Green Plains Partners LP (GPP)

Price:

12.31 USD

( - -0.07 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Golar LNG Limited

VALUE SCORE:

0

2nd position

Robin Energy Ltd.

VALUE SCORE:

9

The best

Plains All American Pipeline, L.P.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Green Plains Partners LP provides fuel storage and transportation services in the United States. It acquires, owns, develops, and operates ethanol and fuel storage facilities, terminals, transportation assets, and other related assets and businesses. The company owns or leases 29 ethanol storage facilities and approximately 43 acres of land; and 4 fuel terminals in Alabama, Louisiana, Mississippi, and Oklahoma. It also owns and operates a fleet of 19 trucks and tankers for transportation of ethanol and other products. The company was incorporated in 2015 and is headquartered in Omaha, Nebraska.

NEWS

Iridium Introduces NTN Direct Service: Will the Stock Benefit?

zacks.com

2024-09-26 11:21:10The 3GPP accepts IRDM's proposal to extend the capability of NB-IoT for Non-Terrestrial Networks into the official Work Plan for 3GPP Release 19.

Green Plains Inc. Completes Acquisition of Green Plains Partners LP

businesswire.com

2024-01-09 16:30:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced the completion of the transactions contemplated by the previously announced Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Green Plains acquired all of the publicly held common units of the Partnership not already owned by Green Plains and its affiliates in exchange for a combination of 0.405 shares of Green Plai.

Green Plains Inc. and Green Plains Partners LP Announce Unitholder Approval of Merger

businesswire.com

2024-01-05 06:59:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced that the Partnership's common unitholders approved that certain Agreement and Plan of Merger, dated as of September 16, 2023 (the “Merger Agreement”), by and among Green Plains, GPLP Holdings Inc., a wholly owned subsidiary of Green Plains (“Holdings”), GPLP Merger Sub LLC, a wholly owned subsidiary of Holdings (“Merger Sub”), the Partner.

Green Plains Partners: Can Its Nearly 14% Dividend Yield Be Sustainable?

seekingalpha.com

2023-12-15 18:23:40Green Plains Partners LP warrants a buy rating for its high dividend yield and sustainability. The ethanol market is expected to see significant growth, benefiting GPP's revenue from storage and transportation. Despite potential risks, GPP has stable fundamentals and low volatility, making it a solid choice for dividend investors.

Green Plains Partners LP (GPP) Q3 2023 Earnings Call Transcript

seekingalpha.com

2023-11-06 05:12:08Green Plains Partners LP (NASDAQ:GPP ) Q3 2023 Earnings Conference Call October 31, 2023 9:00 AM ET Company Participants Phil Boggs - Executive Vice President-Investor Relations Todd Becker - President and Chief Executive Officer Jim Stark - Chief Financial Officer Devin Mogler - Senior Vice President-Government Relations, Sustainability & Communications Conference Call Participants Jordan Levy - Truist Securities Manav Gupta - UBS Craig Irwin - ROTH MKM Ben Bienvenu - Stephens Eric Stine - Craig-Hallum Salvator Tiano - Bank of America Andrew Strelzik - BMO Kristen Owen - Oppenheimer Operator Good morning and welcome to the Green Plains Inc. and Green Plains Partners Third Quarter 2023 Earnings Conference Call. Following the company's prepared remarks, instructions will be provided for Q&A.

Green Plains Partners Reports Third Quarter 2023 Financial Results

businesswire.com

2023-10-31 06:57:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) (the “partnership” or “Green Plains Partners”) today announced financial and operating results for the third quarter of 2023. Net income attributable to the partnership was $9.4 million, or $0.40 per common unit, for the third quarter of 2023, compared with net income of $10.2 million, or $0.43 per common unit, for the same period in 2022. The partnership also reported adjusted EBITDA of $12.7 million and distributable cash flo.

Green Plains Partners Announces Quarterly Distribution

businesswire.com

2023-10-19 16:15:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) today announced that the Board of Directors of its general partner declared a quarterly cash distribution of $0.455 per unit on all of its outstanding common units for the third quarter of 2023, or $1.82 per unit on an annualized basis. The distribution is payable on November 10, 2023, to unitholders of record at the close of business on November 3, 2023. Qualified Notice This release serves as qualified notice to brokers and n.

Green Plains to Host Third Quarter 2023 Earnings Conference Call on October 31, 2023

businesswire.com

2023-10-17 16:15:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ:GPRE) and Green Plains Partners LP (NASDAQ:GPP) will release third quarter 2023 financial results prior to the market opening on October 31, 2023, and then host a joint conference call beginning at 9 a.m. Eastern time (8 a.m. Central time) to discuss third quarter 2023 performance and outlook. Domestic and international participants can access the conference call by dialing 888.210.4215 and 646.960.0269, respectively, and referencing confe.

Shareholder Alert: Ademi LLP investigates whether Green Plains Partners LP has obtained a Fair Price in its transaction with Green Plains Inc.

prnewswire.com

2023-09-18 14:04:00MILWAUKEE , Sept. 18, 2023 /PRNewswire/ -- Ademi LLP is investigating the Partnership (NASDAQ: GPP) for possible breaches of fiduciary duty and other violations of law in its transaction with Green Plains.

Why Shares of Green Plains Partners Just Hit a 52-Week High

fool.com

2023-09-18 12:11:21Green Plains will acquire Green Plains Partners, of which it currently owns a roughly 51% stake. The merger represents a 20% premium to the partnership's closing price a day before the original proposal in May.

Green Plains Inc. and Green Plains Partners LP Announce Definitive Merger Agreement

businesswire.com

2023-09-18 08:30:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced that they have entered into a definitive merger agreement pursuant to which Green Plains will acquire all of the publicly held common units of the Partnership not already owned by Green Plains and its affiliates in exchange for a combination of Green Plains common stock and cash. Under the merger agreement, each outstanding common unit of.

Green Plains Partners Reports Second Quarter 2023 Financial Results

businesswire.com

2023-08-04 07:32:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) today announced financial and operating results for the second quarter of 2023. Net income attributable to the partnership was $9.3 million, or $0.39 per common unit, for the second quarter of 2023, compared with net income of $10.5 million, or $0.44 per common unit, for the same period in 2022. The partnership also reported adjusted EBITDA of $12.7 million and distributable cash flow of $10.7 million for the second quarter of.

Green Plains Partners Announces Quarterly Distribution

businesswire.com

2023-07-20 16:20:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) today announced that the Board of Directors of its general partner declared a quarterly cash distribution of $0.455 per unit on all of its outstanding common units for the second quarter of 2023, or $1.82 per unit on an annualized basis. The distribution is payable on August 11, 2023, to unitholders of record at the close of business on August 4, 2023. Qualified Notice This release serves as qualified notice to brokers and nomi.

Green Plains to Host Second Quarter 2023 Earnings Conference Call on August 4, 2023

businesswire.com

2023-07-18 16:10:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ:GPRE) and Green Plains Partners LP (NASDAQ:GPP) will release second quarter 2023 financial results prior to the market opening on August 4, 2023, and then host a joint conference call beginning at 9 a.m. Eastern time (8 a.m. Central time) to discuss second quarter 2023 performance and outlook. Domestic and international participants can access the conference call by dialing 888.210.4215 and 646.960.0269, respectively, and referencing confe.

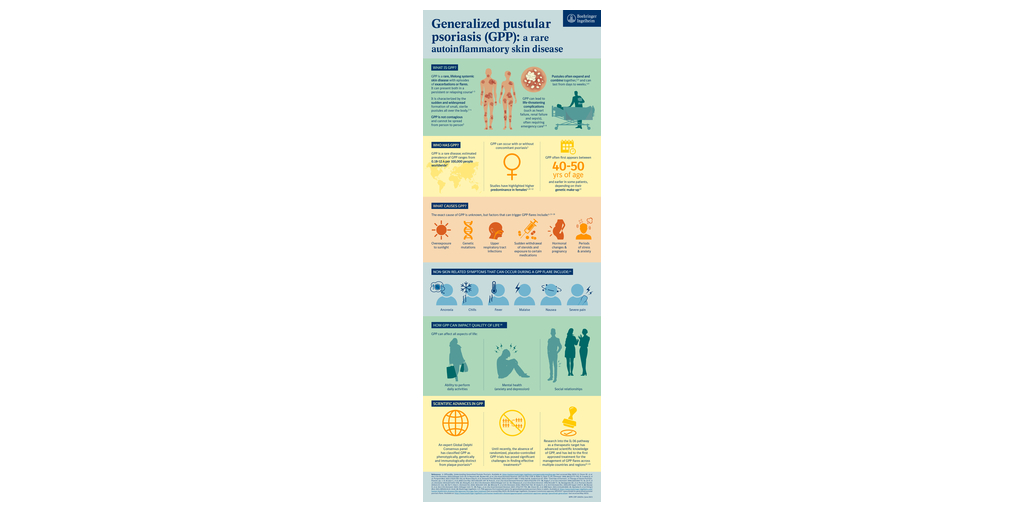

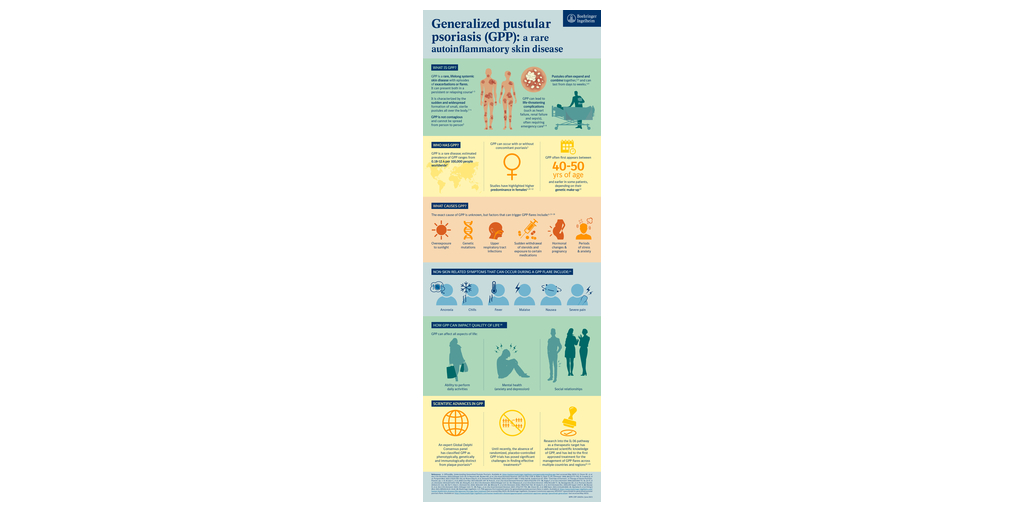

Spesolimab prevents generalized pustular psoriasis flares in EFFISAYIL™ 2 trial

headlinesoftoday.com

2023-07-04 03:51:50Data demonstrate superiority vs. placebo in preventing generalized pustular psoriasis (GPP) flares up to 48 weeks1 Prevention of unpredictable flares addresses a high unmet patient need2,3 Results build on the EFFISAYIL™ 1 trial, which demonstrated rapid and sustained pustular and skin clearance in flaring GPP patients treated with spesolimab for 12 weeks2 INGELHEIM, Germany–(BUSINESS WIRE)–Today, […]...

Green Plains Partners: Growing Volumes Benefiting The High Yield

seekingalpha.com

2023-07-02 04:07:52Green Plains Partners LP has strong exposure to growing demand for ethanol. GPP has built up a solid balance sheet which can support the operations efficiently. The high yield is sustainable thanks to strong cash flows, making GPP an appealing long-term position.

Iridium Introduces NTN Direct Service: Will the Stock Benefit?

zacks.com

2024-09-26 11:21:10The 3GPP accepts IRDM's proposal to extend the capability of NB-IoT for Non-Terrestrial Networks into the official Work Plan for 3GPP Release 19.

Green Plains Inc. Completes Acquisition of Green Plains Partners LP

businesswire.com

2024-01-09 16:30:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced the completion of the transactions contemplated by the previously announced Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Green Plains acquired all of the publicly held common units of the Partnership not already owned by Green Plains and its affiliates in exchange for a combination of 0.405 shares of Green Plai.

Green Plains Inc. and Green Plains Partners LP Announce Unitholder Approval of Merger

businesswire.com

2024-01-05 06:59:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced that the Partnership's common unitholders approved that certain Agreement and Plan of Merger, dated as of September 16, 2023 (the “Merger Agreement”), by and among Green Plains, GPLP Holdings Inc., a wholly owned subsidiary of Green Plains (“Holdings”), GPLP Merger Sub LLC, a wholly owned subsidiary of Holdings (“Merger Sub”), the Partner.

Green Plains Partners: Can Its Nearly 14% Dividend Yield Be Sustainable?

seekingalpha.com

2023-12-15 18:23:40Green Plains Partners LP warrants a buy rating for its high dividend yield and sustainability. The ethanol market is expected to see significant growth, benefiting GPP's revenue from storage and transportation. Despite potential risks, GPP has stable fundamentals and low volatility, making it a solid choice for dividend investors.

Green Plains Partners LP (GPP) Q3 2023 Earnings Call Transcript

seekingalpha.com

2023-11-06 05:12:08Green Plains Partners LP (NASDAQ:GPP ) Q3 2023 Earnings Conference Call October 31, 2023 9:00 AM ET Company Participants Phil Boggs - Executive Vice President-Investor Relations Todd Becker - President and Chief Executive Officer Jim Stark - Chief Financial Officer Devin Mogler - Senior Vice President-Government Relations, Sustainability & Communications Conference Call Participants Jordan Levy - Truist Securities Manav Gupta - UBS Craig Irwin - ROTH MKM Ben Bienvenu - Stephens Eric Stine - Craig-Hallum Salvator Tiano - Bank of America Andrew Strelzik - BMO Kristen Owen - Oppenheimer Operator Good morning and welcome to the Green Plains Inc. and Green Plains Partners Third Quarter 2023 Earnings Conference Call. Following the company's prepared remarks, instructions will be provided for Q&A.

Green Plains Partners Reports Third Quarter 2023 Financial Results

businesswire.com

2023-10-31 06:57:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) (the “partnership” or “Green Plains Partners”) today announced financial and operating results for the third quarter of 2023. Net income attributable to the partnership was $9.4 million, or $0.40 per common unit, for the third quarter of 2023, compared with net income of $10.2 million, or $0.43 per common unit, for the same period in 2022. The partnership also reported adjusted EBITDA of $12.7 million and distributable cash flo.

Green Plains Partners Announces Quarterly Distribution

businesswire.com

2023-10-19 16:15:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) today announced that the Board of Directors of its general partner declared a quarterly cash distribution of $0.455 per unit on all of its outstanding common units for the third quarter of 2023, or $1.82 per unit on an annualized basis. The distribution is payable on November 10, 2023, to unitholders of record at the close of business on November 3, 2023. Qualified Notice This release serves as qualified notice to brokers and n.

Green Plains to Host Third Quarter 2023 Earnings Conference Call on October 31, 2023

businesswire.com

2023-10-17 16:15:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ:GPRE) and Green Plains Partners LP (NASDAQ:GPP) will release third quarter 2023 financial results prior to the market opening on October 31, 2023, and then host a joint conference call beginning at 9 a.m. Eastern time (8 a.m. Central time) to discuss third quarter 2023 performance and outlook. Domestic and international participants can access the conference call by dialing 888.210.4215 and 646.960.0269, respectively, and referencing confe.

Shareholder Alert: Ademi LLP investigates whether Green Plains Partners LP has obtained a Fair Price in its transaction with Green Plains Inc.

prnewswire.com

2023-09-18 14:04:00MILWAUKEE , Sept. 18, 2023 /PRNewswire/ -- Ademi LLP is investigating the Partnership (NASDAQ: GPP) for possible breaches of fiduciary duty and other violations of law in its transaction with Green Plains.

Why Shares of Green Plains Partners Just Hit a 52-Week High

fool.com

2023-09-18 12:11:21Green Plains will acquire Green Plains Partners, of which it currently owns a roughly 51% stake. The merger represents a 20% premium to the partnership's closing price a day before the original proposal in May.

Green Plains Inc. and Green Plains Partners LP Announce Definitive Merger Agreement

businesswire.com

2023-09-18 08:30:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced that they have entered into a definitive merger agreement pursuant to which Green Plains will acquire all of the publicly held common units of the Partnership not already owned by Green Plains and its affiliates in exchange for a combination of Green Plains common stock and cash. Under the merger agreement, each outstanding common unit of.

Green Plains Partners Reports Second Quarter 2023 Financial Results

businesswire.com

2023-08-04 07:32:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) today announced financial and operating results for the second quarter of 2023. Net income attributable to the partnership was $9.3 million, or $0.39 per common unit, for the second quarter of 2023, compared with net income of $10.5 million, or $0.44 per common unit, for the same period in 2022. The partnership also reported adjusted EBITDA of $12.7 million and distributable cash flow of $10.7 million for the second quarter of.

Green Plains Partners Announces Quarterly Distribution

businesswire.com

2023-07-20 16:20:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Partners LP (NASDAQ:GPP) today announced that the Board of Directors of its general partner declared a quarterly cash distribution of $0.455 per unit on all of its outstanding common units for the second quarter of 2023, or $1.82 per unit on an annualized basis. The distribution is payable on August 11, 2023, to unitholders of record at the close of business on August 4, 2023. Qualified Notice This release serves as qualified notice to brokers and nomi.

Green Plains to Host Second Quarter 2023 Earnings Conference Call on August 4, 2023

businesswire.com

2023-07-18 16:10:00OMAHA, Neb.--(BUSINESS WIRE)--Green Plains Inc. (NASDAQ:GPRE) and Green Plains Partners LP (NASDAQ:GPP) will release second quarter 2023 financial results prior to the market opening on August 4, 2023, and then host a joint conference call beginning at 9 a.m. Eastern time (8 a.m. Central time) to discuss second quarter 2023 performance and outlook. Domestic and international participants can access the conference call by dialing 888.210.4215 and 646.960.0269, respectively, and referencing confe.

Spesolimab prevents generalized pustular psoriasis flares in EFFISAYIL™ 2 trial

headlinesoftoday.com

2023-07-04 03:51:50Data demonstrate superiority vs. placebo in preventing generalized pustular psoriasis (GPP) flares up to 48 weeks1 Prevention of unpredictable flares addresses a high unmet patient need2,3 Results build on the EFFISAYIL™ 1 trial, which demonstrated rapid and sustained pustular and skin clearance in flaring GPP patients treated with spesolimab for 12 weeks2 INGELHEIM, Germany–(BUSINESS WIRE)–Today, […]...

Green Plains Partners: Growing Volumes Benefiting The High Yield

seekingalpha.com

2023-07-02 04:07:52Green Plains Partners LP has strong exposure to growing demand for ethanol. GPP has built up a solid balance sheet which can support the operations efficiently. The high yield is sustainable thanks to strong cash flows, making GPP an appealing long-term position.