International Flavors & Fragrances Inc. (IFFT)

Price:

47.56 USD

( - -1.32 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Sitio Royalties Corp.

VALUE SCORE:

0

2nd position

Vale S.A.

VALUE SCORE:

9

The best

Rio Tinto Group

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

NEWS

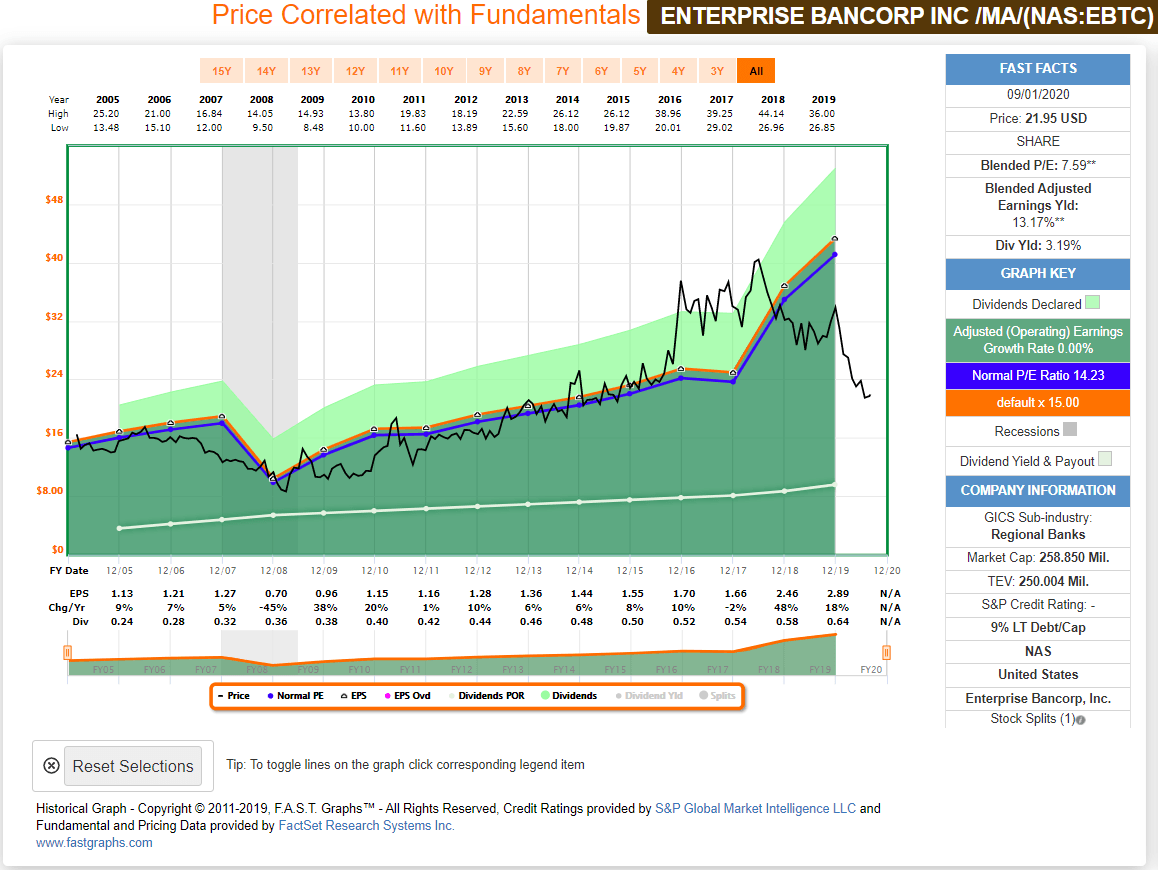

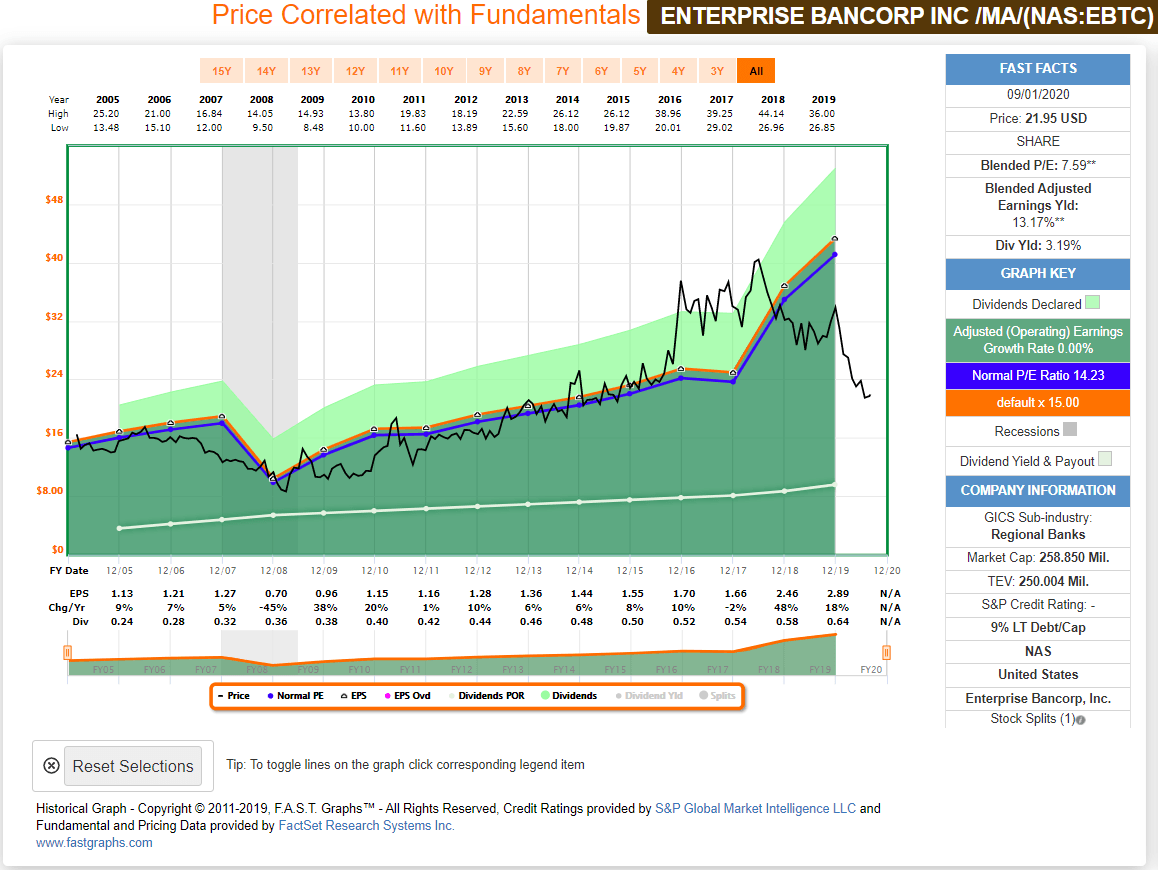

Dividend Champions For September 2020

seekingalpha.com

2020-09-02 19:40:08Monthly update of the Dividend Champions List. 34 companies declared higher dividends in the past month, with an average increase of 8.4% over their previous payouts.

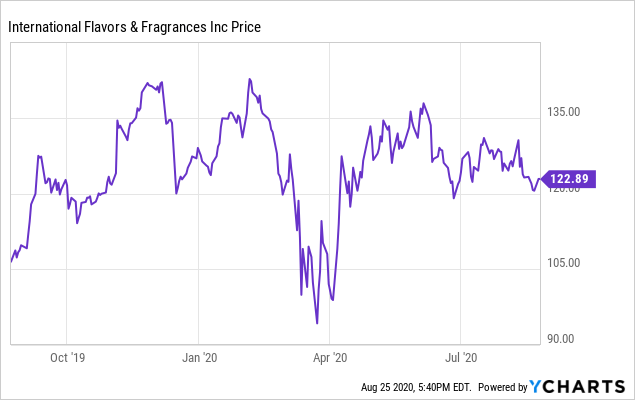

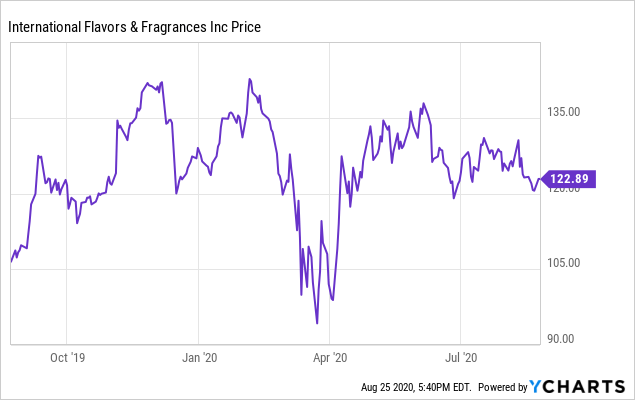

International Flavors & Fragrances: Not Cheap, But There's A Possibility To Get The Stock At A Lower Price

seekingalpha.com

2020-08-26 10:00:00IFF has never been cheap and remained impressively stable during the COVID-19 pandemic. The stock is currently trading at a free cash flow yield of around 4.5%.

Dividend Champion And Contender Highlights: Week Of August 16

seekingalpha.com

2020-08-15 15:51:42A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends.

Dividend Champion And Contender Highlights: Week Of June 28

seekingalpha.com

2020-06-27 13:37:38A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends. Companies with upcoming ex-dividend dates.

Dividend Champions For September 2020

seekingalpha.com

2020-09-02 19:40:08Monthly update of the Dividend Champions List. 34 companies declared higher dividends in the past month, with an average increase of 8.4% over their previous payouts.

International Flavors & Fragrances: Not Cheap, But There's A Possibility To Get The Stock At A Lower Price

seekingalpha.com

2020-08-26 10:00:00IFF has never been cheap and remained impressively stable during the COVID-19 pandemic. The stock is currently trading at a free cash flow yield of around 4.5%.

Dividend Champion And Contender Highlights: Week Of August 16

seekingalpha.com

2020-08-15 15:51:42A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends.

Dividend Champion And Contender Highlights: Week Of June 28

seekingalpha.com

2020-06-27 13:37:38A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends. Companies with upcoming ex-dividend dates.