Eaton Vance 2021 Target Term Trust (EHT)

Price:

9.84 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Citigroup Capital XIII TR PFD SECS

VALUE SCORE:

6

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

ClearBridge Energy Midstream Opportunity Fund Inc

VALUE SCORE:

15

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Eaton Vance High Income 2021 Target Term Trust is a diversified, closed-end management investment company. The Company's investment objectives are high current income and to return $9.85 per share, the original net asset value per common share before deducting offering costs of $0.02 per common share (Original NAV), to holders of common shares on or about July 1, 2021. Its portfolio includes investments in energy, healthcare, telecommunications, technology, gaming, air transportation, diversified financial services, steel, containers, and cable/satellite television (TV) sectors. Eaton Vance Management is the investment advisor of the Company.

NEWS

Eaton Vance 2021 Target Term Trust Announces Termination and Liquidation

prnewswire.com

2021-07-02 16:01:00BOSTON, July 2, 2021 /PRNewswire/ -- Eaton Vance 2021 Target Term Trust (NYSE: EHT) (the "Trust") was terminated and liquidated following the close of business on July 1, 2021. The termination and liquidation occurred in accordance with the Trust's investment objectives and organizational documents, consistent with the Trust's previously announced liquidation plans.

EHT Is Terminating - Investors Have Options For Their Funds

seekingalpha.com

2021-06-09 21:10:17Target Term funds start life with a set date to end, sometimes with one extension, with the goal of returning the original NAV. EHT is honoring the July date. Since late 2020 when the July termination was confirmed, EHT has been in the process of changing its asset mix in preparation for this event.

Eaton Vance 2021 Target Term Trust Announces Liquidation Details

prnewswire.com

2021-06-01 16:01:00BOSTON, June 1, 2021 /PRNewswire/ -- Eaton Vance 2021 Target Term Trust (NYSE: EHT) (the "Trust") announced today new details concerning its liquidation. Consistent with its investment objectives and organizational documents, the Trust plans to terminate its existence and liquidate on or about July 1, 2021.

8 Closed-End Fund Buys In December To Finish Out A Volatile Year

seekingalpha.com

2021-01-15 06:12:25For the broader indexes, December continued along its upward momentum. Overall, the market seems to be quite lofty at these levels, so keeping a cash allocation could be appropriate.

EHT And JHB: 2 Target Term 2021 CEFs With 4%-5% Annualized Return Remaining

seekingalpha.com

2020-12-31 12:25:43EHT is due to liquidate on July 1, 2021, while JHB is set to terminate on Nov.r 1, 2021. EHT surprisingly boosted its distribution by +60% this month, bucking the trend for target term funds.

Weekly Closed-End Fund Roundup: September 6, 2020

seekingalpha.com

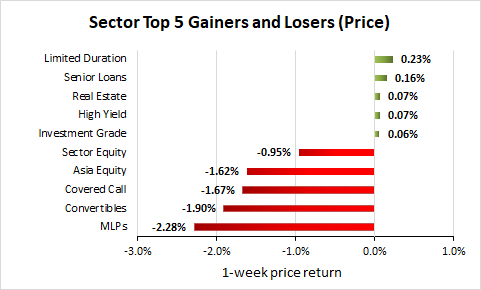

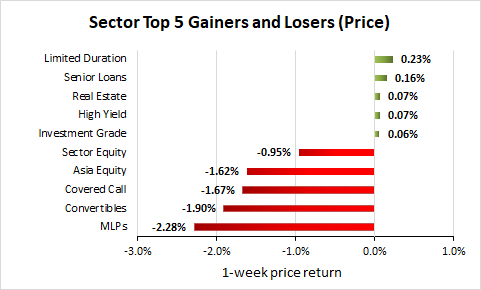

2020-09-13 04:32:185 out of 23 CEF sectors positive on price and 7 out of 23 sectors positive on NAV last week. Risk-off as MLPs and convertibles lag.

Eaton Vance (NYSE:EV) PT Raised to $42.00

thelincolnianonline.com

2020-08-22 07:58:46Eaton Vance (NYSE:EV) had its target price hoisted by investment analysts at Citigroup from $36.00 to $42.00 in a research note issued to investors on Thursday, The Fly reports. The firm presently has a “neutral” rating on the asset manager’s stock. Citigroup‘s price objective indicates a potential upside of 9.35% from the company’s current price. […]

Steward Partners Investment Advisory LLC Purchases 21,495 Shares of EATON VANCE MUN/SHS (NYSE:ETX)

thelincolnianonline.com

2020-08-22 07:28:45Steward Partners Investment Advisory LLC lifted its position in shares of EATON VANCE MUN/SHS (NYSE:ETX) by 222.2% during the second quarter, Holdings Channel.com reports. The institutional investor owned 31,169 shares of the investment management company’s stock after acquiring an additional 21,495 shares during the quarter. Steward Partners Investment Advisory LLC’s holdings in EATON VANCE MUN/SHS […]

Weekly Closed-End Fund Roundup: August 2, 2020

seekingalpha.com

2020-08-11 10:06:5721 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Commodities lead as precious metals rally.

Vident Investment Advisory LLC Has $569,000 Stock Position in Eaton Vance Corp (NYSE:EV)

thelincolnianonline.com

2020-08-09 23:46:44Vident Investment Advisory LLC reduced its position in Eaton Vance Corp (NYSE:EV) by 60.0% in the 2nd quarter, HoldingsChannel reports. The firm owned 14,735 shares of the asset manager’s stock after selling 22,084 shares during the period. Vident Investment Advisory LLC’s holdings in Eaton Vance were worth $569,000 as of its most recent filing with […]

Monthly Review Of DivGro: July 2020

seekingalpha.com

2020-08-05 13:15:00In this article, I review my portfolio of dividend growth stocks, DivGro. I provide a summary of transactions and show how those transactions affect DivGro's projected annual dividend income.

Cambridge Investment Research Advisors Inc. Sells 19,881 Shares of Eaton Vance Senior Floating-Rate Trust (NYSE:EFR)

thelincolnianonline.com

2020-08-05 07:40:50Cambridge Investment Research Advisors Inc. lessened its stake in Eaton Vance Senior Floating-Rate Trust (NYSE:EFR) by 12.9% in the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 134,393 shares of the company’s stock after selling 19,881 shares during the period. Cambridge Investment […]

Raymond James & Associates Has $11.78 Million Holdings in Eaton Vance Tax-Managed Global Buy-Write (NYSE:ETW)

thelincolnianonline.com

2020-08-04 06:50:43Raymond James & Associates grew its holdings in Eaton Vance Tax-Managed Global Buy-Write (NYSE:ETW) by 4.5% during the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,361,331 shares of the company’s stock after purchasing an additional 58,651 shares during the period. Raymond James & Associates’ holdings […]

Weekly Closed-End Fund Roundup: July 26, 2020

seekingalpha.com

2020-08-03 13:49:1421 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Boosts to USA/ASG, and the Flaherty & Crumrine funds.

Eaton Vance Corp (NYSE:EV) Shares Sold by Nisa Investment Advisors LLC

thelincolnianonline.com

2020-08-03 08:14:41Nisa Investment Advisors LLC lowered its stake in Eaton Vance Corp (NYSE:EV) by 3.2% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 36,230 shares of the asset manager’s stock after selling 1,200 shares during the quarter. Nisa Investment Advisors LLC’s holdings in […]

Eaton Vance Tax-Advantaged Global Dvd. (NYSE:ETG) Shares Purchased by Janney Montgomery Scott LLC

thelincolnianonline.com

2020-08-03 07:16:55Janney Montgomery Scott LLC grew its stake in shares of Eaton Vance Tax-Advantaged Global Dvd. (NYSE:ETG) by 5.2% during the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 95,790 shares of the company’s stock after acquiring an additional 4,697 shares […]

Eaton Vance 2021 Target Term Trust Announces Termination and Liquidation

prnewswire.com

2021-07-02 16:01:00BOSTON, July 2, 2021 /PRNewswire/ -- Eaton Vance 2021 Target Term Trust (NYSE: EHT) (the "Trust") was terminated and liquidated following the close of business on July 1, 2021. The termination and liquidation occurred in accordance with the Trust's investment objectives and organizational documents, consistent with the Trust's previously announced liquidation plans.

EHT Is Terminating - Investors Have Options For Their Funds

seekingalpha.com

2021-06-09 21:10:17Target Term funds start life with a set date to end, sometimes with one extension, with the goal of returning the original NAV. EHT is honoring the July date. Since late 2020 when the July termination was confirmed, EHT has been in the process of changing its asset mix in preparation for this event.

Eaton Vance 2021 Target Term Trust Announces Liquidation Details

prnewswire.com

2021-06-01 16:01:00BOSTON, June 1, 2021 /PRNewswire/ -- Eaton Vance 2021 Target Term Trust (NYSE: EHT) (the "Trust") announced today new details concerning its liquidation. Consistent with its investment objectives and organizational documents, the Trust plans to terminate its existence and liquidate on or about July 1, 2021.

8 Closed-End Fund Buys In December To Finish Out A Volatile Year

seekingalpha.com

2021-01-15 06:12:25For the broader indexes, December continued along its upward momentum. Overall, the market seems to be quite lofty at these levels, so keeping a cash allocation could be appropriate.

EHT And JHB: 2 Target Term 2021 CEFs With 4%-5% Annualized Return Remaining

seekingalpha.com

2020-12-31 12:25:43EHT is due to liquidate on July 1, 2021, while JHB is set to terminate on Nov.r 1, 2021. EHT surprisingly boosted its distribution by +60% this month, bucking the trend for target term funds.

Weekly Closed-End Fund Roundup: September 6, 2020

seekingalpha.com

2020-09-13 04:32:185 out of 23 CEF sectors positive on price and 7 out of 23 sectors positive on NAV last week. Risk-off as MLPs and convertibles lag.

Eaton Vance (NYSE:EV) PT Raised to $42.00

thelincolnianonline.com

2020-08-22 07:58:46Eaton Vance (NYSE:EV) had its target price hoisted by investment analysts at Citigroup from $36.00 to $42.00 in a research note issued to investors on Thursday, The Fly reports. The firm presently has a “neutral” rating on the asset manager’s stock. Citigroup‘s price objective indicates a potential upside of 9.35% from the company’s current price. […]

Steward Partners Investment Advisory LLC Purchases 21,495 Shares of EATON VANCE MUN/SHS (NYSE:ETX)

thelincolnianonline.com

2020-08-22 07:28:45Steward Partners Investment Advisory LLC lifted its position in shares of EATON VANCE MUN/SHS (NYSE:ETX) by 222.2% during the second quarter, Holdings Channel.com reports. The institutional investor owned 31,169 shares of the investment management company’s stock after acquiring an additional 21,495 shares during the quarter. Steward Partners Investment Advisory LLC’s holdings in EATON VANCE MUN/SHS […]

Weekly Closed-End Fund Roundup: August 2, 2020

seekingalpha.com

2020-08-11 10:06:5721 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Commodities lead as precious metals rally.

Vident Investment Advisory LLC Has $569,000 Stock Position in Eaton Vance Corp (NYSE:EV)

thelincolnianonline.com

2020-08-09 23:46:44Vident Investment Advisory LLC reduced its position in Eaton Vance Corp (NYSE:EV) by 60.0% in the 2nd quarter, HoldingsChannel reports. The firm owned 14,735 shares of the asset manager’s stock after selling 22,084 shares during the period. Vident Investment Advisory LLC’s holdings in Eaton Vance were worth $569,000 as of its most recent filing with […]

Monthly Review Of DivGro: July 2020

seekingalpha.com

2020-08-05 13:15:00In this article, I review my portfolio of dividend growth stocks, DivGro. I provide a summary of transactions and show how those transactions affect DivGro's projected annual dividend income.

Cambridge Investment Research Advisors Inc. Sells 19,881 Shares of Eaton Vance Senior Floating-Rate Trust (NYSE:EFR)

thelincolnianonline.com

2020-08-05 07:40:50Cambridge Investment Research Advisors Inc. lessened its stake in Eaton Vance Senior Floating-Rate Trust (NYSE:EFR) by 12.9% in the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 134,393 shares of the company’s stock after selling 19,881 shares during the period. Cambridge Investment […]

Raymond James & Associates Has $11.78 Million Holdings in Eaton Vance Tax-Managed Global Buy-Write (NYSE:ETW)

thelincolnianonline.com

2020-08-04 06:50:43Raymond James & Associates grew its holdings in Eaton Vance Tax-Managed Global Buy-Write (NYSE:ETW) by 4.5% during the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,361,331 shares of the company’s stock after purchasing an additional 58,651 shares during the period. Raymond James & Associates’ holdings […]

Weekly Closed-End Fund Roundup: July 26, 2020

seekingalpha.com

2020-08-03 13:49:1421 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Boosts to USA/ASG, and the Flaherty & Crumrine funds.

Eaton Vance Corp (NYSE:EV) Shares Sold by Nisa Investment Advisors LLC

thelincolnianonline.com

2020-08-03 08:14:41Nisa Investment Advisors LLC lowered its stake in Eaton Vance Corp (NYSE:EV) by 3.2% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 36,230 shares of the asset manager’s stock after selling 1,200 shares during the quarter. Nisa Investment Advisors LLC’s holdings in […]

Eaton Vance Tax-Advantaged Global Dvd. (NYSE:ETG) Shares Purchased by Janney Montgomery Scott LLC

thelincolnianonline.com

2020-08-03 07:16:55Janney Montgomery Scott LLC grew its stake in shares of Eaton Vance Tax-Advantaged Global Dvd. (NYSE:ETG) by 5.2% during the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 95,790 shares of the company’s stock after acquiring an additional 4,697 shares […]