Gladstone Commercial Corporation (GOODM)

Price:

25.01 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

New York Mortgage Trust, Inc.

VALUE SCORE:

0

2nd position

Gladstone Commercial Corporation

VALUE SCORE:

6

The best

Gladstone Commercial Corporation

VALUE SCORE:

8

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Gladstone Commercial Corporation is a real estate investment trust focused on acquiring, owning, and operating net leased industrial and office properties across the United States. Including payments through September 2020, Gladstone Commercial has paid 189 consecutive monthly cash distributions on its common stock. Prior to paying distributions on a monthly basis, Gladstone Commercial paid five consecutive quarterly cash distributions. The company has also paid 53 consecutive monthly cash distributions on its Series D Preferred Stock, 12 consecutive monthly cash distributions on its Series E Preferred Stock and three consecutive monthly cash distributions on its Series F Preferred Stock. Gladstone Commercial has never skipped, reduced or deferred a distribution since its inception in 2003.

NEWS

6 REITs That Could Cut The Cheese

seekingalpha.com

2021-08-01 07:00:006 REITs That Could Cut The Cheese

Gladstone Commercial Corporation Announces Conditional Optional Redemption of all Outstanding Shares of its Series D Preferred Stock

accesswire.com

2021-05-27 16:10:00MCLEAN, VA / ACCESSWIRE / May 27, 2021 / Gladstone Commercial Corporation (NASDAQ:GOOD) (the "Company"), today announced the conditional optional redemption of all of the outstanding shares of its 7.00% Series D Cumulative Redeemable Preferred Stock, par value $0.001 per share (the "Series D Preferred Stock"). The optional redemption is contingent upon the Company having sufficient liquidity to complete such redemption on the redemption date, and the Company reserves the right to postpone or cancel any such voluntary redemption in its sole discretion.

Top REITs To Buy For 2021

seekingalpha.com

2021-01-19 08:25:00The REIT market is vast and versatile. While some offer great potential, many others aren't worth buying. In today's market, we favor a very specific type of REIT, and avoid most others.

Buy Rated Preferreds (And Market Update)

seekingalpha.com

2021-01-18 07:00:00Preferreds have continued powering higher on the back of lower volatility and spread compression. Few opportunities exist among IG preferreds but there are still some beaten-down high yield preferreds with catch-up potential.

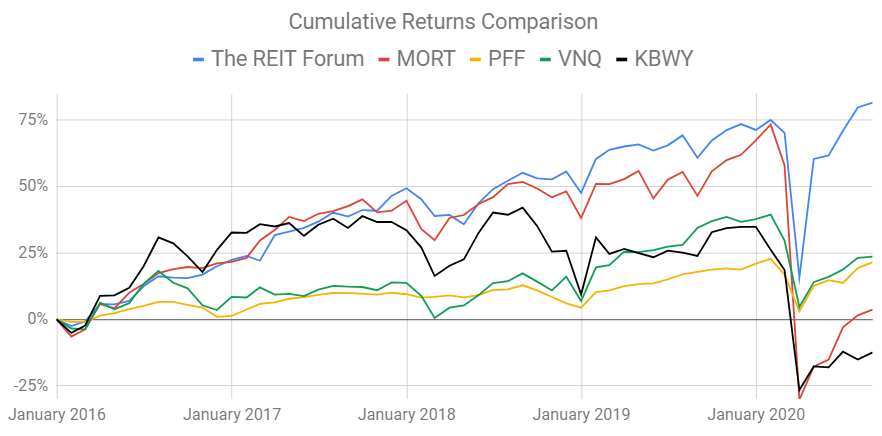

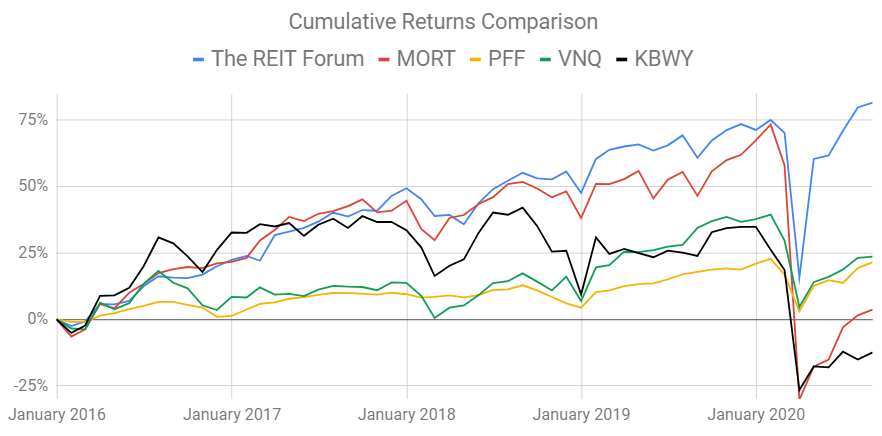

Here's Why My REITs Beat Your REITs

seekingalpha.com

2020-09-14 07:00:00Over the last several years we've seen larger equity REITs consistently outperform, but the gap becomes even larger with the recession.

Housing Stays Red Hot

seekingalpha.com

2020-08-22 09:00:00U.S. equity markets climbed to fresh all-time record highs this week as another slate of stellar housing data provided reassuring evidence that the economic rebound remains on solid footing.

Gladstone Commercial Corporation (GOOD) CEO David Gladstone on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-28 14:23:06Gladstone Commercial Corporation (NASDAQ:GOOD) Q2 2020 Earnings Conference Call July 28, 2020 8:30 AM ET Company Participants David Gladstone - Chief Executive Officer Michael LiCalsi - General Counsel and Secretary Bob Cutlip - President Mike Sodo - Chief Financial Officer Conference Call Participants Gaurav Mehta - National Securities Rob Stevenson - Janney John Massocca - Ladenburg Thalmann Craig Kucera - B.

Gladstone Commercial Corporation 2020 Q2 - Results - Earnings Call Presentation

seekingalpha.com

2020-07-27 16:53:08The following slide deck was published by Gladstone Commercial Corporation in conjunction with their 2020 Q2 earnings call.

6 REITs That Could Cut The Cheese

seekingalpha.com

2021-08-01 07:00:006 REITs That Could Cut The Cheese

Gladstone Commercial Corporation Announces Conditional Optional Redemption of all Outstanding Shares of its Series D Preferred Stock

accesswire.com

2021-05-27 16:10:00MCLEAN, VA / ACCESSWIRE / May 27, 2021 / Gladstone Commercial Corporation (NASDAQ:GOOD) (the "Company"), today announced the conditional optional redemption of all of the outstanding shares of its 7.00% Series D Cumulative Redeemable Preferred Stock, par value $0.001 per share (the "Series D Preferred Stock"). The optional redemption is contingent upon the Company having sufficient liquidity to complete such redemption on the redemption date, and the Company reserves the right to postpone or cancel any such voluntary redemption in its sole discretion.

Top REITs To Buy For 2021

seekingalpha.com

2021-01-19 08:25:00The REIT market is vast and versatile. While some offer great potential, many others aren't worth buying. In today's market, we favor a very specific type of REIT, and avoid most others.

Buy Rated Preferreds (And Market Update)

seekingalpha.com

2021-01-18 07:00:00Preferreds have continued powering higher on the back of lower volatility and spread compression. Few opportunities exist among IG preferreds but there are still some beaten-down high yield preferreds with catch-up potential.

Here's Why My REITs Beat Your REITs

seekingalpha.com

2020-09-14 07:00:00Over the last several years we've seen larger equity REITs consistently outperform, but the gap becomes even larger with the recession.

Housing Stays Red Hot

seekingalpha.com

2020-08-22 09:00:00U.S. equity markets climbed to fresh all-time record highs this week as another slate of stellar housing data provided reassuring evidence that the economic rebound remains on solid footing.

Gladstone Commercial Corporation (GOOD) CEO David Gladstone on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-28 14:23:06Gladstone Commercial Corporation (NASDAQ:GOOD) Q2 2020 Earnings Conference Call July 28, 2020 8:30 AM ET Company Participants David Gladstone - Chief Executive Officer Michael LiCalsi - General Counsel and Secretary Bob Cutlip - President Mike Sodo - Chief Financial Officer Conference Call Participants Gaurav Mehta - National Securities Rob Stevenson - Janney John Massocca - Ladenburg Thalmann Craig Kucera - B.

Gladstone Commercial Corporation 2020 Q2 - Results - Earnings Call Presentation

seekingalpha.com

2020-07-27 16:53:08The following slide deck was published by Gladstone Commercial Corporation in conjunction with their 2020 Q2 earnings call.