Eldorado Gold Corporation (EGO)

Price:

34.65 USD

( - -0.43 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

DRDGOLD Limited

VALUE SCORE:

8

2nd position

Kinross Gold Corporation

VALUE SCORE:

9

The best

Harmony Gold Mining Company Limited

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Eldorado Gold Corporation, together with its subsidiaries, engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, Greece, and Romania. The company primarily produces gold, as well as silver, lead, and zinc. It holds a 100% interest in the Kisladag and Efemcukuru gold mines located in western Turkey; 100% interest in Lamaque gold mines located in Canada; and Olympias, Stratoni, Skouries, Perama Hill, and Sapes gold mines located in Greece, as well as the 80.5% interest in Certej development projects located in Romania. The company was formerly known as Eldorado Corporation Ltd. and changed its name to Eldorado Gold Corporation in April 1996. Eldorado Gold Corporation was incorporated in 1992 and is headquartered in Vancouver, Canada.

NEWS

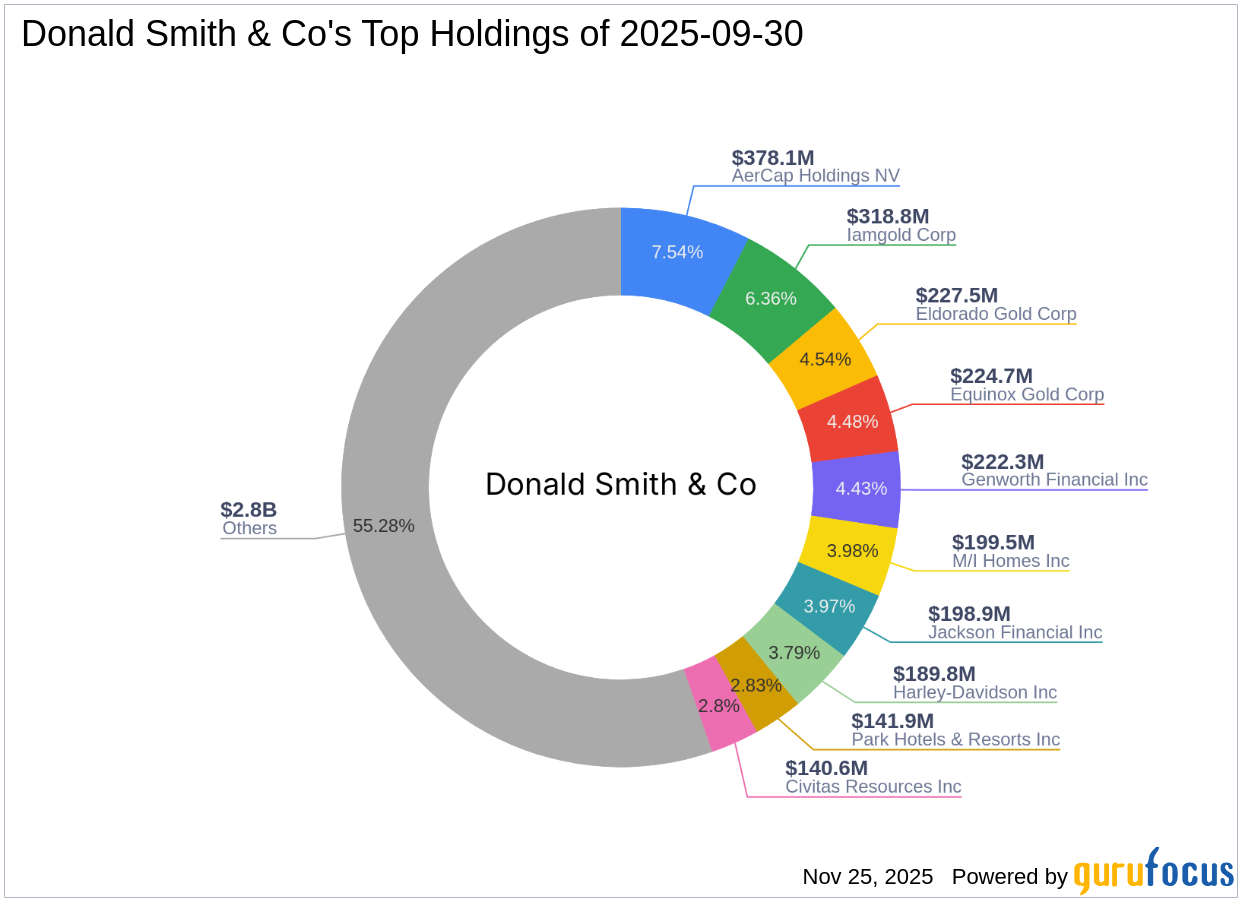

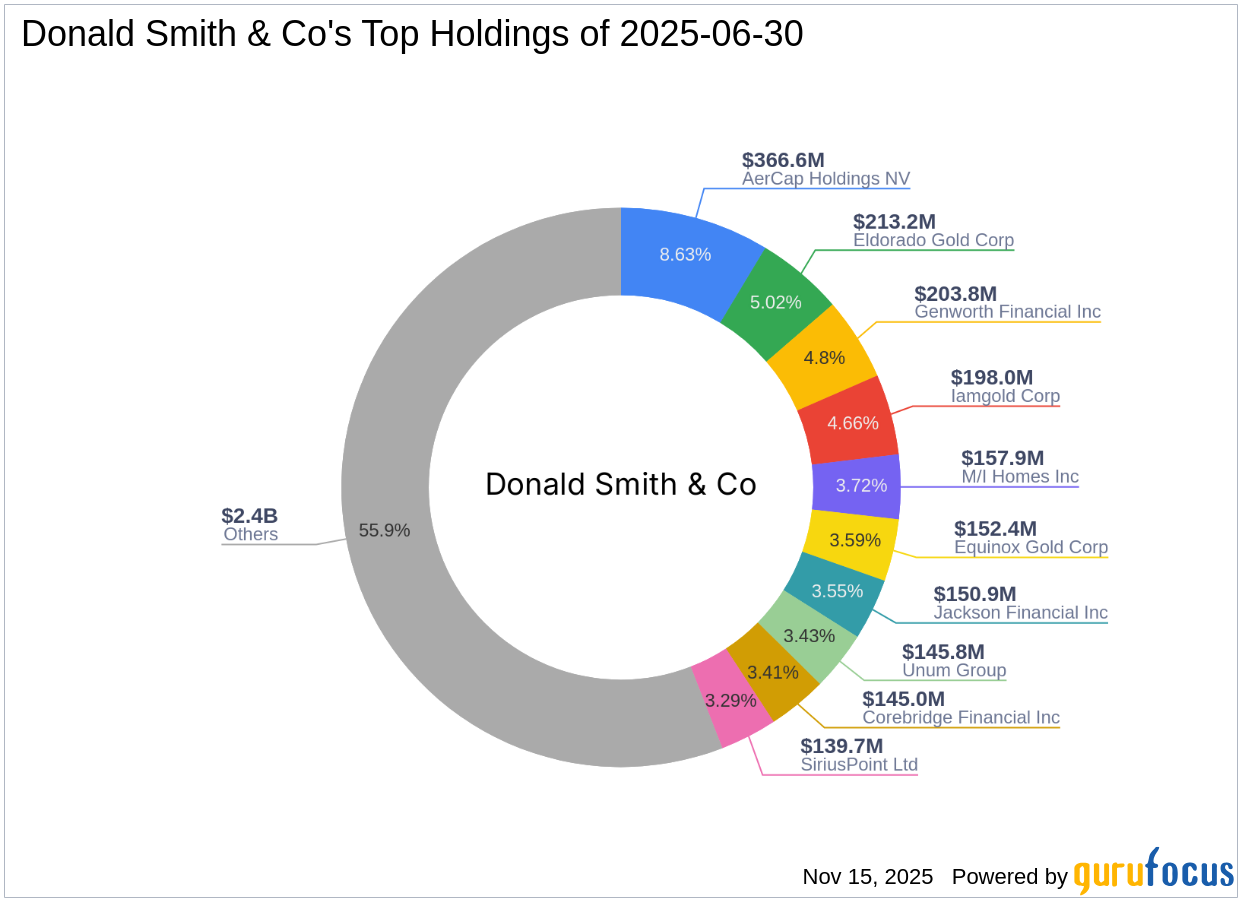

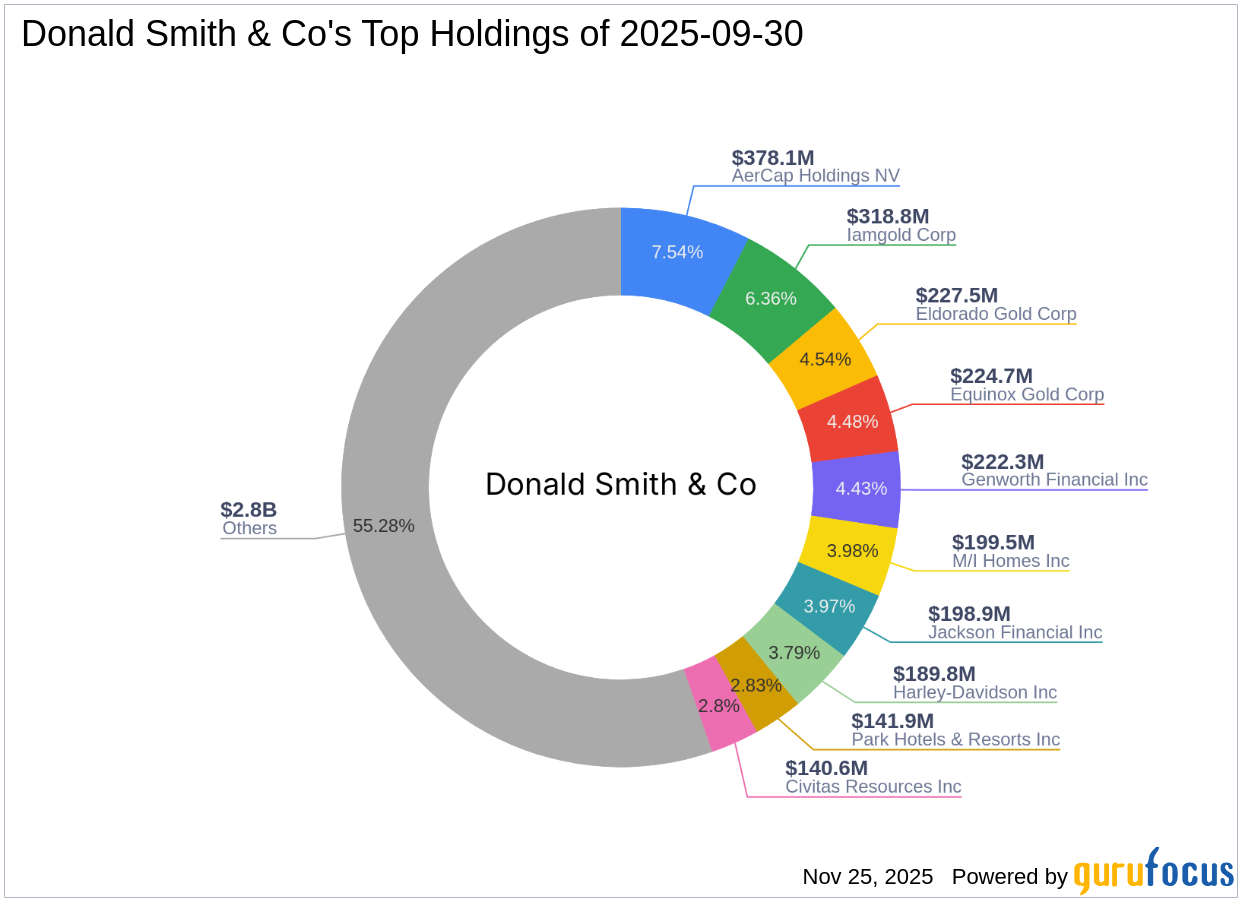

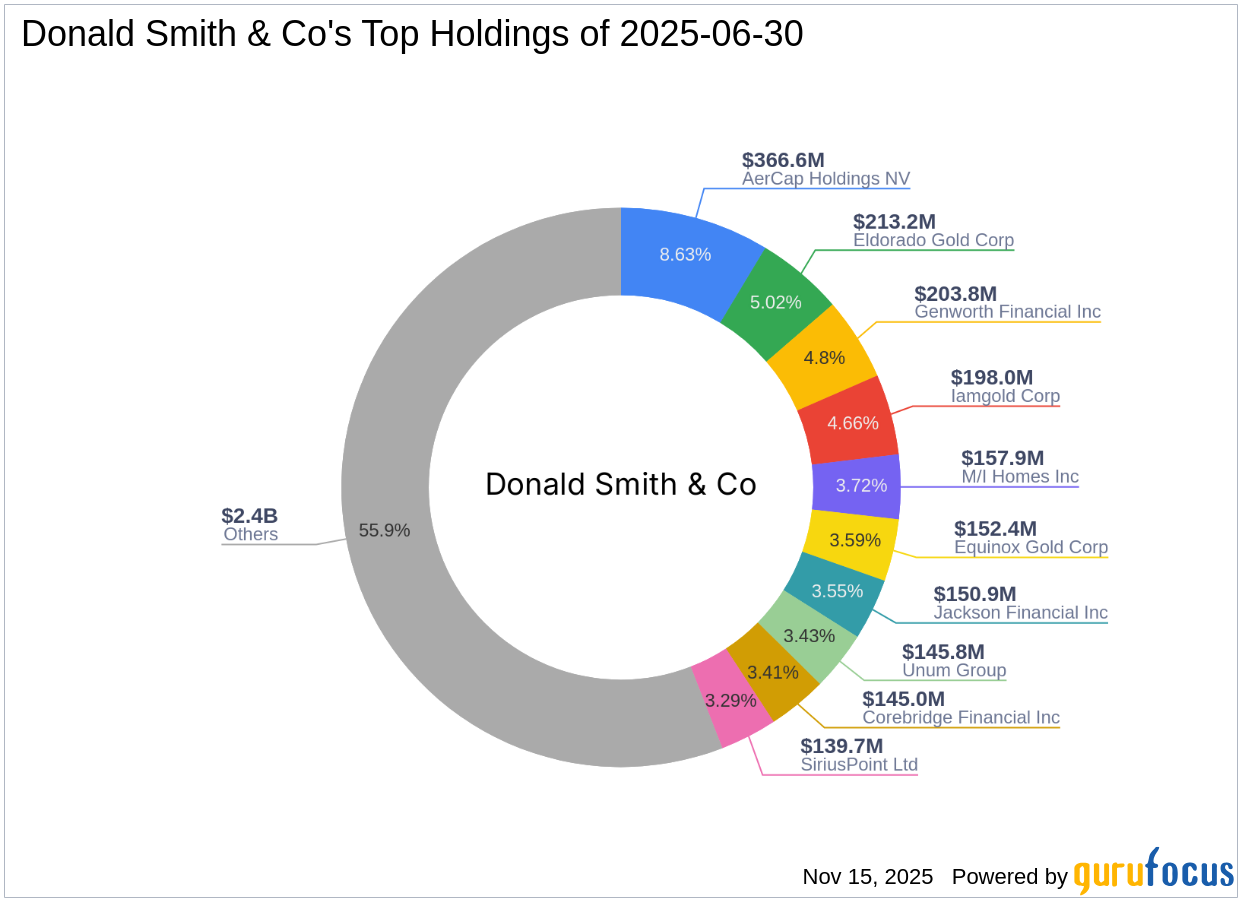

Eldorado Gold Corporation $EGO is Donald Smith & CO. Inc.’s 2nd Largest Position

defenseworld.net

2025-12-07 04:32:43Donald Smith and CO. Inc. cut its holdings in Eldorado Gold Corporation (NYSE: EGO) (TSE: ELD) by 16.1% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 10,481,326 shares of the basic materials company's stock after selling 2,011,430 shares

Eldorado Gold (NYSE:EGO) Hits New 1-Year High – Here’s Why

defenseworld.net

2025-12-07 02:20:43Shares of Eldorado Gold Corporation (NYSE: EGO - Get Free Report) (TSE: ELD) hit a new 52-week high during mid-day trading on Friday. The company traded as high as $31.93 and last traded at $31.3510, with a volume of 1277 shares. The stock had previously closed at $31.29. Analyst Ratings Changes A number of equities research

PGIM Jennison Natural Resources Fund Q3 2025 Contributors And Detractors

seekingalpha.com

2025-12-02 13:20:00PGIM Jennison Natural Resources Fund generated a strong return and outperformed its Lipper Global Natural Resources Index benchmark for the quarter. Key contributors include Agnico Eagle Mines (AEM), Hudbay Minerals (HBM), and Eldorado Gold (EGO). Key detractors include EQT Corp (EQT), Expand Energy Corporation (EXE), and ARC Resources (AETUF).

Eldorado Gold Corporation $EGO Shares Bought by American Century Companies Inc.

defenseworld.net

2025-12-02 04:14:51American Century Companies Inc. grew its position in Eldorado Gold Corporation (NYSE: EGO) (TSE: ELD) by 8.4% during the second quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,146,359 shares of the basic materials company's stock after purchasing an additional 88,752 shares during the quarter.

Eldorado Gold (NYSE:EGO) Hits New 1-Year High – Still a Buy?

defenseworld.net

2025-11-30 02:32:48Shares of Eldorado Gold Corporation (NYSE: EGO - Get Free Report) (TSE: ELD) reached a new 52-week high on Friday. The stock traded as high as $31.33 and last traded at $31.0330, with a volume of 48836 shares traded. The stock had previously closed at $30.68. Analyst Ratings Changes A number of research analysts have recently

Eldorado Gold (TSE:ELD) Sets New 12-Month High on Analyst Upgrade

defenseworld.net

2025-11-29 01:14:47Eldorado Gold Co. (TSE: ELD - Get Free Report) (NYSE: EGO) hit a new 52-week high during mid-day trading on Friday after BMO Capital Markets raised their price target on the stock from C$50.00 to C$53.00. The company traded as high as C$43.87 and last traded at C$43.55, with a volume of 34870 shares traded. The stock

This Gold Stock Shines With Several Spots To Buy Shares

investors.com

2025-11-26 13:26:02This gold stock has already doubled but here's where to pick up shares.

Eldorado Gold Releases Updated Mineral Reserve and Mineral Resource Statement; Offsetting Depletion and Increasing Mineral Reserves at Key Operations

globenewswire.com

2025-11-26 07:00:00VANCOUVER, British Columbia, Nov. 26, 2025 (GLOBE NEWSWIRE) -- Eldorado Gold Corporation (TSX:ELD) (NYSE:EGO) (“Eldorado” or “the Company”) today releases its updated Mineral Reserve and Mineral Resource (“MRMR”) estimates as of September 30, 2025. “Our commitment to exploration continues to unlock long-term value, driving another increase in Mineral Reserves,” said George Burns, Chief Executive Officer.

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Donald Smith & Co Reduces Stake in Galiano Gold Inc

gurufocus.com

2025-11-14 22:16:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Galiano Gold Inc. The firm reduced its holdings in Galia

Donald Smith & Co's Recent Transaction with Chatham Lodging Trust

gurufocus.com

2025-11-14 22:14:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Chatham Lodging Trust, a U.S.-based real estate investme

Donald Smith & Co Reduces Stake in Cool Co Ltd: A Strategic Portfolio Adjustment

gurufocus.com

2025-11-14 22:13:00Overview of the Recent Transaction On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Cool Co Ltd (CLCO), a

Donald Smith & Co Reduces Stake in Beazer Homes USA Inc

gurufocus.com

2025-11-14 22:11:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Beazer Homes USA Inc (BZH), reducing its holdings by 77,

Donald Smith & Co Increases Stake in Allegiant Travel Co

gurufocus.com

2025-11-14 22:10:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a significant transaction involving Allegiant Travel Co (ALGT). The firm added 263,388 sha

Donald Smith & Co Reduces Stake in Algoma Steel Group Inc

gurufocus.com

2025-11-14 22:08:00Recent Transaction Overview On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Algoma Steel Group Inc. The

Eldorado Gold: Recent Correction Offers An Entry Point Despite Q3 Production Miss

seekingalpha.com

2025-11-06 08:01:25Eldorado Gold (EGO) reported Q3 2025 production of 115,190 ounces, down 8% year-over-year and the lowest third-quarter output since 2022. Olympias production fell sharply by 36% Y/Y, while Lamaque outperformed with an 8% Y/Y increase and strong margins, highlighting operational divergence. Turkish operations Kisladag and Efemcukuru saw production declines and higher costs, prompting management to revise annual cost guidance upward.

Eldorado Gold Corporation $EGO is Donald Smith & CO. Inc.’s 2nd Largest Position

defenseworld.net

2025-12-07 04:32:43Donald Smith and CO. Inc. cut its holdings in Eldorado Gold Corporation (NYSE: EGO) (TSE: ELD) by 16.1% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 10,481,326 shares of the basic materials company's stock after selling 2,011,430 shares

Eldorado Gold (NYSE:EGO) Hits New 1-Year High – Here’s Why

defenseworld.net

2025-12-07 02:20:43Shares of Eldorado Gold Corporation (NYSE: EGO - Get Free Report) (TSE: ELD) hit a new 52-week high during mid-day trading on Friday. The company traded as high as $31.93 and last traded at $31.3510, with a volume of 1277 shares. The stock had previously closed at $31.29. Analyst Ratings Changes A number of equities research

PGIM Jennison Natural Resources Fund Q3 2025 Contributors And Detractors

seekingalpha.com

2025-12-02 13:20:00PGIM Jennison Natural Resources Fund generated a strong return and outperformed its Lipper Global Natural Resources Index benchmark for the quarter. Key contributors include Agnico Eagle Mines (AEM), Hudbay Minerals (HBM), and Eldorado Gold (EGO). Key detractors include EQT Corp (EQT), Expand Energy Corporation (EXE), and ARC Resources (AETUF).

Eldorado Gold Corporation $EGO Shares Bought by American Century Companies Inc.

defenseworld.net

2025-12-02 04:14:51American Century Companies Inc. grew its position in Eldorado Gold Corporation (NYSE: EGO) (TSE: ELD) by 8.4% during the second quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,146,359 shares of the basic materials company's stock after purchasing an additional 88,752 shares during the quarter.

Eldorado Gold (NYSE:EGO) Hits New 1-Year High – Still a Buy?

defenseworld.net

2025-11-30 02:32:48Shares of Eldorado Gold Corporation (NYSE: EGO - Get Free Report) (TSE: ELD) reached a new 52-week high on Friday. The stock traded as high as $31.33 and last traded at $31.0330, with a volume of 48836 shares traded. The stock had previously closed at $30.68. Analyst Ratings Changes A number of research analysts have recently

Eldorado Gold (TSE:ELD) Sets New 12-Month High on Analyst Upgrade

defenseworld.net

2025-11-29 01:14:47Eldorado Gold Co. (TSE: ELD - Get Free Report) (NYSE: EGO) hit a new 52-week high during mid-day trading on Friday after BMO Capital Markets raised their price target on the stock from C$50.00 to C$53.00. The company traded as high as C$43.87 and last traded at C$43.55, with a volume of 34870 shares traded. The stock

This Gold Stock Shines With Several Spots To Buy Shares

investors.com

2025-11-26 13:26:02This gold stock has already doubled but here's where to pick up shares.

Eldorado Gold Releases Updated Mineral Reserve and Mineral Resource Statement; Offsetting Depletion and Increasing Mineral Reserves at Key Operations

globenewswire.com

2025-11-26 07:00:00VANCOUVER, British Columbia, Nov. 26, 2025 (GLOBE NEWSWIRE) -- Eldorado Gold Corporation (TSX:ELD) (NYSE:EGO) (“Eldorado” or “the Company”) today releases its updated Mineral Reserve and Mineral Resource (“MRMR”) estimates as of September 30, 2025. “Our commitment to exploration continues to unlock long-term value, driving another increase in Mineral Reserves,” said George Burns, Chief Executive Officer.

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Donald Smith & Co Reduces Stake in Galiano Gold Inc

gurufocus.com

2025-11-14 22:16:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Galiano Gold Inc. The firm reduced its holdings in Galia

Donald Smith & Co's Recent Transaction with Chatham Lodging Trust

gurufocus.com

2025-11-14 22:14:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Chatham Lodging Trust, a U.S.-based real estate investme

Donald Smith & Co Reduces Stake in Cool Co Ltd: A Strategic Portfolio Adjustment

gurufocus.com

2025-11-14 22:13:00Overview of the Recent Transaction On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Cool Co Ltd (CLCO), a

Donald Smith & Co Reduces Stake in Beazer Homes USA Inc

gurufocus.com

2025-11-14 22:11:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Beazer Homes USA Inc (BZH), reducing its holdings by 77,

Donald Smith & Co Increases Stake in Allegiant Travel Co

gurufocus.com

2025-11-14 22:10:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a significant transaction involving Allegiant Travel Co (ALGT). The firm added 263,388 sha

Donald Smith & Co Reduces Stake in Algoma Steel Group Inc

gurufocus.com

2025-11-14 22:08:00Recent Transaction Overview On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Algoma Steel Group Inc. The

Eldorado Gold: Recent Correction Offers An Entry Point Despite Q3 Production Miss

seekingalpha.com

2025-11-06 08:01:25Eldorado Gold (EGO) reported Q3 2025 production of 115,190 ounces, down 8% year-over-year and the lowest third-quarter output since 2022. Olympias production fell sharply by 36% Y/Y, while Lamaque outperformed with an 8% Y/Y increase and strong margins, highlighting operational divergence. Turkish operations Kisladag and Efemcukuru saw production declines and higher costs, prompting management to revise annual cost guidance upward.