International Flavors & Fragrances Inc. (IFF)

Price:

82.11 USD

( - -0.13 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

The Sherwin-Williams Company

VALUE SCORE:

4

2nd position

Eastman Chemical Company

VALUE SCORE:

10

The best

Oil-Dri Corporation of America

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

International Flavors & Fragrances Inc., together with its subsidiaries, manufactures and sells cosmetic active and natural health ingredients for use in various consumer products in Europe, Africa, the Middle East, Greater Asia, North America, and Latin America. It operates through Nourish, Scent, Health & Biosciences, and Pharma Solutions segments. The Nourish segment offers natural and plant-based specialty food ingredients, such as flavor compounds, and savory solutions and inclusions. It also provides natural food protection ingredients consist of natural antioxidants and anti-microbials as well as beverages, sweets , and dairy products. The Scent segment provides fragrance compounds, which include fine fragrances comprising perfumes and colognes, as well as consumer fragrances; fragrance ingredients comprising synthetic and natural ingredients that could be combined with other materials to create fragrance and consumer compounds; and cosmetic active ingredients consisting of active and functional ingredients, botanicals, and delivery systems to support its customers' cosmetic and personal care product lines. The Health & Biosciences segment develops and produces enzymes, food cultures, probiotics, and specialty ingredients. The Pharma Solutions segment produces and sells cellulosics and seaweed-based pharma excipients. The company sells its products primarily to manufacturers of perfumes and cosmetics, hair and other personal care products, soaps and detergents, cleaning products, dairy, meat and other processed foods, beverages, snacks and savory foods, sweet and baked goods, dietary supplements, infant and elderly nutrition, functional food, and pharmaceutical excipients and oral care products. International Flavors & Fragrances Inc. was founded in 1833 and is headquartered in New York, New York.

NEWS

LMR Unveils Tonka Bean CO₂ Absolute: Gourmand Excellence from Planet-Friendly Extraction

businesswire.com

2026-02-24 08:15:00GRASSE, France--(BUSINESS WIRE)--IFF (NYSE: IFF) — LMR Naturals by IFF—a global leader in natural ingredients for perfumery, cosmetics and flavors—has introduced Tonka Bean CO₂ Absolute to its Conscious Collection, a line of 12 highly sustainable and traceable natural ingredients for perfumes and flavors. Tonka Bean CO₂ Absolute is a natural extract with a gourmand olfactive signature. This new addition to the perfumer's palette is produced with renewable and recycled supercritical CO2 at IFF's.

CenterBook Partners LP Invests $813,000 in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-21 04:08:52CenterBook Partners LP purchased a new stake in International Flavors and Fragrances Inc. (NYSE: IFF) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 13,205 shares of the specialty chemicals company's stock, valued at approximately $813,000. Several other large investors have

Aberdeen Group plc Decreases Holdings in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-20 04:42:54Aberdeen Group plc reduced its stake in shares of International Flavors and Fragrances Inc. (NYSE: IFF) by 27.3% during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 171,675 shares of the specialty chemicals company's stock after selling 64,349 shares during the quarter.

International Flavors & Fragrances Inc. (IFF) Presents at Consumer Analyst Group of New York Conference 2026 Prepared Remarks Transcript

seekingalpha.com

2026-02-19 17:14:57International Flavors & Fragrances Inc. (IFF) Presents at Consumer Analyst Group of New York Conference 2026 Prepared Remarks Transcript

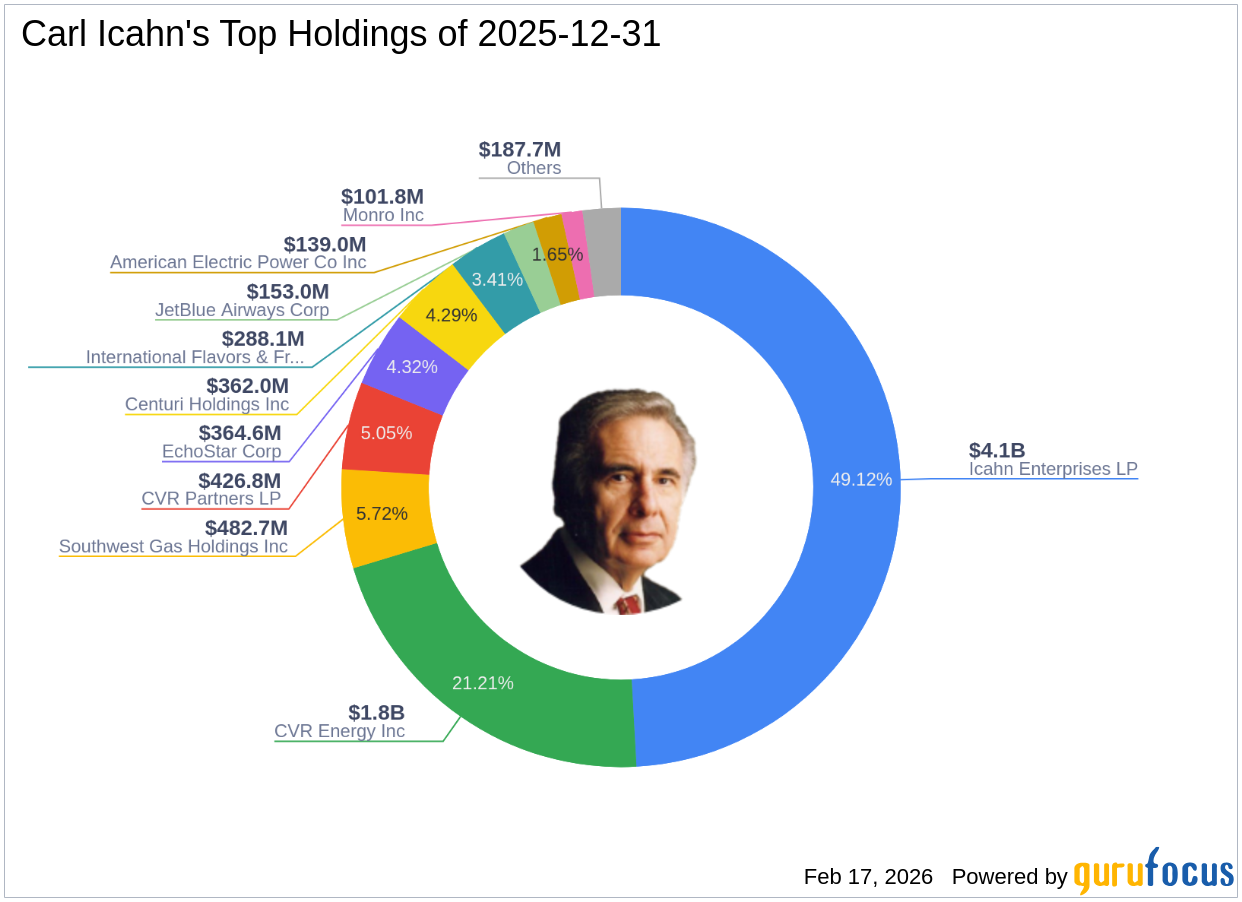

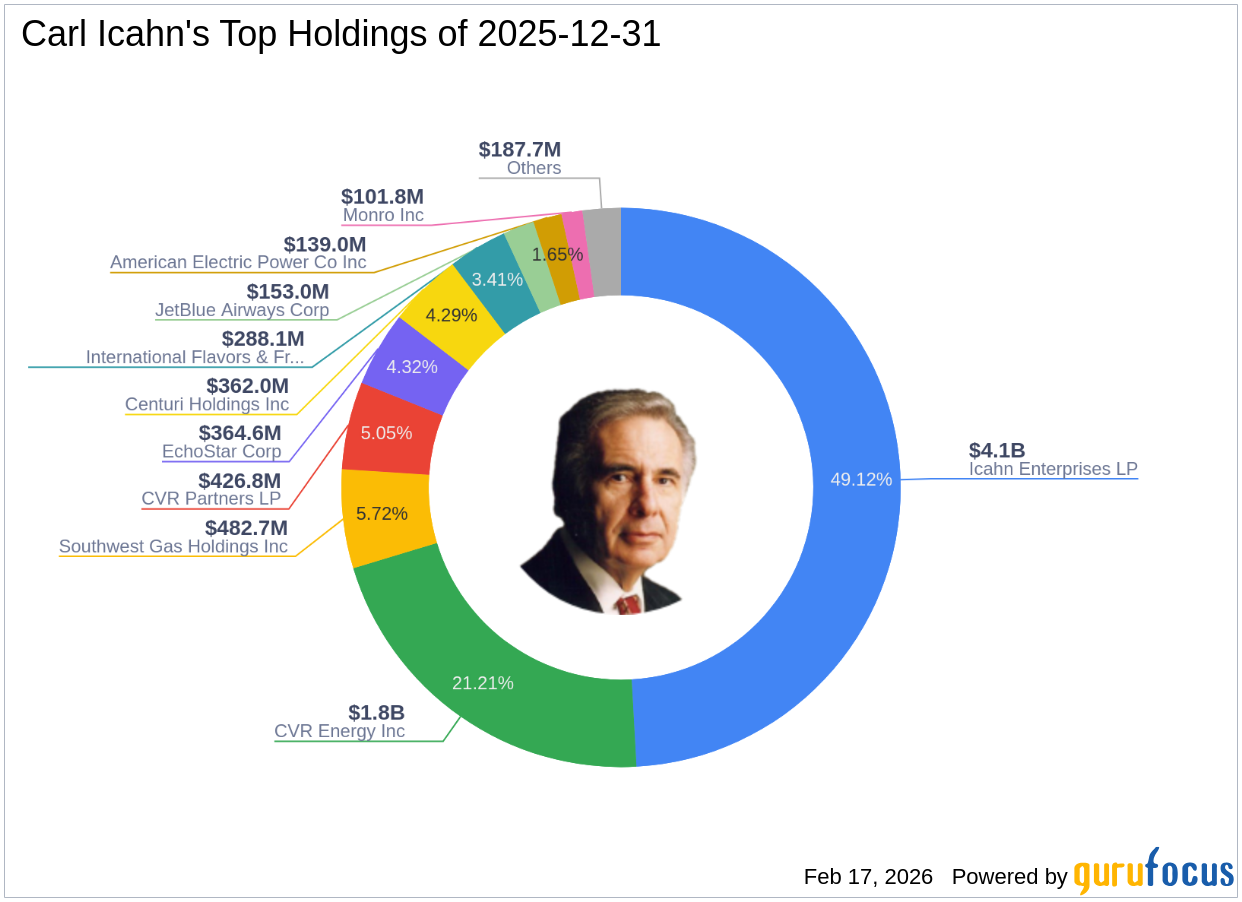

Carl Icahn's Strategic Moves: A Closer Look at Icahn Enterprises LP

gurufocus.com

2026-02-17 18:06:00Insights from the Fourth Quarter 2025 13F Filing Carl Icahn (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing ins

International Flavors & Fragrances Inc (IFF) Q4 2025 Earnings Call Highlights: Strong Growth in Taste and Health Segments Amid Challenges

gurufocus.com

2026-02-12 16:03:00Revenue: Nearly $2.6 billion in the fourth quarter.EBITDA: $437 million for the fourth quarter, a 7% increase.EBITDA Margin: Increased by 90 basis points to 16

International Flavors Q4 Earnings Miss Estimates, Sales Dip Y/Y

zacks.com

2026-02-12 13:26:23IFF's Q4 earnings miss estimates as sales fall 6.6% y/y, but currency-neutral growth and segment gains hint at mixed momentum heading into 2026.

International Flavors & Fragrances Inc. (IFF) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-02-12 12:04:19International Flavors & Fragrances Inc. (IFF) Q4 2025 Earnings Call Transcript

Eubel Brady & Suttman Asset Management Inc. Has $28.02 Million Stock Holdings in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-12 05:16:55Eubel Brady and Suttman Asset Management Inc. grew its position in shares of International Flavors and Fragrances Inc. (NYSE: IFF) by 20.7% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 455,277 shares of the specialty chemicals company's stock

International Flavors (IFF) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

zacks.com

2026-02-11 19:00:39The headline numbers for International Flavors (IFF) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

International Flavors (IFF) Q4 Earnings Miss Estimates

zacks.com

2026-02-11 18:26:08International Flavors (IFF) came out with quarterly earnings of $0.8 per share, missing the Zacks Consensus Estimate of $0.85 per share. This compares to earnings of $0.97 per share a year ago.

IFF Reports Fourth Quarter and Full Year 2025 Results

businesswire.com

2026-02-11 16:15:00NEW YORK--(BUSINESS WIRE)---- $IFF--International Flavors & Fragrances Inc. (NYSE: IFF) reported financial results for the fourth quarter and full year ended December 31, 2025. Full year 2025 Consolidated Summary: Reported Adjusted (GAAP) (Non-GAAP)1 Sales Loss Before Taxes EPS Operating EBITDA Operating EBITDA Margin EPS ex Amortization $10.9 B $(412) M $(1.46) $2.1 B 19.2% $4.20 Management Commentary “IFF delivered a solid 2025 performance, meeting the full-year financial com.

Compagnie Lombard Odier SCmA Reduces Stock Position in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-10 03:48:52Compagnie Lombard Odier SCmA reduced its stake in shares of International Flavors and Fragrances Inc. (NYSE: IFF) by 38.4% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 81,071 shares of the specialty chemicals company's stock after

International Flavors to Report Q4 Earnings: What's in Store?

zacks.com

2026-02-09 11:15:25IFF heads into Q4 earnings with an estimated sales and profit decline, even as volume growth and cost controls offer support.

International Flavors & Fragrances (IFF) Expected to Announce Earnings on Wednesday

defenseworld.net

2026-02-09 03:34:42International Flavors and Fragrances (NYSE: IFF - Get Free Report) will likely be posting its Q4 2025 results after the market closes on Wednesday, February 11th. Analysts expect International Flavors and Fragrances to post earnings of $0.84 per share and revenue of $2.5212 billion for the quarter. Individuals can find conference call details on the company's

International Flavors (IFF) Q4 Earnings Preview: What You Should Know Beyond the Headline Estimates

zacks.com

2026-02-06 10:16:32Beyond analysts' top-and-bottom-line estimates for International Flavors (IFF), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2025.

LMR Unveils Tonka Bean CO₂ Absolute: Gourmand Excellence from Planet-Friendly Extraction

businesswire.com

2026-02-24 08:15:00GRASSE, France--(BUSINESS WIRE)--IFF (NYSE: IFF) — LMR Naturals by IFF—a global leader in natural ingredients for perfumery, cosmetics and flavors—has introduced Tonka Bean CO₂ Absolute to its Conscious Collection, a line of 12 highly sustainable and traceable natural ingredients for perfumes and flavors. Tonka Bean CO₂ Absolute is a natural extract with a gourmand olfactive signature. This new addition to the perfumer's palette is produced with renewable and recycled supercritical CO2 at IFF's.

CenterBook Partners LP Invests $813,000 in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-21 04:08:52CenterBook Partners LP purchased a new stake in International Flavors and Fragrances Inc. (NYSE: IFF) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 13,205 shares of the specialty chemicals company's stock, valued at approximately $813,000. Several other large investors have

Aberdeen Group plc Decreases Holdings in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-20 04:42:54Aberdeen Group plc reduced its stake in shares of International Flavors and Fragrances Inc. (NYSE: IFF) by 27.3% during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 171,675 shares of the specialty chemicals company's stock after selling 64,349 shares during the quarter.

International Flavors & Fragrances Inc. (IFF) Presents at Consumer Analyst Group of New York Conference 2026 Prepared Remarks Transcript

seekingalpha.com

2026-02-19 17:14:57International Flavors & Fragrances Inc. (IFF) Presents at Consumer Analyst Group of New York Conference 2026 Prepared Remarks Transcript

Carl Icahn's Strategic Moves: A Closer Look at Icahn Enterprises LP

gurufocus.com

2026-02-17 18:06:00Insights from the Fourth Quarter 2025 13F Filing Carl Icahn (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing ins

International Flavors & Fragrances Inc (IFF) Q4 2025 Earnings Call Highlights: Strong Growth in Taste and Health Segments Amid Challenges

gurufocus.com

2026-02-12 16:03:00Revenue: Nearly $2.6 billion in the fourth quarter.EBITDA: $437 million for the fourth quarter, a 7% increase.EBITDA Margin: Increased by 90 basis points to 16

International Flavors Q4 Earnings Miss Estimates, Sales Dip Y/Y

zacks.com

2026-02-12 13:26:23IFF's Q4 earnings miss estimates as sales fall 6.6% y/y, but currency-neutral growth and segment gains hint at mixed momentum heading into 2026.

International Flavors & Fragrances Inc. (IFF) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-02-12 12:04:19International Flavors & Fragrances Inc. (IFF) Q4 2025 Earnings Call Transcript

Eubel Brady & Suttman Asset Management Inc. Has $28.02 Million Stock Holdings in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-12 05:16:55Eubel Brady and Suttman Asset Management Inc. grew its position in shares of International Flavors and Fragrances Inc. (NYSE: IFF) by 20.7% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 455,277 shares of the specialty chemicals company's stock

International Flavors (IFF) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

zacks.com

2026-02-11 19:00:39The headline numbers for International Flavors (IFF) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

International Flavors (IFF) Q4 Earnings Miss Estimates

zacks.com

2026-02-11 18:26:08International Flavors (IFF) came out with quarterly earnings of $0.8 per share, missing the Zacks Consensus Estimate of $0.85 per share. This compares to earnings of $0.97 per share a year ago.

IFF Reports Fourth Quarter and Full Year 2025 Results

businesswire.com

2026-02-11 16:15:00NEW YORK--(BUSINESS WIRE)---- $IFF--International Flavors & Fragrances Inc. (NYSE: IFF) reported financial results for the fourth quarter and full year ended December 31, 2025. Full year 2025 Consolidated Summary: Reported Adjusted (GAAP) (Non-GAAP)1 Sales Loss Before Taxes EPS Operating EBITDA Operating EBITDA Margin EPS ex Amortization $10.9 B $(412) M $(1.46) $2.1 B 19.2% $4.20 Management Commentary “IFF delivered a solid 2025 performance, meeting the full-year financial com.

Compagnie Lombard Odier SCmA Reduces Stock Position in International Flavors & Fragrances Inc. $IFF

defenseworld.net

2026-02-10 03:48:52Compagnie Lombard Odier SCmA reduced its stake in shares of International Flavors and Fragrances Inc. (NYSE: IFF) by 38.4% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 81,071 shares of the specialty chemicals company's stock after

International Flavors to Report Q4 Earnings: What's in Store?

zacks.com

2026-02-09 11:15:25IFF heads into Q4 earnings with an estimated sales and profit decline, even as volume growth and cost controls offer support.

International Flavors & Fragrances (IFF) Expected to Announce Earnings on Wednesday

defenseworld.net

2026-02-09 03:34:42International Flavors and Fragrances (NYSE: IFF - Get Free Report) will likely be posting its Q4 2025 results after the market closes on Wednesday, February 11th. Analysts expect International Flavors and Fragrances to post earnings of $0.84 per share and revenue of $2.5212 billion for the quarter. Individuals can find conference call details on the company's

International Flavors (IFF) Q4 Earnings Preview: What You Should Know Beyond the Headline Estimates

zacks.com

2026-02-06 10:16:32Beyond analysts' top-and-bottom-line estimates for International Flavors (IFF), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2025.