Houston Wire & Cable Company (HWCC)

Price:

5.30 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Lawson Products, Inc.

VALUE SCORE:

0

2nd position

Pool Corporation

VALUE SCORE:

8

The best

DXP Enterprises, Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Houston Wire & Cable Company, through its subsidiaries, sells electrical and mechanical wire and cable, industrial fasteners, hardware, and related services in the United States. The company offers wire and cable products, including continuous and interlocked armor cables; control and power cables; electronic wires and cables; flexible and portable cords; instrumentation and thermocouple cables; lead and high temperature cables; medium voltage cables; and premise and category wires and cables, primary and secondary aluminum distribution cables, and steel wire ropes and wire rope slings, as well as synthetic fiber rope slings, chains, shackles, and other related hardware and corrosion resistant products. It also provides private branded products comprising its proprietary brand LifeGuard, a low-smoke zero-halogen cable. The company's products are used in maintenance, repair, and operations activities, and related projects; larger-scale projects in the utility, industrial, and infrastructure markets; and a range of industrial applications, such as communications, energy, engineering and construction, general manufacturing, marine construction and marine transportation, mining, infrastructure, oilfield services, petrochemical, transportation, utility, wastewater treatment, and food and beverage. Houston Wire & Cable Company was founded in 1975 and is headquartered in Houston, Texas.

NEWS

OmniCable Completes Acquisition of Houston Wire & Cable Company

globenewswire.com

2021-06-15 16:40:00HOUSTON and WEST CHESTER, Pa., June 15, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (NASDAQ: HWCC) (HWCC) and Omni Cable, LLC (OmniCable) today announced that the acquisition of HWCC by OmniCable has been completed, following approval of the transaction by HWCC stockholders at a special meeting earlier today.

Houston Wire & Cable Company Postpones 2021 Annual Meeting in Light of Pending Acquisition by OmniCable

globenewswire.com

2021-04-29 10:33:00HOUSTON, April 29, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (NASDAQ: HWCC) (HWCC) has postponed its Annual Meeting of Stockholders in light of its proposed merger with a subsidiary of Omni Cable, LLC (OmniCable) pursuant to the Agreement and Plan of Merger dated as of March 24, 2021, among OmniCable, its subsidiary and HWCC.

SHAREHOLDER ALERT: WeissLaw LLP Investigates Houston Wire & Cable Company

prnewswire.com

2021-03-25 17:20:00NEW YORK, March 25, 2021 /PRNewswire/ -- WeissLaw LLP is investigating possible breaches of fiduciary duty and other violations of law by the board of directors of Houston Wire & Cable Company ("HWCC") (NASDAQ: HWCC) in connection with the proposed acquisition of the Company by Omni Cable, LLC ("OmniCable"). Under the terms of the merger agreement, HWCC shareholders will receive $5.30 in cash for each share of HWCC common stock that they hold.

Shareholder Alert: Ademi LLP investigates whether Houston Wire & Cable Company has obtained a Fair Price in its transaction with Omni Cable

prnewswire.com

2021-03-25 11:50:00MILWAUKEE, March 25, 2021 /PRNewswire/ -- Ademi LLP is investigating Houston Wire (NASDAQ: HWCC) for possible breaches of fiduciary duty and other violations of law in its transaction with Omni Cable. Click here to learn how to join the action: https://www.ademilaw.com/case/houston-wire-cable-company or call Guri Ademi toll-free at 866-264-3995.

Houston Wire Merger Investigation: Halper Sadeh LLP Announces Investigation Into Whether the Sale of Houston Wire & Cable Company Is Fair to Shareholders; Investors Are Encouraged to Contact the Firm – HWCC

businesswire.com

2021-03-25 11:02:00NEW YORK--(BUSINESS WIRE)--Halper Sadeh LLP, a global investor rights law firm, is investigating whether the sale of Houston Wire & Cable Company (NASDAQ: HWCC) to Omni Cable, LLC for $5.30 per share is fair to Houston Wire shareholders. Halper Sadeh encourages Houston Wire shareholders to click here to learn more about their legal rights and options or contact Daniel Sadeh or Zachary Halper at (212) 763-0060 or sadeh@halpersadeh.com or zhalper@halpersadeh.com. The investigation concerns wh

HWCC Stock Price Increases Over 50% Pre-Market: Why It Happened

pulse2.com

2021-03-25 07:13:25The stock price of Houston Wire & Cable Company (NASDAQ: HWCC) increased by over 50% pre-market. This is why it happened.

Houston Wire & Cable Company to be Acquired by OmniCable in $91 Million Transaction

globenewswire.com

2021-03-25 06:45:00HWCC Stockholders to Receive $5.30 per Share in Cash HWCC Stockholders to Receive $5.30 per Share in Cash

Houston Wire & Cable Company Completes Sale of Southwest Wire Rope Division

globenewswire.com

2021-03-15 01:15:00HOUSTON, March 15, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it completed the sale of its Southwest Wire Rope business, a leading provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excluded approximately $2.9 million of trade accounts receivable, which HWCC retained. HWCC used the net sales proceeds of approximately $3.4 million to further reduce revolver debt.

Houston Wire & Cable Company to Sell Southwest Wire Rope Division, Use Proceeds to Reduce Revolver Debt

globenewswire.com

2021-01-13 17:08:00HOUSTON, Jan. 13, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it has entered into a definitive asset purchase agreement for the sale of its Southwest Wire Rope business, a leading provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excludes approximately $2.6 million of trade accounts receivable, which HWCC will retain. HWCC expects to use the net sales proceeds and accounts receivable collections to further reduce Revolver debt. HWCC has already reduced Revolver debt to approximately $21.4 million as of January 13, 2021, from a peak of $95.2 million in the first quarter of 2020.

Houston Wire & Cable Company Completes Sale of Southern Wire Division and Achieves Debt Reduction Goal

globenewswire.com

2021-01-06 12:30:00HOUSTON, Jan. 06, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it completed the sale of its Southern Wire business, a leading wholesale distributor of wire rope and rigging products, to Southern Rigging Companies. The sale closed on December 31, 2020 for a purchase price of $20 million, subject to a working capital adjustment. HWCC used the net proceeds of approximately $18.1 million to reduce debt.

Houston Wire & Cable Company to Sell Southern Wire Division

globenewswire.com

2020-12-02 18:15:00HOUSTON, Dec. 02, 2020 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it has entered into a definitive asset purchase agreement for the sale of its Southern Wire business, a leading wholesale distributor of wire rope and rigging products, for a purchase price of $20 million, subject to a working capital adjustment. HWCC expects to use the net sales proceeds to reduce debt.

Houston Wire & Cable Company Announces Results for the Quarter Ended September 30, 2020, Update on Continuing Cost and Debt Reduction

globenewswire.com

2020-11-05 19:42:00HOUSTON, Nov. 05, 2020 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (NASDAQ: HWCC) (the “Company”) announced operating results for the third quarter ended September 30, 2020 and progress on its continuing cost and debt reduction programs.

Houston Wire & Cable Company Announces Third Quarter 2020 Earnings Release Date

globenewswire.com

2020-10-30 07:42:00HOUSTON, Oct. 30, 2020 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq:HWCC) announced today that the company will release Third Quarter 2020 results after market close on Thursday, November 5th, 2020.

Searching For Wonderful Businesses: Encore Wire (NASDAQ:WIRE)

seekingalpha.com

2020-08-03 17:56:14Shares of Encore Wire represent a compelling long-term value proposition for investors. The company has a strong balance sheet with zero debt and no goodwill, growing through the methodical investment of retained earnings.

Deep Value Index Posts Strong Outperformance Vs. Nasdaq During COVID-19 Pandemic

seekingalpha.com

2020-07-27 10:24:10Value has lagged Growth during the last ten years. Even during the Covid-19 pandemic, Growth continues to outperform value by a wide margin.

HOUSTON WIRE & CABLE CO : Changes in Registrant's Certifying Accountant, Financial Statements and Exhibits (form 8-K) | MarketScreener

marketscreener.com

2020-06-26 18:29:02

OmniCable Completes Acquisition of Houston Wire & Cable Company

globenewswire.com

2021-06-15 16:40:00HOUSTON and WEST CHESTER, Pa., June 15, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (NASDAQ: HWCC) (HWCC) and Omni Cable, LLC (OmniCable) today announced that the acquisition of HWCC by OmniCable has been completed, following approval of the transaction by HWCC stockholders at a special meeting earlier today.

Houston Wire & Cable Company Postpones 2021 Annual Meeting in Light of Pending Acquisition by OmniCable

globenewswire.com

2021-04-29 10:33:00HOUSTON, April 29, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (NASDAQ: HWCC) (HWCC) has postponed its Annual Meeting of Stockholders in light of its proposed merger with a subsidiary of Omni Cable, LLC (OmniCable) pursuant to the Agreement and Plan of Merger dated as of March 24, 2021, among OmniCable, its subsidiary and HWCC.

SHAREHOLDER ALERT: WeissLaw LLP Investigates Houston Wire & Cable Company

prnewswire.com

2021-03-25 17:20:00NEW YORK, March 25, 2021 /PRNewswire/ -- WeissLaw LLP is investigating possible breaches of fiduciary duty and other violations of law by the board of directors of Houston Wire & Cable Company ("HWCC") (NASDAQ: HWCC) in connection with the proposed acquisition of the Company by Omni Cable, LLC ("OmniCable"). Under the terms of the merger agreement, HWCC shareholders will receive $5.30 in cash for each share of HWCC common stock that they hold.

Shareholder Alert: Ademi LLP investigates whether Houston Wire & Cable Company has obtained a Fair Price in its transaction with Omni Cable

prnewswire.com

2021-03-25 11:50:00MILWAUKEE, March 25, 2021 /PRNewswire/ -- Ademi LLP is investigating Houston Wire (NASDAQ: HWCC) for possible breaches of fiduciary duty and other violations of law in its transaction with Omni Cable. Click here to learn how to join the action: https://www.ademilaw.com/case/houston-wire-cable-company or call Guri Ademi toll-free at 866-264-3995.

Houston Wire Merger Investigation: Halper Sadeh LLP Announces Investigation Into Whether the Sale of Houston Wire & Cable Company Is Fair to Shareholders; Investors Are Encouraged to Contact the Firm – HWCC

businesswire.com

2021-03-25 11:02:00NEW YORK--(BUSINESS WIRE)--Halper Sadeh LLP, a global investor rights law firm, is investigating whether the sale of Houston Wire & Cable Company (NASDAQ: HWCC) to Omni Cable, LLC for $5.30 per share is fair to Houston Wire shareholders. Halper Sadeh encourages Houston Wire shareholders to click here to learn more about their legal rights and options or contact Daniel Sadeh or Zachary Halper at (212) 763-0060 or sadeh@halpersadeh.com or zhalper@halpersadeh.com. The investigation concerns wh

HWCC Stock Price Increases Over 50% Pre-Market: Why It Happened

pulse2.com

2021-03-25 07:13:25The stock price of Houston Wire & Cable Company (NASDAQ: HWCC) increased by over 50% pre-market. This is why it happened.

Houston Wire & Cable Company to be Acquired by OmniCable in $91 Million Transaction

globenewswire.com

2021-03-25 06:45:00HWCC Stockholders to Receive $5.30 per Share in Cash HWCC Stockholders to Receive $5.30 per Share in Cash

Houston Wire & Cable Company Completes Sale of Southwest Wire Rope Division

globenewswire.com

2021-03-15 01:15:00HOUSTON, March 15, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it completed the sale of its Southwest Wire Rope business, a leading provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excluded approximately $2.9 million of trade accounts receivable, which HWCC retained. HWCC used the net sales proceeds of approximately $3.4 million to further reduce revolver debt.

Houston Wire & Cable Company to Sell Southwest Wire Rope Division, Use Proceeds to Reduce Revolver Debt

globenewswire.com

2021-01-13 17:08:00HOUSTON, Jan. 13, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it has entered into a definitive asset purchase agreement for the sale of its Southwest Wire Rope business, a leading provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excludes approximately $2.6 million of trade accounts receivable, which HWCC will retain. HWCC expects to use the net sales proceeds and accounts receivable collections to further reduce Revolver debt. HWCC has already reduced Revolver debt to approximately $21.4 million as of January 13, 2021, from a peak of $95.2 million in the first quarter of 2020.

Houston Wire & Cable Company Completes Sale of Southern Wire Division and Achieves Debt Reduction Goal

globenewswire.com

2021-01-06 12:30:00HOUSTON, Jan. 06, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it completed the sale of its Southern Wire business, a leading wholesale distributor of wire rope and rigging products, to Southern Rigging Companies. The sale closed on December 31, 2020 for a purchase price of $20 million, subject to a working capital adjustment. HWCC used the net proceeds of approximately $18.1 million to reduce debt.

Houston Wire & Cable Company to Sell Southern Wire Division

globenewswire.com

2020-12-02 18:15:00HOUSTON, Dec. 02, 2020 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it has entered into a definitive asset purchase agreement for the sale of its Southern Wire business, a leading wholesale distributor of wire rope and rigging products, for a purchase price of $20 million, subject to a working capital adjustment. HWCC expects to use the net sales proceeds to reduce debt.

Houston Wire & Cable Company Announces Results for the Quarter Ended September 30, 2020, Update on Continuing Cost and Debt Reduction

globenewswire.com

2020-11-05 19:42:00HOUSTON, Nov. 05, 2020 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (NASDAQ: HWCC) (the “Company”) announced operating results for the third quarter ended September 30, 2020 and progress on its continuing cost and debt reduction programs.

Houston Wire & Cable Company Announces Third Quarter 2020 Earnings Release Date

globenewswire.com

2020-10-30 07:42:00HOUSTON, Oct. 30, 2020 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq:HWCC) announced today that the company will release Third Quarter 2020 results after market close on Thursday, November 5th, 2020.

Searching For Wonderful Businesses: Encore Wire (NASDAQ:WIRE)

seekingalpha.com

2020-08-03 17:56:14Shares of Encore Wire represent a compelling long-term value proposition for investors. The company has a strong balance sheet with zero debt and no goodwill, growing through the methodical investment of retained earnings.

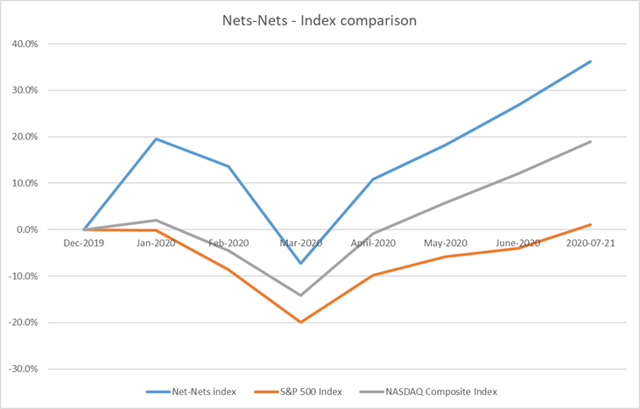

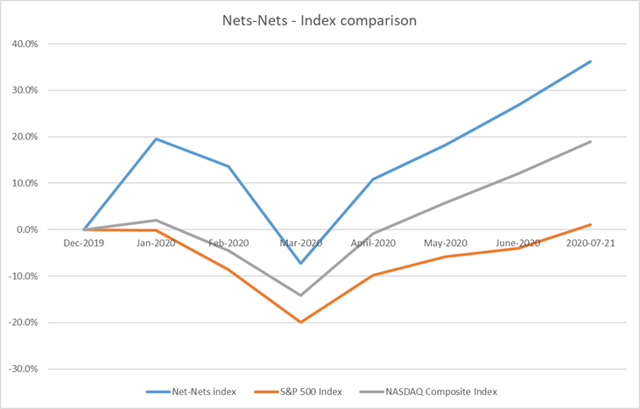

Deep Value Index Posts Strong Outperformance Vs. Nasdaq During COVID-19 Pandemic

seekingalpha.com

2020-07-27 10:24:10Value has lagged Growth during the last ten years. Even during the Covid-19 pandemic, Growth continues to outperform value by a wide margin.

HOUSTON WIRE & CABLE CO : Changes in Registrant's Certifying Accountant, Financial Statements and Exhibits (form 8-K) | MarketScreener

marketscreener.com

2020-06-26 18:29:02