First Trust Dorsey Wright Momentum & Low Volatility ETF (DVOL)

Price:

35.09 USD

( - -0.14 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Under normal conditions, the fund will invest at least 90% of its net assets (including investment borrowings) in the equity securities that comprise the index. The index is a rules-based equity index designed to track the overall performance of the 50 stocks comprising the NASDAQ US Large Mid Cap Index TM that exhibit the lowest levels of volatility while still maintaining high levels of "relative strength."

NEWS

DVOL: Unusual Strategy With Unconvincing Results

seekingalpha.com

2025-05-09 13:15:36First Trust Dorsey Wright Momentum & Low Volatility ETF holds 50 stocks with high price relative strength and low price volatility. DVOL is overweight in financials, but the sector breakdown may vary with sector momentum. Since its inception, DVOL has underperformed the Russell 1000 in return and Sharpe ratio, with a deeper maximum drawdown.

Should You Fear a Bear Market & Recession? ETFs in Focus

zacks.com

2025-04-09 14:00:37The tech-focused Nasdaq officially entered bear market territory on April 4, 2025, falling over 20% from its December peak. The plunge came as Wall Street grew increasingly anxious about the economic health amid President Donald Trump's tariff announcement.

Selected ETFs To Watch In 2025

seekingalpha.com

2025-01-31 22:00:00Following on last week's top 10 list, this week's blog focuses on ETFs related to the stocks in the list. For this week, we then screened for ETFs that contained each stock that were also rated 5 (Strong Buy), focusing on the ETF that held the stock in the greatest percentage, then traveling down the lists of ETFs that held it until we found one rated 5. This resulted in a list of Strong Buy 5 rated ETFs that held at least one Strong Buy 5 rated stock as a major holding.

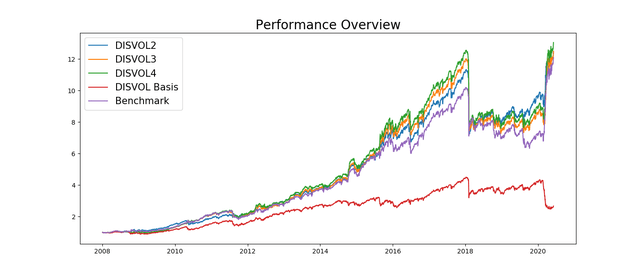

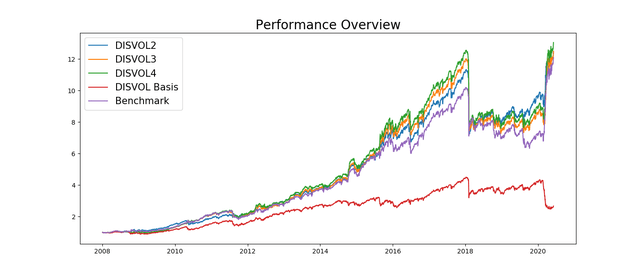

Backtesting The Discrete Volatility Model For Trading VXX - A Comparison Of DISVOL Models

seekingalpha.com

2020-09-14 09:50:04We backtest the discrete volatility model from Lazard Asset Management for a VXX trading strategy. The additional layer of specification yields a stellar return in the in-sample period, but disappoints in the out-of-sample period.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Bet on Low-Beta ETFs in an Uncertain Market

zacks.com

2020-03-20 15:15:00Low-beta products exhibit greater levels of stability than their market-sensitive counterparts and will usually lose less when the market is crumbling.

Low Beta ETFs to Consider in an Uncertain Market

zacks.com

2020-03-04 16:10:00Investors seeking to remain invested in the equity world could consider low beta ETFs.

No data to display

DVOL: Unusual Strategy With Unconvincing Results

seekingalpha.com

2025-05-09 13:15:36First Trust Dorsey Wright Momentum & Low Volatility ETF holds 50 stocks with high price relative strength and low price volatility. DVOL is overweight in financials, but the sector breakdown may vary with sector momentum. Since its inception, DVOL has underperformed the Russell 1000 in return and Sharpe ratio, with a deeper maximum drawdown.

Should You Fear a Bear Market & Recession? ETFs in Focus

zacks.com

2025-04-09 14:00:37The tech-focused Nasdaq officially entered bear market territory on April 4, 2025, falling over 20% from its December peak. The plunge came as Wall Street grew increasingly anxious about the economic health amid President Donald Trump's tariff announcement.

Selected ETFs To Watch In 2025

seekingalpha.com

2025-01-31 22:00:00Following on last week's top 10 list, this week's blog focuses on ETFs related to the stocks in the list. For this week, we then screened for ETFs that contained each stock that were also rated 5 (Strong Buy), focusing on the ETF that held the stock in the greatest percentage, then traveling down the lists of ETFs that held it until we found one rated 5. This resulted in a list of Strong Buy 5 rated ETFs that held at least one Strong Buy 5 rated stock as a major holding.

Backtesting The Discrete Volatility Model For Trading VXX - A Comparison Of DISVOL Models

seekingalpha.com

2020-09-14 09:50:04We backtest the discrete volatility model from Lazard Asset Management for a VXX trading strategy. The additional layer of specification yields a stellar return in the in-sample period, but disappoints in the out-of-sample period.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Bet on Low-Beta ETFs in an Uncertain Market

zacks.com

2020-03-20 15:15:00Low-beta products exhibit greater levels of stability than their market-sensitive counterparts and will usually lose less when the market is crumbling.

Low Beta ETFs to Consider in an Uncertain Market

zacks.com

2020-03-04 16:10:00Investors seeking to remain invested in the equity world could consider low beta ETFs.