WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD)

Price:

22.49 USD

( + 0.03 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

iShares Fallen Angels USD Bond ETF

VALUE SCORE:

12

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The index is designed to provide long exposure to the performance of selected issuers in the U.S. non-investment-grade corporate bond ("junk bonds") market that are deemed to have favorable fundamental and income characteristics while seeking to manage interest rate risk through the use of short positions in U.S. treasury securities. The fund is non-diversified.

NEWS

This ETF Could Be a Better Bet Than Senior Loans

etftrends.com

2025-09-26 08:15:54The Federal Reserve recently pared interest rates by 25 basis points, setting the stage for what some experts believe will be two more cuts before the end of this year and another pair in early 2026.

3 Fixed Income ETFs for Institutionals Worried by Rates

etftrends.com

2023-03-01 15:03:50Institutional investor worried about the looming wrath of the Fed? You're not alone — a survey of U.S. institutional investors conducted by CoreData Research recently found that 50 percent of institutionals are worried that higher rates may lead to significant withdrawals of major sources of liquidity.

An Inflation Toolkit for Advisors From WisdomTree

etftrends.com

2022-02-09 15:17:39It's a difficult season for advisors who are still working to create optimal portfolios for their clients in a time of rising interest rates, inflation, supply chain disruptions, and more. WisdomTree Asset Management's Jeremy Schwartz, CFA and global CIO, and Kevin Flanagan, head of fixed income strategy, joined Dave Nadig, CIO and director of research [.

WisdomTree's ETFs to Keep in Mind for 2022

etftrends.com

2021-12-14 17:43:38As we consider the current economic cycle, exchange traded fund investors could focus on key macro themes to better adapt to the changes ahead. In the recent webcast, WisdomTree 2022 Outlook, Kevin Flanagan, head of fixed income strategy, highlighted the ongoing economic expansion with real GDP expected to grow 4.0% over 2022, with inflation easing [.

3 For '21: Key Fixed Income Themes For The New Year

seekingalpha.com

2020-12-25 03:22:50With interest rates at historical lows, investors will be tasked with looking for income without moving too far out in duration or, perhaps more importantly, sacrificing credit quality. While we expect the Fed to keep rates at or near zero, intermediate to longer-dated Treasury yields could still grind higher, with the yield curve steepening due to unprecedented monetary and fiscal stimulus.

What Goes Up Has Definitely Been Coming Down

seekingalpha.com

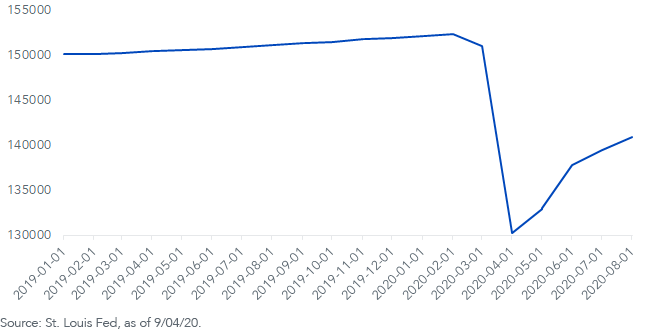

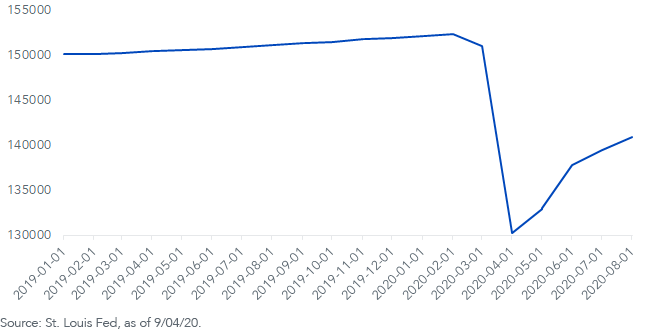

2020-09-11 01:19:25New hiring has now recouped nearly 50% of the total job losses that occurred during March and April. The unemployment rate shrank 1.8 percentage points in August, falling to 8.4%.

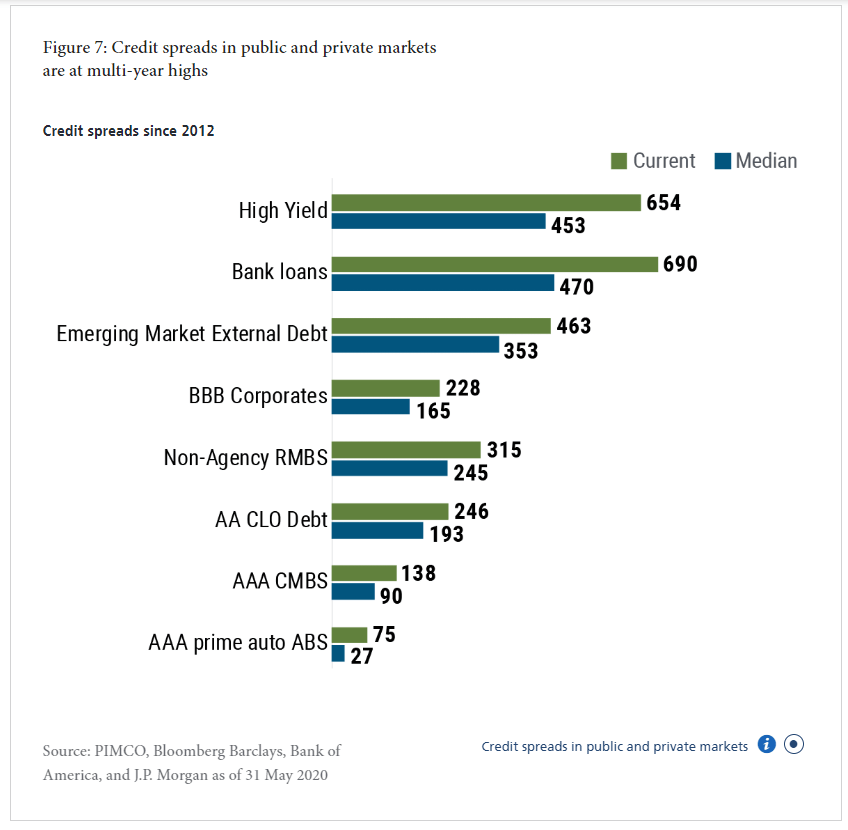

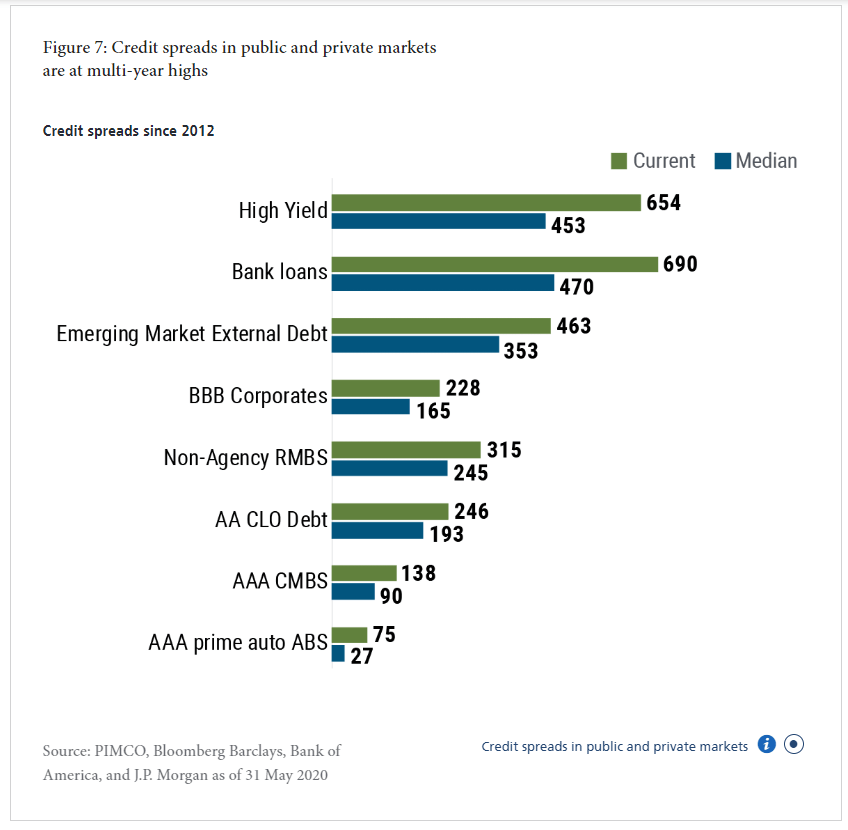

A Cyclical Rotation In Corporate Credit

seekingalpha.com

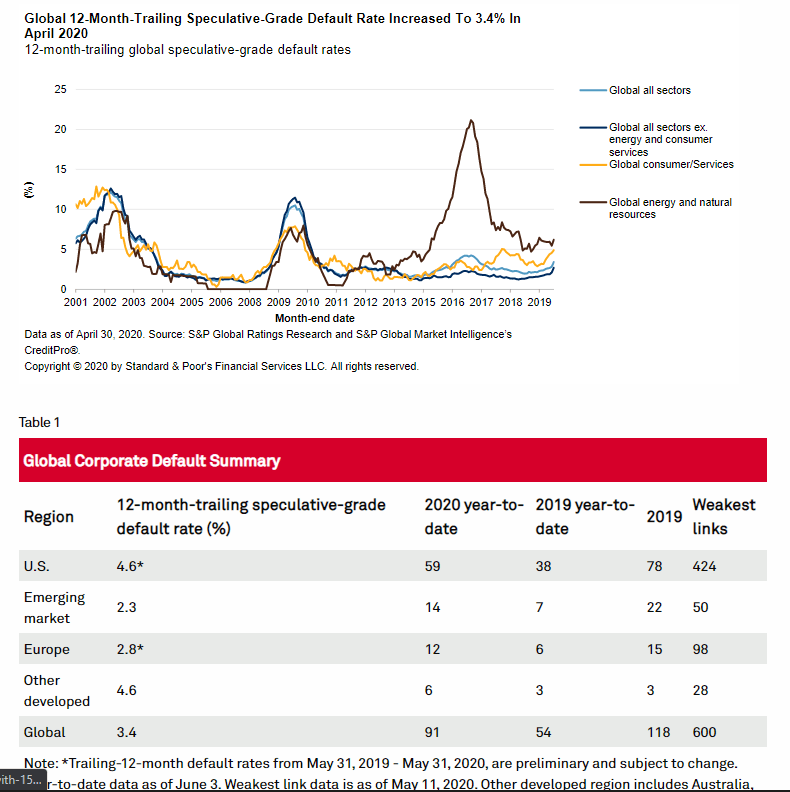

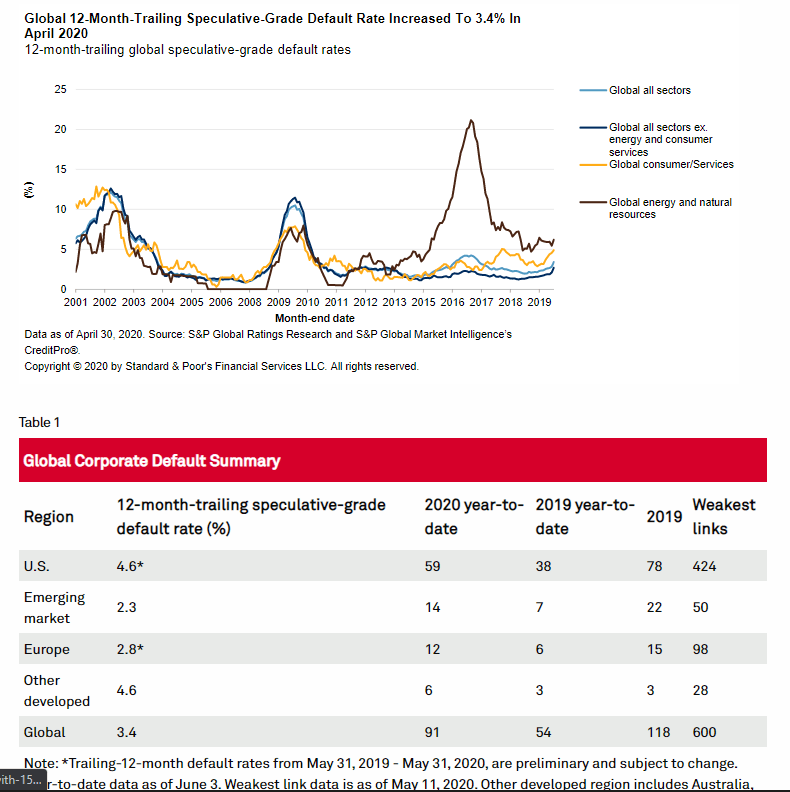

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

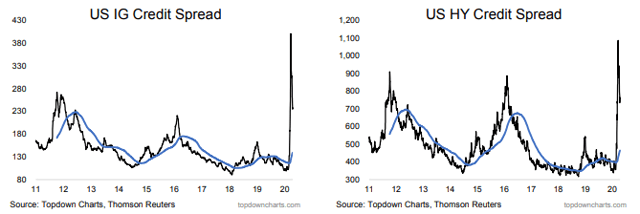

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

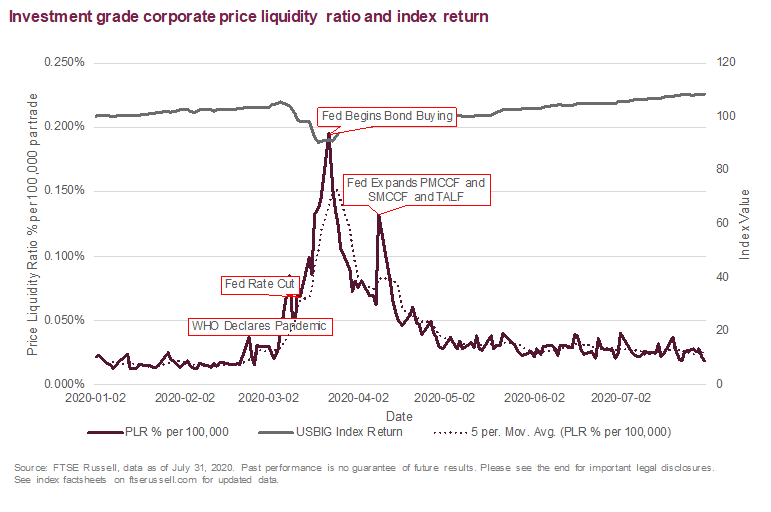

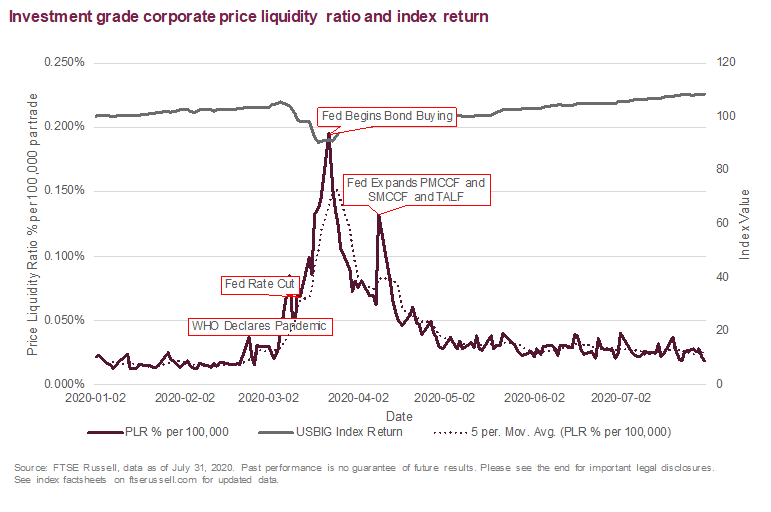

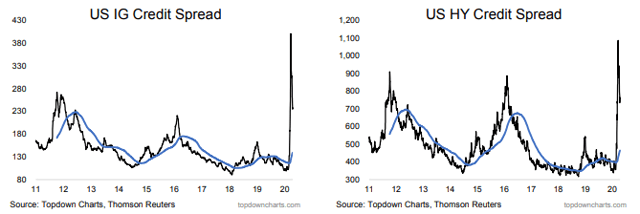

Crisis? What Crisis? USD Corporate Bond Liquidity Since COVID

seekingalpha.com

2020-08-27 06:34:44As the mid-March 2020 market volatility affected USD corporate bond prices, it also compromised their liquidity.

Corporate Credit Markets Remain In Good Shape

seekingalpha.com

2020-07-20 14:06:47The name of the bond market game since COVID-19 hit, if it can be summarized in one sentence, is that credit spread assets continue to make sense.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Today's Portfolios 'Can't Get No Satisfaction' From Yesterday's Instruments

seekingalpha.com

2020-06-24 10:14:48The U.S. policy response has been the most remarkable of the developed markets, not least because of the explicit marriage of monetary and fiscal policy for the

Corporate Credit Spreads Continue To Improve

seekingalpha.com

2020-06-22 06:42:05The corporate bond market has typically been an institutional market that the largest mutual fund firms and sell-side firms like Goldman Sachs and Morgan Stanle

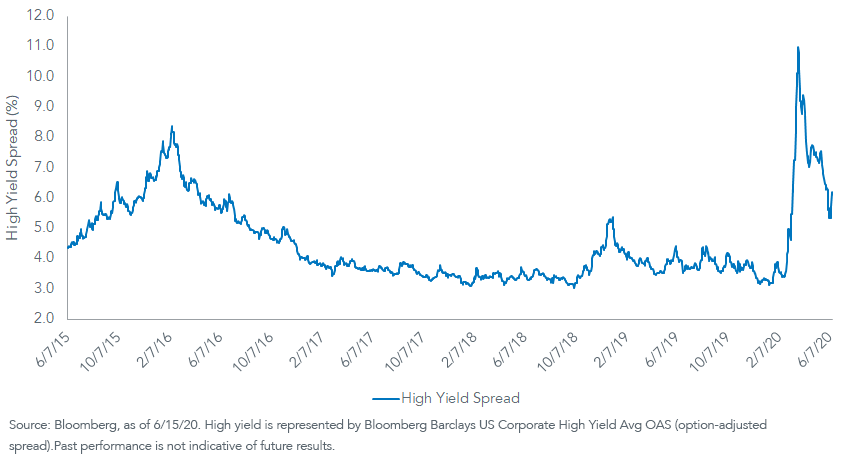

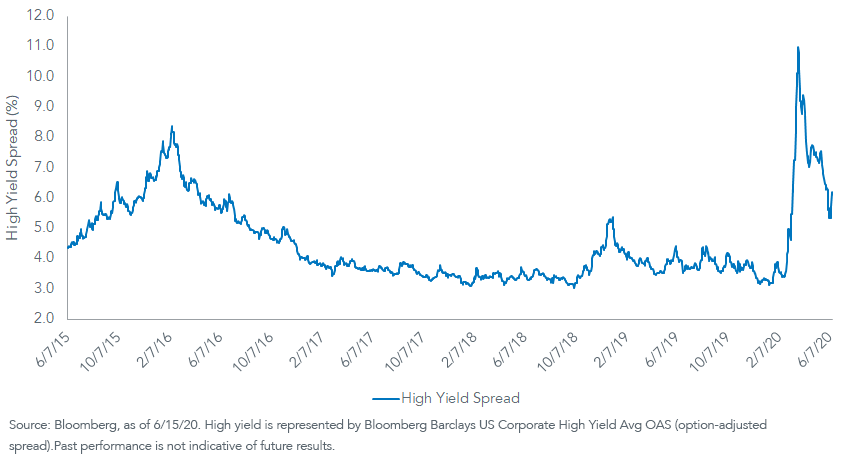

High Hopes

seekingalpha.com

2020-06-17 20:07:41I'll be the first to admit that a great deal of uncertainty remains in the fixed income investment landscape. Since the tumultuous selling in March, the U.S. HY

The Fed, Fundamentals, And Credit

seekingalpha.com

2020-04-21 10:12:33The Fed’s backstop helped bring down credit spreads, both investment grade and high yield. Banks appear positioned to make it through the Corona Crash according

No data to display

This ETF Could Be a Better Bet Than Senior Loans

etftrends.com

2025-09-26 08:15:54The Federal Reserve recently pared interest rates by 25 basis points, setting the stage for what some experts believe will be two more cuts before the end of this year and another pair in early 2026.

3 Fixed Income ETFs for Institutionals Worried by Rates

etftrends.com

2023-03-01 15:03:50Institutional investor worried about the looming wrath of the Fed? You're not alone — a survey of U.S. institutional investors conducted by CoreData Research recently found that 50 percent of institutionals are worried that higher rates may lead to significant withdrawals of major sources of liquidity.

An Inflation Toolkit for Advisors From WisdomTree

etftrends.com

2022-02-09 15:17:39It's a difficult season for advisors who are still working to create optimal portfolios for their clients in a time of rising interest rates, inflation, supply chain disruptions, and more. WisdomTree Asset Management's Jeremy Schwartz, CFA and global CIO, and Kevin Flanagan, head of fixed income strategy, joined Dave Nadig, CIO and director of research [.

WisdomTree's ETFs to Keep in Mind for 2022

etftrends.com

2021-12-14 17:43:38As we consider the current economic cycle, exchange traded fund investors could focus on key macro themes to better adapt to the changes ahead. In the recent webcast, WisdomTree 2022 Outlook, Kevin Flanagan, head of fixed income strategy, highlighted the ongoing economic expansion with real GDP expected to grow 4.0% over 2022, with inflation easing [.

3 For '21: Key Fixed Income Themes For The New Year

seekingalpha.com

2020-12-25 03:22:50With interest rates at historical lows, investors will be tasked with looking for income without moving too far out in duration or, perhaps more importantly, sacrificing credit quality. While we expect the Fed to keep rates at or near zero, intermediate to longer-dated Treasury yields could still grind higher, with the yield curve steepening due to unprecedented monetary and fiscal stimulus.

What Goes Up Has Definitely Been Coming Down

seekingalpha.com

2020-09-11 01:19:25New hiring has now recouped nearly 50% of the total job losses that occurred during March and April. The unemployment rate shrank 1.8 percentage points in August, falling to 8.4%.

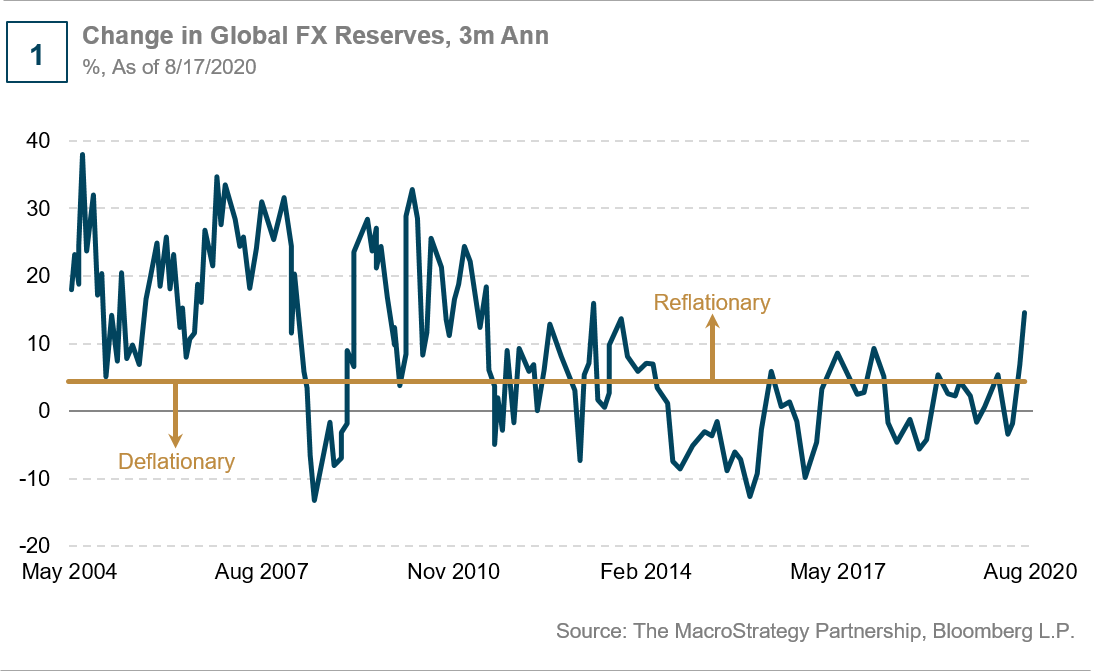

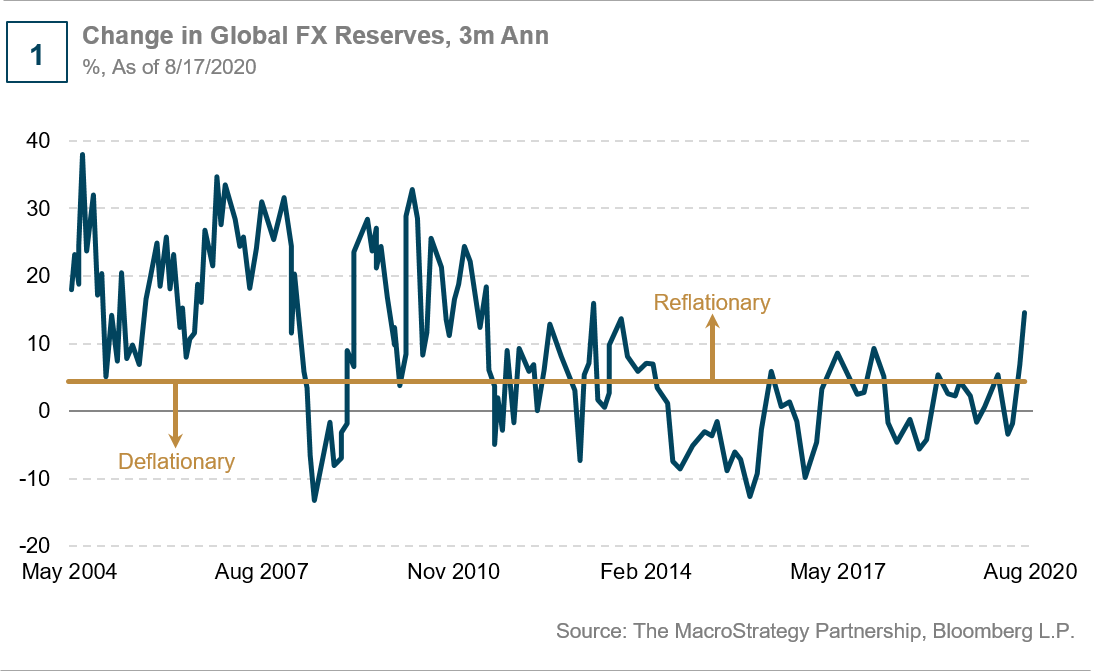

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Crisis? What Crisis? USD Corporate Bond Liquidity Since COVID

seekingalpha.com

2020-08-27 06:34:44As the mid-March 2020 market volatility affected USD corporate bond prices, it also compromised their liquidity.

Corporate Credit Markets Remain In Good Shape

seekingalpha.com

2020-07-20 14:06:47The name of the bond market game since COVID-19 hit, if it can be summarized in one sentence, is that credit spread assets continue to make sense.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Today's Portfolios 'Can't Get No Satisfaction' From Yesterday's Instruments

seekingalpha.com

2020-06-24 10:14:48The U.S. policy response has been the most remarkable of the developed markets, not least because of the explicit marriage of monetary and fiscal policy for the

Corporate Credit Spreads Continue To Improve

seekingalpha.com

2020-06-22 06:42:05The corporate bond market has typically been an institutional market that the largest mutual fund firms and sell-side firms like Goldman Sachs and Morgan Stanle

High Hopes

seekingalpha.com

2020-06-17 20:07:41I'll be the first to admit that a great deal of uncertainty remains in the fixed income investment landscape. Since the tumultuous selling in March, the U.S. HY

The Fed, Fundamentals, And Credit

seekingalpha.com

2020-04-21 10:12:33The Fed’s backstop helped bring down credit spreads, both investment grade and high yield. Banks appear positioned to make it through the Corona Crash according