WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

Price:

67.16 USD

( - -0.18 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Vanguard Total International Bond Index Fd Admiral Shs

VALUE SCORE:

10

2nd position

Vanguard Emerging Markets Bond Fund Investor Shares

VALUE SCORE:

12

The best

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Under normal circumstances, the fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in corporate debt. The manager attempts to maintain an aggregate portfolio duration of between two and ten years under normal market conditions. The fund may invest up to 20% of its net assets in derivatives, such as swaps and forward currency contracts. It is non-diversified.

NEWS

Rising Titans: The Allure of Emerging Market Corporates

etftrends.com

2024-03-16 10:54:45By Behnood Noei, CFA Director, Fixed Income In 2023, a dominant theme for markets was the return of income in fixed income. Fast-forward to 2024, and despite a significant rally in spreads and a fall in yields during the fourth quarter, we believe this theme is still alive and well.

Spotting Opportunities And Risks Across The EM Investment Universe

seekingalpha.com

2022-08-31 11:40:00In emerging markets valuations look attractive today after the losses across financial markets early this year. PIMCO's investment process is founded upon our macroeconomic outlook and our in-house country and credit research.

Technical Tailwinds May Lift EMFX

seekingalpha.com

2021-11-30 13:45:00Performance of emerging markets local currency bonds has been negatively impacted by the U.S. dollar's strength since mid-year, despite the higher real yields and upside growth surprises in many emerging markets. Currency returns can be volatile, and external factors can have a bigger short-term impact on an emerging markets currency (EMFX) even if relatively attractive fundamentals may provide longer-term support.

CEF Weekly Market Review: Market Shrugs Off Treasury Weakness

seekingalpha.com

2021-10-17 02:38:41We review CEF market valuation and performance over the first full week of October and highlight recent market events. The CEF market took advantage of the rally in stocks and mostly shrugged off the continued rise in Treasury yields.

Foreign Bond ETFs Are Having A Tough Year

seekingalpha.com

2021-09-30 09:37:00International diversification for bond allocations is, in theory, an attractive concept, but in practice it's not working out so great in 2021 for US investors, based on a set of ETFs. A key headwind for foreign bonds is the rebound in the US dollar.

The Green Bond Potential In Emerging Markets

seekingalpha.com

2021-09-16 02:05:00We have seen a sharp growth in the issuance of not only green bonds but also sustainability bonds and social bonds, which are closely related. When thinking about issuance outside of the corporate space, sovereigns and state-owned enterprises in Latin America are leading in that respect, with Asia closely following.

3 Segments, Multiple Opportunities In Emerging Markets

seekingalpha.com

2021-04-27 11:05:50Emerging markets offer attractive alternatives to fixed income investors searching for yield amid the trillions of dollars of negative-, zero-, and low-yielding debt globally. Within emerging market hard currency investment grade bonds, we think it is prudent to be shorter duration or at least hedge the Treasury risk component, given the low yield per unit of duration today.

Giving Credit Where It's Due

seekingalpha.com

2021-04-15 00:11:27Giving Credit Where It's Due

When High Spreads Mean ETFs Work

etf.com

2020-10-28 08:50:00There's something comforting about the list of the ETFs with the highest trading spreads.

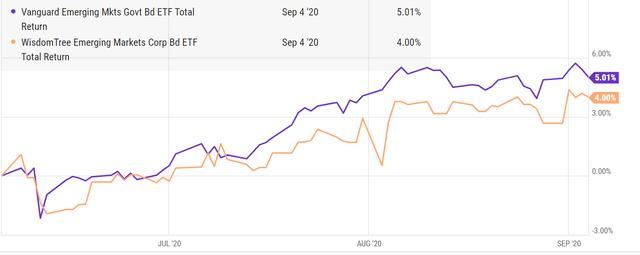

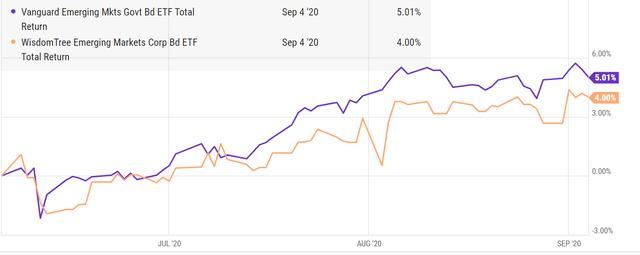

Vanguard Emerging Markets Government Bond ETF: Riding The Weak Dollar To New Highs

seekingalpha.com

2020-09-09 19:02:49The US dollar has weakened in 2020 and conditions point toward further weakness. EM government bonds historically carry less volatility and risk than EM corporate bonds.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEARCA:DGS) Stock Price Passes Above 200 Day Moving Average of $41.20

thelincolnianonline.com

2020-06-10 03:32:45WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEARCA:DGS) shares crossed above its 200-day moving average during trading on Tuesday . The stock has a 200-day moving average of $41.20 and traded as high as $41.28. WisdomTree Emerging Markets SmallCap Dividend Fund shares last traded at $41.28, with a volume of 158,900 shares. The firm has a […]

SEBI Allows Some Debt Funds To Increase Investment In Govt Bonds

goodreturns.in

2020-05-19 07:15:47In line with the demands of the mutual fund industry body, in a letter to the Association of Mutual Funds of India (AMFI), SEBI said that asset management companies (AMCs) can invest additional 15 percent of the AUM (assets under management) of Corporate Bond Fund, Banking and PSU Fund and Credit Risk Fund in G-Secs an

No data to display

Rising Titans: The Allure of Emerging Market Corporates

etftrends.com

2024-03-16 10:54:45By Behnood Noei, CFA Director, Fixed Income In 2023, a dominant theme for markets was the return of income in fixed income. Fast-forward to 2024, and despite a significant rally in spreads and a fall in yields during the fourth quarter, we believe this theme is still alive and well.

Spotting Opportunities And Risks Across The EM Investment Universe

seekingalpha.com

2022-08-31 11:40:00In emerging markets valuations look attractive today after the losses across financial markets early this year. PIMCO's investment process is founded upon our macroeconomic outlook and our in-house country and credit research.

Technical Tailwinds May Lift EMFX

seekingalpha.com

2021-11-30 13:45:00Performance of emerging markets local currency bonds has been negatively impacted by the U.S. dollar's strength since mid-year, despite the higher real yields and upside growth surprises in many emerging markets. Currency returns can be volatile, and external factors can have a bigger short-term impact on an emerging markets currency (EMFX) even if relatively attractive fundamentals may provide longer-term support.

CEF Weekly Market Review: Market Shrugs Off Treasury Weakness

seekingalpha.com

2021-10-17 02:38:41We review CEF market valuation and performance over the first full week of October and highlight recent market events. The CEF market took advantage of the rally in stocks and mostly shrugged off the continued rise in Treasury yields.

Foreign Bond ETFs Are Having A Tough Year

seekingalpha.com

2021-09-30 09:37:00International diversification for bond allocations is, in theory, an attractive concept, but in practice it's not working out so great in 2021 for US investors, based on a set of ETFs. A key headwind for foreign bonds is the rebound in the US dollar.

The Green Bond Potential In Emerging Markets

seekingalpha.com

2021-09-16 02:05:00We have seen a sharp growth in the issuance of not only green bonds but also sustainability bonds and social bonds, which are closely related. When thinking about issuance outside of the corporate space, sovereigns and state-owned enterprises in Latin America are leading in that respect, with Asia closely following.

3 Segments, Multiple Opportunities In Emerging Markets

seekingalpha.com

2021-04-27 11:05:50Emerging markets offer attractive alternatives to fixed income investors searching for yield amid the trillions of dollars of negative-, zero-, and low-yielding debt globally. Within emerging market hard currency investment grade bonds, we think it is prudent to be shorter duration or at least hedge the Treasury risk component, given the low yield per unit of duration today.

Giving Credit Where It's Due

seekingalpha.com

2021-04-15 00:11:27Giving Credit Where It's Due

When High Spreads Mean ETFs Work

etf.com

2020-10-28 08:50:00There's something comforting about the list of the ETFs with the highest trading spreads.

Vanguard Emerging Markets Government Bond ETF: Riding The Weak Dollar To New Highs

seekingalpha.com

2020-09-09 19:02:49The US dollar has weakened in 2020 and conditions point toward further weakness. EM government bonds historically carry less volatility and risk than EM corporate bonds.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEARCA:DGS) Stock Price Passes Above 200 Day Moving Average of $41.20

thelincolnianonline.com

2020-06-10 03:32:45WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEARCA:DGS) shares crossed above its 200-day moving average during trading on Tuesday . The stock has a 200-day moving average of $41.20 and traded as high as $41.28. WisdomTree Emerging Markets SmallCap Dividend Fund shares last traded at $41.28, with a volume of 158,900 shares. The firm has a […]

SEBI Allows Some Debt Funds To Increase Investment In Govt Bonds

goodreturns.in

2020-05-19 07:15:47In line with the demands of the mutual fund industry body, in a letter to the Association of Mutual Funds of India (AMFI), SEBI said that asset management companies (AMCs) can invest additional 15 percent of the AUM (assets under management) of Corporate Bond Fund, Banking and PSU Fund and Credit Risk Fund in G-Secs an