First Trust Emerging Markets Small Cap AlphaDEX Fund (FEMS)

Price:

47.92 USD

( - -0.06 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

ProShares UltraShort Nasdaq Biotechnology

VALUE SCORE:

9

2nd position

SuRo Capital Corp. 6.00% Notes due 2026

VALUE SCORE:

13

The best

SuRo Capital Corp.

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks, depositary receipts, real estate investment trusts (REITs) and preferred shares that comprise the index. The index is designed to select stocks from the NASDAQ Emerging Markets Index (the base index) that may generate positive alpha, or risk-adjusted returns, relative to traditional indices through the use of the AlphaDEX® selection methodology.

NEWS

First Trust Emerging Markets Small Cap AlphaDEX Fund (NASDAQ:FEMS) Stock Passes Below Fifty Day Moving Average – Here’s Why

defenseworld.net

2026-01-03 05:16:52First Trust Emerging Markets Small Cap AlphaDEX Fund (NASDAQ: FEMS - Get Free Report) shares crossed below its 50-day moving average during trading on Friday. The stock has a 50-day moving average of $42.32 and traded as low as $42.19. First Trust Emerging Markets Small Cap AlphaDEX Fund shares last traded at $42.43, with a

FEMS: This Small-Cap Emerging Market Fund Fails To Generate Interest

seekingalpha.com

2023-03-19 07:20:17FEMS offers investors an option to invest in some potential alpha generating small-cap equities in diversified sectors in the emerging market economies. 70 percent of FEMS's investments are in Turkey, Taiwan, China, and Brazil. 65 percent is invested in basic materials, energy, industrial & technology sectors.

EEMS Vs. FEMS: Comparing Small-Cap Emerging Market Equity ETFs

seekingalpha.com

2022-12-25 09:00:00The iShares MSCI Emerging Markets Small-Cap ETF invests based on the MSCI Emerging Markets Small Cap Index. The First Trust Emerging Markets Small Cap AlphaDEX ETF invests based on the NASDAQ AlphaDEX Emerging Markets Small Cap Index.

Play a Bounce in Growth and Emerging Markets With This ETF

etftrends.com

2022-05-16 19:40:44Investors looking at emerging markets and having an “aha moment” might be wondering if a bounceback play is in the works. While it's possible, headwinds abound, making it necessary to look at the opportunity with a discerning screener.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

Why Emerging Market Small-Cap Stocks Might Mean Big Profits

fool.com

2020-11-13 09:00:00Emerging markets are poised to soar, but avoid political landmines with small-cap stocks.

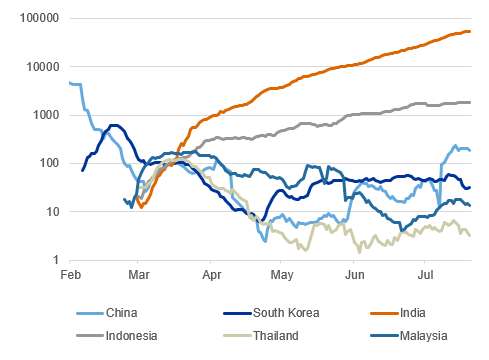

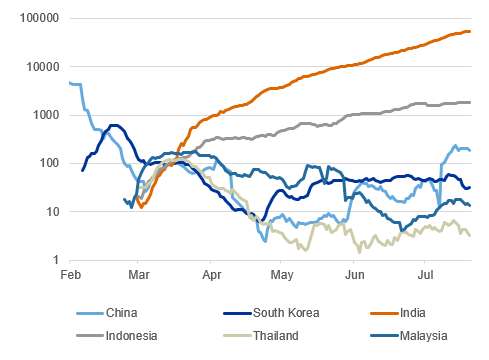

3 Big Challenges For Emerging Markets Amid COVID-19

seekingalpha.com

2020-08-13 13:29:50Today, China's economic recovery continues ticking along, and we are even seeing some indicators showing growth relative to last year.

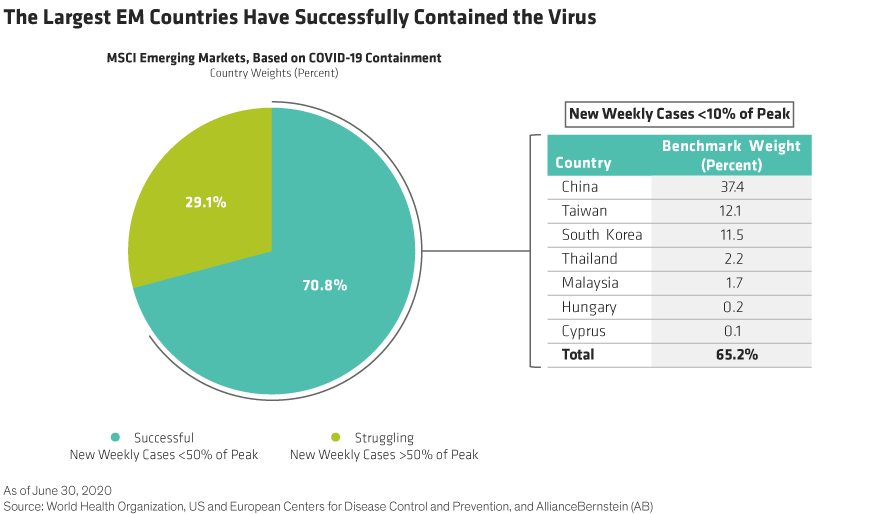

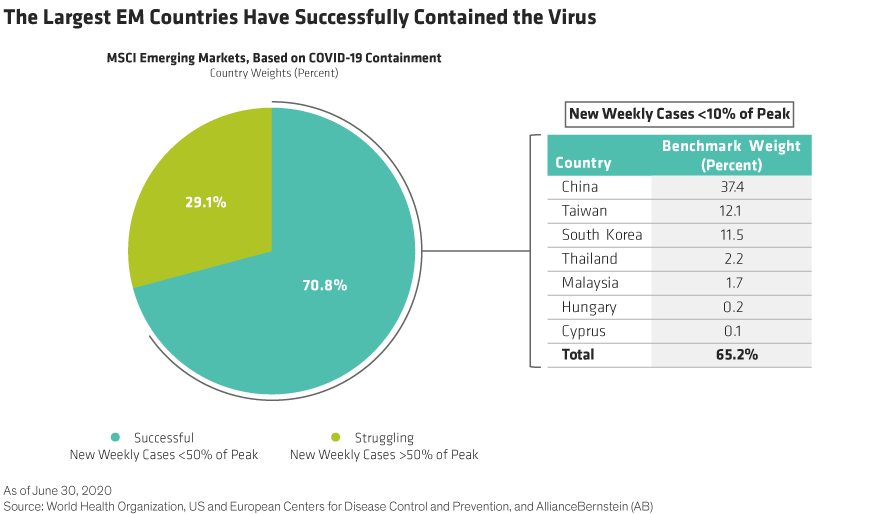

Emerging-Market Equities: Looking Past The Pandemic

seekingalpha.com

2020-07-21 10:43:36During the COVID-19 crisis, investor flight to safety assets and a strong US dollar battered emerging market stocks this year.

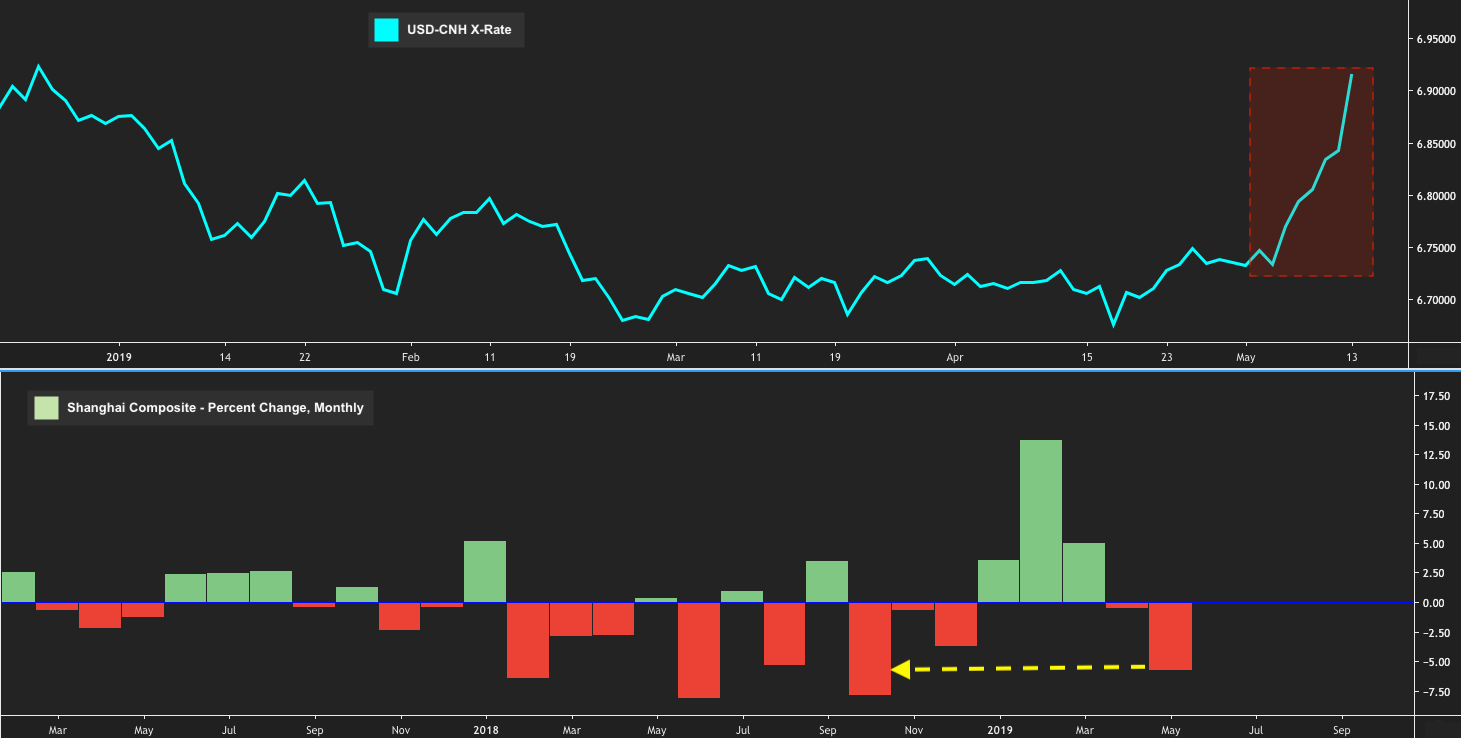

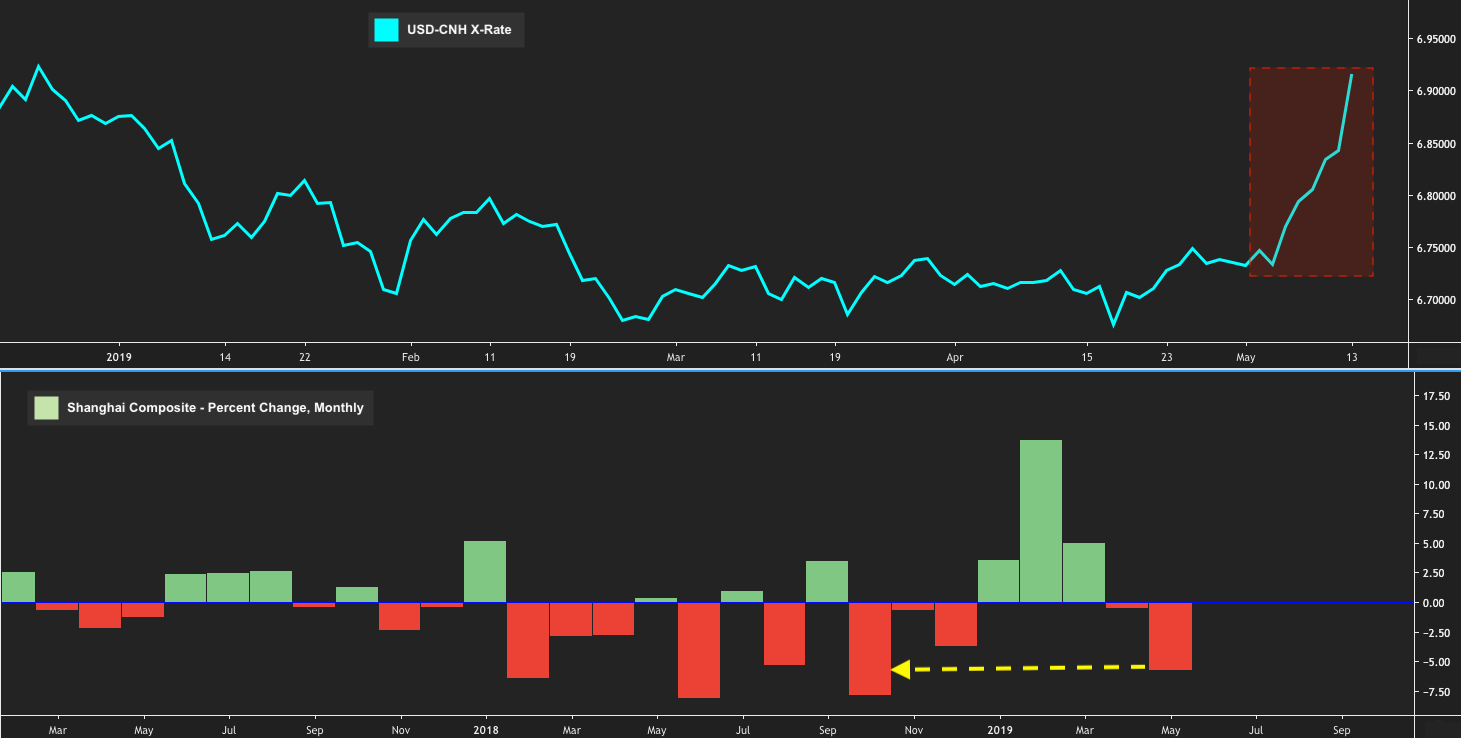

Monday, Bloody Monday

seekingalpha.com

2019-05-13 17:48:25No summary available.

No data to display

First Trust Emerging Markets Small Cap AlphaDEX Fund (NASDAQ:FEMS) Stock Passes Below Fifty Day Moving Average – Here’s Why

defenseworld.net

2026-01-03 05:16:52First Trust Emerging Markets Small Cap AlphaDEX Fund (NASDAQ: FEMS - Get Free Report) shares crossed below its 50-day moving average during trading on Friday. The stock has a 50-day moving average of $42.32 and traded as low as $42.19. First Trust Emerging Markets Small Cap AlphaDEX Fund shares last traded at $42.43, with a

FEMS: This Small-Cap Emerging Market Fund Fails To Generate Interest

seekingalpha.com

2023-03-19 07:20:17FEMS offers investors an option to invest in some potential alpha generating small-cap equities in diversified sectors in the emerging market economies. 70 percent of FEMS's investments are in Turkey, Taiwan, China, and Brazil. 65 percent is invested in basic materials, energy, industrial & technology sectors.

EEMS Vs. FEMS: Comparing Small-Cap Emerging Market Equity ETFs

seekingalpha.com

2022-12-25 09:00:00The iShares MSCI Emerging Markets Small-Cap ETF invests based on the MSCI Emerging Markets Small Cap Index. The First Trust Emerging Markets Small Cap AlphaDEX ETF invests based on the NASDAQ AlphaDEX Emerging Markets Small Cap Index.

Play a Bounce in Growth and Emerging Markets With This ETF

etftrends.com

2022-05-16 19:40:44Investors looking at emerging markets and having an “aha moment” might be wondering if a bounceback play is in the works. While it's possible, headwinds abound, making it necessary to look at the opportunity with a discerning screener.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

Why Emerging Market Small-Cap Stocks Might Mean Big Profits

fool.com

2020-11-13 09:00:00Emerging markets are poised to soar, but avoid political landmines with small-cap stocks.

3 Big Challenges For Emerging Markets Amid COVID-19

seekingalpha.com

2020-08-13 13:29:50Today, China's economic recovery continues ticking along, and we are even seeing some indicators showing growth relative to last year.

Emerging-Market Equities: Looking Past The Pandemic

seekingalpha.com

2020-07-21 10:43:36During the COVID-19 crisis, investor flight to safety assets and a strong US dollar battered emerging market stocks this year.

Monday, Bloody Monday

seekingalpha.com

2019-05-13 17:48:25No summary available.