Generac Holdings Inc. (GNRC)

Price:

171.33 USD

( + 4.38 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Parker-Hannifin Corporation

VALUE SCORE:

6

2nd position

Dover Corporation

VALUE SCORE:

10

The best

Cummins Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

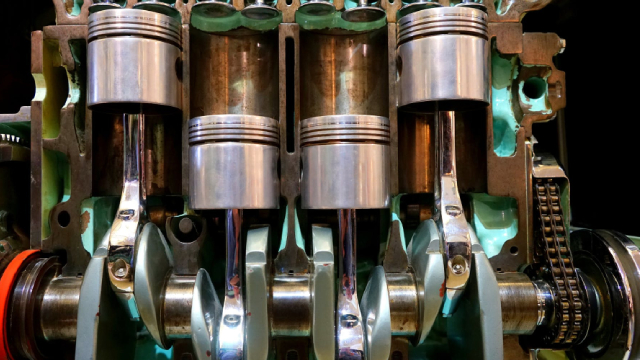

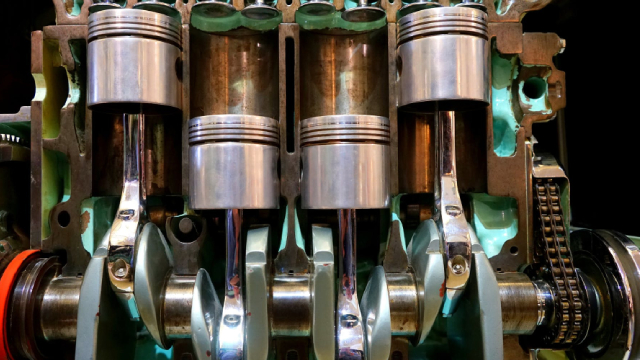

Generac Holdings Inc. designs, manufactures, and sells power generation equipment, energy storage systems, and other power products for the residential, and light commercial and industrial markets worldwide. The company offers engines, alternators, batteries, electronic controls, steel enclosures, and other components. It also provides residential automatic standby generators ranging in output from 7.5kW to 150kW; air-cooled engine residential standby generators ranging from 7.5kW to 26kW; liquid-cooled engine generators with outputs ranging from 22kW to 150kW; and Mobile Link, a remote monitoring system for home standby generators. In addition, the company offers various portable generators ranging in size from 800W to 17.5kW; outdoor power equipment, such as trimmers, field and brush mowers, log splitters, stump grinders, chipper shredders, lawn and leaf vacuums, pressure washers, and water pumps; and clean energy solution under the PWRcell and PWRview brands. Further, it provides light towers, mobile generators, and mobile energy storage systems; commercial mobile pumps and dust-suppression equipment; various gaseous-engine control systems and accessories; light-commercial standby generators ranging from 22kW to 150kW and related transfer switches providing three-phase power for small and mid-sized businesses; and industrial generators ranging in output from 10kW to 3,250kW used as emergency backup for healthcare, telecom, datacom, commercial office, retail, municipal, and manufacturing markets. Additionally, the company sells aftermarket service parts and product accessories to dealers. It distributes its products through independent residential dealers, industrial distributors and dealers, national and regional retailers, e-commerce partners, electrical, HVAC and solar wholesalers, catalogs, equipment rental companies and distributors, and solar installers; and directly to end users. The company was founded in 1959 and is headquartered in Waukesha, Wisconsin.

NEWS

Generac: A Few Underappreciated Reasons To Pursue This Energy-Tech Specialist

seekingalpha.com

2025-10-07 05:02:34Generac Holdings has only expanded by 7% this year, underperforming other industrial and Russell 1000 stocks by a large margin. GNRC's EBITDA margins are set to expand by 120bps over two years, supported by strong pricing, operating leverage, supply chain improvements, and high-margin recurring revenue. Despite witnessing a steep contraction in Q2, the current FCF yield is already above average at mid-single-digits, and a marked improvement in H2 will lift buyback momentum.

DR Power Introduces the XD45 Commercial Leaf & Lawn Vacuum: A New Force in Property Cleanup

prnewswire.com

2025-09-18 07:00:00The XD45 debuts as DR Power's first commercial-grade walk-behind vacuum. SOUTH BURLINGTON, Vt.

GNRC Launches PWRmicro Inverter to Boost Solar Output and Integration

zacks.com

2025-09-04 12:31:07Generac introduces PWRmicro microinverter, boosting solar power output, streamlining installs and integrating with its clean energy ecosystem.

Generac Up 39% in Three Months: Where Will the Stock Head From Here?

zacks.com

2025-09-04 10:25:30GNRC stock surged 39% in three months as residential and C&I momentum, plus new product launches, fuel long-term growth potential.

These Were the 5 Top-Performing Stocks in the S&P 500 in July 2025

fool.com

2025-08-30 03:50:00There were only 22 trading days in July. But that was all the time that the five best-performing S&P 500 stocks that month needed to gain 24% or more.

Generac CEO: Power outages are more frequent and lasting longer

youtube.com

2025-08-29 15:14:20Aaron Jagdfeld, Generac chairman and CEO, joins 'Power Lunch' to discuss the current state of the power grid, if whole home generators are a must-have and much more.

Why Is Generac Holdings (GNRC) Down 4% Since Last Earnings Report?

zacks.com

2025-08-29 12:37:13Generac Holdings (GNRC) reported earnings 30 days ago. What's next for the stock?

Why Generac Holdings (GNRC) is a Top Momentum Stock for the Long-Term

zacks.com

2025-08-26 10:51:55Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Generac Holdings (GNRC) Just Reclaimed the 20-Day Moving Average

zacks.com

2025-08-25 10:36:06From a technical perspective, Generac Holdings (GNRC) is looking like an interesting pick, as it just reached a key level of support. GNRC recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

Take Profits Now: 3 Overbought Stocks Primed for a Pullback

marketbeat.com

2025-08-25 09:17:10One of investors' most challenging questions is when to sell a winning stock. No one ever went broke taking profits, but exiting a high-flying stock too early can cause FOMO and create the temptation to chase.

Generac Holdings (GNRC) is a Top-Ranked Growth Stock: Should You Buy?

zacks.com

2025-08-05 10:46:51Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

These Were the 2 Best-Performing Stocks in the S&P 500 in July 2025

fool.com

2025-08-04 07:37:00Stocks crept higher again in July as the S&P 500 index (^GSPC -1.60%) finished the month up 2.2%.

Why Generac Stock Was Soaring This Week

fool.com

2025-08-01 07:39:42Veteran generator manufacturer Generac Holdings' (GNRC 7.80%) stock was full of energy for investors over the past few days. On the back of a solid quarterly earnings report and subsequent analyst price target hikes, the company's share price was up by a robust 24% week to date as of early Friday morning, according to data compiled by S&P Global Market Intelligence.

Generac (GNRC) Q2 EPS Jumps 22%

fool.com

2025-07-31 13:15:49Generac (GNRC 8.13%), known for its home and industrial backup power solutions, released its second quarter 2025 results on July 30, 2025. The headline news was better-than-expected earnings per share and revenue, with EPS (non-GAAP) at $1.65, ahead of the $1.36 estimate, and revenue reaching $1,061 million, exceeding the $1,031 million consensus for Q2 2025.

Generac Soars On Another Earnings Beat, But Tariff Risks Remain

seekingalpha.com

2025-07-31 07:00:00Generac delivered a strong Q2 earnings beat and raised guidance, driven by robust residential and data center demand, especially in hurricane-prone US regions. Gross margins improved despite tariffs, as Generac successfully passed higher costs to customers without hurting demand, supporting continued earnings outperformance. Risks include ongoing tariff uncertainty and a contraction in the solar segment, but climate-driven demand and data center growth remain tailwinds.

Why Generac Rallied Today

fool.com

2025-07-30 14:57:45Shares of on-premise generator company Generac (GNRC 19.18%) rallied on Wednesday, up 16.2% as of 1:32 p.m. ET.

Generac: A Few Underappreciated Reasons To Pursue This Energy-Tech Specialist

seekingalpha.com

2025-10-07 05:02:34Generac Holdings has only expanded by 7% this year, underperforming other industrial and Russell 1000 stocks by a large margin. GNRC's EBITDA margins are set to expand by 120bps over two years, supported by strong pricing, operating leverage, supply chain improvements, and high-margin recurring revenue. Despite witnessing a steep contraction in Q2, the current FCF yield is already above average at mid-single-digits, and a marked improvement in H2 will lift buyback momentum.

DR Power Introduces the XD45 Commercial Leaf & Lawn Vacuum: A New Force in Property Cleanup

prnewswire.com

2025-09-18 07:00:00The XD45 debuts as DR Power's first commercial-grade walk-behind vacuum. SOUTH BURLINGTON, Vt.

GNRC Launches PWRmicro Inverter to Boost Solar Output and Integration

zacks.com

2025-09-04 12:31:07Generac introduces PWRmicro microinverter, boosting solar power output, streamlining installs and integrating with its clean energy ecosystem.

Generac Up 39% in Three Months: Where Will the Stock Head From Here?

zacks.com

2025-09-04 10:25:30GNRC stock surged 39% in three months as residential and C&I momentum, plus new product launches, fuel long-term growth potential.

These Were the 5 Top-Performing Stocks in the S&P 500 in July 2025

fool.com

2025-08-30 03:50:00There were only 22 trading days in July. But that was all the time that the five best-performing S&P 500 stocks that month needed to gain 24% or more.

Generac CEO: Power outages are more frequent and lasting longer

youtube.com

2025-08-29 15:14:20Aaron Jagdfeld, Generac chairman and CEO, joins 'Power Lunch' to discuss the current state of the power grid, if whole home generators are a must-have and much more.

Why Is Generac Holdings (GNRC) Down 4% Since Last Earnings Report?

zacks.com

2025-08-29 12:37:13Generac Holdings (GNRC) reported earnings 30 days ago. What's next for the stock?

Why Generac Holdings (GNRC) is a Top Momentum Stock for the Long-Term

zacks.com

2025-08-26 10:51:55Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Generac Holdings (GNRC) Just Reclaimed the 20-Day Moving Average

zacks.com

2025-08-25 10:36:06From a technical perspective, Generac Holdings (GNRC) is looking like an interesting pick, as it just reached a key level of support. GNRC recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

Take Profits Now: 3 Overbought Stocks Primed for a Pullback

marketbeat.com

2025-08-25 09:17:10One of investors' most challenging questions is when to sell a winning stock. No one ever went broke taking profits, but exiting a high-flying stock too early can cause FOMO and create the temptation to chase.

Generac Holdings (GNRC) is a Top-Ranked Growth Stock: Should You Buy?

zacks.com

2025-08-05 10:46:51Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

These Were the 2 Best-Performing Stocks in the S&P 500 in July 2025

fool.com

2025-08-04 07:37:00Stocks crept higher again in July as the S&P 500 index (^GSPC -1.60%) finished the month up 2.2%.

Why Generac Stock Was Soaring This Week

fool.com

2025-08-01 07:39:42Veteran generator manufacturer Generac Holdings' (GNRC 7.80%) stock was full of energy for investors over the past few days. On the back of a solid quarterly earnings report and subsequent analyst price target hikes, the company's share price was up by a robust 24% week to date as of early Friday morning, according to data compiled by S&P Global Market Intelligence.

Generac (GNRC) Q2 EPS Jumps 22%

fool.com

2025-07-31 13:15:49Generac (GNRC 8.13%), known for its home and industrial backup power solutions, released its second quarter 2025 results on July 30, 2025. The headline news was better-than-expected earnings per share and revenue, with EPS (non-GAAP) at $1.65, ahead of the $1.36 estimate, and revenue reaching $1,061 million, exceeding the $1,031 million consensus for Q2 2025.

Generac Soars On Another Earnings Beat, But Tariff Risks Remain

seekingalpha.com

2025-07-31 07:00:00Generac delivered a strong Q2 earnings beat and raised guidance, driven by robust residential and data center demand, especially in hurricane-prone US regions. Gross margins improved despite tariffs, as Generac successfully passed higher costs to customers without hurting demand, supporting continued earnings outperformance. Risks include ongoing tariff uncertainty and a contraction in the solar segment, but climate-driven demand and data center growth remain tailwinds.

Why Generac Rallied Today

fool.com

2025-07-30 14:57:45Shares of on-premise generator company Generac (GNRC 19.18%) rallied on Wednesday, up 16.2% as of 1:32 p.m. ET.