DTE Energy Company JR SUB DEB 76 (DTJ)

Price:

25.09 USD

( + 0.00 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

NextEra Energy Inc

VALUE SCORE:

0

2nd position

DTE Energy Company 2020 Series

VALUE SCORE:

11

The best

Korea Electric Power Corporation

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to approximately 2.3 million residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through fossil-fuel, hydroelectric pumped storage, and nuclear plants, as well as wind and other renewable assets. This segment owns and operates approximately 698 distribution substations and 449,800 line transformers. The company's Gas segment purchases, stores, transports, distributes, and sells natural gas to approximately 1.3 million residential, commercial, and industrial customers throughout Michigan; and sells storage and transportation capacity. This segment has approximately 20,000 miles of distribution mains; 1,304,000 service pipelines; and 1,305,000 active meters, as well as owns approximately 2,000 miles of transmission pipelines. The company's Power and Industrial Projects segment offers metallurgical coke; pulverized coal and petroleum coke to the steel, pulp and paper, and other industries; and power, steam and chilled water production, and wastewater treatment services, as well as supplies compressed air to industrial customers. Its Energy Trading segment engages in power, natural gas, and environmental marketing and trading; structured transactions; and the optimization of contracted natural gas pipeline transportation and storage positions. The company was founded in 1903 and is headquartered in Detroit, Michigan.

NEWS

Utilities And UTES Dashboard For May

seekingalpha.com

2021-05-14 05:57:14Utilities And UTES Dashboard For May

IDU: Utilities Dashboard For February

seekingalpha.com

2021-02-15 08:27:36IDU: Utilities Dashboard For February

FUTY: Utilities Dashboard For January

seekingalpha.com

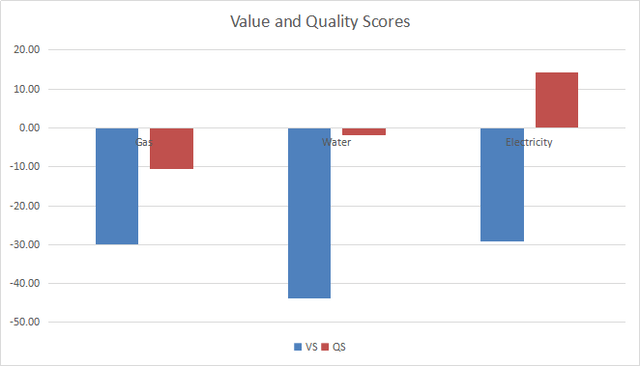

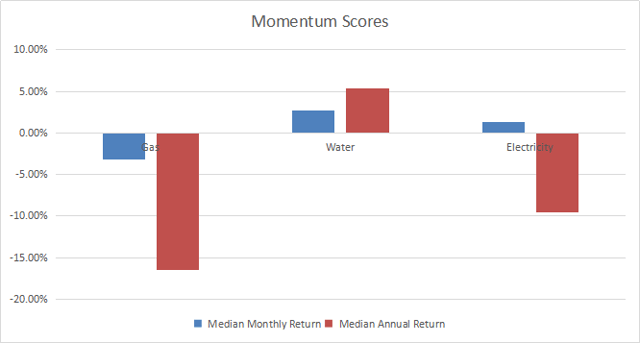

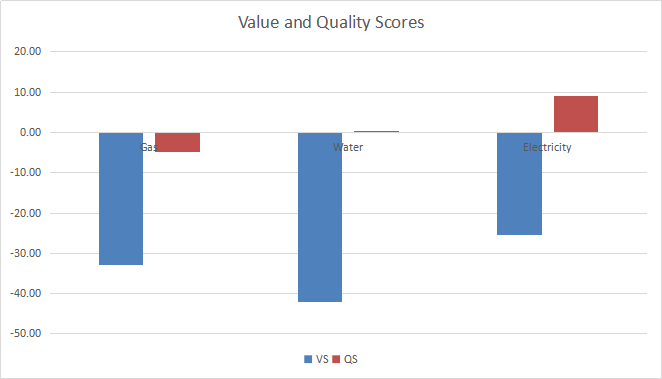

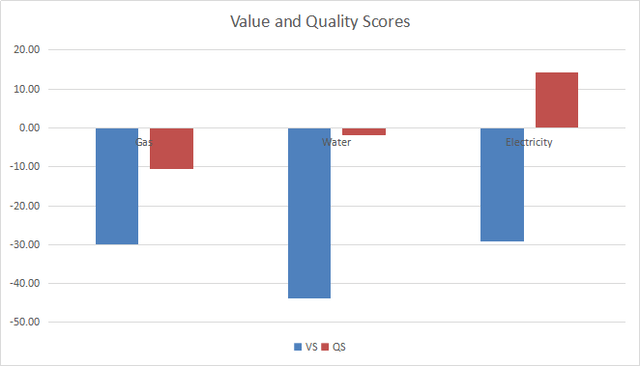

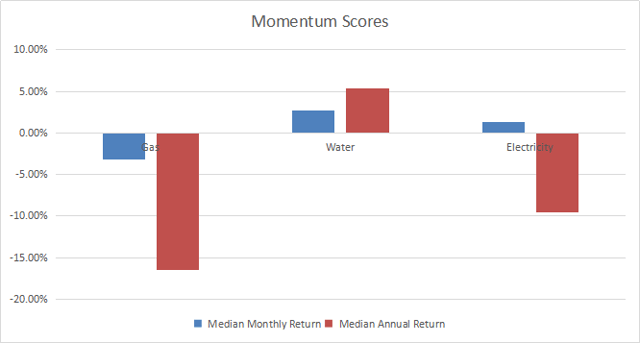

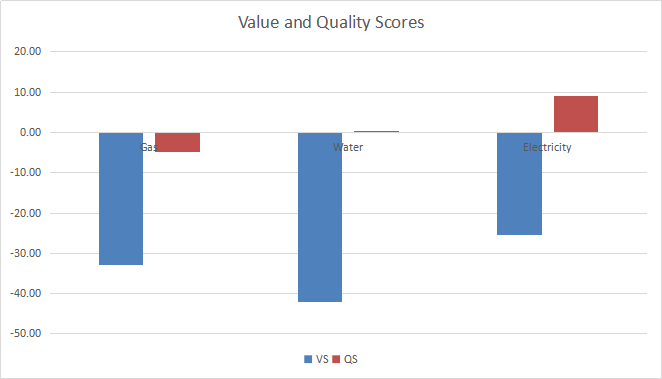

2021-01-27 09:11:35A dashboard with industry metrics in utilities. Value and quality scores, and their evolution since last month.

Entergy: Reasonable Valuation, Strong Yield, Growth Potential From This Utility

seekingalpha.com

2021-01-11 10:33:46Entergy: Reasonable Valuation, Strong Yield, Growth Potential From This Utility

Dividend Champion And Contender Highlights: Week Of September 13

seekingalpha.com

2020-09-12 14:41:38A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends.

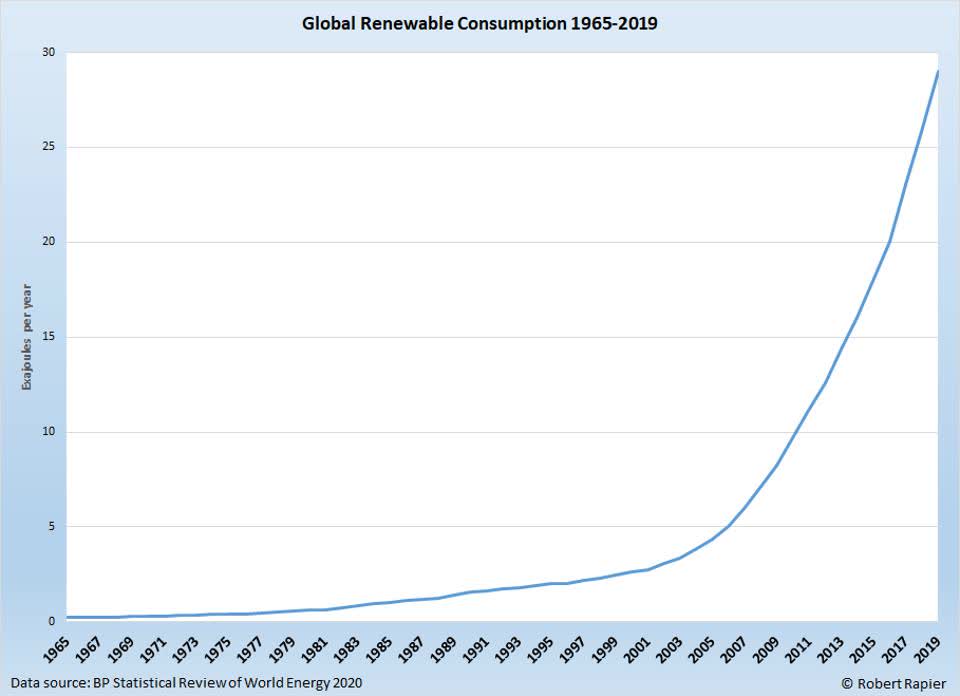

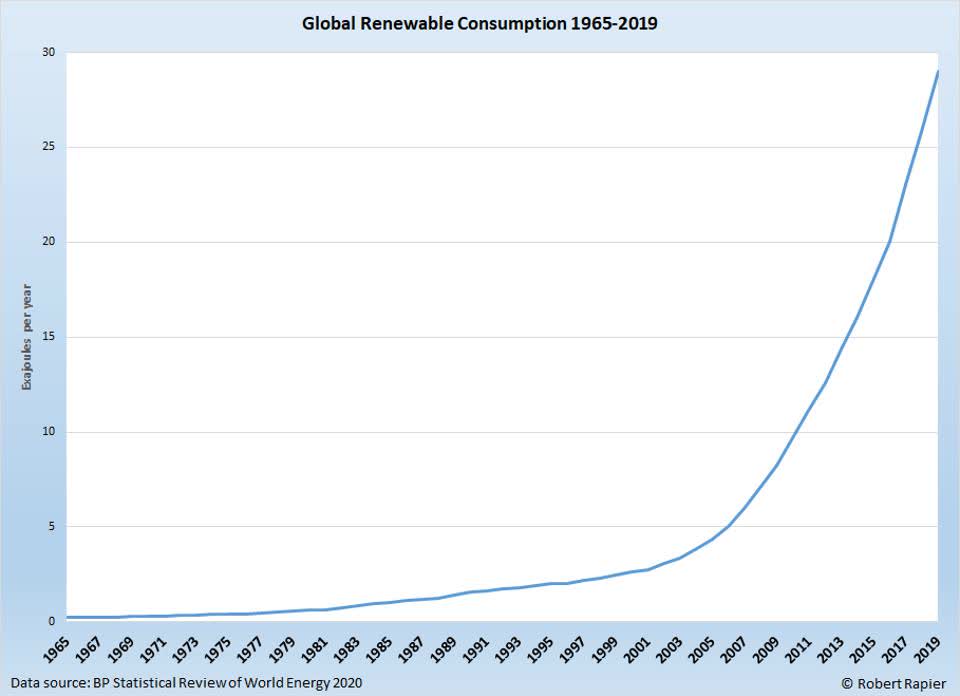

Renewable Energy Is Set For Exponential Growth In The Years Ahead

seekingalpha.com

2020-09-02 13:21:17The world is changing right before our eyes. Twenty years ago, renewable energy sources like wind and solar were expensive, inefficient, and generally avoided by the for-profit sector.

Utilities Dashboard For August

seekingalpha.com

2020-08-20 10:39:26A dashboard with metrics of value, quality and momentum. Value and quality scores relative to historical averages.

DTE Energy Company (DTE) CEO Jerry Norcia on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-28 15:53:12DTE Energy Company (NYSE:DTE) Q2 2020 Earnings Conference Call July 28, 2020, 09:00 AM ET Company Participants Barbara Tuckfield - Director-IR Jerry Norcia - President and CEO David Ruud - SVP and CFO Conference Call Participants Shar Pourreza - Guggenheim Partners Michael Weinstein - Credit Suisse Julien Dumoulin-Smith - Bank of America Jeremy Tonet - JPMorgan Jonathan Arnold - Vertical Research Durgesh Chopra - Evercore Sophie Karp - KeyBanc James Thalacker - BMO Capital Markets David Fishman - Goldman Sachs Andrew Weisel - Scotiabank Presentation Operator Good morning, ladies and gentlemen, thank you for standing by, and welcome to the DTE Energy Second Quarter 2020 Earnings Conference Call.

DTE Energy Company 2020 Q2 - Results - Earnings Call Presentation

seekingalpha.com

2020-07-28 07:39:56The following slide deck was published by DTE Energy Company in conjunction with their 2020 Q2 earnings call.

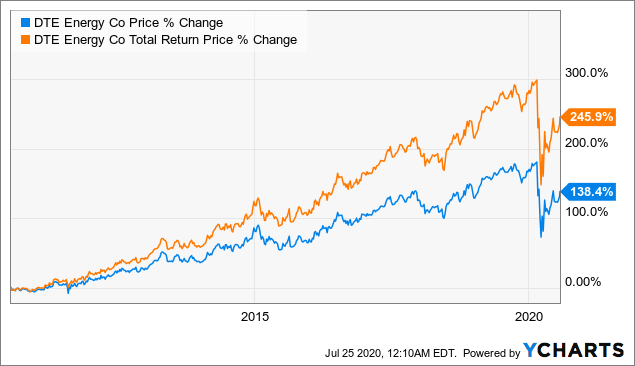

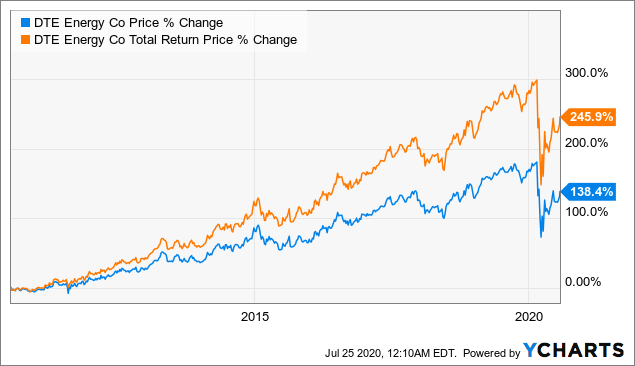

DTE Energy: EPS Growth Should Continue Thanks To Its Capital Projects

seekingalpha.com

2020-07-27 14:17:36DTE Energy has a plan to invest $19 billion of capital in the next five years to grow its business in Michigan.

Utilities Dashboard - July Edition

seekingalpha.com

2020-07-23 10:31:55A dashboard with metrics of value, quality and momentum. Value and quality scores relative to historical averages.

Utilities Dashboard - June Edition

seekingalpha.com

2020-06-26 07:56:00A dashboard in utilities with metrics of value, quality and momentum. Value and quality scores relative to historical averages. The best and the worst in value,

Q3 2020 Earnings Estimate for DTE Energy Co Issued By KeyCorp (NYSE:DTE)

thelincolnianonline.com

2020-05-01 07:34:44DTE Energy Co (NYSE:DTE) – KeyCorp lifted their Q3 2020 EPS estimates for shares of DTE Energy in a report issued on Tuesday, April 28th. KeyCorp analyst S. Karp now expects that the utilities provider will post earnings of $1.93 per share for the quarter, up from their prior estimate of $1.84. KeyCorp currently has […]

Certified Advisory Corp Has $35,000 Holdings in DTE Energy Co (NYSE:DTE)

thelincolnianonline.com

2020-04-30 11:45:00Certified Advisory Corp reduced its stake in shares of DTE Energy Co (NYSE:DTE) by 39.2% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 366 shares of the utilities provider’s stock after selling 236 shares during the quarter. Certified Advisory […]

BBVA USA Bancshares Inc. Sells 275 Shares of DTE Energy Co (NYSE:DTE)

thelincolnianonline.com

2020-04-30 09:40:55BBVA USA Bancshares Inc. trimmed its stake in shares of DTE Energy Co (NYSE:DTE) by 3.6% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 7,322 shares of the utilities provider’s stock after selling 275 shares during the quarter. BBVA […]

Cognios Capital LLC Has $212,000 Stake in DTE Energy Co (NYSE:DTE)

thelincolnianonline.com

2020-04-29 11:16:45Cognios Capital LLC trimmed its stake in shares of DTE Energy Co (NYSE:DTE) by 30.9% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 2,240 shares of the utilities provider’s stock after selling 1,003 shares during the quarter. Cognios […]

Utilities And UTES Dashboard For May

seekingalpha.com

2021-05-14 05:57:14Utilities And UTES Dashboard For May

IDU: Utilities Dashboard For February

seekingalpha.com

2021-02-15 08:27:36IDU: Utilities Dashboard For February

FUTY: Utilities Dashboard For January

seekingalpha.com

2021-01-27 09:11:35A dashboard with industry metrics in utilities. Value and quality scores, and their evolution since last month.

Entergy: Reasonable Valuation, Strong Yield, Growth Potential From This Utility

seekingalpha.com

2021-01-11 10:33:46Entergy: Reasonable Valuation, Strong Yield, Growth Potential From This Utility

Dividend Champion And Contender Highlights: Week Of September 13

seekingalpha.com

2020-09-12 14:41:38A weekly summary of dividend activity for Dividend Champions and Contenders. Companies which changed their dividends.

Renewable Energy Is Set For Exponential Growth In The Years Ahead

seekingalpha.com

2020-09-02 13:21:17The world is changing right before our eyes. Twenty years ago, renewable energy sources like wind and solar were expensive, inefficient, and generally avoided by the for-profit sector.

Utilities Dashboard For August

seekingalpha.com

2020-08-20 10:39:26A dashboard with metrics of value, quality and momentum. Value and quality scores relative to historical averages.

DTE Energy Company (DTE) CEO Jerry Norcia on Q2 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-07-28 15:53:12DTE Energy Company (NYSE:DTE) Q2 2020 Earnings Conference Call July 28, 2020, 09:00 AM ET Company Participants Barbara Tuckfield - Director-IR Jerry Norcia - President and CEO David Ruud - SVP and CFO Conference Call Participants Shar Pourreza - Guggenheim Partners Michael Weinstein - Credit Suisse Julien Dumoulin-Smith - Bank of America Jeremy Tonet - JPMorgan Jonathan Arnold - Vertical Research Durgesh Chopra - Evercore Sophie Karp - KeyBanc James Thalacker - BMO Capital Markets David Fishman - Goldman Sachs Andrew Weisel - Scotiabank Presentation Operator Good morning, ladies and gentlemen, thank you for standing by, and welcome to the DTE Energy Second Quarter 2020 Earnings Conference Call.

DTE Energy Company 2020 Q2 - Results - Earnings Call Presentation

seekingalpha.com

2020-07-28 07:39:56The following slide deck was published by DTE Energy Company in conjunction with their 2020 Q2 earnings call.

DTE Energy: EPS Growth Should Continue Thanks To Its Capital Projects

seekingalpha.com

2020-07-27 14:17:36DTE Energy has a plan to invest $19 billion of capital in the next five years to grow its business in Michigan.

Utilities Dashboard - July Edition

seekingalpha.com

2020-07-23 10:31:55A dashboard with metrics of value, quality and momentum. Value and quality scores relative to historical averages.

Utilities Dashboard - June Edition

seekingalpha.com

2020-06-26 07:56:00A dashboard in utilities with metrics of value, quality and momentum. Value and quality scores relative to historical averages. The best and the worst in value,

Q3 2020 Earnings Estimate for DTE Energy Co Issued By KeyCorp (NYSE:DTE)

thelincolnianonline.com

2020-05-01 07:34:44DTE Energy Co (NYSE:DTE) – KeyCorp lifted their Q3 2020 EPS estimates for shares of DTE Energy in a report issued on Tuesday, April 28th. KeyCorp analyst S. Karp now expects that the utilities provider will post earnings of $1.93 per share for the quarter, up from their prior estimate of $1.84. KeyCorp currently has […]

Certified Advisory Corp Has $35,000 Holdings in DTE Energy Co (NYSE:DTE)

thelincolnianonline.com

2020-04-30 11:45:00Certified Advisory Corp reduced its stake in shares of DTE Energy Co (NYSE:DTE) by 39.2% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 366 shares of the utilities provider’s stock after selling 236 shares during the quarter. Certified Advisory […]

BBVA USA Bancshares Inc. Sells 275 Shares of DTE Energy Co (NYSE:DTE)

thelincolnianonline.com

2020-04-30 09:40:55BBVA USA Bancshares Inc. trimmed its stake in shares of DTE Energy Co (NYSE:DTE) by 3.6% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 7,322 shares of the utilities provider’s stock after selling 275 shares during the quarter. BBVA […]

Cognios Capital LLC Has $212,000 Stake in DTE Energy Co (NYSE:DTE)

thelincolnianonline.com

2020-04-29 11:16:45Cognios Capital LLC trimmed its stake in shares of DTE Energy Co (NYSE:DTE) by 30.9% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 2,240 shares of the utilities provider’s stock after selling 1,003 shares during the quarter. Cognios […]