iShares GNMA Bond ETF (GNMA)

Price:

44.46 USD

( + 0.06 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

iShares iBonds Dec 2025 Term Treasury ETF

VALUE SCORE:

10

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund will invest at least 80% of its assets in the component securities of the underlying index and to-be-announced transactions (“TBAs”) that have economic characteristics that are substantially identical to the economic characteristics of the component securities of the underlying index. The underlying index includes fixed-rate MBS issued by GNMA that have 30- or 15-year maturities. The index measures the performance of mortgage-backed pass-through securities issued by GNMA.

NEWS

Notes from the Desk: All Aboard the MBS Train

https://www.etftrends.com

2024-05-20 11:51:56The agency MBS sector has emerged as one of the best relative valuation opportunities in the fixed income market over the past year. Given the stabilization in yields after the May FOMC meeting and the recent cooling of economic data, we believe agency MBS outperformance could continue. Mortgaged-backed securities (MBS) are bonds backed by both the principal and interest cash flows of underlying mortgages, which are pooled and repackaged into interest-bearing bonds through a process called securitization. The mortgage cash flows are passed through to the holders of those bonds. MBS can be backed by both residential and commercial real estate mortgages that are issued either by a housing agency – Fannie Mae (FNMA), Freddie Mac (FHLMC), or Ginnie Mae (GNMA) – or private financial institutions, commonly referred to as non-agency. The MBS market is one of the largest and most liquid global asset classes, with more than $12 trillion of securities outstanding and over $300 billion in average daily trading volume. For this Notes from the Desk, we will be focusing on agency-issued residential mortgages. One of the features of agency MBS is that they have a government-backed credit guarantee from one of the housing agencies. While these agencies aren’t owned by the federal government, they are often seen as backed by it. Thus, agency MBS are not considered to carry any credit risk. However, this doesn’t mean agency MBS are risk-free; there are three key risks associated with these bonds. First, prepayment risk is the possibility that mortgages within an MBS pool are prematurely paid back, which is detrimental to a bondholder as they would have lower future interest payments from the underlying home loans. The duration, or interest rate sensitivity, of an agency MBS would then get smaller as interest rates fall, and vice versa when yields rise, which results in MBS having negative convexity. The second key risk has emerged only in the quantitative easing era. As the Federal Reserve has been a large player in the MBS market, changing expectations around the Fed’s balance sheet policy has been a driver of MBS spreads. Third, US commercial banks are some of the largest buyers of MBS historically, and the regional banking crisis in 2023 has resulted in less demand for MBS, which has kept spreads elevated. The chart below shows the current coupon MBS spread versus BBB corporate bonds. Despite having no credit risk, MBS are trading at a discount to the lower end of the investment grade corporate bond quality segment. We continue to believe that the current valuation of agency MBS offers an opportunity to pick up a yield spread without taking on credit risk. As nearly 80% of mortgages have a rate below 5%, prepayment risk should not emerge as a key risk in the near term. Additionally, the FOMC has started to reduce the pace at which it is shrinking its balance sheet, which is a positive signal for MBS. Finally, the risk emanating from commercial banks should decrease as interest rates stabilize at or lower than current levels. The FOMC has all but ruled out interest rate hikes this year despite stronger-than-expected inflation in the first quarter, so the distribution of outcomes for interest rates remains skewed to the downside. Since rate volatility decreased after the May FOMC meeting and recent data fell short of expectations, the agency MBS market has responded accordingly, with excess returns over treasuries reaching a six-month high. This trend may continue, as agency MBS valuations remain attractive. For more news, information, and analysis, visit the ETF Strategist Channel. Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

iShares Slashes Fees On 8 ETFs

etf.com

2021-10-26 04:55:40The affected funds include the firm's lineup of asset allocation ETFs.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Ladenburg Thalmann Financial Services Inc. Sells 556 Shares of iShares GNMA Bond ETF (NASDAQ:GNMA)

thelincolnianonline.com

2020-04-14 10:16:57Ladenburg Thalmann Financial Services Inc. trimmed its position in iShares GNMA Bond ETF (NASDAQ:GNMA) by 7.4% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 6,951 shares of the company’s stock after selling 556 shares during the period. Ladenburg Thalmann Financial […]

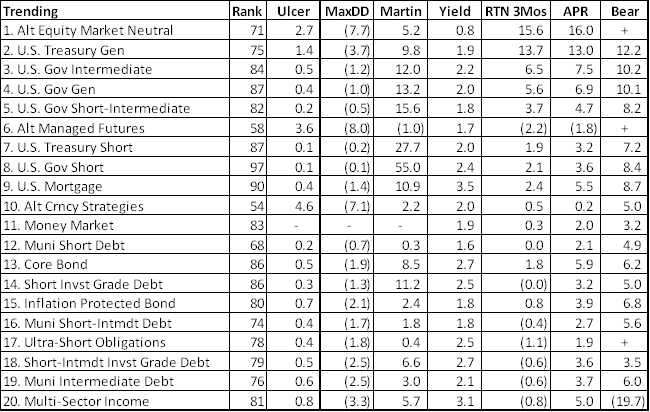

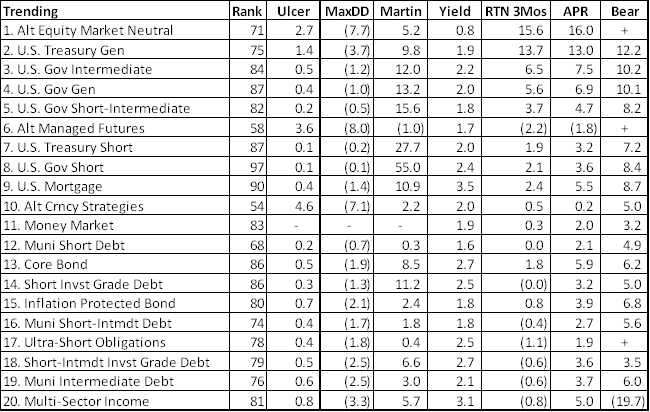

Reviewing Funds For Risk Adjusted Performance

seekingalpha.com

2020-04-12 14:14:17Mutual Fund Observer is used to evaluate funds with March data for Risk (Ulcer Index), Risk-Adjusted Returns (Martin Ratio), and trends among others. Mixed Asse

Task Force Created to Solve Liquidity Crunch Among Mortgage Firms

fool.com

2020-03-27 15:04:00With homeowners deferring loan payments, mortgage servicing firms find themselves in a major cash crunch.

For Bonds It's Probably 'Game Over'

seekingalpha.com

2020-03-16 13:23:07The tremendous bull bond market run from 1981 is probably now ending. When it comes to bonds, deflationary economic trends are misleading. The Fed and other maj

Performance Of Low-Risk Vanguard Portfolio Year To Date

seekingalpha.com

2020-03-11 16:38:12The February Vanguard Model Portfolio is updated with the recent data from turbulent markets to see how it has held up. Mutual Fund Observer Risk and Performanc

No data to display

Notes from the Desk: All Aboard the MBS Train

https://www.etftrends.com

2024-05-20 11:51:56The agency MBS sector has emerged as one of the best relative valuation opportunities in the fixed income market over the past year. Given the stabilization in yields after the May FOMC meeting and the recent cooling of economic data, we believe agency MBS outperformance could continue. Mortgaged-backed securities (MBS) are bonds backed by both the principal and interest cash flows of underlying mortgages, which are pooled and repackaged into interest-bearing bonds through a process called securitization. The mortgage cash flows are passed through to the holders of those bonds. MBS can be backed by both residential and commercial real estate mortgages that are issued either by a housing agency – Fannie Mae (FNMA), Freddie Mac (FHLMC), or Ginnie Mae (GNMA) – or private financial institutions, commonly referred to as non-agency. The MBS market is one of the largest and most liquid global asset classes, with more than $12 trillion of securities outstanding and over $300 billion in average daily trading volume. For this Notes from the Desk, we will be focusing on agency-issued residential mortgages. One of the features of agency MBS is that they have a government-backed credit guarantee from one of the housing agencies. While these agencies aren’t owned by the federal government, they are often seen as backed by it. Thus, agency MBS are not considered to carry any credit risk. However, this doesn’t mean agency MBS are risk-free; there are three key risks associated with these bonds. First, prepayment risk is the possibility that mortgages within an MBS pool are prematurely paid back, which is detrimental to a bondholder as they would have lower future interest payments from the underlying home loans. The duration, or interest rate sensitivity, of an agency MBS would then get smaller as interest rates fall, and vice versa when yields rise, which results in MBS having negative convexity. The second key risk has emerged only in the quantitative easing era. As the Federal Reserve has been a large player in the MBS market, changing expectations around the Fed’s balance sheet policy has been a driver of MBS spreads. Third, US commercial banks are some of the largest buyers of MBS historically, and the regional banking crisis in 2023 has resulted in less demand for MBS, which has kept spreads elevated. The chart below shows the current coupon MBS spread versus BBB corporate bonds. Despite having no credit risk, MBS are trading at a discount to the lower end of the investment grade corporate bond quality segment. We continue to believe that the current valuation of agency MBS offers an opportunity to pick up a yield spread without taking on credit risk. As nearly 80% of mortgages have a rate below 5%, prepayment risk should not emerge as a key risk in the near term. Additionally, the FOMC has started to reduce the pace at which it is shrinking its balance sheet, which is a positive signal for MBS. Finally, the risk emanating from commercial banks should decrease as interest rates stabilize at or lower than current levels. The FOMC has all but ruled out interest rate hikes this year despite stronger-than-expected inflation in the first quarter, so the distribution of outcomes for interest rates remains skewed to the downside. Since rate volatility decreased after the May FOMC meeting and recent data fell short of expectations, the agency MBS market has responded accordingly, with excess returns over treasuries reaching a six-month high. This trend may continue, as agency MBS valuations remain attractive. For more news, information, and analysis, visit the ETF Strategist Channel. Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

iShares Slashes Fees On 8 ETFs

etf.com

2021-10-26 04:55:40The affected funds include the firm's lineup of asset allocation ETFs.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Ladenburg Thalmann Financial Services Inc. Sells 556 Shares of iShares GNMA Bond ETF (NASDAQ:GNMA)

thelincolnianonline.com

2020-04-14 10:16:57Ladenburg Thalmann Financial Services Inc. trimmed its position in iShares GNMA Bond ETF (NASDAQ:GNMA) by 7.4% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 6,951 shares of the company’s stock after selling 556 shares during the period. Ladenburg Thalmann Financial […]

Reviewing Funds For Risk Adjusted Performance

seekingalpha.com

2020-04-12 14:14:17Mutual Fund Observer is used to evaluate funds with March data for Risk (Ulcer Index), Risk-Adjusted Returns (Martin Ratio), and trends among others. Mixed Asse

Task Force Created to Solve Liquidity Crunch Among Mortgage Firms

fool.com

2020-03-27 15:04:00With homeowners deferring loan payments, mortgage servicing firms find themselves in a major cash crunch.

For Bonds It's Probably 'Game Over'

seekingalpha.com

2020-03-16 13:23:07The tremendous bull bond market run from 1981 is probably now ending. When it comes to bonds, deflationary economic trends are misleading. The Fed and other maj

Performance Of Low-Risk Vanguard Portfolio Year To Date

seekingalpha.com

2020-03-11 16:38:12The February Vanguard Model Portfolio is updated with the recent data from turbulent markets to see how it has held up. Mutual Fund Observer Risk and Performanc