Eagle Materials Inc. (EXP)

Price:

225.80 USD

( - -5.89 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Martin Marietta Materials, Inc.

VALUE SCORE:

7

2nd position

Amrize Ltd

VALUE SCORE:

8

The best

Tecnoglass Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Eagle Materials Inc., through its subsidiaries, produces and supplies heavy construction materials and light building materials in the United States. It operates through Cement, Concrete and Aggregates, Gypsum Wallboard, and Recycled Paperboard segments. The company engages in the mining of limestone for the manufacture, production, distribution, and sale of Portland cement; grinding and sale of slag; and mining of gypsum for the manufacture and sale of gypsum wallboards used to finish the interior walls and ceilings in residential, commercial, and industrial structures. It also manufactures and sells recycled paperboard to gypsum wallboard industry and other paperboard converters, as well as containerboard and lightweight packaging grades. In addition, the company engages in the sale of ready-mix concrete; and mining, extracting, production, and sale of aggregates, including crushed stones, sand, and gravel. Its products are used in commercial and residential construction; public construction projects; and projects to build, expand, and repair roads and highways. The company was formerly known as Centex Construction Products, Inc. and changed its name to Eagle Materials, Inc. in January 2004. Eagle Materials Inc. was founded in 1963 and is headquartered in Dallas, Texas.

NEWS

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Blackstone, Blue Owl Capital, Booking Holdings, Cheniere Energy, Comcast, Domino’s Pizza, KeyCorp, Qualcomm, and More

247wallst.com

2026-02-24 08:00:47Pre-Market Stock Futures: Futures are trading higher this morning after a dreadful day to start the trading week. Various reasons were cited for the risk-off bias on Monday, but the tariff situation, which the President raised to 15% from 10% over the weekend after the Supreme Court struck it down last Friday, was one of... Here Are Tuesday's Top Wall Street Analyst Research Calls: Blackstone, Blue Owl Capital, Booking Holdings, Cheniere Energy, Comcast, Domino's Pizza, KeyCorp, Qualcomm, and More.

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Albemarle, BitGo Holdings, Chevron, Dollar General, Equifax, Shopify, Southwest Airlines, Visa, and More

247wallst.com

2026-02-17 07:49:48Pre-Market Stock Futures: Futures are trading lower as investors and traders return from the three-day holiday break, after a wild week that saw just about everything. The catalyst on Friday was that the January consumer price index data came in below estimates at 2.4%. While anyone buying beef recently would dispute that inflation is lower,... Here Are Tuesday's Top Wall Street Analyst Research Calls: Albemarle, BitGo Holdings, Chevron, Dollar General, Equifax, Shopify, Southwest Airlines, Visa, and More.

Why a $104 Million Allocation to Eagle Materials Stock Could Signal Confidence in Construction's Next Cycle

fool.com

2026-02-14 12:27:39Black Creek Investment Management acquired 502,120 shares in Eagle Materials during the fourth quarter. The quarter-end position value increased by $103.78 million due to the new share purchase.

Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 (CRESW) Q2 2026 Earnings Call Transcript

seekingalpha.com

2026-02-10 18:44:24Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 (CRESW) Q2 2026 Earnings Call Transcript

Eagle Materials Declares Quarterly Dividend

businesswire.com

2026-02-10 16:15:00DALLAS--(BUSINESS WIRE)--The Board of Directors of Eagle Materials Inc. (NYSE: EXP) has declared a quarterly cash dividend of $0.25 per share, payable on April 13, 2026, to stockholders of record of its Common Stock at the close of business on March 16, 2026. About Eagle Materials Inc. Eagle Materials Inc. is a leading U.S. manufacturer of heavy construction products and light building materials. Eagle's primary products, Portland Cement and Gypsum Wallboard, are essential for building, expandi.

Harbor SMID Cap Value ETF Q4 2025 Performance Review

seekingalpha.com

2026-02-10 14:20:00Timken remains a compelling investment as it supplies essential components that customers cannot easily replace. MDU remains an attractive investment as electricity demand continues to rise, particularly from energy-intensive industries such as data centers locating in the central United States. During the quarter, Raymond James' shares declined by 7.0% despite adjusted earnings exceeding consensus expectations by 10%, reflecting investor focus on near-term margin pressure rather than underlying business momentum.

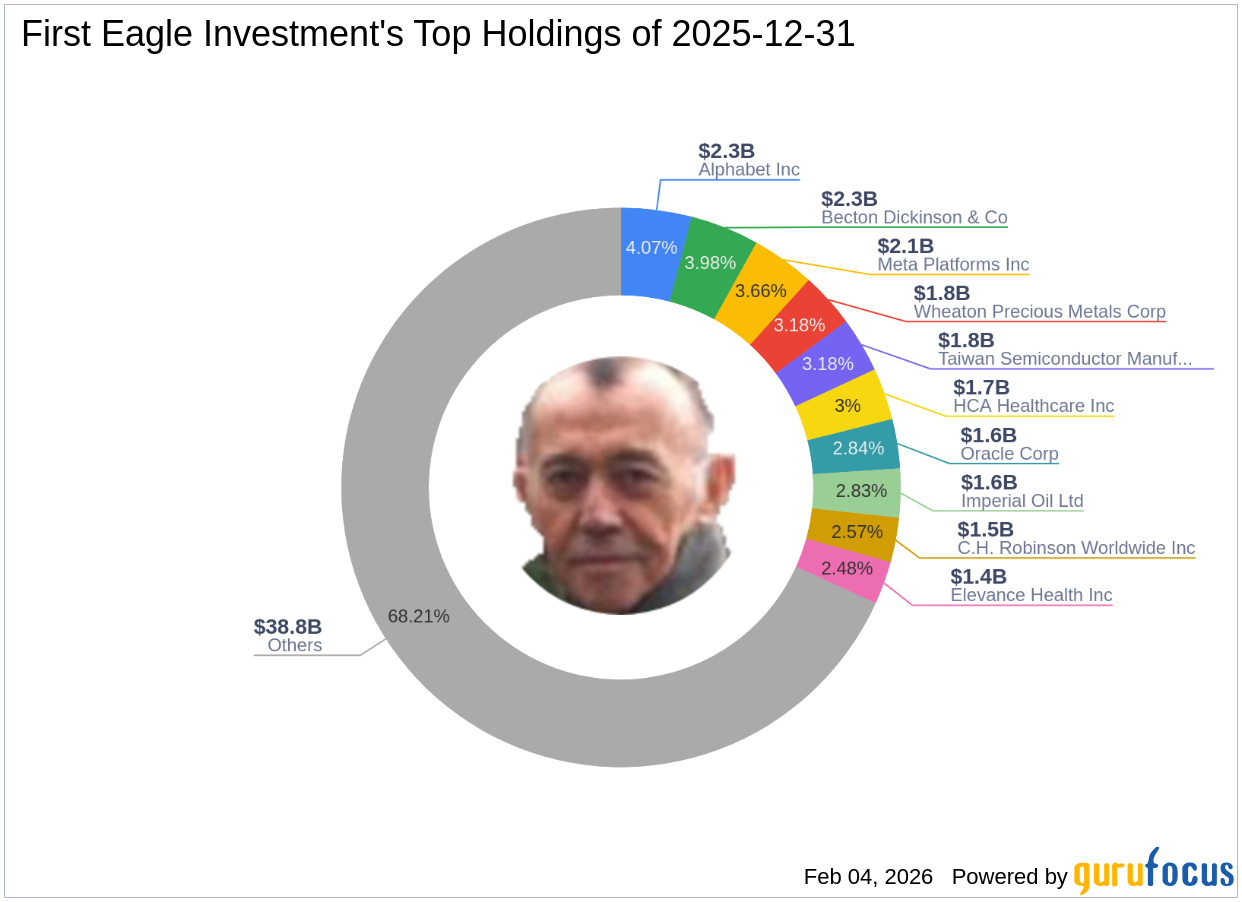

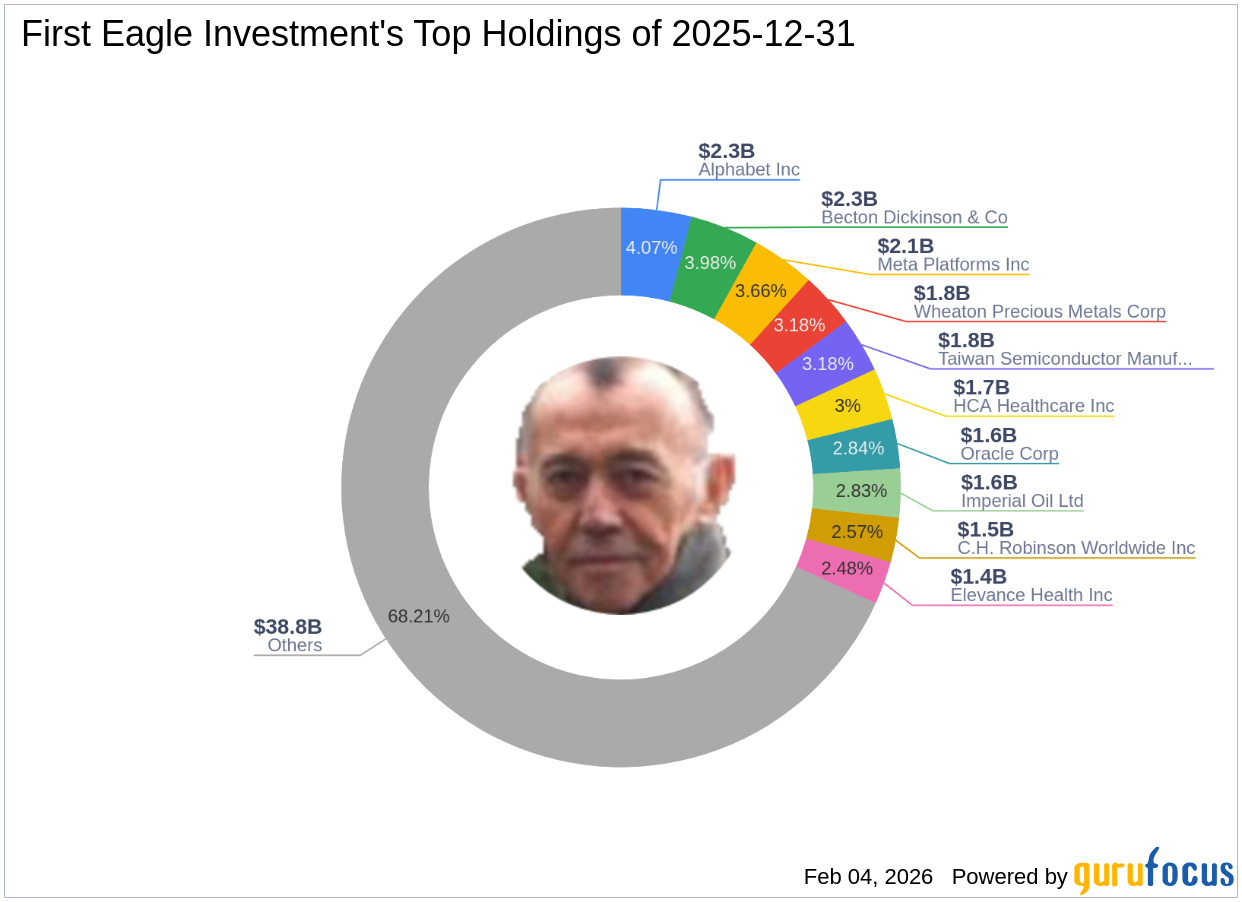

Weyerhaeuser Co: A Significant Addition to First Eagle Investment's Portfolio

gurufocus.com

2026-02-04 17:02:00First Eagle Investment (Trades, Portfolio)'s Strategic Moves in Q4 2025 First Eagle Investment (Trades, Portfolio) recently submitted its 13F filing for the fo

Eagle Materials: Heavy Materials Strength Offsets Wallboard Weakness

seekingalpha.com

2026-02-04 16:23:15Eagle Materials Inc. reported flat Q3 '26 revenue and missed EPS, with heavy materials strength offset by wallboard weakness. EXP maintains a solid balance sheet, low leverage, and active buybacks, but elevated capex is directed toward major growth projects. Heavy materials benefit from infrastructure and nonresidential demand, while wallboard faces ongoing residential headwinds and pricing pressure.

Electra Awards $6.1 Million Contract to EXP Services for Project Management and Engineering Support at Ontario Refinery

globenewswire.com

2026-02-03 07:00:00TORONTO, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V: ELBM) (“Electra” or the “Company”) has awarded a US$6.1 million (C$8.3 million) contract to EXP Services Inc. ("EXP") to provide engineering, project management, and construction management services during the construction phase of Electra's Ontario battery materials refinery project.

Principal Financial Group Inc. Grows Stock Position in Eagle Materials Inc $EXP

defenseworld.net

2026-02-03 03:12:57Principal Financial Group Inc. raised its position in Eagle Materials Inc (NYSE: EXP) by 14.6% in the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 511,372 shares of the construction company's stock after acquiring an additional 65,072 shares during the quarter.

Harbor Mid Cap Value ETF Q4 2025 Performance Drivers And Trading Highlights

seekingalpha.com

2026-01-30 10:45:00In the fourth quarter of 2025, the Harbor Mid Cap Value ETF returned 2.00% (NAV), outperforming its benchmark, the Russell Midcap® Value Index. We added Eagle Materials to the portfolio during the quarter, a U.S.-focused manufacturer of essential construction materials, including cement, wallboard, and aggregates. We sold Sealed Air Corporation during the quarter due to crowding out, a packaging solutions company providing protective, food, and specialty packaging products.

Compared to Estimates, Eagle Materials (EXP) Q3 Earnings: A Look at Key Metrics

zacks.com

2026-01-29 13:01:25Although the revenue and EPS for Eagle Materials (EXP) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Eagle Materials Inc. (EXP) Q3 2026 Earnings Call Transcript

seekingalpha.com

2026-01-29 11:22:21Eagle Materials Inc. (EXP) Q3 2026 Earnings Call Transcript

Eagle Materials (EXP) Q3 Earnings Lag Estimates

zacks.com

2026-01-29 08:46:07Eagle Materials (EXP) came out with quarterly earnings of $3.22 per share, missing the Zacks Consensus Estimate of $3.32 per share. This compares to earnings of $3.59 per share a year ago.

Eagle Materials Reports Third Quarter Results

businesswire.com

2026-01-29 06:30:00DALLAS--(BUSINESS WIRE)--Eagle Materials Inc. (NYSE: EXP) today reported financial results for the third quarter of fiscal 2026 ended December 31, 2025. Notable items for the quarter are highlighted below (unless otherwise noted, all comparisons are with the prior year's fiscal third quarter). Third Quarter Fiscal 2026 Highlights Revenue of $556.0 million Net Earnings of $102.9 million Net Earnings per share of $3.22 Adjusted EBITDA of $190.1 million Adjusted EBITDA is a non-GAAP financial meas.

Eagle Materials Inc $EXP Position Increased by Federated Hermes Inc.

defenseworld.net

2026-01-29 04:24:56Federated Hermes Inc. boosted its stake in shares of Eagle Materials Inc (NYSE: EXP) by 0.6% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 463,693 shares of the construction company's stock after purchasing an additional 2,772 shares during the quarter. Federated

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Blackstone, Blue Owl Capital, Booking Holdings, Cheniere Energy, Comcast, Domino’s Pizza, KeyCorp, Qualcomm, and More

247wallst.com

2026-02-24 08:00:47Pre-Market Stock Futures: Futures are trading higher this morning after a dreadful day to start the trading week. Various reasons were cited for the risk-off bias on Monday, but the tariff situation, which the President raised to 15% from 10% over the weekend after the Supreme Court struck it down last Friday, was one of... Here Are Tuesday's Top Wall Street Analyst Research Calls: Blackstone, Blue Owl Capital, Booking Holdings, Cheniere Energy, Comcast, Domino's Pizza, KeyCorp, Qualcomm, and More.

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Albemarle, BitGo Holdings, Chevron, Dollar General, Equifax, Shopify, Southwest Airlines, Visa, and More

247wallst.com

2026-02-17 07:49:48Pre-Market Stock Futures: Futures are trading lower as investors and traders return from the three-day holiday break, after a wild week that saw just about everything. The catalyst on Friday was that the January consumer price index data came in below estimates at 2.4%. While anyone buying beef recently would dispute that inflation is lower,... Here Are Tuesday's Top Wall Street Analyst Research Calls: Albemarle, BitGo Holdings, Chevron, Dollar General, Equifax, Shopify, Southwest Airlines, Visa, and More.

Why a $104 Million Allocation to Eagle Materials Stock Could Signal Confidence in Construction's Next Cycle

fool.com

2026-02-14 12:27:39Black Creek Investment Management acquired 502,120 shares in Eagle Materials during the fourth quarter. The quarter-end position value increased by $103.78 million due to the new share purchase.

Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 (CRESW) Q2 2026 Earnings Call Transcript

seekingalpha.com

2026-02-10 18:44:24Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria WT EXP 030926 (CRESW) Q2 2026 Earnings Call Transcript

Eagle Materials Declares Quarterly Dividend

businesswire.com

2026-02-10 16:15:00DALLAS--(BUSINESS WIRE)--The Board of Directors of Eagle Materials Inc. (NYSE: EXP) has declared a quarterly cash dividend of $0.25 per share, payable on April 13, 2026, to stockholders of record of its Common Stock at the close of business on March 16, 2026. About Eagle Materials Inc. Eagle Materials Inc. is a leading U.S. manufacturer of heavy construction products and light building materials. Eagle's primary products, Portland Cement and Gypsum Wallboard, are essential for building, expandi.

Harbor SMID Cap Value ETF Q4 2025 Performance Review

seekingalpha.com

2026-02-10 14:20:00Timken remains a compelling investment as it supplies essential components that customers cannot easily replace. MDU remains an attractive investment as electricity demand continues to rise, particularly from energy-intensive industries such as data centers locating in the central United States. During the quarter, Raymond James' shares declined by 7.0% despite adjusted earnings exceeding consensus expectations by 10%, reflecting investor focus on near-term margin pressure rather than underlying business momentum.

Weyerhaeuser Co: A Significant Addition to First Eagle Investment's Portfolio

gurufocus.com

2026-02-04 17:02:00First Eagle Investment (Trades, Portfolio)'s Strategic Moves in Q4 2025 First Eagle Investment (Trades, Portfolio) recently submitted its 13F filing for the fo

Eagle Materials: Heavy Materials Strength Offsets Wallboard Weakness

seekingalpha.com

2026-02-04 16:23:15Eagle Materials Inc. reported flat Q3 '26 revenue and missed EPS, with heavy materials strength offset by wallboard weakness. EXP maintains a solid balance sheet, low leverage, and active buybacks, but elevated capex is directed toward major growth projects. Heavy materials benefit from infrastructure and nonresidential demand, while wallboard faces ongoing residential headwinds and pricing pressure.

Electra Awards $6.1 Million Contract to EXP Services for Project Management and Engineering Support at Ontario Refinery

globenewswire.com

2026-02-03 07:00:00TORONTO, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V: ELBM) (“Electra” or the “Company”) has awarded a US$6.1 million (C$8.3 million) contract to EXP Services Inc. ("EXP") to provide engineering, project management, and construction management services during the construction phase of Electra's Ontario battery materials refinery project.

Principal Financial Group Inc. Grows Stock Position in Eagle Materials Inc $EXP

defenseworld.net

2026-02-03 03:12:57Principal Financial Group Inc. raised its position in Eagle Materials Inc (NYSE: EXP) by 14.6% in the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 511,372 shares of the construction company's stock after acquiring an additional 65,072 shares during the quarter.

Harbor Mid Cap Value ETF Q4 2025 Performance Drivers And Trading Highlights

seekingalpha.com

2026-01-30 10:45:00In the fourth quarter of 2025, the Harbor Mid Cap Value ETF returned 2.00% (NAV), outperforming its benchmark, the Russell Midcap® Value Index. We added Eagle Materials to the portfolio during the quarter, a U.S.-focused manufacturer of essential construction materials, including cement, wallboard, and aggregates. We sold Sealed Air Corporation during the quarter due to crowding out, a packaging solutions company providing protective, food, and specialty packaging products.

Compared to Estimates, Eagle Materials (EXP) Q3 Earnings: A Look at Key Metrics

zacks.com

2026-01-29 13:01:25Although the revenue and EPS for Eagle Materials (EXP) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Eagle Materials Inc. (EXP) Q3 2026 Earnings Call Transcript

seekingalpha.com

2026-01-29 11:22:21Eagle Materials Inc. (EXP) Q3 2026 Earnings Call Transcript

Eagle Materials (EXP) Q3 Earnings Lag Estimates

zacks.com

2026-01-29 08:46:07Eagle Materials (EXP) came out with quarterly earnings of $3.22 per share, missing the Zacks Consensus Estimate of $3.32 per share. This compares to earnings of $3.59 per share a year ago.

Eagle Materials Reports Third Quarter Results

businesswire.com

2026-01-29 06:30:00DALLAS--(BUSINESS WIRE)--Eagle Materials Inc. (NYSE: EXP) today reported financial results for the third quarter of fiscal 2026 ended December 31, 2025. Notable items for the quarter are highlighted below (unless otherwise noted, all comparisons are with the prior year's fiscal third quarter). Third Quarter Fiscal 2026 Highlights Revenue of $556.0 million Net Earnings of $102.9 million Net Earnings per share of $3.22 Adjusted EBITDA of $190.1 million Adjusted EBITDA is a non-GAAP financial meas.

Eagle Materials Inc $EXP Position Increased by Federated Hermes Inc.

defenseworld.net

2026-01-29 04:24:56Federated Hermes Inc. boosted its stake in shares of Eagle Materials Inc (NYSE: EXP) by 0.6% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 463,693 shares of the construction company's stock after purchasing an additional 2,772 shares during the quarter. Federated