DXP Enterprises, Inc. (DXPE)

Price:

114.72 USD

( - -1.33 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Pool Corporation

VALUE SCORE:

6

2nd position

Titan Machinery Inc.

VALUE SCORE:

7

The best

Distribution Solutions Group, Inc.

VALUE SCORE:

7

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

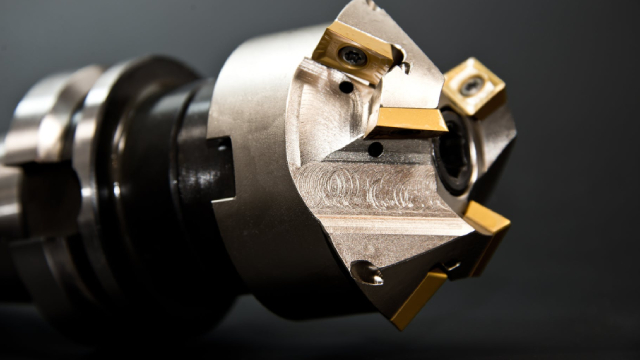

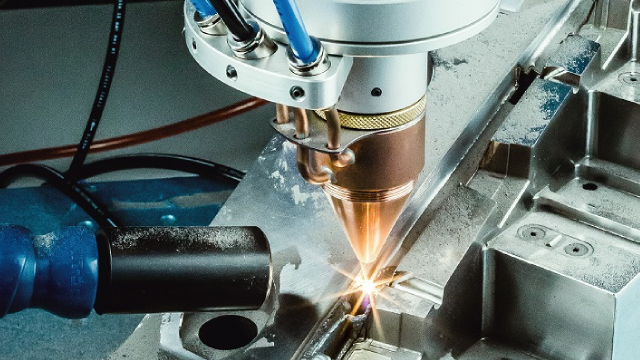

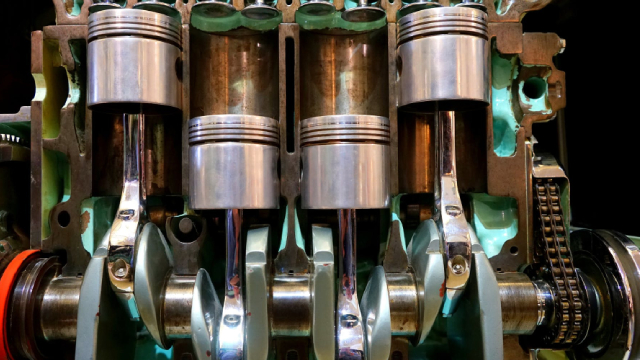

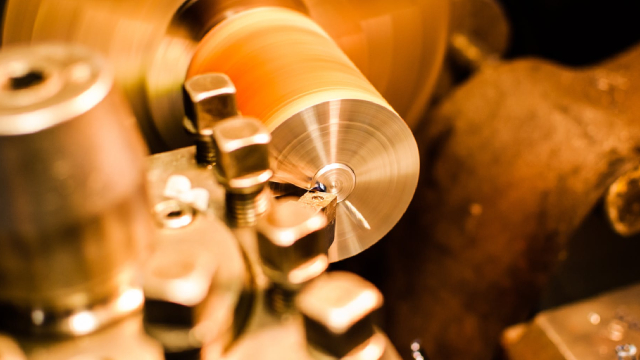

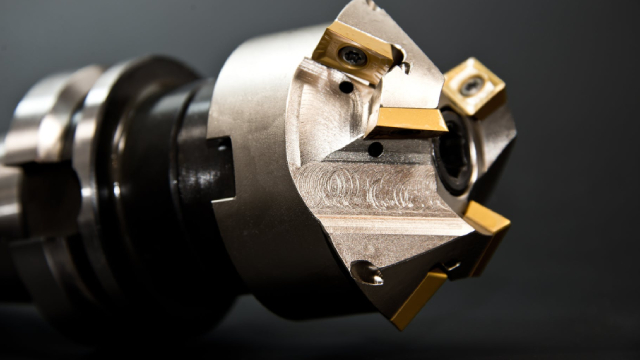

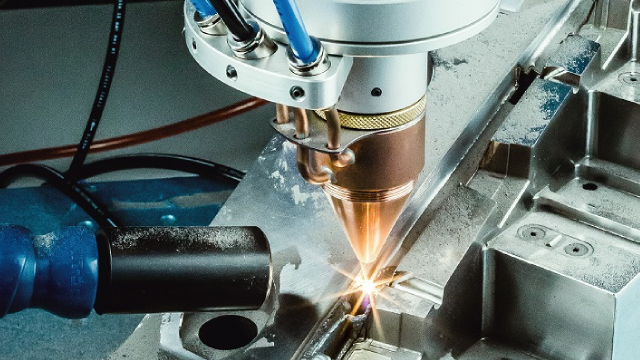

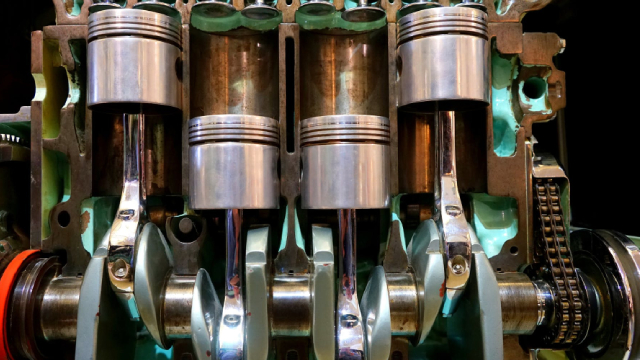

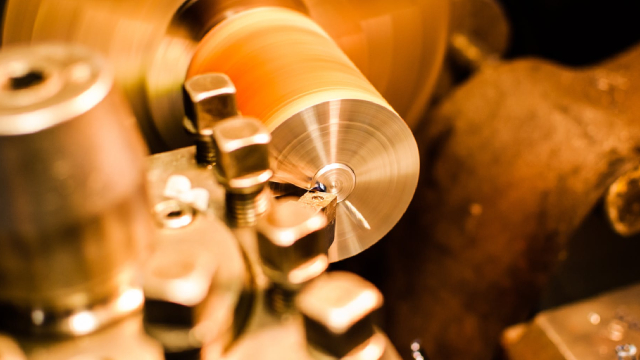

DXP Enterprises, Inc., together with its subsidiaries, engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services to the energy and industrial customers primarily in the United States and Canada. It operates through three segments: Service Centers (SC), Supply Chain Services (SCS), and Innovative Pumping Solutions (IPS). The SC segment offers MRO products, equipment, and integrated services, including technical expertise and logistics services. It offers a range of MRO products in the rotating equipment, bearing, power transmission, hose, fluid power, metal working, fastener, industrial supply, safety products, and safety services categories. This segment serves customers in the oil and gas, food and beverage, petrochemical, transportation, other general industrial, mining, construction, chemical, municipal, agriculture, and pulp and paper industries. The SCS segment manages procurement and inventory management solutions; and offers outsourced MRO solutions for sourcing MRO products, including inventory optimization and management, store room management, transaction consolidation and control, vendor oversight and procurement cost optimization, productivity improvement, and customized reporting services. Its programs include SmartAgreement, a procurement solution for various MRO categories; SmartBuy, an on-site or centralized MRO procurement solution; SmartSource, an on-site procurement and storeroom management solution; SmartStore, an e-Catalog solution; SmartVend, an industrial dispensing solution; and SmartServ, an integrated service pump solution. The IPS segment fabricates and assembles custom-made pump packages, remanufactures pumps, and manufactures branded private label pumps. The company was founded in 1908 and is based in Houston, Texas.

NEWS

DXP Enterprises: Staying Bullish With Growth On Track

seekingalpha.com

2025-08-14 03:12:33DXP Enterprises delivered double-digit revenue growth, led by a robust 27.5% increase in its IPS segment and strong service center demand. Recent acquisitions and a healthy backlog are expected to further boost topline growth, with operational improvements supporting margin expansion in FY25 and beyond. Despite the recent run-up, the stock remains attractively valued versus sector peers, making it a decent buy given its growth outlook.

DXP Enterprises (DXPE) Q2 EPS Jumps 43%

fool.com

2025-08-07 14:59:31DXP Enterprises (DXPE) Q2 EPS Jumps 43%

DXP Enterprises, Inc. (DXPE) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-07 13:28:57DXP Enterprises, Inc. (NASDAQ:DXPE ) Q2 2025 Earnings Conference Call August 7, 2025 11:30 AM ET Company Participants David R. Little - Chairman of the Board, President & CEO Kent Yee - Senior VP, CFO, Secretary & Director Conference Call Participants Zachary Ryan Marriott - Stephens Inc., Research Division Operator Thank you for standing by.

DXP Enterprises (DXPE) Q2 2025 Earnings Transcript

fool.com

2025-08-07 12:13:02Image source: The Motley Fool.

DXP Enterprises, Inc. Reports Second Quarter 2025 Results

businesswire.com

2025-08-06 18:04:00HOUSTON--(BUSINESS WIRE)-- #DXPE--DXP Enterprises, Inc. ("DXP" or the "Company") (NASDAQ: DXPE) today announced financial results for the second quarter ended June 30, 2025. The following are results for the three months ended June 30, 2025, compared to the three months ended June 30, 2024, and March 31, 2025, where appropriate. A reconciliation of the non-GAAP financial measures can be found in the back of this press release. Second Quarter 2025 Financial Highlights: Sales increased 11.9 percent to $4.

DXP Enterprises Q2 Earnings Preview - Why I Expect Another Beat

seekingalpha.com

2025-08-06 09:00:34DXP Enterprises delivered strong Q1 2025 results, with double-digit sales and earnings growth driven by organic momentum and accretive acquisitions. The company's diversified end markets, robust backlog, and ongoing M&A strategy support continued growth and margin expansion through 2025. Despite a significant stock rally, DXPE remains undervalued with a $156 price target, offering +40% upside given its growth and profitability profile.

DXP Enterprises (DXPE) Is a Great Choice for 'Trend' Investors, Here's Why

zacks.com

2025-08-01 09:50:32DXP Enterprises (DXPE) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

DXP Enterprises, Inc. Announces Second Quarter 2025 Earnings Release and Conference Call

businesswire.com

2025-07-31 19:36:00HOUSTON--(BUSINESS WIRE)-- #dxpe--DXP Enterprises, Inc. (the “Company”) (NASDAQ: DXPE), a leading business to business products and service distributor that adds value and total cost savings solutions to MRO and OEM customers in virtually every industry, plans to issue a press release announcing its financial results for the quarter ended June 30, 2025, on Wednesday, August 6th. The earnings announcement will be released after the market closes. DXP will host a conference call, to be webcast live, on t.

DXP Enterprises (DXPE) Ascends While Market Falls: Some Facts to Note

zacks.com

2025-07-30 18:45:45In the most recent trading session, DXP Enterprises (DXPE) closed at $111.84, indicating a +1.19% shift from the previous trading day.

Here's Why DXP Enterprises (DXPE) Fell More Than Broader Market

zacks.com

2025-07-29 18:51:14DXP Enterprises (DXPE) reached $110.53 at the closing of the latest trading day, reflecting a -1.1% change compared to its last close.

Are Industrial Products Stocks Lagging DXP Enterprises (DXPE) This Year?

zacks.com

2025-07-28 10:41:30Here is how DXP Enterprises (DXPE) and RBC Bearings (RBC) have performed compared to their sector so far this year.

DXP Enterprises (DXPE) Outperforms Broader Market: What You Need to Know

zacks.com

2025-07-22 18:51:18In the most recent trading session, DXP Enterprises (DXPE) closed at $99.71, indicating a +1.38% shift from the previous trading day.

DXP Enterprises (DXPE) Stock Dips While Market Gains: Key Facts

zacks.com

2025-07-16 18:51:24In the most recent trading session, DXP Enterprises (DXPE) closed at $97.23, indicating a -2.13% shift from the previous trading day.

Here's Why Momentum in DXP Enterprises (DXPE) Should Keep going

zacks.com

2025-07-16 09:51:15If you are looking for stocks that are well positioned to maintain their recent uptrend, DXP Enterprises (DXPE) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

DXP Enterprises (DXPE) Exceeds Market Returns: Some Facts to Consider

zacks.com

2025-07-10 18:51:15DXP Enterprises (DXPE) closed the most recent trading day at $93.73, moving +1.18% from the previous trading session.

Is DXP Enterprises (DXPE) Stock Outpacing Its Industrial Products Peers This Year?

zacks.com

2025-07-10 10:41:18Here is how DXP Enterprises (DXPE) and Ardagh Metal Packaging S.A. (AMBP) have performed compared to their sector so far this year.

No data to display

DXP Enterprises: Staying Bullish With Growth On Track

seekingalpha.com

2025-08-14 03:12:33DXP Enterprises delivered double-digit revenue growth, led by a robust 27.5% increase in its IPS segment and strong service center demand. Recent acquisitions and a healthy backlog are expected to further boost topline growth, with operational improvements supporting margin expansion in FY25 and beyond. Despite the recent run-up, the stock remains attractively valued versus sector peers, making it a decent buy given its growth outlook.

DXP Enterprises (DXPE) Q2 EPS Jumps 43%

fool.com

2025-08-07 14:59:31DXP Enterprises (DXPE) Q2 EPS Jumps 43%

DXP Enterprises, Inc. (DXPE) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-07 13:28:57DXP Enterprises, Inc. (NASDAQ:DXPE ) Q2 2025 Earnings Conference Call August 7, 2025 11:30 AM ET Company Participants David R. Little - Chairman of the Board, President & CEO Kent Yee - Senior VP, CFO, Secretary & Director Conference Call Participants Zachary Ryan Marriott - Stephens Inc., Research Division Operator Thank you for standing by.

DXP Enterprises (DXPE) Q2 2025 Earnings Transcript

fool.com

2025-08-07 12:13:02Image source: The Motley Fool.

DXP Enterprises, Inc. Reports Second Quarter 2025 Results

businesswire.com

2025-08-06 18:04:00HOUSTON--(BUSINESS WIRE)-- #DXPE--DXP Enterprises, Inc. ("DXP" or the "Company") (NASDAQ: DXPE) today announced financial results for the second quarter ended June 30, 2025. The following are results for the three months ended June 30, 2025, compared to the three months ended June 30, 2024, and March 31, 2025, where appropriate. A reconciliation of the non-GAAP financial measures can be found in the back of this press release. Second Quarter 2025 Financial Highlights: Sales increased 11.9 percent to $4.

DXP Enterprises Q2 Earnings Preview - Why I Expect Another Beat

seekingalpha.com

2025-08-06 09:00:34DXP Enterprises delivered strong Q1 2025 results, with double-digit sales and earnings growth driven by organic momentum and accretive acquisitions. The company's diversified end markets, robust backlog, and ongoing M&A strategy support continued growth and margin expansion through 2025. Despite a significant stock rally, DXPE remains undervalued with a $156 price target, offering +40% upside given its growth and profitability profile.

DXP Enterprises (DXPE) Is a Great Choice for 'Trend' Investors, Here's Why

zacks.com

2025-08-01 09:50:32DXP Enterprises (DXPE) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

DXP Enterprises, Inc. Announces Second Quarter 2025 Earnings Release and Conference Call

businesswire.com

2025-07-31 19:36:00HOUSTON--(BUSINESS WIRE)-- #dxpe--DXP Enterprises, Inc. (the “Company”) (NASDAQ: DXPE), a leading business to business products and service distributor that adds value and total cost savings solutions to MRO and OEM customers in virtually every industry, plans to issue a press release announcing its financial results for the quarter ended June 30, 2025, on Wednesday, August 6th. The earnings announcement will be released after the market closes. DXP will host a conference call, to be webcast live, on t.

DXP Enterprises (DXPE) Ascends While Market Falls: Some Facts to Note

zacks.com

2025-07-30 18:45:45In the most recent trading session, DXP Enterprises (DXPE) closed at $111.84, indicating a +1.19% shift from the previous trading day.

Here's Why DXP Enterprises (DXPE) Fell More Than Broader Market

zacks.com

2025-07-29 18:51:14DXP Enterprises (DXPE) reached $110.53 at the closing of the latest trading day, reflecting a -1.1% change compared to its last close.

Are Industrial Products Stocks Lagging DXP Enterprises (DXPE) This Year?

zacks.com

2025-07-28 10:41:30Here is how DXP Enterprises (DXPE) and RBC Bearings (RBC) have performed compared to their sector so far this year.

DXP Enterprises (DXPE) Outperforms Broader Market: What You Need to Know

zacks.com

2025-07-22 18:51:18In the most recent trading session, DXP Enterprises (DXPE) closed at $99.71, indicating a +1.38% shift from the previous trading day.

DXP Enterprises (DXPE) Stock Dips While Market Gains: Key Facts

zacks.com

2025-07-16 18:51:24In the most recent trading session, DXP Enterprises (DXPE) closed at $97.23, indicating a -2.13% shift from the previous trading day.

Here's Why Momentum in DXP Enterprises (DXPE) Should Keep going

zacks.com

2025-07-16 09:51:15If you are looking for stocks that are well positioned to maintain their recent uptrend, DXP Enterprises (DXPE) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

DXP Enterprises (DXPE) Exceeds Market Returns: Some Facts to Consider

zacks.com

2025-07-10 18:51:15DXP Enterprises (DXPE) closed the most recent trading day at $93.73, moving +1.18% from the previous trading session.

Is DXP Enterprises (DXPE) Stock Outpacing Its Industrial Products Peers This Year?

zacks.com

2025-07-10 10:41:18Here is how DXP Enterprises (DXPE) and Ardagh Metal Packaging S.A. (AMBP) have performed compared to their sector so far this year.