Frontier Communications Parent, Inc. (FYBR)

Price:

37.93 USD

( - -0.06 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Liberty Latin America Ltd.

VALUE SCORE:

3

2nd position

Liberty Broadband Corporation

VALUE SCORE:

11

The best

Comcast Corporation

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Frontier Communications Parent, Inc., together with its subsidiaries, provides communications services for consumer and business customers in 25 states in the United States. It offers data and Internet, voice, video, and other services. The company was formerly known as Frontier Communications Corporation and changed its name to Frontier Communications Parent, Inc. in April 2021. Frontier Communications Parent, Inc. was incorporated in 1935 and is based in Norwalk, Connecticut.

NEWS

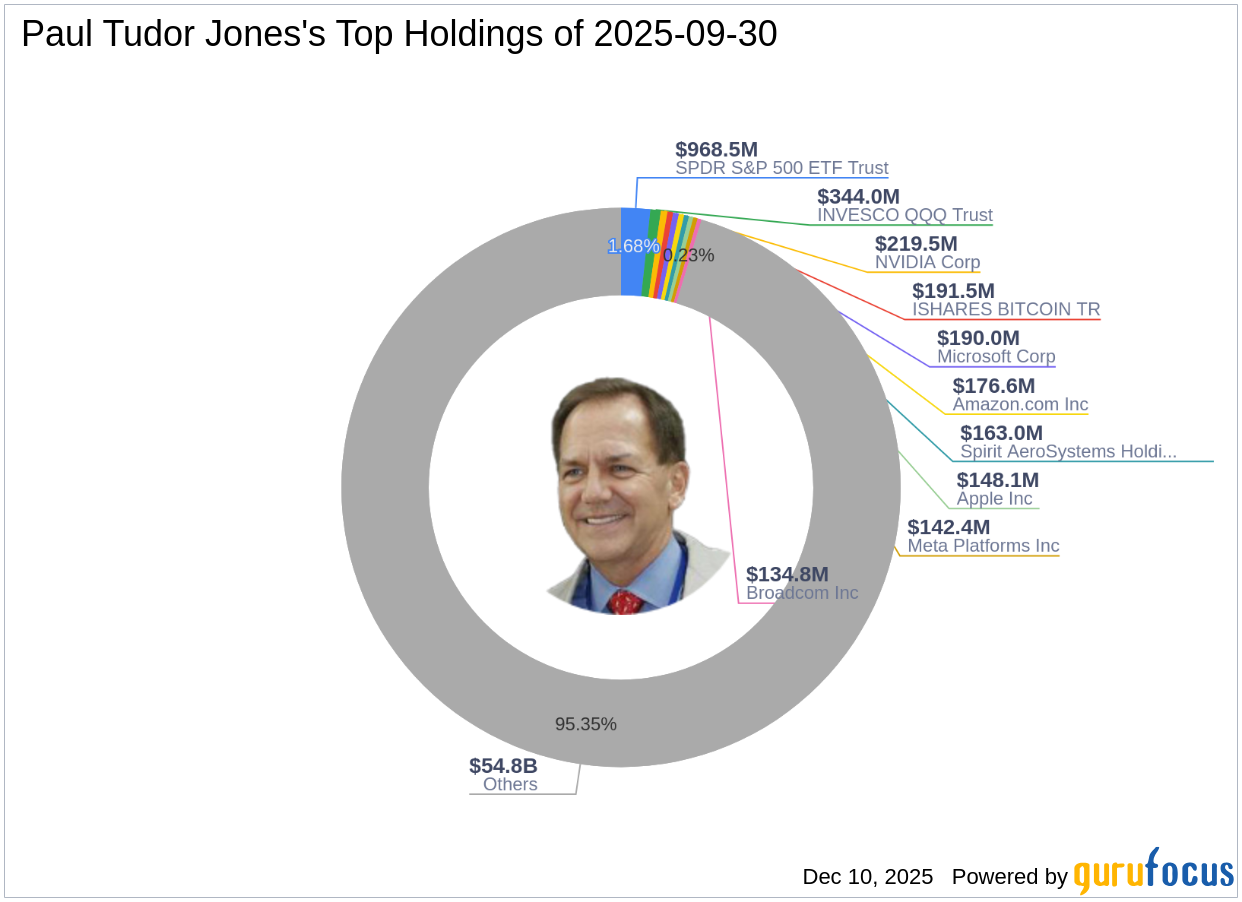

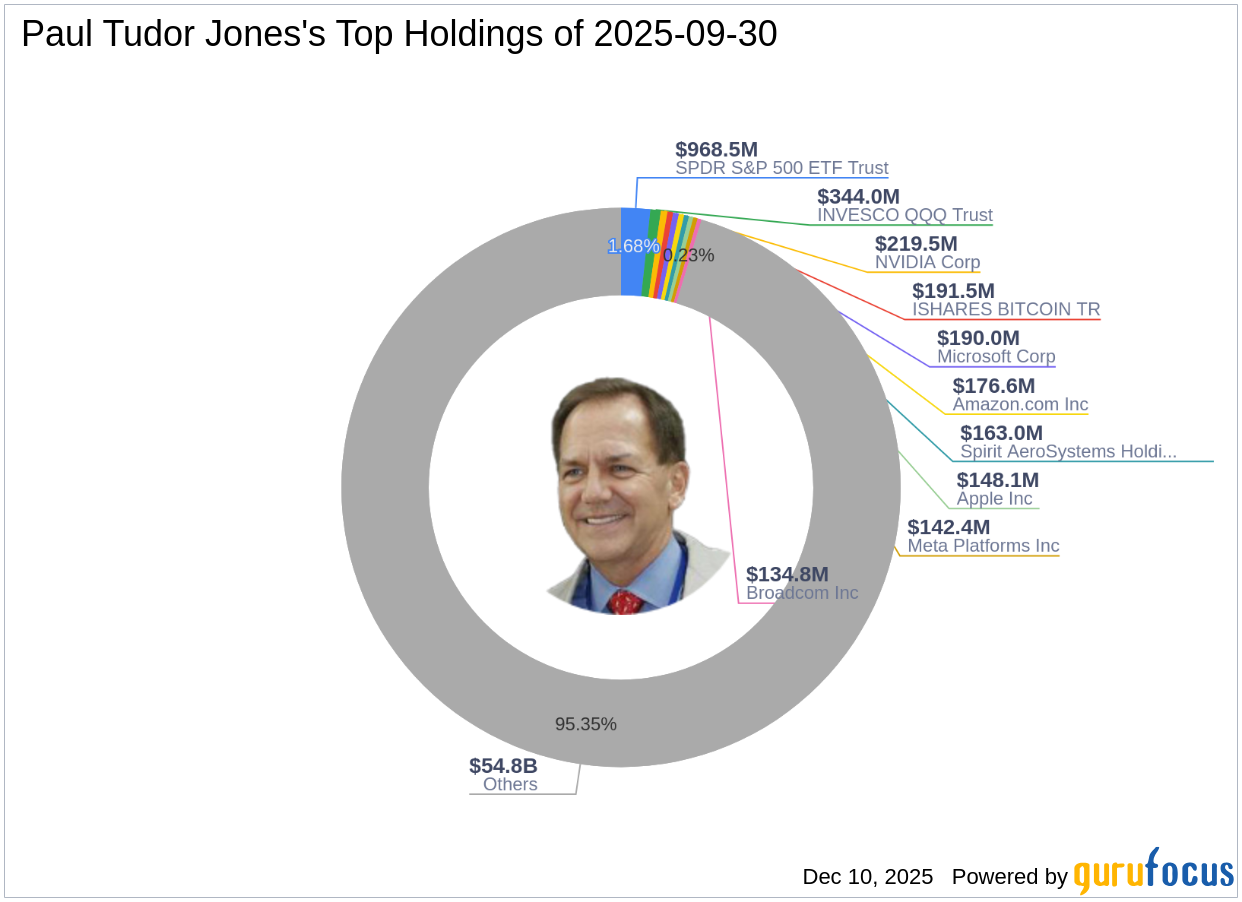

Paul Tudor Jones Reduces Stake in SPDR S&P 500 ETF Trust by 0.72%

gurufocus.com

2025-12-10 11:02:00Insight into the Guru's Strategic Moves in Q3 2025 Paul Tudor Jones (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, provid

Investor Exits $3.4 Million Frontier Communications Stake as Verizon Deal's Potential Closure Looms

fool.com

2025-11-29 12:22:30New York City-based Anchorage Capital Advisors sold 93,562 shares of Frontier Communications Parent in the third quarter. The move marked an exit for Anchorage, which reported holding no shares of Frontier at quarter-end, thereby eliminating a position previously worth about $3.4 million.

Verizon seeks $10 billion from bond sale tied to Frontier deal, Bloomberg News reports

reuters.com

2025-11-10 09:14:45Verizon Communications is looking to raise about $10 billion in the corporate bond market to fund its deal of Frontier Communications , Bloomberg News reported on Monday, citing a person familiar with the matter.

Compared to Estimates, Frontier Communications (FYBR) Q3 Earnings: A Look at Key Metrics

zacks.com

2025-10-28 20:31:18The headline numbers for Frontier Communications (FYBR) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Frontier Communications (FYBR) Reports Q3 Loss, Tops Revenue Estimates

zacks.com

2025-10-28 18:31:11Frontier Communications (FYBR) came out with a quarterly loss of $0.3 per share versus the Zacks Consensus Estimate of a loss of $0.4. This compares to a loss of $0.33 per share a year ago.

Frontier Reports Third-Quarter 2025 Results

businesswire.com

2025-10-28 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) reported third-quarter 2025 results today. “The team absolutely crushed it – once again delivering our best quarter ever,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “We achieved outstanding results across our operational and financial metrics, delivered double-digit EBITDA growth and reached an all-time high in customer growth.” Jeffery continued, “Our success is a credit to the.

DekaBank Deutsche Girozentrale Has $3.37 Million Position in Frontier Communications Parent, Inc. $FYBR

defenseworld.net

2025-10-26 04:50:55DekaBank Deutsche Girozentrale lowered its position in Frontier Communications Parent, Inc. (NASDAQ: FYBR) by 11.9% during the second quarter, according to its most recent Form 13F filing with the SEC. The fund owned 92,500 shares of the company's stock after selling 12,500 shares during the period. DekaBank Deutsche Girozentrale's holdings in Frontier Communications

Frontier to Report Third-Quarter 2025 Earnings on October 28, 2025

businesswire.com

2025-10-14 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ:FYBR): What's happening? Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) today announced it will report its third-quarter 2025 financial results after the market closes on Tuesday, October 28, 2025. Pending Acquisition by Verizon As previously announced, on September 4, 2024, Verizon Communications Inc. (“Verizon”) and Frontier Communications Parent, Inc. entered into a definitive agreement for Verizon to acq.

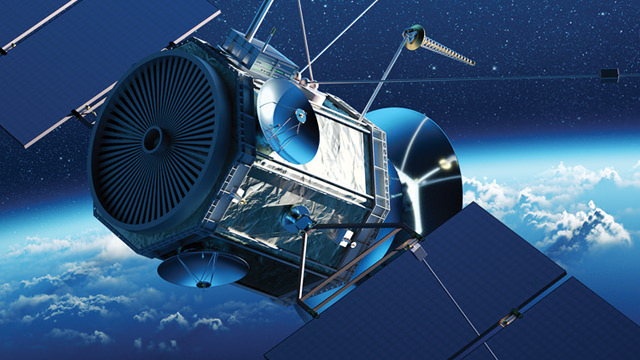

'The race is on:' Why Frontier is bullish on fiber, and Dallas, after Verizon's $20B bid

techxplore.com

2025-08-07 06:23:21With digital devices powering every aspect of life and business, telecommunications providers are going neck and neck to provide faster internet speeds at scale―using fiber technology as a linchpin.

Compared to Estimates, Frontier Communications (FYBR) Q2 Earnings: A Look at Key Metrics

zacks.com

2025-07-29 20:31:04Although the revenue and EPS for Frontier Communications (FYBR) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Frontier Communications (FYBR) Reports Q2 Loss, Tops Revenue Estimates

zacks.com

2025-07-29 18:31:19Frontier Communications (FYBR) came out with a quarterly loss of $0.49 per share versus the Zacks Consensus Estimate of a loss of $0.31. This compares to a loss of $0.49 per share a year ago.

Frontier Reports Second-Quarter 2025 Results

businesswire.com

2025-07-29 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) reported second-quarter 2025 results today. “Q2 was a breakout quarter for the builders of Gigabit America – we delivered record fiber sales while growing ARPU and achieved our highest quarterly revenue and EBITDA since we emerged from bankruptcy four years ago,” said Nick Jeffery, President and Chief Executive Officer of Frontier. Jeffery continued, “We built our strategy on the belief that with every new.

Frontier Communications (FYBR) Expected to Beat Earnings Estimates: Should You Buy?

zacks.com

2025-07-22 11:06:43Frontier Communications (FYBR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Frontier to Report Second-Quarter 2025 Earnings on July 29, 2025

businesswire.com

2025-07-15 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ:FYBR): What's happening? Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) today announced it will report its second-quarter 2025 financial results after the market closes on Tuesday, July 29, 2025. Pending Acquisition by Verizon As previously announced, on September 4, 2024, Verizon Communications Inc. (“Verizon”) and Frontier Communications Parent, Inc. entered into a definitive agreement for Verizon to acqui.

Cash Flow Matters: Two Cheap Stocks With Relatively Secure Dividends And Upside Potential

seekingalpha.com

2025-07-08 07:15:00Despite new S&P highs, I expect continued market volatility and see a 50/50 chance of recession in the next 6–12 months. The Fed's reluctance to cut rates, ongoing trade tensions, and potential stagflation keep me cautious, even as market sentiment turns greedy. Realty Income remains attractive for dividend investors due to its diversified portfolio, strong balance sheet, and proactive management despite tenant challenges.

No data to display

Paul Tudor Jones Reduces Stake in SPDR S&P 500 ETF Trust by 0.72%

gurufocus.com

2025-12-10 11:02:00Insight into the Guru's Strategic Moves in Q3 2025 Paul Tudor Jones (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, provid

Investor Exits $3.4 Million Frontier Communications Stake as Verizon Deal's Potential Closure Looms

fool.com

2025-11-29 12:22:30New York City-based Anchorage Capital Advisors sold 93,562 shares of Frontier Communications Parent in the third quarter. The move marked an exit for Anchorage, which reported holding no shares of Frontier at quarter-end, thereby eliminating a position previously worth about $3.4 million.

Verizon seeks $10 billion from bond sale tied to Frontier deal, Bloomberg News reports

reuters.com

2025-11-10 09:14:45Verizon Communications is looking to raise about $10 billion in the corporate bond market to fund its deal of Frontier Communications , Bloomberg News reported on Monday, citing a person familiar with the matter.

Compared to Estimates, Frontier Communications (FYBR) Q3 Earnings: A Look at Key Metrics

zacks.com

2025-10-28 20:31:18The headline numbers for Frontier Communications (FYBR) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Frontier Communications (FYBR) Reports Q3 Loss, Tops Revenue Estimates

zacks.com

2025-10-28 18:31:11Frontier Communications (FYBR) came out with a quarterly loss of $0.3 per share versus the Zacks Consensus Estimate of a loss of $0.4. This compares to a loss of $0.33 per share a year ago.

Frontier Reports Third-Quarter 2025 Results

businesswire.com

2025-10-28 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) reported third-quarter 2025 results today. “The team absolutely crushed it – once again delivering our best quarter ever,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “We achieved outstanding results across our operational and financial metrics, delivered double-digit EBITDA growth and reached an all-time high in customer growth.” Jeffery continued, “Our success is a credit to the.

DekaBank Deutsche Girozentrale Has $3.37 Million Position in Frontier Communications Parent, Inc. $FYBR

defenseworld.net

2025-10-26 04:50:55DekaBank Deutsche Girozentrale lowered its position in Frontier Communications Parent, Inc. (NASDAQ: FYBR) by 11.9% during the second quarter, according to its most recent Form 13F filing with the SEC. The fund owned 92,500 shares of the company's stock after selling 12,500 shares during the period. DekaBank Deutsche Girozentrale's holdings in Frontier Communications

Frontier to Report Third-Quarter 2025 Earnings on October 28, 2025

businesswire.com

2025-10-14 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ:FYBR): What's happening? Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) today announced it will report its third-quarter 2025 financial results after the market closes on Tuesday, October 28, 2025. Pending Acquisition by Verizon As previously announced, on September 4, 2024, Verizon Communications Inc. (“Verizon”) and Frontier Communications Parent, Inc. entered into a definitive agreement for Verizon to acq.

'The race is on:' Why Frontier is bullish on fiber, and Dallas, after Verizon's $20B bid

techxplore.com

2025-08-07 06:23:21With digital devices powering every aspect of life and business, telecommunications providers are going neck and neck to provide faster internet speeds at scale―using fiber technology as a linchpin.

Compared to Estimates, Frontier Communications (FYBR) Q2 Earnings: A Look at Key Metrics

zacks.com

2025-07-29 20:31:04Although the revenue and EPS for Frontier Communications (FYBR) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Frontier Communications (FYBR) Reports Q2 Loss, Tops Revenue Estimates

zacks.com

2025-07-29 18:31:19Frontier Communications (FYBR) came out with a quarterly loss of $0.49 per share versus the Zacks Consensus Estimate of a loss of $0.31. This compares to a loss of $0.49 per share a year ago.

Frontier Reports Second-Quarter 2025 Results

businesswire.com

2025-07-29 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) reported second-quarter 2025 results today. “Q2 was a breakout quarter for the builders of Gigabit America – we delivered record fiber sales while growing ARPU and achieved our highest quarterly revenue and EBITDA since we emerged from bankruptcy four years ago,” said Nick Jeffery, President and Chief Executive Officer of Frontier. Jeffery continued, “We built our strategy on the belief that with every new.

Frontier Communications (FYBR) Expected to Beat Earnings Estimates: Should You Buy?

zacks.com

2025-07-22 11:06:43Frontier Communications (FYBR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Frontier to Report Second-Quarter 2025 Earnings on July 29, 2025

businesswire.com

2025-07-15 16:05:00DALLAS--(BUSINESS WIRE)--Frontier Communications Parent, Inc. (NASDAQ:FYBR): What's happening? Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier”) today announced it will report its second-quarter 2025 financial results after the market closes on Tuesday, July 29, 2025. Pending Acquisition by Verizon As previously announced, on September 4, 2024, Verizon Communications Inc. (“Verizon”) and Frontier Communications Parent, Inc. entered into a definitive agreement for Verizon to acqui.

Cash Flow Matters: Two Cheap Stocks With Relatively Secure Dividends And Upside Potential

seekingalpha.com

2025-07-08 07:15:00Despite new S&P highs, I expect continued market volatility and see a 50/50 chance of recession in the next 6–12 months. The Fed's reluctance to cut rates, ongoing trade tensions, and potential stagflation keep me cautious, even as market sentiment turns greedy. Realty Income remains attractive for dividend investors due to its diversified portfolio, strong balance sheet, and proactive management despite tenant challenges.