Great Elm Capital Corp. 6.75% Notes Due 2025 (GECCM)

Price:

25.03 USD

( - -0.02 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Great Elm Capital is an externally-managed business development company that invests in the debt instruments of middle-market companies. The company seeks to generate current income and capital appreciation through debt and equity investments and invests primarily in senior secured and senior unsecured debt instruments, as well as in junior loans and mezzanine debt of middle-market companies and small businesses.

NEWS

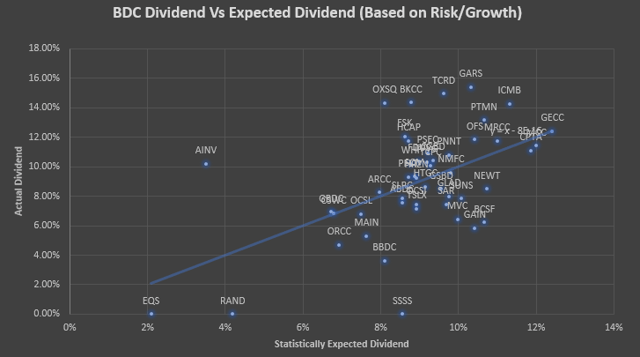

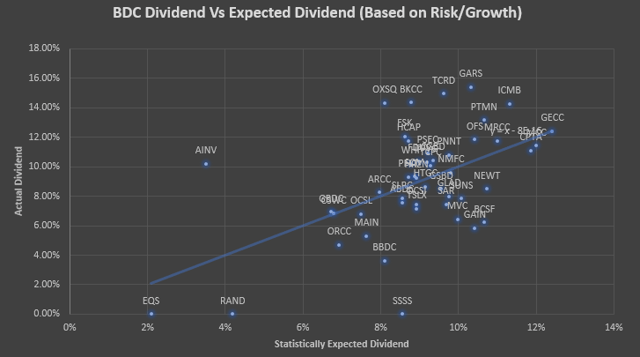

Ranking Business Development Companies From Most Undervalued To Overvalued

seekingalpha.com

2020-01-27 00:47:36As high-yield credit spreads fall, it may be a good time to look to business-development-companies. While high dividend returns and low PB ratios are great, one

Ranking Business Development Companies From Most Undervalued To Overvalued

seekingalpha.com

2020-01-27 00:47:36As high-yield credit spreads fall, it may be a good time to look to business-development-companies. While high dividend returns and low PB ratios are great, one