First Trust Canada AlphaDEX Fund (FCAN)

Price:

20.71 USD

( - -0.04 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

The investment seeks investment results that correspond generally to the price and yield (before the fund's fees and expenses) of an equity index called the NASDAQ AlphaDEX® Canada Index. The fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks, depositary receipts, real estate investment trusts (REITs) and preferred shares that comprise the index. The index is designed to select stocks from the NASDAQ Canada Index (the base index) that may generate positive alpha, or risk-adjusted returns, relative to traditional indices through the use of the AlphaDEX® selection methodology.

NEWS

First Trust Announces Expected Effective Date of ETF Reorganization

businesswire.com

2020-10-29 16:31:00WHEATON, Ill.--(BUSINESS WIRE)--First Trust Advisors L.P. (“FTA”) announced today that, subject to the satisfaction of certain customary closing conditions, the reorganization of First Trust Australia AlphaDEX® Fund (NYSE Arca: FAUS), First Trust Canada AlphaDEX® Fund (Nasdaq: FCAN), First Trust Hong Kong AlphaDEX® Fund (Nasdaq: FHK), and First Trust South Korea AlphaDEX® Fund (Nasdaq: FKO), each an index based exchange-traded fund (“ETF”), managed by FTA, into First Trust Developed Markets ex-

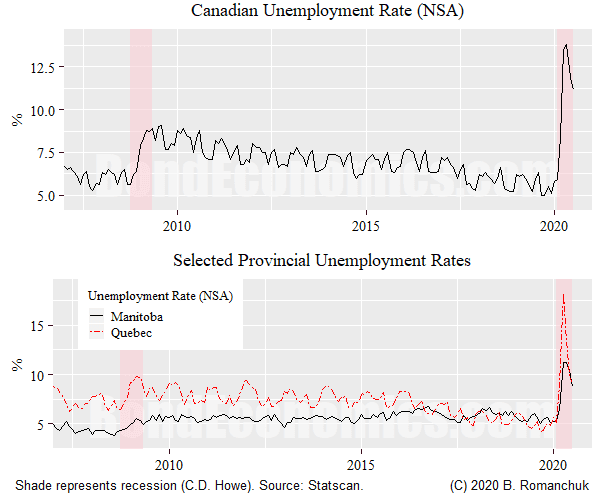

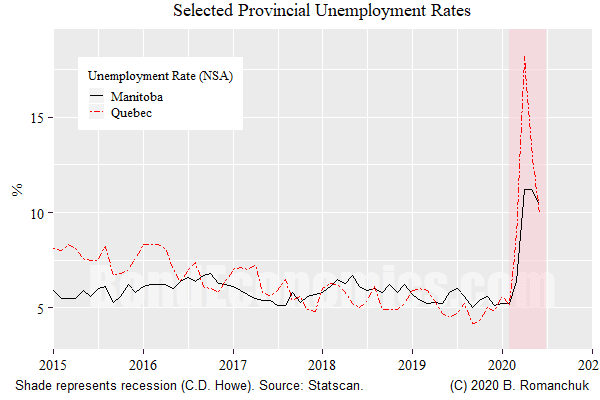

Canada's Resilience: The Recovery Starts Showing The 'Swoosh'

seekingalpha.com

2020-09-12 14:25:51Canada could outperform the U.S. economy in the second half of 2020.

Canadian Big Bank Resiliency: Is The Worst Behind Us?

seekingalpha.com

2020-09-11 06:05:42Signs of recovery for Canadian big banks. Will strong trading revenues for banks last? Canadian big bank stocks poised to play catch up..

Bank Of Canada Keeps Key Interest Rate Target On Hold

seekingalpha.com

2020-09-10 07:30:51Bank of Canada keeps rates unchanged at 0.25%. Uncertainty remains as Canadian economy moves into recuperation phase.

Comments On Canadian Inflation Risks

seekingalpha.com

2020-08-23 13:04:32There has been a cabinet shuffle in Canada. Newspaper reports hint at philosophical changes, moving towards a more free-spending strategy.

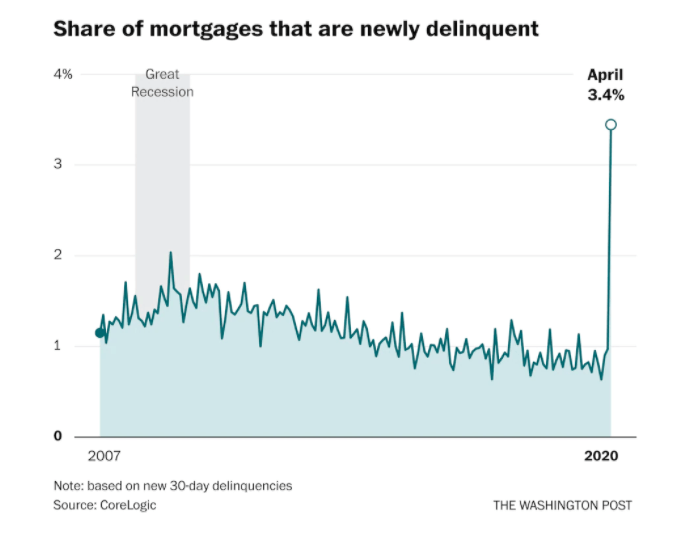

Government-Boosted Economy Approaches Next Hard Return

seekingalpha.com

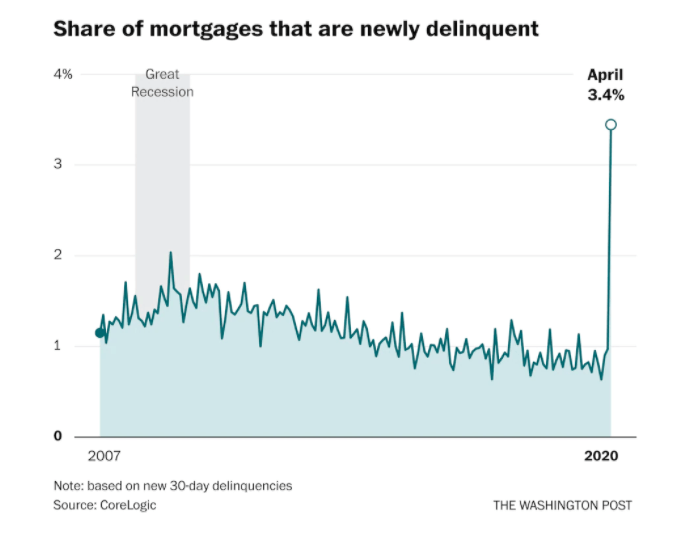

2020-08-19 06:20:21On top of government-sanctioned deferral programs for mortgages, other debts and rents, the Canada Emergency Response Benefit doled out $2,000 per month to keep Canadians spending since the end of March.

Canada's Trade Deficit Widens. But Can A Rebound Be Near?

seekingalpha.com

2020-08-19 05:12:57Compared with their pre-pandemic levels, nominal exports and imports are well below February levels. Trade with the U.S.

Winners And Losers From Shifting Canadian Consumer Trends

seekingalpha.com

2020-07-28 10:53:52Consumer spending trends as re-openings begin. Business spending lags consumers but still trending up.

Canada's Slowing Population Growth And The Impact On Housing

seekingalpha.com

2020-07-25 04:23:24The COVID-19 pandemic is causing Canada's immigration to plunge. Lower immigration levels in Canada could create a long-term drag on housing.

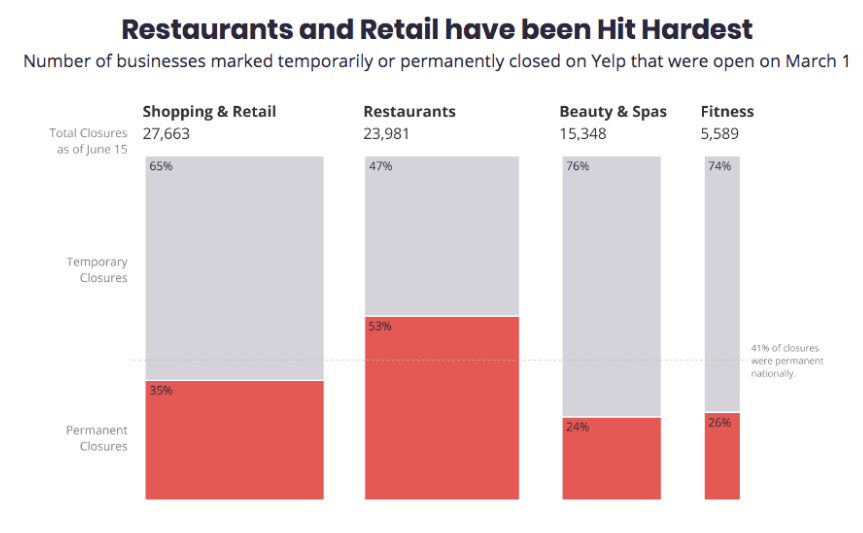

Household Behavior Shifts: Positive Longer Term, Negative For Economy Near Term

seekingalpha.com

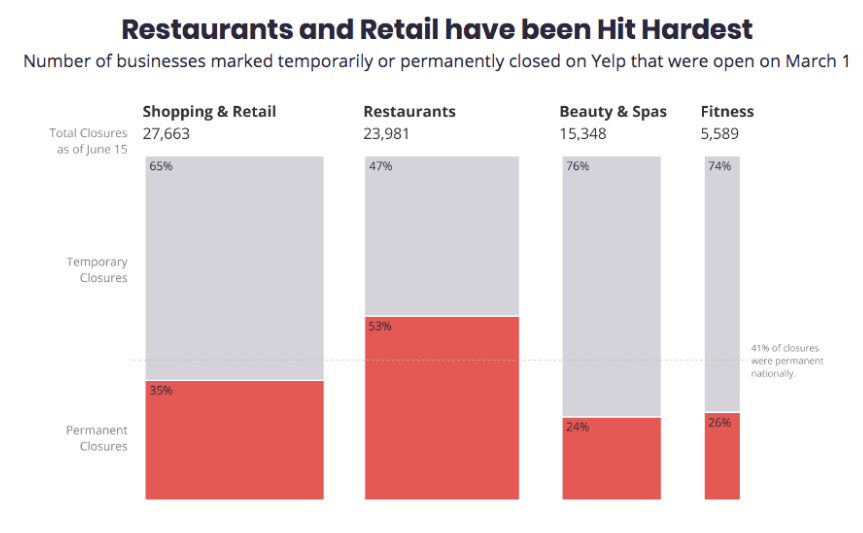

2020-07-22 08:18:11Half of the independent Canadian restaurants recently surveyed say that they are unlikely to survive the current crisis.

First Trust Canada AlphaDEX Fund (NASDAQ:FCAN) Shares Up 3.5%

thelincolnianonline.com

2020-07-18 01:26:41First Trust Canada AlphaDEX Fund (NASDAQ:FCAN) shares shot up 3.5% during mid-day trading on Friday . The company traded as high as $20.71 and last traded at $20.71, 900 shares changed hands during mid-day trading. A decline of 17% from the average session volume of 1,087 shares. The stock had previously closed at $20.01. The […]

Banks And Borrowers Not In Quick Recovery

seekingalpha.com

2020-07-16 19:48:30As the Trump admin works daily to prop up the stock market as key to its re-election bid in November, a financial pandemic continues to undercut the real economy and national income.

BOC Holds Steady, Sees Slow And Uncertain Economic Recovery

seekingalpha.com

2020-07-16 10:17:04Bank of Canada leaves rates unchanged at 0.25%. A risk to the BoC's outlook is a big second wave of the virus.

Moving To New Steady State

seekingalpha.com

2020-07-14 01:48:03My argument has been that economies would return to a steady state path, with certain industries crippled (e.g., mass tourism), but other industries able to operate.

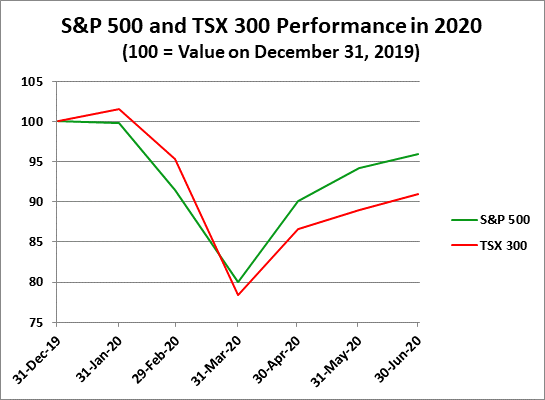

Monthly Newsletter - June 2020

seekingalpha.com

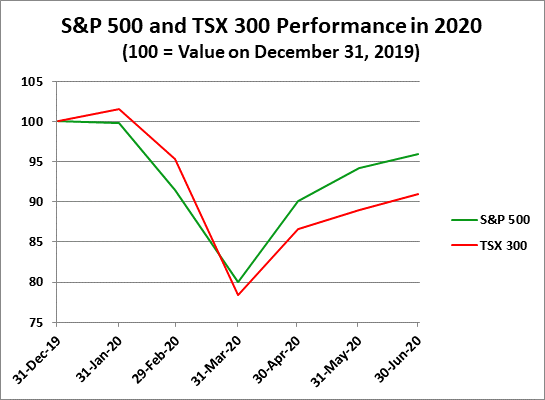

2020-07-12 10:27:43Most investors would say that a drop of less than 5% for the S&P 500 is no big deal over half a year, nor is the less pleasant but not extraordinary drawdown of 9% for the TSX.

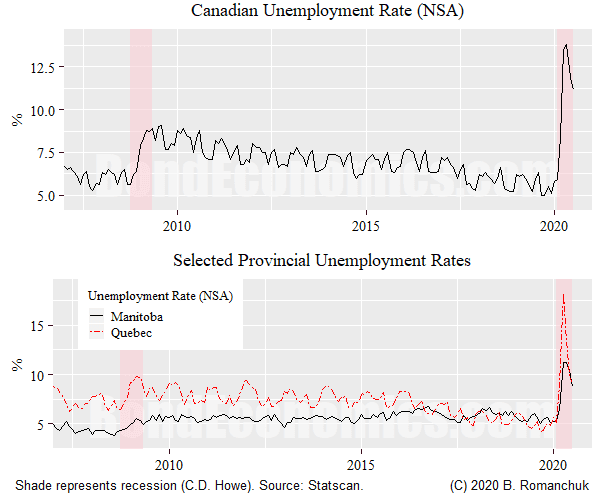

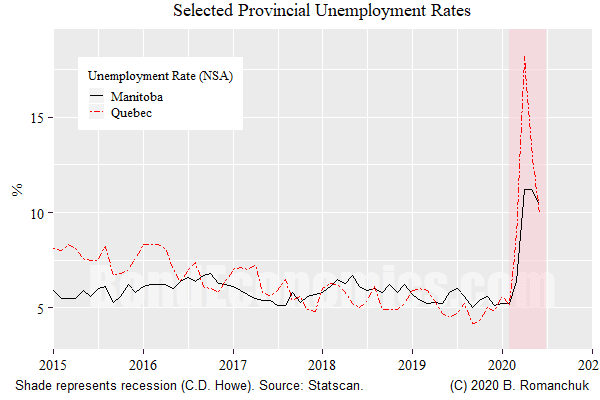

Canada Bounces Back With 1 Million Jobs. But Still A Long Way To Go

seekingalpha.com

2020-07-12 05:29:02Is the big jobs rebound in Canada a positive sign for economic recovery? Sentiment for business investment in Canada.

No data to display

First Trust Announces Expected Effective Date of ETF Reorganization

businesswire.com

2020-10-29 16:31:00WHEATON, Ill.--(BUSINESS WIRE)--First Trust Advisors L.P. (“FTA”) announced today that, subject to the satisfaction of certain customary closing conditions, the reorganization of First Trust Australia AlphaDEX® Fund (NYSE Arca: FAUS), First Trust Canada AlphaDEX® Fund (Nasdaq: FCAN), First Trust Hong Kong AlphaDEX® Fund (Nasdaq: FHK), and First Trust South Korea AlphaDEX® Fund (Nasdaq: FKO), each an index based exchange-traded fund (“ETF”), managed by FTA, into First Trust Developed Markets ex-

Canada's Resilience: The Recovery Starts Showing The 'Swoosh'

seekingalpha.com

2020-09-12 14:25:51Canada could outperform the U.S. economy in the second half of 2020.

Canadian Big Bank Resiliency: Is The Worst Behind Us?

seekingalpha.com

2020-09-11 06:05:42Signs of recovery for Canadian big banks. Will strong trading revenues for banks last? Canadian big bank stocks poised to play catch up..

Bank Of Canada Keeps Key Interest Rate Target On Hold

seekingalpha.com

2020-09-10 07:30:51Bank of Canada keeps rates unchanged at 0.25%. Uncertainty remains as Canadian economy moves into recuperation phase.

Comments On Canadian Inflation Risks

seekingalpha.com

2020-08-23 13:04:32There has been a cabinet shuffle in Canada. Newspaper reports hint at philosophical changes, moving towards a more free-spending strategy.

Government-Boosted Economy Approaches Next Hard Return

seekingalpha.com

2020-08-19 06:20:21On top of government-sanctioned deferral programs for mortgages, other debts and rents, the Canada Emergency Response Benefit doled out $2,000 per month to keep Canadians spending since the end of March.

Canada's Trade Deficit Widens. But Can A Rebound Be Near?

seekingalpha.com

2020-08-19 05:12:57Compared with their pre-pandemic levels, nominal exports and imports are well below February levels. Trade with the U.S.

Winners And Losers From Shifting Canadian Consumer Trends

seekingalpha.com

2020-07-28 10:53:52Consumer spending trends as re-openings begin. Business spending lags consumers but still trending up.

Canada's Slowing Population Growth And The Impact On Housing

seekingalpha.com

2020-07-25 04:23:24The COVID-19 pandemic is causing Canada's immigration to plunge. Lower immigration levels in Canada could create a long-term drag on housing.

Household Behavior Shifts: Positive Longer Term, Negative For Economy Near Term

seekingalpha.com

2020-07-22 08:18:11Half of the independent Canadian restaurants recently surveyed say that they are unlikely to survive the current crisis.

First Trust Canada AlphaDEX Fund (NASDAQ:FCAN) Shares Up 3.5%

thelincolnianonline.com

2020-07-18 01:26:41First Trust Canada AlphaDEX Fund (NASDAQ:FCAN) shares shot up 3.5% during mid-day trading on Friday . The company traded as high as $20.71 and last traded at $20.71, 900 shares changed hands during mid-day trading. A decline of 17% from the average session volume of 1,087 shares. The stock had previously closed at $20.01. The […]

Banks And Borrowers Not In Quick Recovery

seekingalpha.com

2020-07-16 19:48:30As the Trump admin works daily to prop up the stock market as key to its re-election bid in November, a financial pandemic continues to undercut the real economy and national income.

BOC Holds Steady, Sees Slow And Uncertain Economic Recovery

seekingalpha.com

2020-07-16 10:17:04Bank of Canada leaves rates unchanged at 0.25%. A risk to the BoC's outlook is a big second wave of the virus.

Moving To New Steady State

seekingalpha.com

2020-07-14 01:48:03My argument has been that economies would return to a steady state path, with certain industries crippled (e.g., mass tourism), but other industries able to operate.

Monthly Newsletter - June 2020

seekingalpha.com

2020-07-12 10:27:43Most investors would say that a drop of less than 5% for the S&P 500 is no big deal over half a year, nor is the less pleasant but not extraordinary drawdown of 9% for the TSX.

Canada Bounces Back With 1 Million Jobs. But Still A Long Way To Go

seekingalpha.com

2020-07-12 05:29:02Is the big jobs rebound in Canada a positive sign for economic recovery? Sentiment for business investment in Canada.