Hennessy Capital Investment Corp. V (HCIC)

Price:

10.05 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Churchill Capital Corp X

VALUE SCORE:

7

2nd position

Range Capital Acquisition Corp.

VALUE SCORE:

10

The best

M3-Brigade Acquisition V Corp. Units

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Hennessy Capital Investment Corp. V does not have significant operations. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company focuses on the industrial technology and infrastructure sectors. The company was formerly known as Hennessy Capital Acquisition Corp. V and changed its name to Hennessy Capital Investment Corp. V in November 2020. Hennessy Capital Investment Corp. V was incorporated in 2020 and is based in Wilson, Wyoming.

NEWS

Churchill Capital IX: Plus Deal Is Intriguing, But SPAC Concerns Remain

seekingalpha.com

2025-07-09 23:59:00Any SPAC, including Churchill Capital IX, merits skepticism given the group's poor performance. But even with that skepticism, CCIX merger of CCIX and autonomous trucking startup Plus stands out as intriguing. Plus is valued at a sharp discount to a peer, has strong partners, and an intriguing business model.

Self-driving startup Plus to go public through $1.2 billion SPAC deal

reuters.com

2025-06-05 08:19:53Self-driving truck startup Plus Automation will go public in the U.S. through a merger with blank-check firm Churchill Capital Corp IX in a $1.2 billion deal, the companies said on Thursday.

Sera Swimwear Launches Public Funding Round to Disrupt the Luxury Plus-Size Swimwear Market

newsfilecorp.com

2025-02-06 13:38:00Tampa, Florida--(Newsfile Corp. - February 6, 2025) - The future of luxury swimwear is here. Sera Swimwear , a pioneering new brand, is launching its first community fundraising round on Wefunder, inviting supporters everywhere to be part of a movement that redefines elegance, confidence, and inclusivity in fashion.

Public Service Enterprise Group: Wind Power A Plus But Stock Overpriced

seekingalpha.com

2022-01-25 06:11:26Public Service Enterprise Group: Wind Power A Plus But Stock Overpriced

Trump's SPAC Could Rocket To A $10 Billion Plus Valuation With No Revenue

forbes.com

2021-12-31 08:15:00While at first look former President Trump's social media company appears to be valued at $2 billion. However, when earnouts and a PIPE investment are included, its market cap could balloon to $10 to $12 billion.

SPAC merger collapses for autonomous trucking software developer Plus

freightwaves.com

2021-11-08 20:47:14Hennessy Capital Acquisition Corp. and autonomous trucking software developer Plus canceled their planned SPAC merger on Monday, a breakup telegraphed in recent weeks by Hennessy's claim that regulations from outside the United States — likely China — were too big a hurdle to clear. The termination is effective immediately given that Monday was the “outside date” for the business combination to go into effect.

Hennessy Capital Investment Corp. V and Plus Mutually Agree to Terminate Business Combination Agreement

businesswire.com

2021-11-08 17:50:00NEW YORK & CUPERTINO, Calif.--(BUSINESS WIRE)--Hennessy Capital Investment Corp. V (NASDAQ: HCIC) (“HCIC V” or “Hennessy Capital”), a publicly traded special purpose acquisition company, and Plus (formerly Plus.ai), a global provider of self-driving truck technology, announced today that the companies have mutually agreed to terminate their previously announced Merger Agreement and Plan of Reorganization, effective immediately, given the November 8, 2021 “outside date” set forth in the Merger Agreement. In light of recent developments in the regulatory environment outside of the United States, Plus is pursuing a potential restructuring of certain aspects of its business, after which HCIC V and Plus may enter into discussions with respect to a potential new business combination. Daniel J. Hennessy, Chairman and CEO of HCIC V, said: “HCIC was formed to merge with a company that provides sustainable technologies. We believe in the potential for autonomous trucks to transform the trucking industry and in Plus’s ability to continue its global deployment of autonomous trucking technology. We remain optimistic that the parties can once again explore a business combination in the near term that will further advance sustainable transportation.” “Plus has achieved tremendous momentum in executing against our plans to bring autonomous trucks to market globally. In 2021, we started delivery of our driver-in autonomous driving solution, PlusDrive, to customers and received thousands of pre-orders. We also completed a fully driverless truck demo on a highway that showcased the future of trucking. We are grateful for the support we have received from the Hennessy team, whose commitment to sustainable commercial transportation technologies we share,” said David Liu, CEO and Co-founder at Plus. Neither party will be required to pay the other a termination fee as a result of the mutual decision to terminate the Merger Agreement. About Hennessy Capital Investment Corp. V Hennessy Capital Investment Corp. V is a special purpose acquisition company (or SPAC) which raised $345 million in its IPO in January 2021 and is listed on the Nasdaq Capital Market (NASDAQ: HCIC). Hennessy Capital Investment Corp. V was founded by Daniel J. Hennessy to pursue an initial business combination, with a specific focus on businesses in the sustainable industrial technology and infrastructure industries. For more information, please visit www.hennessycapllc.com. About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley. Plus is developing high-performance full-stack Level 4 autonomous driving technology to enable driverless trucks. Plus’s first commercial product, PlusDrive, is a driver-in solution that supports drivers to make long-haul trucking safer, more efficient, more comfortable, and more sustainable. PlusDrive is already being delivered to world-class fleets and truck manufacturers. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Hennessy Capital’s or Plus’s future plans, strategy and performance. Such forward-looking statements include, but are not limited to, the capability of Plus’s technology, the restructuring of certain aspects of Plus’s business and statements relating to the proposed business combination between Plus and Hennessy Capital, including possible future discussions between the parties with respect to a potential new business combination transaction. Such forward-looking statements are based on current expectations that are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from expectations expressed or implied by such forward-looking statements. Investors are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. These forward-looking statements are made as of the date of this press release, and neither Hennessy Capital nor Plus assumes any obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law.

Endangered SPAC? Public trading path for Plus could be in jeopardy

freightwaves.com

2021-10-22 11:50:09Signs are flashing red for the business combination of autonomous trucking software developer Plus getting to the finish line of its $3.3 billion SPAC merger with Hennessy Capital Acquisition Corp. V. A Sept. 27 Securities and Exchange Commission filing by HCIC (NASDAQ: HCIC) declares it unlikely the merger will conclude by the “outside date” of Nov. 8.

Autonomous Trucking Technology Company Plus Expands Business to Europe

businesswire.com

2021-10-19 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology, announced that the company is expanding its business presence into Europe. Plus has hired Bosch veteran and German native Sun-Mi “Sunny” Choi as Senior Director of Business Development to accelerate its European expansion as the company grows its global footprint. Choi will help deepen existing and future collaboration with truck manufacturers, suppliers, and other Europe-based partners. Plus has already started global customer deployment of its autonomous trucking technology this year. Choi brings to Plus extensive automotive customer, market, and strategic partnership experience in the area of new mobility and technology across Europe, the U.S., China, and Korea. She was previously Director of Business Development and Strategy at Bosch where she cultivated new business and partnerships focused on Connected, Automated, Shared, and Electrified Mobility. In her decade at Bosch, where she was posted in Germany, Korea, China, and the U.S, she also served as Chief of Staff to the Board member of the Bosch Group overseeing Asia Pacific. Choi started her career as a project manager for complex engineering projects at the industrial manufacturing technology company Siemens. “Europe is an exciting market for autonomous trucking development. Our expansion into Europe will help us deepen our partnerships with OEMs and collaborations with key suppliers and partners. Sunny will play a key role in those efforts as we look to accelerate the scale of our delivery,” said Shawn Kerrigan, COO and Co-Founder of Plus. Sunny Choi said, “This is an exciting time for mobility and autonomous trucking, and a unique opportunity to be joining the experienced and growing Plus team. Plus’s key strength and differentiator is that it is the first technology developer to have started commercial deployment of autonomous trucking technology to customers. Plus’s driver-in PlusDrive solution provides significant value to customers and accelerates the development of our L4 fully autonomous system. I look forward to leveraging my multilingual skills and global mindset to build meaningful partnerships as Plus expands to Europe.” About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley. Plus is developing high-performance full-stack Level 4 autonomous driving technology to enable driverless trucks. Plus’s first commercial product, PlusDrive, is a driver-in solution that supports drivers to make long-haul trucking safer, more efficient, more comfortable, and more sustainable. PlusDrive is already being delivered to world-class customers including fleets and truck manufacturers. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Plus’s future plans, strategy and performance. Such statements include, but are not limited to, Plus’s market opportunity in Europe, the potential benefits to Plus of expanding to Europe, Plus’s ability to be successful in Europe, Plus’s current or future production capacity and deliveries, Plus’s technology including the general and specific types of potential benefits from Plus’s technology, including those relating to safety, efficiency, sustainability, driver retention and cost-reductions, the size and growth of the markets in which Plus’s current or future end-customers operate, Plus’s execution against or the anticipated results of Plus’s go-to-market strategy and Plus’s ability to compete with its competitors. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including the ability of Plus to commercialize its autonomous driving system, delays in the design, production and launch of new products, the ability of Plus’s end-customers to obtain anticipated benefits of Plus’s technology, demand for Plus’s products and technology, Plus’s ability to successfully expand to Europe and those more fully described under the section entitled “Risk Factors” in Form F-4 that New Plus will file with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Plus assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law.

Autonomous Trucking Technology Company Plus Joins PAVE’s Board of Directors

businesswire.com

2021-10-07 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology, announced today that the company has been elected to the Board of Directors of PAVE, an industry coalition with the mission to educate policymakers and the public about the potential of automated vehicles. Wiley Deck, Vice President of Government Affairs and Public Policy at Plus, will represent the company on the Board. As the only Level 4 autonomous trucking technology company that has already started delivering a commercial autonomous driving solution to customers, Plus will work with industry leaders to deepen the understanding of the benefits that automated trucks can offer today and in the future, including increased safety, efficiency, sustainability, and driver comfort. 2021 has been a milestone year for Plus. The company started customer delivery of its commercial driver-in autonomous driving solution, PlusDrive, in February. PlusDrive is a repackaged and governed application of the company’s Level 4 autonomous driving technology, designed specifically to make long-haul trucking safer, more efficient, more comfortable, and better for the environment. PlusDrive can be added to existing trucks or integrated directly onto new trucks built at the factory. “The safe introduction of automated trucks requires favorable policies and public support. Plus is excited to collaborate with industry partners through organizations like PAVE to share information with policymakers and the public about autonomous trucks. Faster, safer, and more efficient long-haul trucking is good for our economy and our daily lives,” said Wiley Deck, Vice President of Government Affairs and Public Policy at Plus. “We are pleased to welcome a leading autonomous trucking technology company Plus to the PAVE Board. As a member-driven organization, PAVE relies on our Board’s leadership to drive our mission and programming. With automated trucking emerging as a key segment of autonomous vehicles, Plus’s involvement and collaboration will boost our efforts to help people understand the transformative potential of autonomous vehicles,” said PAVE Executive Director Tara Andringa. About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley. Plus is developing high-performance full-stack Level 4 autonomous driving technology to enable driverless trucks. Plus’s first commercial product, PlusDrive, is a driver-in solution that supports drivers to make long-haul trucking safer, more efficient, more comfortable, and more sustainable. PlusDrive is already being delivered to world-class customers including fleets and truck manufacturers. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. About Partners for Automated Vehicle Education Partners for Automated Vehicle Education (PAVE) is a diverse coalition that unites industry partners and nonprofit groups who believe in the potential of autonomous vehicles and understand the importance of education in realizing that potential. For more information about PAVE, visit https://pavecampaign.org/.

Plus Delivers Initial Production Units of the PlusDrive Autonomous Driving Technology Solution to the World’s Largest Heavy Duty Truck Manufacturer FAW

businesswire.com

2021-09-29 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology that recently disclosed its proposed business combination with Hennessy Capital Investment Corp. V (NASDAQ: HCIC), announced today that Plus has delivered the initial production batch of PlusDrive autonomous driving units to FAW in order for FAW to integrate the units and launch China’s first driver-in autonomous trucks. The delivery is part of an agreement with FAW in which Plus sells PlusDrive units to FAW, which will handle the installation of the autonomous driving technology on their factory production line. FAW will leverage its extensive sales and service network to manage the sales and maintenance of the autonomous trucks. FAW and Plus will work together to update and maintain the autonomous driving technology behind PlusDrive. “2021 has been a particularly exciting year for our team at Plus as we start to deliver our core autonomous trucking product, PlusDrive, to the market. Whether that is directly to fleets as we have done in the U.S. or to OEMs like FAW in China, we are excited that soon fleets will be operating their PlusDrive-enabled autonomous trucks on public roads in both the U.S. and China. Looking ahead, we will continue to execute against our go-to-market strategy as a technology provider enabling the trucking industry with our cutting-edge autonomous driving solution. We are committed to generating long-term, sustainable shareholder value,” said Shawn Kerrigan, COO and Co-founder at Plus. FAW’s new line of autonomous trucks has so far received thousands of units in pre-orders from large fleets in China, including new pre-orders from Rokin and Duckbill which adds to the pre-order from Guangzhou Zhihong. Xiong Xingming, CEO at Rokin, China’s largest refrigerated and frozen goods transport company with more than 60,000 trucks, said: “Autonomous trucks powered by PlusDrive are a revolutionary product for our industry. It enhances safety, efficiency and sustainability. This will bring tremendous benefit to our network of commercial vehicles.” “As the trucking industry faces a continued driver shortage, the demand for autonomous trucks that enhance the safety, efficiency and sustainability of long-haul trucking is increasing. We recognize the immense value that FAW’s autonomous trucks powered by PlusDrive will be able to deliver across our network of over 30,000 trucks,” said Liu Zhiyuan, CEO and Founder of Guangzhou Zhihong. Temasek Holdings-backed container truck fleet company, Duckbill, operates a network of over 40,000 trucks. Tang Hongbin, CEO and Founder of Duckbill, said: “Container trucking is growing significantly, and fleet efficiency is critically important for the continued expansion of our business. We look forward to working with Plus on applying autonomous driving technology to make container trucking more efficient, lower shipping costs, and benefit consumers globally.” About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley and founded in 2016 by serial entrepreneurs and industry veterans who have extensive experience in high tech and artificial intelligence. Plus is developing low-cost, high-performance full-stack Level 4 autonomous driving technology to make long-haul trucking safer, more efficient, and more sustainable. Plus is also collaborating with leading truck manufacturers, fleets, and ecosystem partners to drive the development of decarbonization transportation solutions including autonomous trucks powered by natural gas. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. On May 7, 2021, PlusAI Corp., Plus Inc. (“New Plus”) and Hennessy Capital Investment Corp. V (NASDAQ: HCIC) (“Hennessy Capital”) entered into a definitive business combination agreement. Upon the closing of the proposed business combination, Plus will be a publicly traded company, and its common stock is expected to trade on the NYSE under the ticker symbol “PLAV”. The proposed business combination has been unanimously approved by the Boards of Directors of both Plus and Hennessy Capital. The closing of the proposed business combination is subject to approval by the stockholders of both Plus and Hennessy Capital and the satisfaction of the necessary regulatory approvals and customary closing conditions. Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Plus’s future plans, strategy and performance. Such statements include, but are not limited to, Plus’s current or future production capacity and deliveries, Plus’s technology, the general and specific types of potential benefits from Plus’s technology, including those relating to safety, efficiency, sustainability, driver retention and cost-reductions, industrial sectors in which Plus’s technology can provide benefits, the size and growth of the markets in which Plus’s current or future end-customers operate, the timing of when, if at all, Plus’s technology is used on public roads by Plus’s customers, receipt of binding orders for Plus’s products pursuant to non-binding pre-orders for FAW’s autonomous trucks, future orders or pre-orders for FAW’s or Plus’s products, FAW’s continued purchases of Plus’s technology, Plus’s ability to rely on and benefit from FAW’s commercial, sales, and service networks, future collaboration between FAW and Plus and any potential benefits from any such collaboration, Plus’s execution against or the anticipated results of Plus’s go-to-market strategy, the timing for the rollout of Plus’s technology including an at-scale rollout of Plus’s technology, Plus’s progress towards an at-scale rollout of Plus’s technology, Plus’s ability to compete with its competitors, Plus’s ability to achieve financial or other operational results, including long-term shareholder value, and statements relating to the proposed business combination between Plus and Hennessy Capital. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including the relationship between FAW and Plus, the ability of Plus to commercialize its autonomous driving system, delays in the design, production and launch of new products, the ability of Plus’s and FAW’s end-customers to obtain anticipated benefits of Plus’s technology, demand for Plus’s and FAW’s products and technology, FAW’s continued purchases of Plus’s products, risks related to the proposed business combination between Plus and Hennessy Capital and those more fully described under the section entitled “Risk Factors” in Form F-4 that New Plus will file with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Plus and Hennessy Capital assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Important Information for Investors and Shareholders As permitted by the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”), and in connection with the proposed business combination, New Plus has confidentially submitted a draft registration statement on Form F-4 (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”), which includes a prospectus with respect to New Plus’s securities to be issued in connection with the business combination and a proxy statement to be distributed to holders of Hennessy Capital’s common stock in connection with Hennessy Capital’s solicitation of proxies for the vote by Hennessy Capital’s stockholders with respect to the business combination and other matters to be described in the Registration Statement (the “Proxy Statement”). After the Registration Statement has been declared effective by the SEC, Hennessy Capital will file the definitive Proxy Statement with the SEC and will mail copies to stockholders of Hennessy Capital as of a record date to be established for voting on the proposed business combination. Additionally, New Plus and Hennessy Capital will file other relevant materials with the SEC in connection with the business combination. Security holders of Plus, New Plus, and Hennessy Capital are urged to read the Registration Statement and Proxy Statement and the other relevant materials when they become available before making any voting decision with respect to the proposed business combination because they will contain important information about the proposed business combination and the parties thereto. Investors and security holders of Plus, New Plus, and Hennessy Capital may also obtain a copy of the Registration Statement and Proxy Statement, when available, as well as other documents filed with the SEC regarding the proposed business combination by New Plus and Hennessy Capital, without charge, at the SEC’s website located at www.sec.gov. Copies of these filings may be obtained free of charge on Plus’s website at http://www.plus.ai or by directing a request to Lynn Miller, General Counsel, 20401 Stevens Creek Boulevard, Cupertino, California 95014 or by telephone at (408) 508-4758, and/or on Hennessy Capital’s website at http://www.hennessycapllc.com/ or by directing a request to Nicholas A. Petruska, Executive Vice President, Chief Financial Officer, 3415 N. Pines Way, Suite 204, Wilson, Wyoming 83014 or by telephone at (307) 201-1903. The information contained on, or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release. Participants in the Solicitation Plus, Hennessy Capital and New Plus and their respective directors and officers may be deemed participants in the solicitation of proxies of Hennessy Capital’s stockholders in connection with the proposed business combination. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Hennessy Capital’s executive officers and directors in the solicitation by reading Hennessy Capital’s Registration Statement on Form S-1, declared effective by the SEC on January 14, 2021, and the Registration Statement, Proxy Statement and other relevant materials filed with the SEC in connection with the proposed business combination when they become available. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Hennessy Capital’s stockholders in connection with the proposed business combination, including a description of their direct and indirect interests, which may, in some cases, be different than those of their stockholders generally, will be set forth in the Proxy Statement when it becomes available.

Plus Delivers Initial Production Units of the PlusDrive Autonomous Driving Technology Solution to the World's Largest Heavy Duty Truck Manufacturer FAW

businesswire.com

2021-09-29 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)-- #autonomoustrucks--Plus (formerly Plus.ai), a global provider of self-driving truck technology that recently disclosed its proposed business combination with Hennessy Capital Investment Corp. V (NASDAQ: HCIC), announced today that Plus has delivered the initial production batch of PlusDrive autonomous driving units to FAW in order for FAW to integrate the units and launch China's first driver-in autonomous trucks. The delivery is part of an agreement with FAW in which Plus sell

4 Self-Driving Truck Stocks You Need to Keep an Eye On

investorplace.com

2021-09-09 12:10:20Self-driving truck stocks give you exposure to an exciting investing niche. If you want to future-proof your portfolio, look no further.

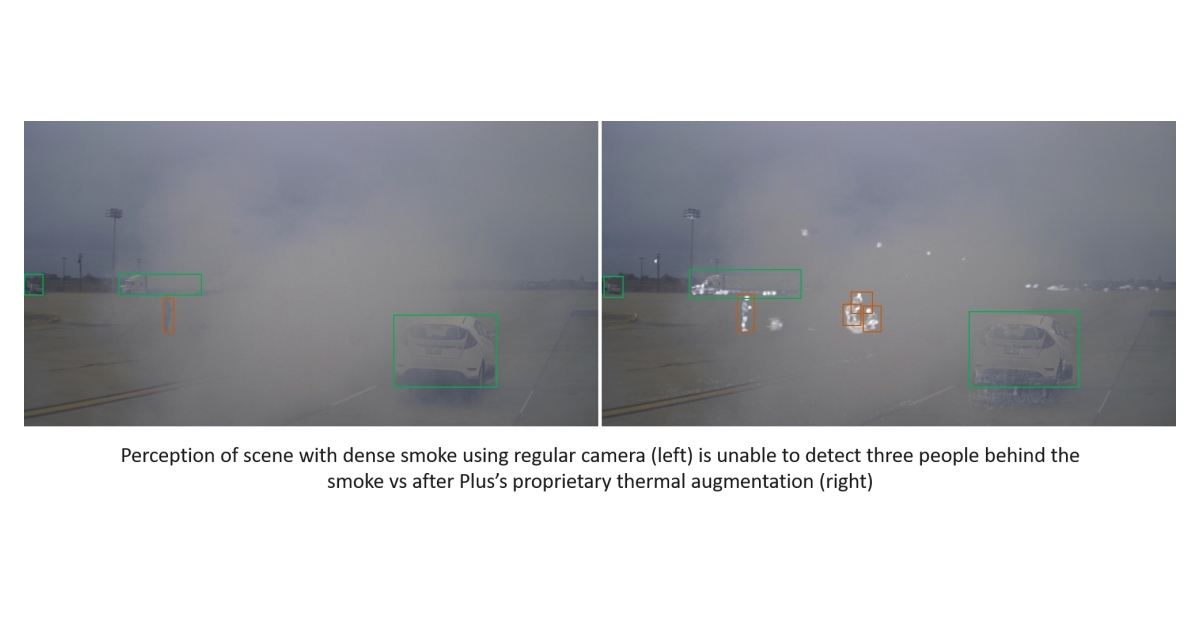

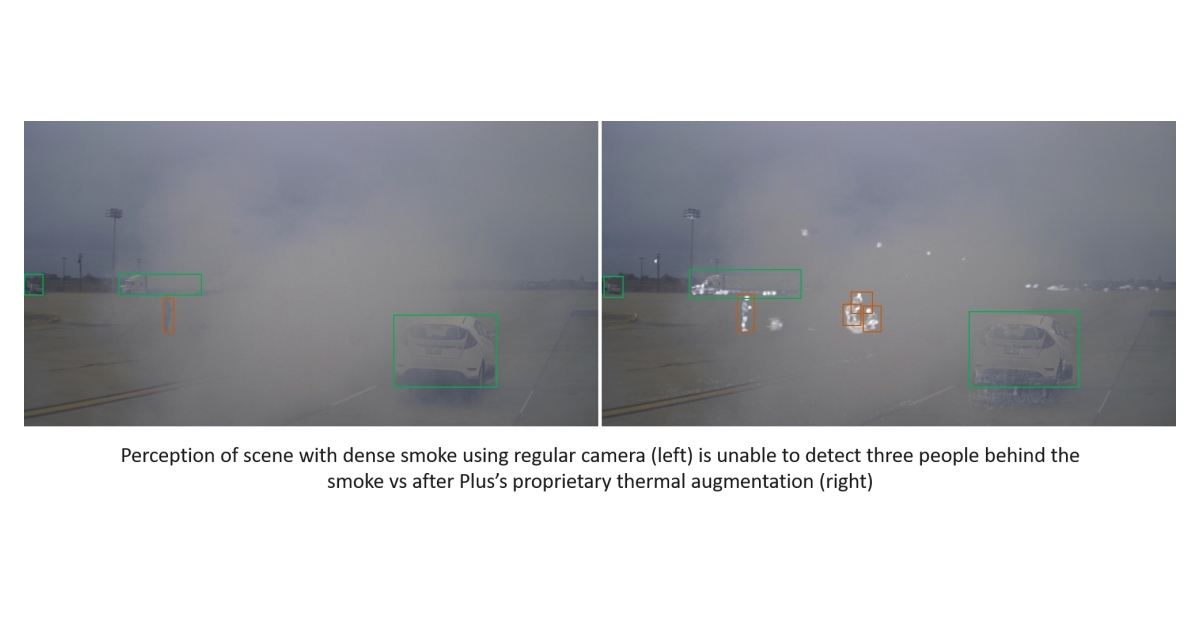

Plus Starts Development With Teledyne FLIR to Test Thermal Cameras for Autonomous Trucks

businesswire.com

2021-09-08 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology that recently disclosed its proposed business combination with Hennessy Capital Investment Corp. V (NASDAQ: HCIC), announced today that it will collaborate with Teledyne FLIR, LLC on a development project to explore the addition of thermal cameras to the sensor stack used with Plus’s Level 4 autonomous driving technology. Plus takes a multi-modal sensor approach and currently uses lidar, cameras, and radar to provide trucks powered by its autonomous driving technology with a 360-degree view around the vehicle. While the current system offers improved safety compared to a traditional truck, thermal cameras add another layer of perception that is particularly useful for heavy trucks that traverse the country in low-visibility and high-contrast conditions. These can include: nighttime, shadows, dusk, or sunrise; direct sun or headlight glare; and challenging scenarios when fog or smoke is present due to environmental conditions. Depending on configuration, thermal cameras can detect and classify pedestrians at distances of up to 250 meters (>820 feet), which is much farther than the reach of typical headlights. They can also provide another layer of perception around the vehicle, particularly helpful when the vehicle is backing up or when being overtaken by an ensuing vehicle. “You can never be too safe when it comes to equipment you put on a heavy truck. Combining thermal cameras with our other sensors would bring an additional margin of safety to our system. Our research pilot will not only assess the technical performance but also consider cost and scale requirements in order to potentially add this to our product roadmap,” said Tim Daly, Chief Architect of Plus. “We are excited to be working with the team at Plus as they explore the integration of thermal cameras into their current sensor suite, creating even safer autonomous commercial vehicles,” said Paul Clayton, General Manager of Components, Industrial Technologies Segment at Teledyne FLIR. “By combining thermal imaging with visible light cameras, lidar, and radar, Plus can create more comprehensive and redundant systems, allowing these vehicles to more readily detect and classify objects and humans on the road to help save lives.” About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley and founded in 2016 by serial entrepreneurs and industry veterans who have extensive experience in high tech and artificial intelligence. Plus is developing low-cost, high-performance full-stack Level 4 autonomous driving technology to make long-haul trucking safer, more efficient, and more sustainable. Plus is also collaborating with leading truck manufacturers, fleets, and ecosystem partners to drive the development of decarbonization transportation solutions including autonomous trucks powered by natural gas. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. On May 7, 2021, PlusAI Corp., Plus Inc. (“New Plus”) and Hennessy Capital Investment Corp. V (NASDAQ: HCIC) (“Hennessy Capital”) entered into a definitive business combination agreement. Upon the closing of the proposed business combination, Plus will be a publicly traded company, and its common stock is expected to trade on the NYSE under the ticker symbol “PLAV”. The proposed business combination has been unanimously approved by the Boards of Directors of both Plus and Hennessy Capital. The closing of the proposed business combination is subject to approval by the stockholders of both Plus and Hennessy Capital and the satisfaction of the necessary regulatory approvals and customary closing conditions. About Teledyne FLIR Teledyne FLIR, a Teledyne Technologies company, is a world leader in intelligent sensing solutions for defense and industrial applications with approximately 4,000 employees worldwide. Founded in 1978, the company creates advanced technologies to help professionals make better, faster decisions that save lives and livelihoods. For more information, please visit www.teledyneflir.com or follow @flir. About Teledyne Technologies Teledyne Technologies is a leading provider of sophisticated digital imaging products and software, instrumentation, aerospace and defense electronics, and engineered systems. Teledyne’s operations are primarily located in the United States, the United Kingdom, Canada, and Western and Northern Europe. For more information, visit Teledyne's website at www.teledyne.com. Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Plus’s future plans, strategy and performance. Such statements include, but are not limited to, the potential benefits of the collaboration between Teledyne FLIR and Plus, the capabilities, specifications, reliability, cost and safety of thermal cameras, Teledyne’s technology, Plus’s technology, the general and specific types of sensors and other technology that Plus does and will use in its current and/or future products, conditions in which certain technology can operate and can provide improved performance, Plus’s ability to integrate new technology into its current and future products, the timing for the rollout of Plus’s technology including an at-scale rollout of Plus’s technology, Plus’s progress towards an at-scale rollout of Plus’s technology, Plus’s plans for testing its technology, Plus’s ability to compete with its competitors, and statements relating to the proposed business combination between Plus and Hennessy Capital. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including the relationship between Teledyne FLIR and Plus, the ability of Plus to commercialize its autonomous driving system, delays in the design, production and launch of new products, risks related to the proposed business combination between Plus and Hennessy Capital and those more fully described under the section entitled “Risk Factors” in Form F-4 that New Plus will file with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Plus and Hennessy Capital assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Important Information for Investors and Shareholders As permitted by the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”), and in connection with the proposed business combination, New Plus has confidentially submitted a draft registration statement on Form F-4 (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”), which includes a prospectus with respect to New Plus’s securities to be issued in connection with the business combination and a proxy statement to be distributed to holders of Hennessy Capital’s common stock in connection with Hennessy Capital’s solicitation of proxies for the vote by Hennessy Capital’s stockholders with respect to the business combination and other matters to be described in the Registration Statement (the “Proxy Statement”). After the Registration Statement has been declared effective by the SEC, Hennessy Capital will file the definitive Proxy Statement with the SEC and will mail copies to stockholders of Hennessy Capital as of a record date to be established for voting on the proposed business combination. Additionally, New Plus and Hennessy Capital will file other relevant materials with the SEC in connection with the business combination. Security holders of Plus, New Plus, and Hennessy Capital are urged to read the Registration Statement and Proxy Statement and the other relevant materials when they become available before making any voting decision with respect to the proposed business combination because they will contain important information about the proposed business combination and the parties thereto. Investors and security holders of Plus, New Plus, and Hennessy Capital may also obtain a copy of the Registration Statement and Proxy Statement, when available, as well as other documents filed with the SEC regarding the proposed business combination by New Plus and Hennessy Capital, without charge, at the SEC’s website located at www.sec.gov. Copies of these filings may be obtained free of charge on Plus’s website at http://www.plus.ai or by directing a request to Lynn Miller, General Counsel, 20401 Stevens Creek Boulevard, Cupertino, California 95014 or by telephone at (408) 508-4758, and/or on Hennessy Capital’s website at http://www.hennessycapllc.com/ or by directing a request to Nicholas A. Petruska, Executive Vice President, Chief Financial Officer, 3415 N. Pines Way, Suite 204, Wilson, Wyoming 83014 or by telephone at (307) 201-1903. The information contained on, or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release. Participants in the Solicitation Plus, Hennessy Capital and New Plus and their respective directors and officers may be deemed participants in the solicitation of proxies of Hennessy Capital’s stockholders in connection with the proposed business combination. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Hennessy Capital’s executive officers and directors in the solicitation by reading Hennessy Capital’s Registration Statement on Form S-1, declared effective by the SEC on January 14, 2021, and the Registration Statement, Proxy Statement and other relevant materials filed with the SEC in connection with the proposed business combination when they become available. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Hennessy Capital’s stockholders in connection with the proposed business combination, including a description of their direct and indirect interests, which may, in some cases, be different than those of their stockholders generally, will be set forth in the Proxy Statement when it becomes available.

What You Need to Know About This Self-Driving Truck Start-up's IPO

fool.com

2021-09-01 10:17:00Plus could become a massive player in the self-driving space.

Plus Completes Driverless Level 4 Semi Truck Highway Demonstration

businesswire.com

2021-08-05 07:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology that recently announced its proposed business combination with Hennessy Capital Investment Corp. V (NASDAQ: HCIC), revealed today that it has completed a driverless Level 4 truck demonstration on a highway. The driverless semi truck was operated using Plus’s Level 4 autonomous driving technology, without a safety driver, teleoperator, or any other forms of human intervention. This represents a significant milestone for the autonomous trucking industry and for Plus, which demonstrated the company’s first driverless Level 4 heavy truck operation at the Qingdao port in April 2018. The driverless Level 4 truck demonstration was completed on the Wufengshan highway in China’s largest economic center of Yangtze Delta. The demonstration was conducted with a special permit on the newly built highway, with Plus being the first company to be granted such a permit in China. During the demonstration, the driverless truck drove safely and smoothly in typical highway traffic. To watch the driverless truck demo, check out this video: https://youtu.be/puisSy5sSzI. “The driverless demo highlights the ability of our Level 4 autonomous driving technology to enable driverless highway operations in a semi truck. The demo shows the safety, maturity, and functionality of our technology, and we are excited to continue to work closely with our suppliers, fleet customers, and OEM partners to further develop, test, and refine a driverless product for commercial deployment,” said Shawn Kerrigan, COO and Co-founder of Plus. Plus expects to launch pilot operations of a fully driverless truck for use in a dedicated environment in 2022. Plus is also applying the Level 4 technology used in the driverless demo to deploy a commercial driver-in product for semi trucks called PlusDrive. PlusDrive can either be a standard configuration of newly built trucks or added to existing trucks in order to help make long-haul trucking safer, more efficient, more comfortable, and better for the environment. Customers of PlusDrive include some of the world’s largest fleets. The first customer delivery of PlusDrive started in February 2021 and mass production of the FAW J7 L3 truck powered by PlusDrive is expected to start in the third quarter of 2021. About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley and founded in 2016 by serial entrepreneurs and industry veterans who have extensive experience in high tech and artificial intelligence. Plus is developing low-cost, high-performance full-stack Level 4 autonomous driving technology to make long-haul trucking safer, more efficient, and more sustainable. Mass production and global deployment of its award-winning, driver-in autonomous driving technology, which reduces fuel consumption by an estimated at least 10% compared to a traditional truck, is planned to start in the third quarter of 2021. Plus is also collaborating with leading truck manufacturers, fleets, and ecosystem partners to drive the development of decarbonization transportation solutions including autonomous trucks powered by natural gas. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. On May 10, 2021, Plus and Hennessy Capital Investment Corp. V (NASDAQ: HCIC) (“HCIC V” or “Hennessy Capital”) entered into a definitive business combination agreement. Upon closing of the proposed business combination, Plus will be a publicly traded company and its common stock is expected to trade on the NYSE under the ticker symbol “PLAV”. The proposed business combination has been unanimously approved by the Boards of Directors of both Plus and HCIC V and is expected to close in the third quarter of 2021, subject to satisfaction of the necessary regulatory approvals and customary closing conditions, including the approval of HCIC V’s stockholders. Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Plus’s future plans, strategy and performance. Such statements include, but are not limited to, the capability of Plus’s technology, the timing for when Plus expects to launch pilot operations of a fully driverless truck for use in a dedicated environment, the timing for mass production of the FAW J7 L3 truck, and statements relating to the proposed business combination between Plus and HCIC V including the timing for the closing of such transaction. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including the ability of Plus to commercialize its autonomous driving system, Plus’s relationship with FAW Jiefang, delays in the design, production and launch of new products, risks related to the proposed business combination between Plus and HCIC V and those more fully described under the section entitled “Risk Factors” in Form F-4 that Plus will file with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Plus assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Important Information for Investors and Shareholders As permitted by the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”), and in connection with the proposed business combination, New Plus has confidentially submitted a draft registration statement on Form F-4 (the “Registration Statement”) with the SEC, which includes a prospectus with respect to New Plus’s securities to be issued in connection with the business combination and a proxy statement to be distributed to holders of Hennessy Capital’s common stock in connection with Hennessy Capital’s solicitation of proxies for the vote by Hennessy Capital’s stockholders with respect to the business combination and other matters to be described in the Registration Statement (the “Proxy Statement”). After the Registration Statement has been declared effective by the SEC, Hennessy Capital will file the definitive Proxy Statement with the SEC and will mail copies to stockholders of Hennessy Capital as of a record date to be established for voting on the proposed business combination. Additionally, New Plus and Hennessy Capital will file other relevant materials with the SEC in connection with the business combination. Security holders of Plus, New Plus, and Hennessy Capital are urged to read the Registration Statement and Proxy Statement and the other relevant materials when they become available before making any voting decision with respect to the proposed business combination because they will contain important information about the proposed business combination and the parties thereto. Investors and security holders of Plus, New Plus, and Hennessy Capital may also obtain a copy of the Registration Statement and Proxy Statement, when available, as well as other documents filed with the SEC regarding the proposed business combination by New Plus and Hennessy Capital, without charge, at the SEC’s website located at www.sec.gov. Copies of these filings may be obtained free of charge on Plus’s website or by directing a request to Plus Inc., and/or on Hennessy Capital’s website at http://www.hennessycapllc.com/ or by directing a request to Nicholas A. Petruska, Executive Vice President, Chief Financial Officer, 3415 N. Pines Way, Suite 204, Wilson, Wyoming 83014 or by telephone at (307) 201-1903. The information contained on, or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release. Participants in the Solicitation Plus, Hennessy Capital and New Plus and their respective directors and officers may be deemed participants in the solicitation of proxies of Hennessy Capital’s stockholders in connection with the proposed business combination. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Hennessy Capital’s executive officers and directors in the solicitation by reading Hennessy Capital’s Registration Statement on Form S-1, declared effective by the SEC on January 14, 2021, and the Registration Statement, Proxy Statement and other relevant materials filed with the SEC in connection with the proposed business combination when they become available. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Hennessy Capital’s stockholders in connection with the proposed business combination, including a description of their direct and indirect interests, which may, in some cases, be different than those of their stockholders generally, will be set forth in the Proxy Statement when it becomes available.

No data to display

Churchill Capital IX: Plus Deal Is Intriguing, But SPAC Concerns Remain

seekingalpha.com

2025-07-09 23:59:00Any SPAC, including Churchill Capital IX, merits skepticism given the group's poor performance. But even with that skepticism, CCIX merger of CCIX and autonomous trucking startup Plus stands out as intriguing. Plus is valued at a sharp discount to a peer, has strong partners, and an intriguing business model.

Self-driving startup Plus to go public through $1.2 billion SPAC deal

reuters.com

2025-06-05 08:19:53Self-driving truck startup Plus Automation will go public in the U.S. through a merger with blank-check firm Churchill Capital Corp IX in a $1.2 billion deal, the companies said on Thursday.

Sera Swimwear Launches Public Funding Round to Disrupt the Luxury Plus-Size Swimwear Market

newsfilecorp.com

2025-02-06 13:38:00Tampa, Florida--(Newsfile Corp. - February 6, 2025) - The future of luxury swimwear is here. Sera Swimwear , a pioneering new brand, is launching its first community fundraising round on Wefunder, inviting supporters everywhere to be part of a movement that redefines elegance, confidence, and inclusivity in fashion.

Public Service Enterprise Group: Wind Power A Plus But Stock Overpriced

seekingalpha.com

2022-01-25 06:11:26Public Service Enterprise Group: Wind Power A Plus But Stock Overpriced

Trump's SPAC Could Rocket To A $10 Billion Plus Valuation With No Revenue

forbes.com

2021-12-31 08:15:00While at first look former President Trump's social media company appears to be valued at $2 billion. However, when earnouts and a PIPE investment are included, its market cap could balloon to $10 to $12 billion.

SPAC merger collapses for autonomous trucking software developer Plus

freightwaves.com

2021-11-08 20:47:14Hennessy Capital Acquisition Corp. and autonomous trucking software developer Plus canceled their planned SPAC merger on Monday, a breakup telegraphed in recent weeks by Hennessy's claim that regulations from outside the United States — likely China — were too big a hurdle to clear. The termination is effective immediately given that Monday was the “outside date” for the business combination to go into effect.

Hennessy Capital Investment Corp. V and Plus Mutually Agree to Terminate Business Combination Agreement

businesswire.com

2021-11-08 17:50:00NEW YORK & CUPERTINO, Calif.--(BUSINESS WIRE)--Hennessy Capital Investment Corp. V (NASDAQ: HCIC) (“HCIC V” or “Hennessy Capital”), a publicly traded special purpose acquisition company, and Plus (formerly Plus.ai), a global provider of self-driving truck technology, announced today that the companies have mutually agreed to terminate their previously announced Merger Agreement and Plan of Reorganization, effective immediately, given the November 8, 2021 “outside date” set forth in the Merger Agreement. In light of recent developments in the regulatory environment outside of the United States, Plus is pursuing a potential restructuring of certain aspects of its business, after which HCIC V and Plus may enter into discussions with respect to a potential new business combination. Daniel J. Hennessy, Chairman and CEO of HCIC V, said: “HCIC was formed to merge with a company that provides sustainable technologies. We believe in the potential for autonomous trucks to transform the trucking industry and in Plus’s ability to continue its global deployment of autonomous trucking technology. We remain optimistic that the parties can once again explore a business combination in the near term that will further advance sustainable transportation.” “Plus has achieved tremendous momentum in executing against our plans to bring autonomous trucks to market globally. In 2021, we started delivery of our driver-in autonomous driving solution, PlusDrive, to customers and received thousands of pre-orders. We also completed a fully driverless truck demo on a highway that showcased the future of trucking. We are grateful for the support we have received from the Hennessy team, whose commitment to sustainable commercial transportation technologies we share,” said David Liu, CEO and Co-founder at Plus. Neither party will be required to pay the other a termination fee as a result of the mutual decision to terminate the Merger Agreement. About Hennessy Capital Investment Corp. V Hennessy Capital Investment Corp. V is a special purpose acquisition company (or SPAC) which raised $345 million in its IPO in January 2021 and is listed on the Nasdaq Capital Market (NASDAQ: HCIC). Hennessy Capital Investment Corp. V was founded by Daniel J. Hennessy to pursue an initial business combination, with a specific focus on businesses in the sustainable industrial technology and infrastructure industries. For more information, please visit www.hennessycapllc.com. About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley. Plus is developing high-performance full-stack Level 4 autonomous driving technology to enable driverless trucks. Plus’s first commercial product, PlusDrive, is a driver-in solution that supports drivers to make long-haul trucking safer, more efficient, more comfortable, and more sustainable. PlusDrive is already being delivered to world-class fleets and truck manufacturers. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Hennessy Capital’s or Plus’s future plans, strategy and performance. Such forward-looking statements include, but are not limited to, the capability of Plus’s technology, the restructuring of certain aspects of Plus’s business and statements relating to the proposed business combination between Plus and Hennessy Capital, including possible future discussions between the parties with respect to a potential new business combination transaction. Such forward-looking statements are based on current expectations that are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from expectations expressed or implied by such forward-looking statements. Investors are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. These forward-looking statements are made as of the date of this press release, and neither Hennessy Capital nor Plus assumes any obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law.

Endangered SPAC? Public trading path for Plus could be in jeopardy

freightwaves.com

2021-10-22 11:50:09Signs are flashing red for the business combination of autonomous trucking software developer Plus getting to the finish line of its $3.3 billion SPAC merger with Hennessy Capital Acquisition Corp. V. A Sept. 27 Securities and Exchange Commission filing by HCIC (NASDAQ: HCIC) declares it unlikely the merger will conclude by the “outside date” of Nov. 8.

Autonomous Trucking Technology Company Plus Expands Business to Europe

businesswire.com

2021-10-19 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology, announced that the company is expanding its business presence into Europe. Plus has hired Bosch veteran and German native Sun-Mi “Sunny” Choi as Senior Director of Business Development to accelerate its European expansion as the company grows its global footprint. Choi will help deepen existing and future collaboration with truck manufacturers, suppliers, and other Europe-based partners. Plus has already started global customer deployment of its autonomous trucking technology this year. Choi brings to Plus extensive automotive customer, market, and strategic partnership experience in the area of new mobility and technology across Europe, the U.S., China, and Korea. She was previously Director of Business Development and Strategy at Bosch where she cultivated new business and partnerships focused on Connected, Automated, Shared, and Electrified Mobility. In her decade at Bosch, where she was posted in Germany, Korea, China, and the U.S, she also served as Chief of Staff to the Board member of the Bosch Group overseeing Asia Pacific. Choi started her career as a project manager for complex engineering projects at the industrial manufacturing technology company Siemens. “Europe is an exciting market for autonomous trucking development. Our expansion into Europe will help us deepen our partnerships with OEMs and collaborations with key suppliers and partners. Sunny will play a key role in those efforts as we look to accelerate the scale of our delivery,” said Shawn Kerrigan, COO and Co-Founder of Plus. Sunny Choi said, “This is an exciting time for mobility and autonomous trucking, and a unique opportunity to be joining the experienced and growing Plus team. Plus’s key strength and differentiator is that it is the first technology developer to have started commercial deployment of autonomous trucking technology to customers. Plus’s driver-in PlusDrive solution provides significant value to customers and accelerates the development of our L4 fully autonomous system. I look forward to leveraging my multilingual skills and global mindset to build meaningful partnerships as Plus expands to Europe.” About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley. Plus is developing high-performance full-stack Level 4 autonomous driving technology to enable driverless trucks. Plus’s first commercial product, PlusDrive, is a driver-in solution that supports drivers to make long-haul trucking safer, more efficient, more comfortable, and more sustainable. PlusDrive is already being delivered to world-class customers including fleets and truck manufacturers. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Plus’s future plans, strategy and performance. Such statements include, but are not limited to, Plus’s market opportunity in Europe, the potential benefits to Plus of expanding to Europe, Plus’s ability to be successful in Europe, Plus’s current or future production capacity and deliveries, Plus’s technology including the general and specific types of potential benefits from Plus’s technology, including those relating to safety, efficiency, sustainability, driver retention and cost-reductions, the size and growth of the markets in which Plus’s current or future end-customers operate, Plus’s execution against or the anticipated results of Plus’s go-to-market strategy and Plus’s ability to compete with its competitors. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including the ability of Plus to commercialize its autonomous driving system, delays in the design, production and launch of new products, the ability of Plus’s end-customers to obtain anticipated benefits of Plus’s technology, demand for Plus’s products and technology, Plus’s ability to successfully expand to Europe and those more fully described under the section entitled “Risk Factors” in Form F-4 that New Plus will file with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Plus assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law.

Autonomous Trucking Technology Company Plus Joins PAVE’s Board of Directors

businesswire.com

2021-10-07 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology, announced today that the company has been elected to the Board of Directors of PAVE, an industry coalition with the mission to educate policymakers and the public about the potential of automated vehicles. Wiley Deck, Vice President of Government Affairs and Public Policy at Plus, will represent the company on the Board. As the only Level 4 autonomous trucking technology company that has already started delivering a commercial autonomous driving solution to customers, Plus will work with industry leaders to deepen the understanding of the benefits that automated trucks can offer today and in the future, including increased safety, efficiency, sustainability, and driver comfort. 2021 has been a milestone year for Plus. The company started customer delivery of its commercial driver-in autonomous driving solution, PlusDrive, in February. PlusDrive is a repackaged and governed application of the company’s Level 4 autonomous driving technology, designed specifically to make long-haul trucking safer, more efficient, more comfortable, and better for the environment. PlusDrive can be added to existing trucks or integrated directly onto new trucks built at the factory. “The safe introduction of automated trucks requires favorable policies and public support. Plus is excited to collaborate with industry partners through organizations like PAVE to share information with policymakers and the public about autonomous trucks. Faster, safer, and more efficient long-haul trucking is good for our economy and our daily lives,” said Wiley Deck, Vice President of Government Affairs and Public Policy at Plus. “We are pleased to welcome a leading autonomous trucking technology company Plus to the PAVE Board. As a member-driven organization, PAVE relies on our Board’s leadership to drive our mission and programming. With automated trucking emerging as a key segment of autonomous vehicles, Plus’s involvement and collaboration will boost our efforts to help people understand the transformative potential of autonomous vehicles,” said PAVE Executive Director Tara Andringa. About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley. Plus is developing high-performance full-stack Level 4 autonomous driving technology to enable driverless trucks. Plus’s first commercial product, PlusDrive, is a driver-in solution that supports drivers to make long-haul trucking safer, more efficient, more comfortable, and more sustainable. PlusDrive is already being delivered to world-class customers including fleets and truck manufacturers. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. About Partners for Automated Vehicle Education Partners for Automated Vehicle Education (PAVE) is a diverse coalition that unites industry partners and nonprofit groups who believe in the potential of autonomous vehicles and understand the importance of education in realizing that potential. For more information about PAVE, visit https://pavecampaign.org/.

Plus Delivers Initial Production Units of the PlusDrive Autonomous Driving Technology Solution to the World’s Largest Heavy Duty Truck Manufacturer FAW

businesswire.com

2021-09-29 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)--Plus (formerly Plus.ai), a global provider of self-driving truck technology that recently disclosed its proposed business combination with Hennessy Capital Investment Corp. V (NASDAQ: HCIC), announced today that Plus has delivered the initial production batch of PlusDrive autonomous driving units to FAW in order for FAW to integrate the units and launch China’s first driver-in autonomous trucks. The delivery is part of an agreement with FAW in which Plus sells PlusDrive units to FAW, which will handle the installation of the autonomous driving technology on their factory production line. FAW will leverage its extensive sales and service network to manage the sales and maintenance of the autonomous trucks. FAW and Plus will work together to update and maintain the autonomous driving technology behind PlusDrive. “2021 has been a particularly exciting year for our team at Plus as we start to deliver our core autonomous trucking product, PlusDrive, to the market. Whether that is directly to fleets as we have done in the U.S. or to OEMs like FAW in China, we are excited that soon fleets will be operating their PlusDrive-enabled autonomous trucks on public roads in both the U.S. and China. Looking ahead, we will continue to execute against our go-to-market strategy as a technology provider enabling the trucking industry with our cutting-edge autonomous driving solution. We are committed to generating long-term, sustainable shareholder value,” said Shawn Kerrigan, COO and Co-founder at Plus. FAW’s new line of autonomous trucks has so far received thousands of units in pre-orders from large fleets in China, including new pre-orders from Rokin and Duckbill which adds to the pre-order from Guangzhou Zhihong. Xiong Xingming, CEO at Rokin, China’s largest refrigerated and frozen goods transport company with more than 60,000 trucks, said: “Autonomous trucks powered by PlusDrive are a revolutionary product for our industry. It enhances safety, efficiency and sustainability. This will bring tremendous benefit to our network of commercial vehicles.” “As the trucking industry faces a continued driver shortage, the demand for autonomous trucks that enhance the safety, efficiency and sustainability of long-haul trucking is increasing. We recognize the immense value that FAW’s autonomous trucks powered by PlusDrive will be able to deliver across our network of over 30,000 trucks,” said Liu Zhiyuan, CEO and Founder of Guangzhou Zhihong. Temasek Holdings-backed container truck fleet company, Duckbill, operates a network of over 40,000 trucks. Tang Hongbin, CEO and Founder of Duckbill, said: “Container trucking is growing significantly, and fleet efficiency is critically important for the continued expansion of our business. We look forward to working with Plus on applying autonomous driving technology to make container trucking more efficient, lower shipping costs, and benefit consumers globally.” About Plus Plus is a global leader in autonomous driving technology for long-haul trucking, headquartered in Silicon Valley and founded in 2016 by serial entrepreneurs and industry veterans who have extensive experience in high tech and artificial intelligence. Plus is developing low-cost, high-performance full-stack Level 4 autonomous driving technology to make long-haul trucking safer, more efficient, and more sustainable. Plus is also collaborating with leading truck manufacturers, fleets, and ecosystem partners to drive the development of decarbonization transportation solutions including autonomous trucks powered by natural gas. For more information, please visit www.plus.ai or follow us on LinkedIn or YouTube. On May 7, 2021, PlusAI Corp., Plus Inc. (“New Plus”) and Hennessy Capital Investment Corp. V (NASDAQ: HCIC) (“Hennessy Capital”) entered into a definitive business combination agreement. Upon the closing of the proposed business combination, Plus will be a publicly traded company, and its common stock is expected to trade on the NYSE under the ticker symbol “PLAV”. The proposed business combination has been unanimously approved by the Boards of Directors of both Plus and Hennessy Capital. The closing of the proposed business combination is subject to approval by the stockholders of both Plus and Hennessy Capital and the satisfaction of the necessary regulatory approvals and customary closing conditions. Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Plus’s future plans, strategy and performance. Such statements include, but are not limited to, Plus’s current or future production capacity and deliveries, Plus’s technology, the general and specific types of potential benefits from Plus’s technology, including those relating to safety, efficiency, sustainability, driver retention and cost-reductions, industrial sectors in which Plus’s technology can provide benefits, the size and growth of the markets in which Plus’s current or future end-customers operate, the timing of when, if at all, Plus’s technology is used on public roads by Plus’s customers, receipt of binding orders for Plus’s products pursuant to non-binding pre-orders for FAW’s autonomous trucks, future orders or pre-orders for FAW’s or Plus’s products, FAW’s continued purchases of Plus’s technology, Plus’s ability to rely on and benefit from FAW’s commercial, sales, and service networks, future collaboration between FAW and Plus and any potential benefits from any such collaboration, Plus’s execution against or the anticipated results of Plus’s go-to-market strategy, the timing for the rollout of Plus’s technology including an at-scale rollout of Plus’s technology, Plus’s progress towards an at-scale rollout of Plus’s technology, Plus’s ability to compete with its competitors, Plus’s ability to achieve financial or other operational results, including long-term shareholder value, and statements relating to the proposed business combination between Plus and Hennessy Capital. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including the relationship between FAW and Plus, the ability of Plus to commercialize its autonomous driving system, delays in the design, production and launch of new products, the ability of Plus’s and FAW’s end-customers to obtain anticipated benefits of Plus’s technology, demand for Plus’s and FAW’s products and technology, FAW’s continued purchases of Plus’s products, risks related to the proposed business combination between Plus and Hennessy Capital and those more fully described under the section entitled “Risk Factors” in Form F-4 that New Plus will file with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Plus and Hennessy Capital assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Important Information for Investors and Shareholders As permitted by the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”), and in connection with the proposed business combination, New Plus has confidentially submitted a draft registration statement on Form F-4 (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”), which includes a prospectus with respect to New Plus’s securities to be issued in connection with the business combination and a proxy statement to be distributed to holders of Hennessy Capital’s common stock in connection with Hennessy Capital’s solicitation of proxies for the vote by Hennessy Capital’s stockholders with respect to the business combination and other matters to be described in the Registration Statement (the “Proxy Statement”). After the Registration Statement has been declared effective by the SEC, Hennessy Capital will file the definitive Proxy Statement with the SEC and will mail copies to stockholders of Hennessy Capital as of a record date to be established for voting on the proposed business combination. Additionally, New Plus and Hennessy Capital will file other relevant materials with the SEC in connection with the business combination. Security holders of Plus, New Plus, and Hennessy Capital are urged to read the Registration Statement and Proxy Statement and the other relevant materials when they become available before making any voting decision with respect to the proposed business combination because they will contain important information about the proposed business combination and the parties thereto. Investors and security holders of Plus, New Plus, and Hennessy Capital may also obtain a copy of the Registration Statement and Proxy Statement, when available, as well as other documents filed with the SEC regarding the proposed business combination by New Plus and Hennessy Capital, without charge, at the SEC’s website located at www.sec.gov. Copies of these filings may be obtained free of charge on Plus’s website at http://www.plus.ai or by directing a request to Lynn Miller, General Counsel, 20401 Stevens Creek Boulevard, Cupertino, California 95014 or by telephone at (408) 508-4758, and/or on Hennessy Capital’s website at http://www.hennessycapllc.com/ or by directing a request to Nicholas A. Petruska, Executive Vice President, Chief Financial Officer, 3415 N. Pines Way, Suite 204, Wilson, Wyoming 83014 or by telephone at (307) 201-1903. The information contained on, or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release. Participants in the Solicitation Plus, Hennessy Capital and New Plus and their respective directors and officers may be deemed participants in the solicitation of proxies of Hennessy Capital’s stockholders in connection with the proposed business combination. Security holders may obtain more detailed information regarding the names, affiliations and interests of certain of Hennessy Capital’s executive officers and directors in the solicitation by reading Hennessy Capital’s Registration Statement on Form S-1, declared effective by the SEC on January 14, 2021, and the Registration Statement, Proxy Statement and other relevant materials filed with the SEC in connection with the proposed business combination when they become available. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Hennessy Capital’s stockholders in connection with the proposed business combination, including a description of their direct and indirect interests, which may, in some cases, be different than those of their stockholders generally, will be set forth in the Proxy Statement when it becomes available.

Plus Delivers Initial Production Units of the PlusDrive Autonomous Driving Technology Solution to the World's Largest Heavy Duty Truck Manufacturer FAW

businesswire.com

2021-09-29 08:00:00CUPERTINO, Calif.--(BUSINESS WIRE)-- #autonomoustrucks--Plus (formerly Plus.ai), a global provider of self-driving truck technology that recently disclosed its proposed business combination with Hennessy Capital Investment Corp. V (NASDAQ: HCIC), announced today that Plus has delivered the initial production batch of PlusDrive autonomous driving units to FAW in order for FAW to integrate the units and launch China's first driver-in autonomous trucks. The delivery is part of an agreement with FAW in which Plus sell

4 Self-Driving Truck Stocks You Need to Keep an Eye On

investorplace.com

2021-09-09 12:10:20Self-driving truck stocks give you exposure to an exciting investing niche. If you want to future-proof your portfolio, look no further.

Plus Starts Development With Teledyne FLIR to Test Thermal Cameras for Autonomous Trucks

businesswire.com