yields +9%

seekingalpha.com

2020-12-01 08:35:00The US dollar is at its weakest point in two years. We examine what a "weak dollar" means.

High-Yield ETFs And CEFs: No Free Lunch

seekingalpha.com

2020-09-10 10:00:00Give me yield or give me death. In a world of perpetually low interest rates, investors have piled into yield-oriented equity sectors to quench their voracious appetite for income.

REITs Unfazed By Tech Wreck

seekingalpha.com

2020-09-05 09:00:00Tech wreck: The unofficial end of summer came with one final splash in its final days as volatility returned to U.S.

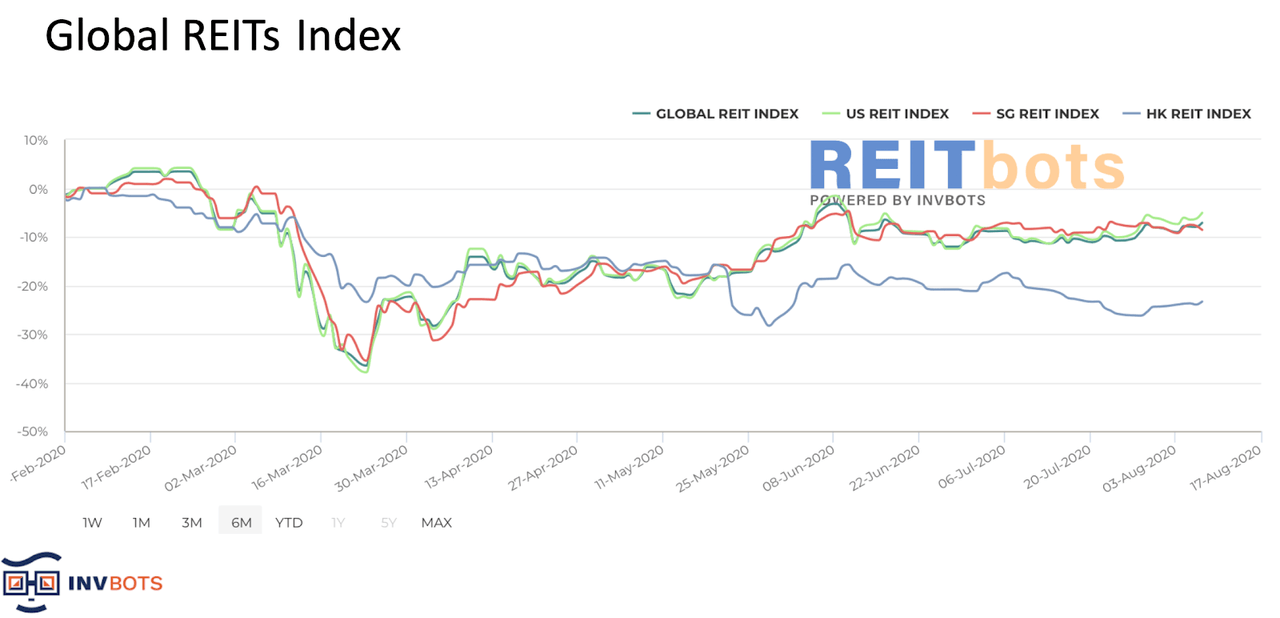

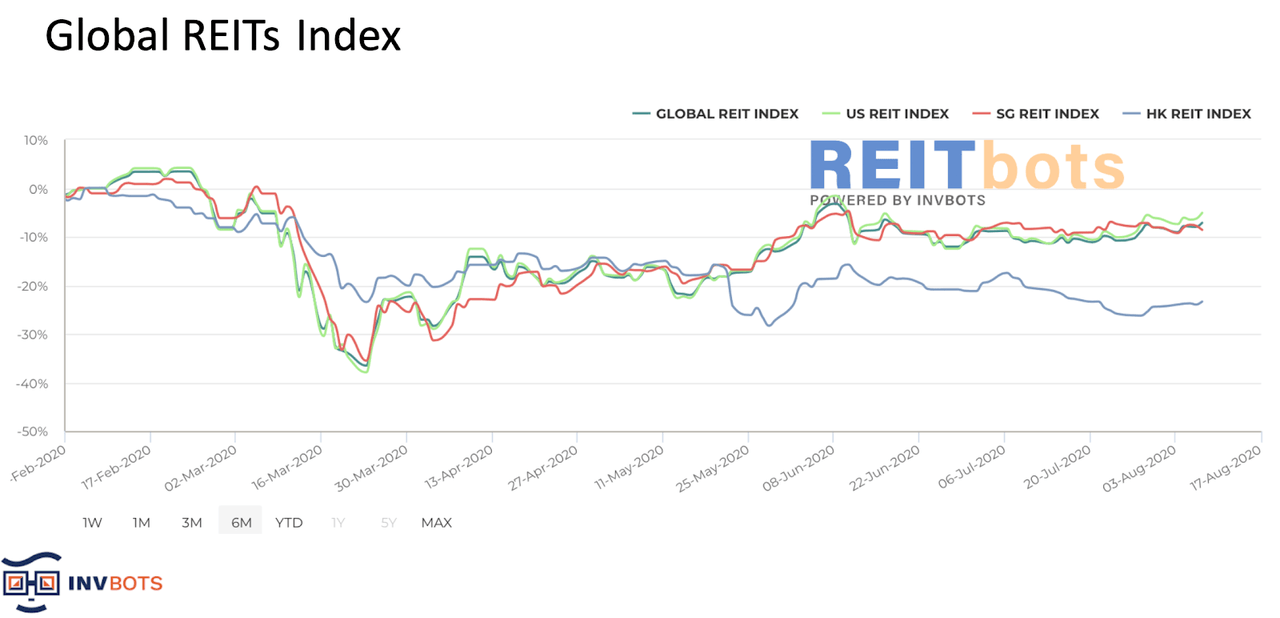

Global Industrial And New Economy REITs Benefited From The Pandemic, Whereas Global Traditional REITs Underperformed

seekingalpha.com

2020-08-18 11:35:47Global REITs market has declined by 4.13% year-to-date according to Invbots Global REITs Index, mainly due to the pandemic and the concern on the global recession.

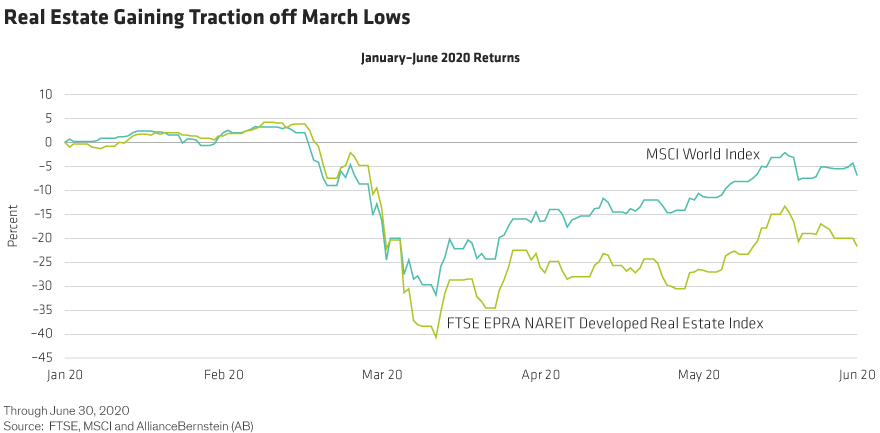

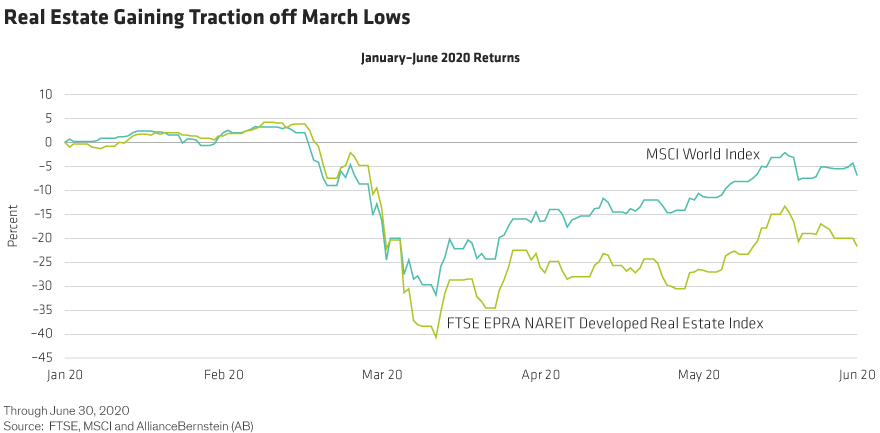

Unlocking REIT Potential Amid COVID-19

seekingalpha.com

2020-07-05 03:29:25COVID-19 upended what had been a healthy real estate market entering 2020. Investors remain cautious after seeing the severe impact to the lodging and retail se

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

No data to display

The Rate-Cut REIT Revival

seekingalpha.com

2025-09-15 09:00:00Three years of persistent rate-driven pressure on the residential and commercial real estate market appears to finally be abating - and not a moment too soon. REITs were hit by a "triple whammy" of rate-related headwinds: higher borrowing costs directly squeezed profitability, eroded the relative appeal of REIT dividends, and made it near-impossible to grow accretively. Since the Fed's initial rate hike in March 2022, REITs have lagged the S&P 500 by a whopping 55 percentage points, nearly 3x the magnitude of underperformance seen in the GFC.

Canadian REITs: Higher Yield Up North

seekingalpha.com

2024-09-27 09:00:00For income-focused investors willing to venture outside the United States, Canadian REITs offer appealing qualities as a potential portfolio diversifier alongside their larger and more established U.S. peers. Canadian REITs, on average, offer higher monthly dividend yields and trade at lower P/FFO multiples compared to their U.S. counterparts, but typically have weaker balance sheets with higher debt ratios. In this report, we take a quick look at 30 Canadian REITs and break down the industry on a sector-by-sector level. We also take a deep dive into H&R REIT.

Listed Real Estate: Searching For Positive Signals While Reviewing The Case For REITs

seekingalpha.com

2023-11-29 06:30:00REIT index performance can be a leading indicator for the asset class as a whole. Our latest Asset Allocation recorded a strong quarter for listed real estate, showing signs of long-awaited resurgence. REITs send encouraging signals. A deeper analysis of sectoral returns since the Great Financial Crisis reveals no clear pattern, vindicating broad sectoral exposure.

Industrial REITs: We Love Logistics

seekingalpha.com

2023-05-05 10:00:00No slowdown here. After the worst year of performance on record in 2022, Industrial REITs have rebounded this year after earnings results showed a surprising re-strengthening of property-level fundamentals. Recent earnings results showed that demand continues to substantially outpace available supply. Rent growth reaccelerated in early-2023, with rental spreads averaging over 40%, while occupancy rates climbed to fresh record.

Storage Wars

seekingalpha.com

2023-04-14 10:30:00Storage REITs are the best-performing property sector this year after lagging in late 2022, lifted by surprisingly solid earnings results and a thawing of the previously icy-cold housing market. Storage demand is driven largely by housing activity – specifically, home sales and rental market turnover - and the recent moderation in mortgage rates has eased concern of a deepening housing recession.

Apartment REITs: Tracking For Soft Landing

seekingalpha.com

2023-02-23 10:00:00Apartment REITs were the second-worst-performing property sector in 2022 - barely outperforming the troubled office sector - despite delivering a record year of operating performance highlighted by 20% FFO growth. Following two years of historic rent growth, there is little doubt that growth will moderate over the coming quarters. Market consensus sees a "hard landing" with rising vacancies and declining rents.

Storage REITs: Downsized Demand

seekingalpha.com

2023-01-27 10:00:00Despite delivering the strongest earnings growth of any property sector in 2022, Self-Storage REITs have stumbled of late amid a post-pandemic demand normalization and pressure from elevated supply growth. Storage demand is driven largely by housing activity – specifically home sales and rental market turnover. Rental market turnover finished 2022 near historic-lows while home sales also dipped to decade-lows.

Industrial REITs: Shortages Become Gluts

seekingalpha.com

2023-01-18 10:00:00Pressured by global recession concerns, Industrial REITs dipped by 30% in 2022 - the sector's worst year on record- snapping a seven-year streak of outperformance over the broader REIT Index. The frenzied investment in logistics space clashed with already-tight supply, fueling an incredible surge in rent growth across logistics and warehouse properties. Market rents have soared 50% since early 2021.

Timber REITs: Renewable Dividends

seekingalpha.com

2021-12-10 10:30:00Across the land, there are few better inflation hedges than land itself. Timber REITs own nearly 30 million acres of land, more acreage than the smallest U.S. five states combined. Truly an "organic growth" sector, Timber REITs - which were initially slammed at the outside of the pandemic - have come roaring back to life over the last twelve months.

Mall REITs: Only The Strong Shall Survive

seekingalpha.com

2021-05-20 14:02:21Despite reporting record-low occupancy rates and rental rate spreads, mall REITs have been the best-performing property sector this year, riding the vaccine-driven reopening rotation to gains of more than 40%.

Weak Dollar? Hedge With High Dividends, Yields +9%

seekingalpha.com

2020-12-01 08:35:00The US dollar is at its weakest point in two years. We examine what a "weak dollar" means.

High-Yield ETFs And CEFs: No Free Lunch

seekingalpha.com

2020-09-10 10:00:00Give me yield or give me death. In a world of perpetually low interest rates, investors have piled into yield-oriented equity sectors to quench their voracious appetite for income.

REITs Unfazed By Tech Wreck

seekingalpha.com

2020-09-05 09:00:00Tech wreck: The unofficial end of summer came with one final splash in its final days as volatility returned to U.S.

Global Industrial And New Economy REITs Benefited From The Pandemic, Whereas Global Traditional REITs Underperformed

seekingalpha.com

2020-08-18 11:35:47Global REITs market has declined by 4.13% year-to-date according to Invbots Global REITs Index, mainly due to the pandemic and the concern on the global recession.

Unlocking REIT Potential Amid COVID-19

seekingalpha.com

2020-07-05 03:29:25COVID-19 upended what had been a healthy real estate market entering 2020. Investors remain cautious after seeing the severe impact to the lodging and retail se

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ