First Trust Mega Cap AlphaDEX Fund (FMK)

Price:

42.92 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

iShares Preferred and Income Securities ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The investment seeks investment results that correspond generally to the price and yield (before the fund's fees and expenses) of an equity index called the Nasdaq AlphaDEX® Mega Cap Index. The fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks that comprise the index. The index is designed to select mega cap stocks from the NASDAQ US 500 Large Cap Index (the base index) that may generate positive alpha, or risk-adjusted returns, relative to traditional indices through the use of the AlphaDEX® selection methodology.

NEWS

First Trust Announces Completion of First Trust Mega Cap AlphaDEX® Fund's Reorganization into First Trust Dow 30 Equal Weight ETF

businesswire.com

2020-12-14 09:02:00WHEATON, Ill.--(BUSINESS WIRE)--First Trust Advisors L.P. (“FTA”) announced today that the reorganization of First Trust Mega Cap AlphaDEX® Fund (Nasdaq: FMK), an index based exchange-traded fund (“ETF”), managed by FTA, into First Trust Dow 30 Equal Weight ETF (NYSE Arca: EDOW), an index based ETF managed by FTA, was completed prior to the open of the NYSE Arca on December 14, 2020. As previously announced, the shareholders of FMK and EDOW approved FMK's reorganization into EDOW at a Joint Spe

First Trust Announces Expected Effective Date of First Trust Mega Cap AlphaDEX® Fund's Reorganization into First Trust Dow 30 Equal Weight ETF

businesswire.com

2020-12-11 09:06:00WHEATON, Ill.--(BUSINESS WIRE)--First Trust Advisors L.P. (“FTA”) announced today that, subject to the satisfaction of certain customary closing conditions, the reorganization of First Trust Mega Cap AlphaDEX® Fund (Nasdaq: FMK), an index based exchange-traded fund (“ETF”), managed by FTA, into First Trust Dow 30 Equal Weight ETF (NYSE Arca: EDOW), an index based ETF managed by FTA, is expected to become effective immediately before the opening of the NYSE Arca on December 14, 2020. As previous

Best And Worst Q4 2020: Large Cap Blend ETFs And Mutual Funds

seekingalpha.com

2020-11-25 10:00:00The Large Cap Blend style ranks second in Q4'20. Based on an aggregation of ratings of 61 ETFs and 661 mutual funds in the Large Cap Blend style.

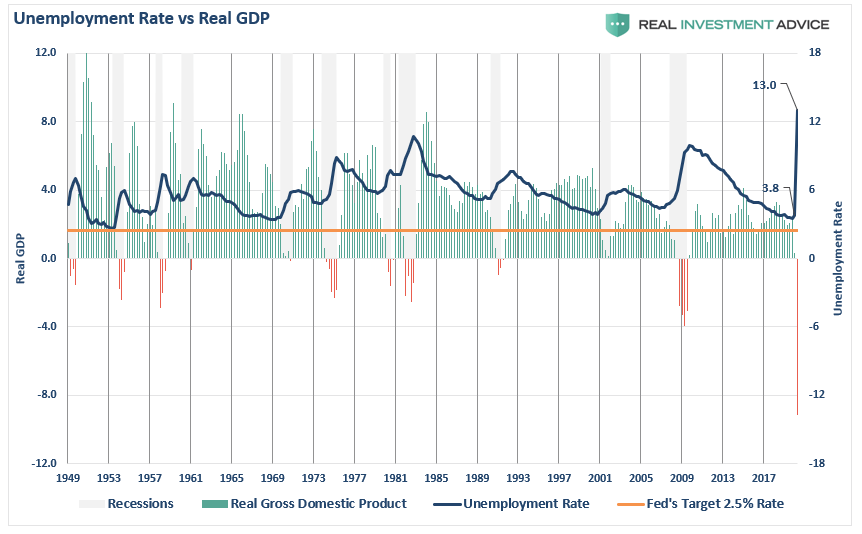

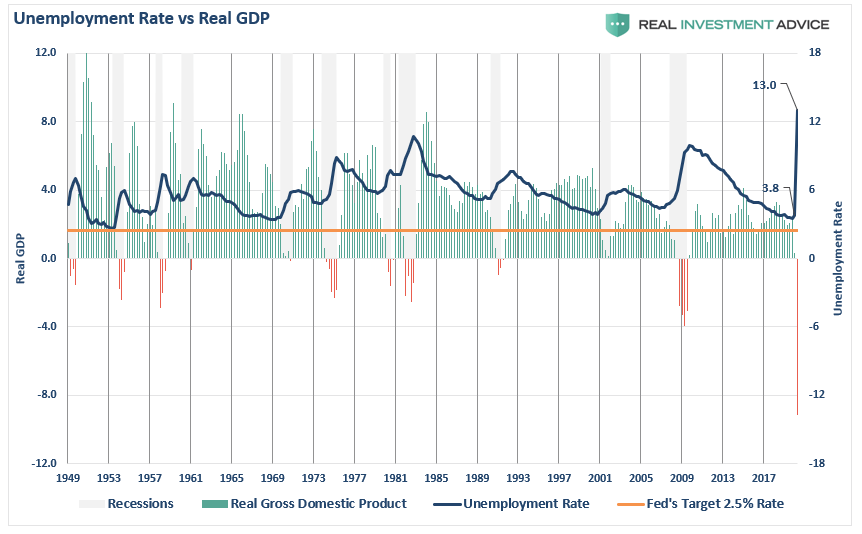

MacroView: 5 Reasons The Fed's New Policy Won't Get Inflation

seekingalpha.com

2020-09-06 10:33:45In today's #Macroview, we will discuss the 5 reasons why the Fed will not get inflation, and why deflation is the bigger risk.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

S&P 500 Earnings Update: Revisions Turned Slightly Negative (Again) This Past Week

seekingalpha.com

2020-06-27 10:18:24Next week, readers will see the quarterly bump in the forward four-quarter estimate. Looking at the forward S&P 500 EPS curve, the revisions this week turned sl

No data to display

First Trust Announces Completion of First Trust Mega Cap AlphaDEX® Fund's Reorganization into First Trust Dow 30 Equal Weight ETF

businesswire.com

2020-12-14 09:02:00WHEATON, Ill.--(BUSINESS WIRE)--First Trust Advisors L.P. (“FTA”) announced today that the reorganization of First Trust Mega Cap AlphaDEX® Fund (Nasdaq: FMK), an index based exchange-traded fund (“ETF”), managed by FTA, into First Trust Dow 30 Equal Weight ETF (NYSE Arca: EDOW), an index based ETF managed by FTA, was completed prior to the open of the NYSE Arca on December 14, 2020. As previously announced, the shareholders of FMK and EDOW approved FMK's reorganization into EDOW at a Joint Spe

First Trust Announces Expected Effective Date of First Trust Mega Cap AlphaDEX® Fund's Reorganization into First Trust Dow 30 Equal Weight ETF

businesswire.com

2020-12-11 09:06:00WHEATON, Ill.--(BUSINESS WIRE)--First Trust Advisors L.P. (“FTA”) announced today that, subject to the satisfaction of certain customary closing conditions, the reorganization of First Trust Mega Cap AlphaDEX® Fund (Nasdaq: FMK), an index based exchange-traded fund (“ETF”), managed by FTA, into First Trust Dow 30 Equal Weight ETF (NYSE Arca: EDOW), an index based ETF managed by FTA, is expected to become effective immediately before the opening of the NYSE Arca on December 14, 2020. As previous

Best And Worst Q4 2020: Large Cap Blend ETFs And Mutual Funds

seekingalpha.com

2020-11-25 10:00:00The Large Cap Blend style ranks second in Q4'20. Based on an aggregation of ratings of 61 ETFs and 661 mutual funds in the Large Cap Blend style.

MacroView: 5 Reasons The Fed's New Policy Won't Get Inflation

seekingalpha.com

2020-09-06 10:33:45In today's #Macroview, we will discuss the 5 reasons why the Fed will not get inflation, and why deflation is the bigger risk.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

S&P 500 Earnings Update: Revisions Turned Slightly Negative (Again) This Past Week

seekingalpha.com

2020-06-27 10:18:24Next week, readers will see the quarterly bump in the forward four-quarter estimate. Looking at the forward S&P 500 EPS curve, the revisions this week turned sl