First Trust Emerging Markets AlphaDEX Fund (FEM)

Price:

26.76 USD

( + 0.59 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

iShares Preferred and Income Securities ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

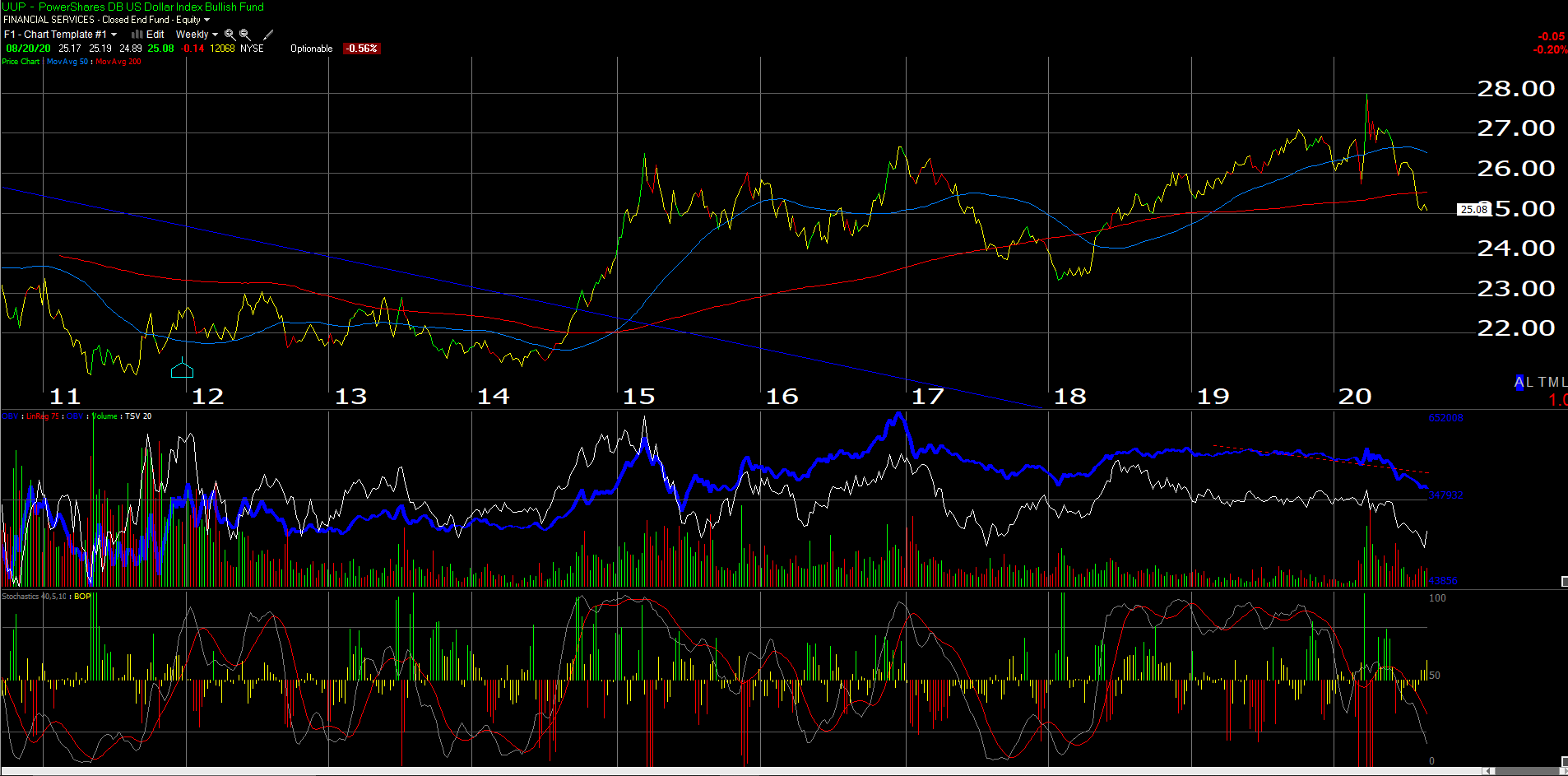

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks, depositary receipts, real estate investment trusts (REITs) and preferred shares that comprise the index. The index is designed to select stocks from the NASDAQ Emerging Markets Index (the base index) that may generate positive alpha, or risk-adjusted returns, relative to traditional indices through the use of the AlphaDEX® selection methodology.

NEWS

Emerging Markets Growth Remains Solid Amid Intensifying Inflationary Pressures

seekingalpha.com

2024-03-14 13:15:00Emerging markets continued to expand at a solid pace midway into the first quarter of 2024, supported by broad-based expansion across both manufacturing and service sectors.

2 ETFs to Watch for Outsized Volume on Emerging Market & Leveraged Natural Gas

zacks.com

2023-02-07 09:02:19Emerging market and leveraged natural gas ETFs saw massive trading volume yesterday.

Who is Gautam Adani, Hindenburg Research's Latest Target?

investorplace.com

2023-01-25 15:41:31Forwarding its reputation as the “Grim Reaper” of enterprises of dubious reputation, notorious short-seller Hindenburg Research blasted Indian conglomerate Adani Group for having “

Steel, Composites, Plastic and Hybrid Industry Forecast 2021-2027 AMR

headlinesoftoday.com

2022-11-01 03:02:16PORTLAND, ORAGON, UNITED STATES, October 31, 2022 /EINPresswire.com/ — Automotive front-end module (FEM) deals with a wide range of products, such as air conditioning (A/C) condensers, grille-opening reinforcement (GOR) panels, crumple zones, bumpers with decorative fascia, hood latches, electronics, and wiring, which have wider applications in vehicles. Automotive front-end module (FEM) avoids the use of […]...

Automotive Front-End Module (FEM) Market Steel, Composites, Plastic and Hybrid Industry Forecast, 2021-2027

headlinesoftoday.com

2022-09-15 18:36:16PORTLAND, ORAGON, UNITED STATES, September 15, 2022 /EINPresswire.com/ — Automotive Front-End Module (FEM) Market by Type (Radiator, Motor Fan, Condenser, Internal Air Cooler and Others), Vehicle Type (Passenger Cars (PC), Light Commercial Vehicles (LCV) and Heavy Commercial Vehicles (HCV)) and Material (Steel, Composites, Plastic and Hybrid): Global Opportunity Analysis and Industry Forecast, 2021-2027 Automotive front-end […]...

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

First Trust's FEM ETF and Why Emerging Markets Are Surging

etftrends.com

2021-01-27 11:36:39Emerging markets equities rallied late last year, and many market observers are wagering more is on the way in 2021. The First Trust Emerging Markets AlphaDEX Fund (FEM) can capture those gains.

Growing Optimism On A COVID-19 Vaccine Boosts Investor Confidence In August

seekingalpha.com

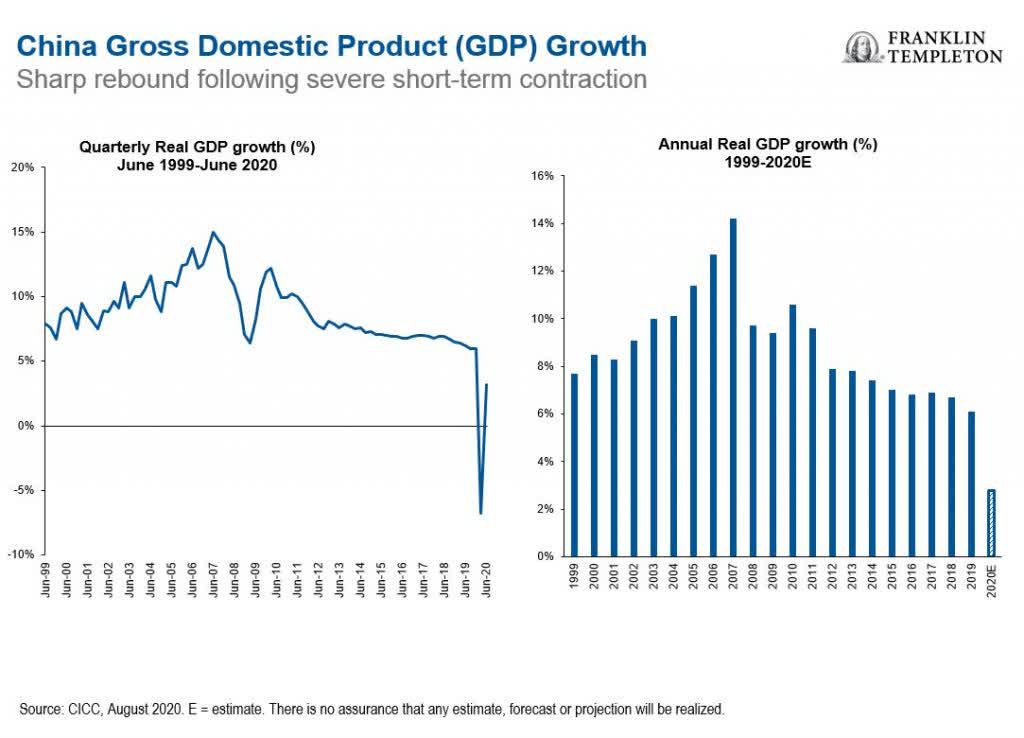

2020-09-11 03:13:50Asian markets rose in August to seal the best regional performance in EMs. Stocks in China, India and Indonesia posted notable gains.

Smaller Stocks Open Broader Windows To Emerging Markets

seekingalpha.com

2020-09-09 19:53:17Allocating to smaller companies can help broaden an EM allocation by providing a different mix of exposures to opportunities across countries and sectors.

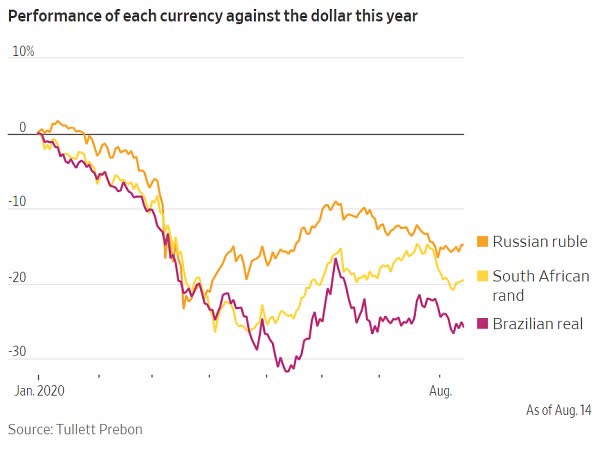

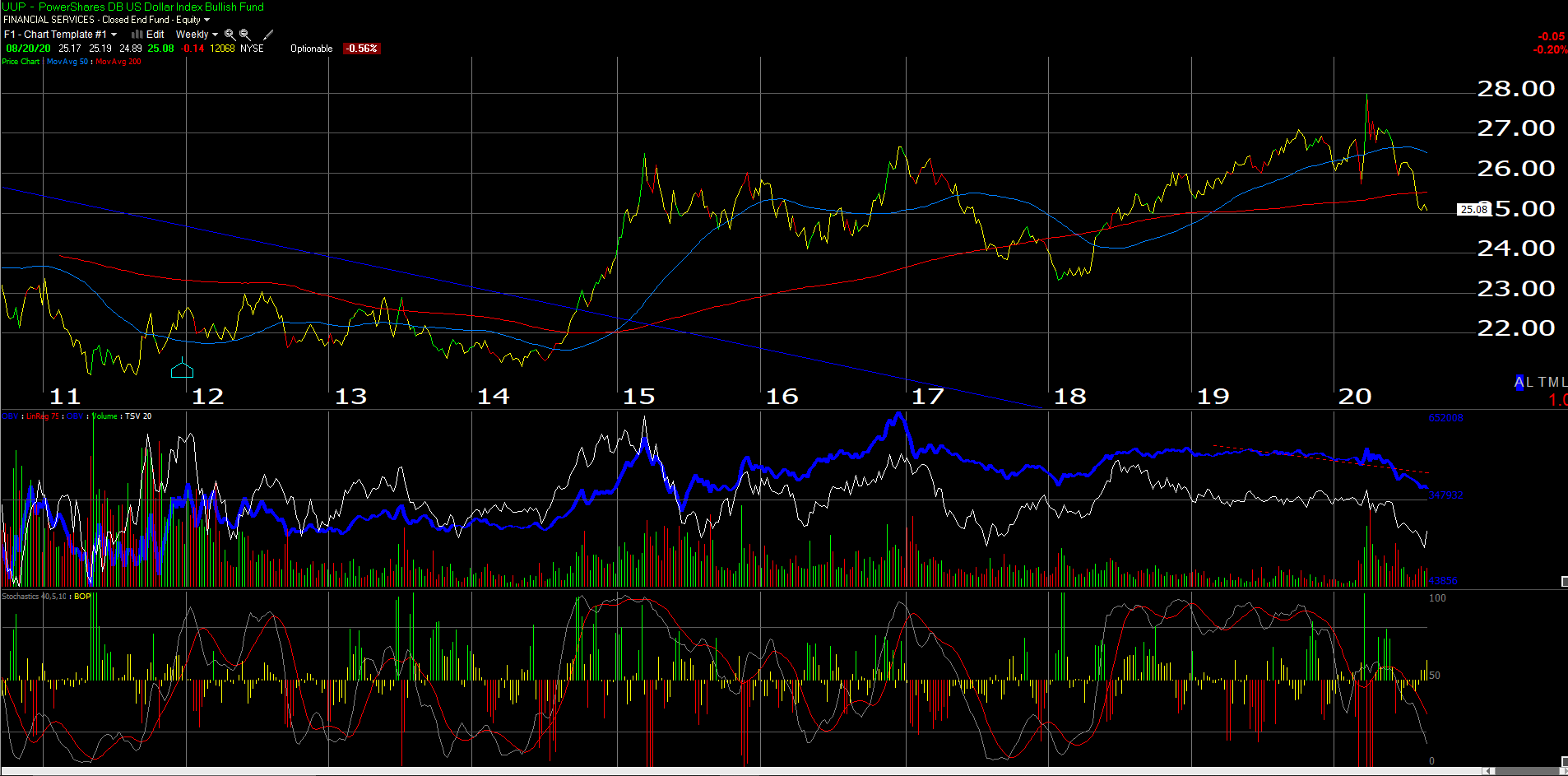

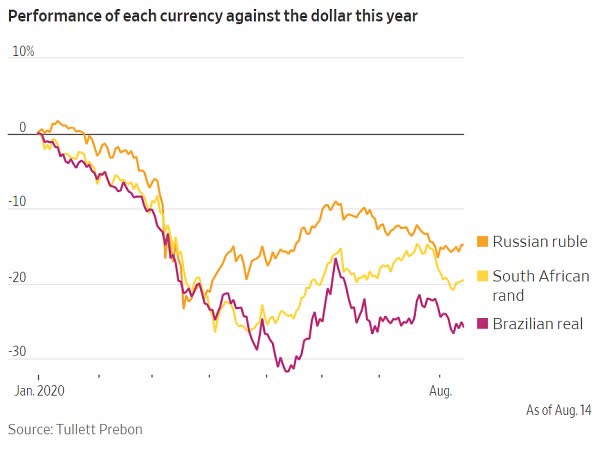

Will A Weak Dollar Bail Out Emerging Markets? Nope

seekingalpha.com

2020-08-22 08:35:57Back in the simpler days of 2019, there was this (now completely forgotten) impending crisis in which emerging market countries' dollar-denominated debt was going to blow up their - and by extension the rest of the world's - economies.

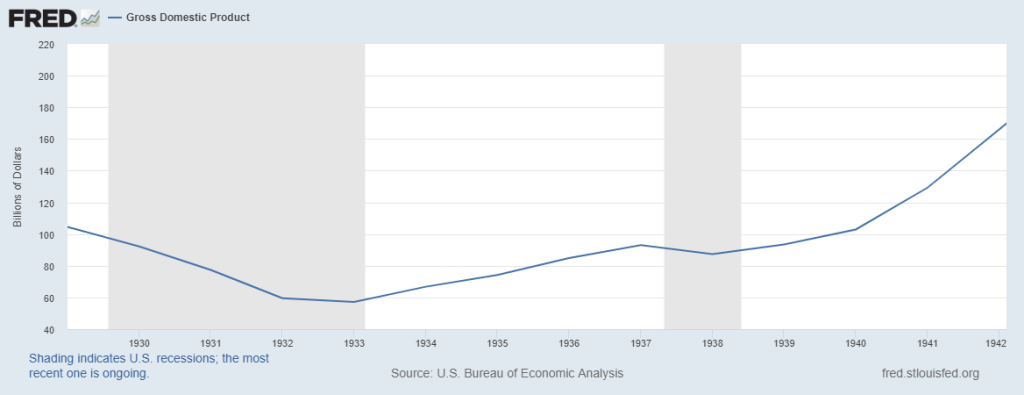

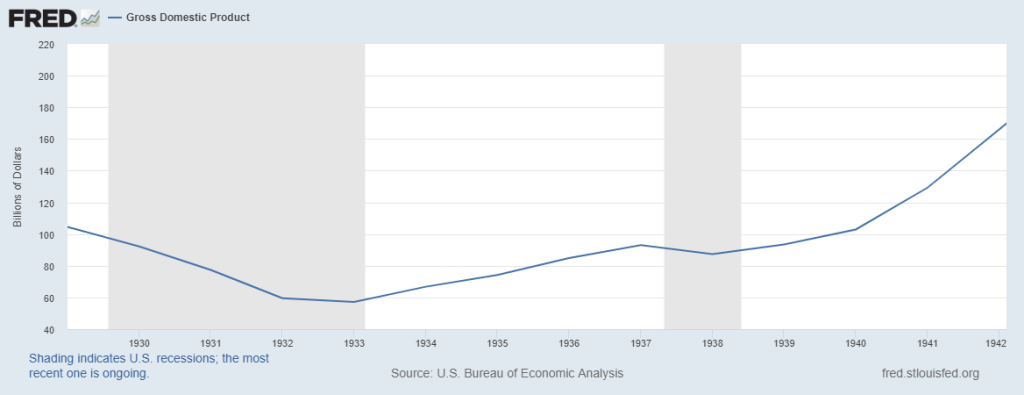

When Does A Recession Become A Depression?

seekingalpha.com

2020-08-21 08:03:19Defining a depression as opposed to a recession is open to wide interpretation. Recessions are a natural part of the credit cycle.

On Emerging Markets, The Dollar And Oakmark Int'l

seekingalpha.com

2020-08-21 05:59:53The emerging markets had a solid July 2020, up roughly 7% depending on the proxy you use. VWO and OAKIX represent uncorrelated holdings for the growthier positions in client accounts.

Euro Strength Driving Dollar Weakness, Inflationary Breakout Stories: Hirst

seekingalpha.com

2020-08-19 23:40:56The size and speed of the dollar’s fall are driven more by euro strength flowing out from the ECB’s move toward debt mutualization than by dollar weakness.

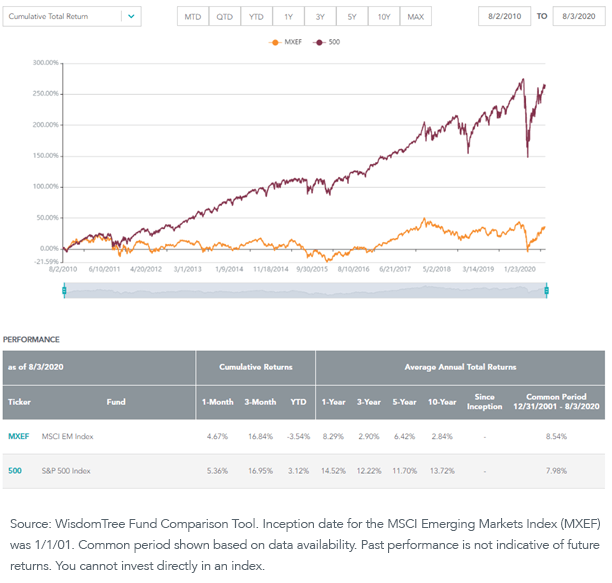

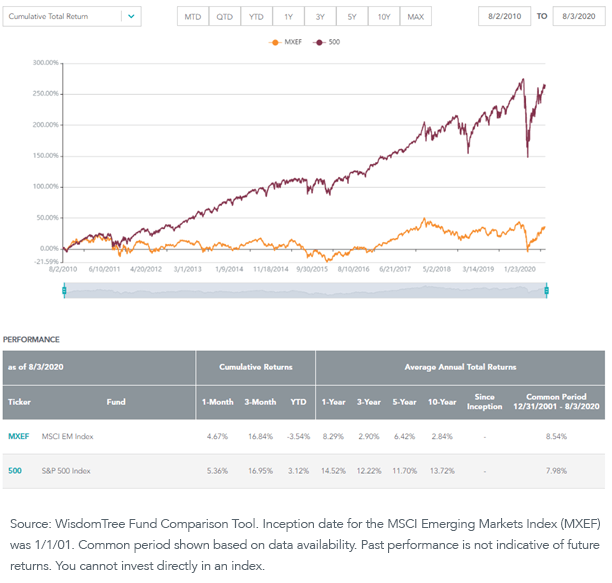

Are Emerging Markets Poised For The Long Run?

seekingalpha.com

2020-08-18 06:06:42It's been a remarkable decade for the S&P 500 Index. Less so for global benchmarks.

Sentiment Speaks: A Huge Opportunity For Investors In 2021

seekingalpha.com

2020-08-17 08:00:00Emerging markets provided us a great warning for the decline experienced earlier in 2020. Emerging markets are now setting up for a multi-year rally.

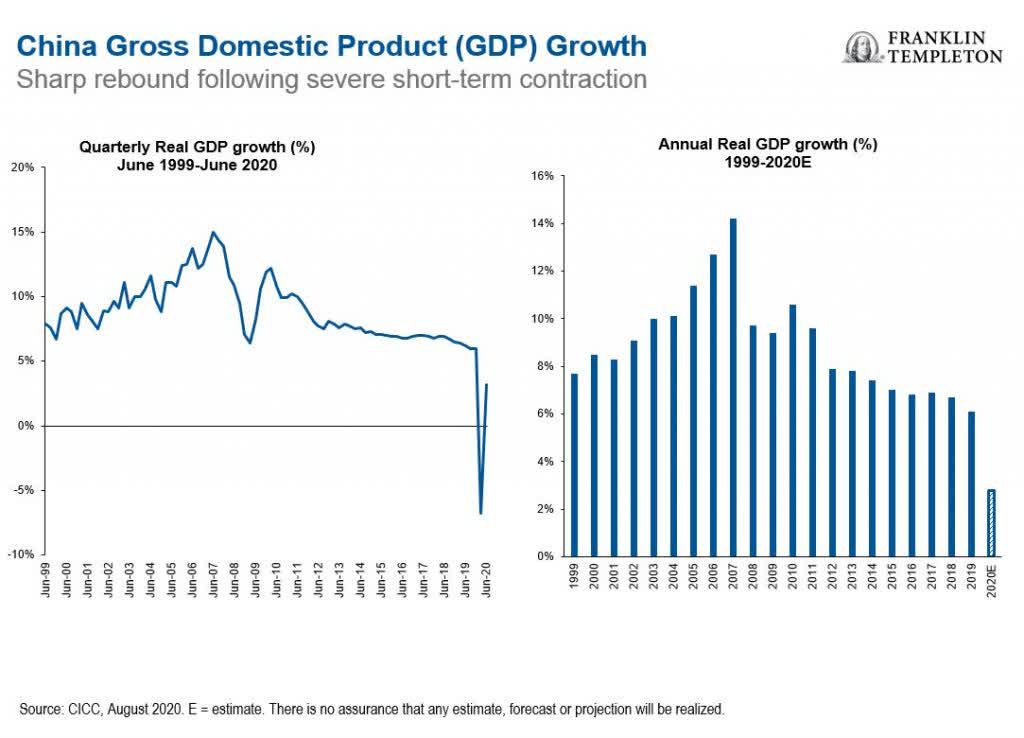

Our Hypothesis For A Bull Market In Emerging Markets Equities

seekingalpha.com

2020-08-15 11:25:18Why we think EM equity asset class will be among the most attractive investment opportunities over the next decade.

No data to display

Emerging Markets Growth Remains Solid Amid Intensifying Inflationary Pressures

seekingalpha.com

2024-03-14 13:15:00Emerging markets continued to expand at a solid pace midway into the first quarter of 2024, supported by broad-based expansion across both manufacturing and service sectors.

2 ETFs to Watch for Outsized Volume on Emerging Market & Leveraged Natural Gas

zacks.com

2023-02-07 09:02:19Emerging market and leveraged natural gas ETFs saw massive trading volume yesterday.

Who is Gautam Adani, Hindenburg Research's Latest Target?

investorplace.com

2023-01-25 15:41:31Forwarding its reputation as the “Grim Reaper” of enterprises of dubious reputation, notorious short-seller Hindenburg Research blasted Indian conglomerate Adani Group for having “

Steel, Composites, Plastic and Hybrid Industry Forecast 2021-2027 AMR

headlinesoftoday.com

2022-11-01 03:02:16PORTLAND, ORAGON, UNITED STATES, October 31, 2022 /EINPresswire.com/ — Automotive front-end module (FEM) deals with a wide range of products, such as air conditioning (A/C) condensers, grille-opening reinforcement (GOR) panels, crumple zones, bumpers with decorative fascia, hood latches, electronics, and wiring, which have wider applications in vehicles. Automotive front-end module (FEM) avoids the use of […]...

Automotive Front-End Module (FEM) Market Steel, Composites, Plastic and Hybrid Industry Forecast, 2021-2027

headlinesoftoday.com

2022-09-15 18:36:16PORTLAND, ORAGON, UNITED STATES, September 15, 2022 /EINPresswire.com/ — Automotive Front-End Module (FEM) Market by Type (Radiator, Motor Fan, Condenser, Internal Air Cooler and Others), Vehicle Type (Passenger Cars (PC), Light Commercial Vehicles (LCV) and Heavy Commercial Vehicles (HCV)) and Material (Steel, Composites, Plastic and Hybrid): Global Opportunity Analysis and Industry Forecast, 2021-2027 Automotive front-end […]...

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

First Trust's FEM ETF and Why Emerging Markets Are Surging

etftrends.com

2021-01-27 11:36:39Emerging markets equities rallied late last year, and many market observers are wagering more is on the way in 2021. The First Trust Emerging Markets AlphaDEX Fund (FEM) can capture those gains.

Growing Optimism On A COVID-19 Vaccine Boosts Investor Confidence In August

seekingalpha.com

2020-09-11 03:13:50Asian markets rose in August to seal the best regional performance in EMs. Stocks in China, India and Indonesia posted notable gains.

Smaller Stocks Open Broader Windows To Emerging Markets

seekingalpha.com

2020-09-09 19:53:17Allocating to smaller companies can help broaden an EM allocation by providing a different mix of exposures to opportunities across countries and sectors.

Will A Weak Dollar Bail Out Emerging Markets? Nope

seekingalpha.com

2020-08-22 08:35:57Back in the simpler days of 2019, there was this (now completely forgotten) impending crisis in which emerging market countries' dollar-denominated debt was going to blow up their - and by extension the rest of the world's - economies.

When Does A Recession Become A Depression?

seekingalpha.com

2020-08-21 08:03:19Defining a depression as opposed to a recession is open to wide interpretation. Recessions are a natural part of the credit cycle.

On Emerging Markets, The Dollar And Oakmark Int'l

seekingalpha.com

2020-08-21 05:59:53The emerging markets had a solid July 2020, up roughly 7% depending on the proxy you use. VWO and OAKIX represent uncorrelated holdings for the growthier positions in client accounts.

Euro Strength Driving Dollar Weakness, Inflationary Breakout Stories: Hirst

seekingalpha.com

2020-08-19 23:40:56The size and speed of the dollar’s fall are driven more by euro strength flowing out from the ECB’s move toward debt mutualization than by dollar weakness.

Are Emerging Markets Poised For The Long Run?

seekingalpha.com

2020-08-18 06:06:42It's been a remarkable decade for the S&P 500 Index. Less so for global benchmarks.

Sentiment Speaks: A Huge Opportunity For Investors In 2021

seekingalpha.com

2020-08-17 08:00:00Emerging markets provided us a great warning for the decline experienced earlier in 2020. Emerging markets are now setting up for a multi-year rally.

Our Hypothesis For A Bull Market In Emerging Markets Equities

seekingalpha.com

2020-08-15 11:25:18Why we think EM equity asset class will be among the most attractive investment opportunities over the next decade.