Deckers Outdoor Corporation (DECK)

Price:

101.18 USD

( - -0.18 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Wolverine World Wide, Inc.

VALUE SCORE:

5

2nd position

Caleres, Inc.

VALUE SCORE:

6

The best

Birkenstock Holding plc

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Deckers Outdoor Corporation, together with its subsidiaries, designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities. The company offers premium footwear, apparel, and accessories under the UGG brand name; sandals, shoes, and boots under the Teva brand name; and relaxed casual shoes and sandals under the Sanuk brand name. It also provides footwear and apparel for ultra-runners and athletes under the Hoka brand name; and fashion casual footwear using other plush materials under the Koolaburra brand. The company sells its products through department stores, domestic independent action sports and outdoor specialty footwear retailers, and larger national retail chains, as well as online retailers. It also sells its products directly to consumers through its retail stores and e-commerce websites, as well as distributes its products through distributors and retailers in the United States, Europe, the Asia-Pacific, Canada, Latin America, and internationally. As of March 31, 2022, it had 149 retail stores, including 75 concept stores and 74 outlet stores worldwide. The company was founded in 1973 and is headquartered in Goleta, California.

NEWS

Investors Heavily Search Deckers Outdoor Corporation (DECK): Here is What You Need to Know

zacks.com

2025-12-12 10:00:48Zacks.com users have recently been watching Deckers (DECK) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

California Public Employees Retirement System Increases Stock Position in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-12-12 03:56:49California Public Employees Retirement System raised its stake in shares of Deckers Outdoor Corporation (NYSE: DECK) by 4.5% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 269,952 shares of the textile maker's stock after acquiring an additional 11,662

GAP vs. DECK: Which Stock Is the Better Value Option?

zacks.com

2025-12-11 12:41:11Investors with an interest in Retail - Apparel and Shoes stocks have likely encountered both Gap (GAP) and Deckers (DECK). But which of these two stocks offers value investors a better bang for their buck right now?

2026 Comeback Picks: 3 S&P Laggards Poised to Break Out

marketbeat.com

2025-12-11 11:38:22There are no sure things in investing. However, reliable patterns can help investors make informed decisions.

Why the Market Dipped But Deckers (DECK) Gained Today

zacks.com

2025-12-08 18:50:41Deckers (DECK) reached $101.21 at the closing of the latest trading day, reflecting a +1.51% change compared to its last close.

Deckers Outdoor: Undervalued, Low-Leveraged Compounder With Tailwinds Ahead

seekingalpha.com

2025-12-06 20:00:00Deckers Outdoor (DECK) is rated Strong Buy with a $117 price target, offering 23% upside and market outperformance potential. DECK trades at a 14x forward P/E, a 16% discount to peers, despite premium margins and 16 consecutive double-beat quarters. Blockbuster brands UGG and HOKA drive robust top and bottom-line growth, with gross margin at 56.2% and net margin at 19%.

4 Things to Watch With DECK Stock in 2026

fool.com

2025-12-06 12:06:00Deckers Outdoor's stock price is down more than 50% this year. Weak consumer discretionary spending has weighed on the stock.

Deckers Outdoor Corporation $DECK Shares Sold by CW Advisors LLC

defenseworld.net

2025-12-05 04:27:04CW Advisors LLC lessened its stake in shares of Deckers Outdoor Corporation (NYSE: DECK) by 10.3% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 84,212 shares of the textile maker's stock after selling 9,630 shares during the

Deckers Outdoor Corporation (NYSE:DECK) Given Consensus Rating of “Hold” by Analysts

defenseworld.net

2025-12-05 02:16:46Shares of Deckers Outdoor Corporation (NYSE: DECK - Get Free Report) have been given an average recommendation of "Hold" by the twenty-five research firms that are currently covering the stock, Marketbeat reports. Two equities research analysts have rated the stock with a sell rating, eleven have assigned a hold rating, ten have given a buy rating

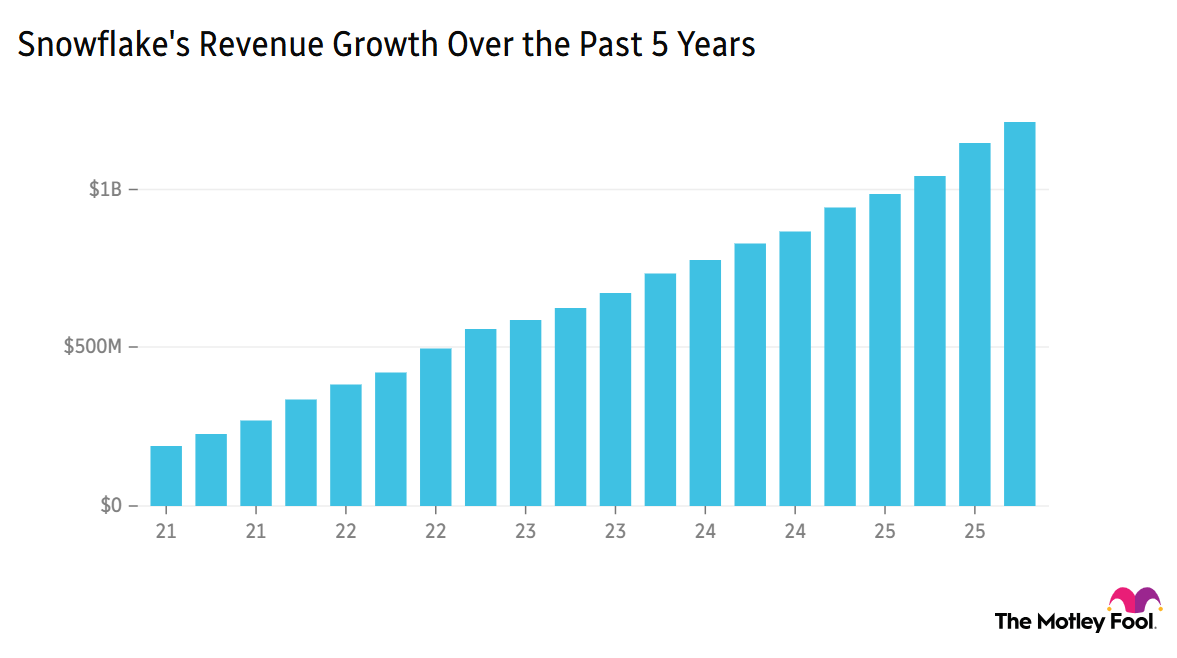

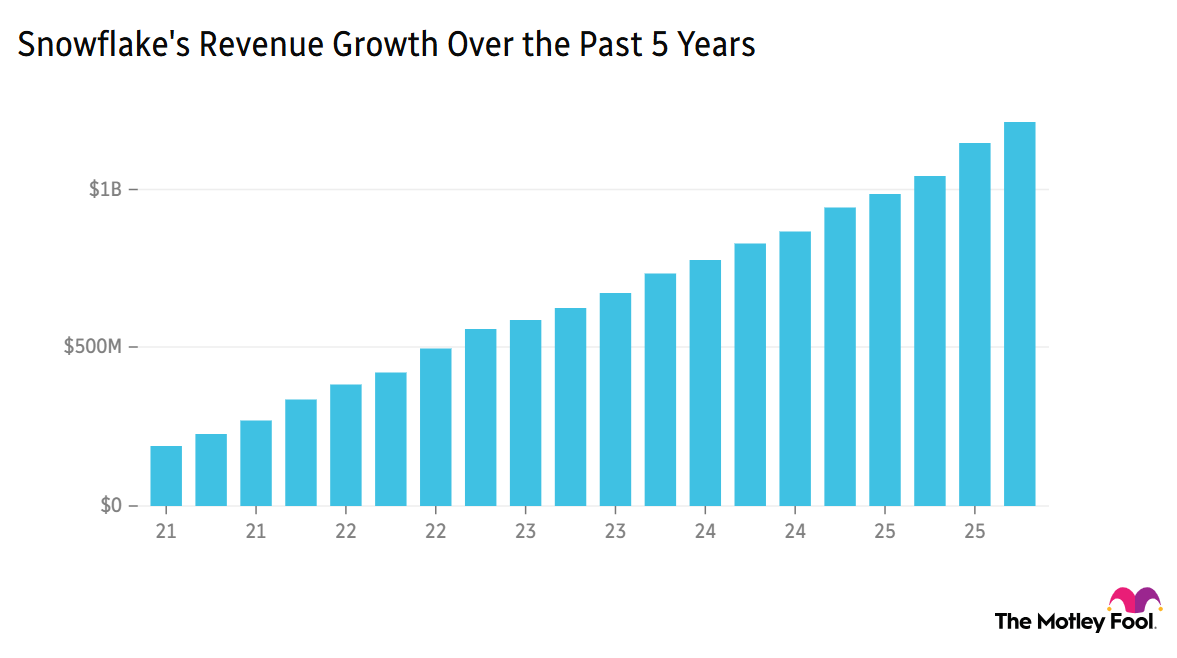

Breakfast News: SNOW's Growth Outlook Cools

fool.com

2025-12-04 07:30:00Snowflake drops on underwhelming growth projections, Meta caught in EU antitrust battle, and more

Edgestream Partners L.P. Has $3.57 Million Stake in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-12-04 04:27:04Edgestream Partners L.P. reduced its position in Deckers Outdoor Corporation (NYSE: DECK) by 45.5% in the undefined quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 34,642 shares of the textile maker's stock after selling 28,966 shares during the quarter. Edgestream Partners

Here is What to Know Beyond Why Deckers Outdoor Corporation (DECK) is a Trending Stock

zacks.com

2025-12-01 10:01:41Deckers (DECK) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Charles Schwab Investment Management Inc. Acquires 31,356 Shares of Deckers Outdoor Corporation $DECK

defenseworld.net

2025-11-29 04:22:51Charles Schwab Investment Management Inc. lifted its holdings in shares of Deckers Outdoor Corporation (NYSE: DECK) by 3.0% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,071,600 shares of the textile maker's stock after acquiring an additional 31,356

Aspex Management HK Ltd Trims Stake in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-11-27 05:20:49Aspex Management HK Ltd cut its position in shares of Deckers Outdoor Corporation (NYSE: DECK) by 26.2% during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,198,917 shares of the textile maker's stock after selling 426,724 shares during the quarter. Deckers Outdoor

Arrowpoint Investment Partners Singapore Pte. Ltd. Acquires New Position in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-11-27 05:20:48Arrowpoint Investment Partners Singapore Pte. Ltd. bought a new position in Deckers Outdoor Corporation (NYSE: DECK) in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 17,146 shares of the textile maker's stock, valued at approximately $1,767,000. Deckers Outdoor makes up

GAP vs. DECK: Which Stock Should Value Investors Buy Now?

zacks.com

2025-11-25 12:41:09Investors looking for stocks in the Retail - Apparel and Shoes sector might want to consider either Gap (GAP) or Deckers (DECK). But which of these two stocks offers value investors a better bang for their buck right now?

No data to display

Investors Heavily Search Deckers Outdoor Corporation (DECK): Here is What You Need to Know

zacks.com

2025-12-12 10:00:48Zacks.com users have recently been watching Deckers (DECK) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

California Public Employees Retirement System Increases Stock Position in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-12-12 03:56:49California Public Employees Retirement System raised its stake in shares of Deckers Outdoor Corporation (NYSE: DECK) by 4.5% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 269,952 shares of the textile maker's stock after acquiring an additional 11,662

GAP vs. DECK: Which Stock Is the Better Value Option?

zacks.com

2025-12-11 12:41:11Investors with an interest in Retail - Apparel and Shoes stocks have likely encountered both Gap (GAP) and Deckers (DECK). But which of these two stocks offers value investors a better bang for their buck right now?

2026 Comeback Picks: 3 S&P Laggards Poised to Break Out

marketbeat.com

2025-12-11 11:38:22There are no sure things in investing. However, reliable patterns can help investors make informed decisions.

Why the Market Dipped But Deckers (DECK) Gained Today

zacks.com

2025-12-08 18:50:41Deckers (DECK) reached $101.21 at the closing of the latest trading day, reflecting a +1.51% change compared to its last close.

Deckers Outdoor: Undervalued, Low-Leveraged Compounder With Tailwinds Ahead

seekingalpha.com

2025-12-06 20:00:00Deckers Outdoor (DECK) is rated Strong Buy with a $117 price target, offering 23% upside and market outperformance potential. DECK trades at a 14x forward P/E, a 16% discount to peers, despite premium margins and 16 consecutive double-beat quarters. Blockbuster brands UGG and HOKA drive robust top and bottom-line growth, with gross margin at 56.2% and net margin at 19%.

4 Things to Watch With DECK Stock in 2026

fool.com

2025-12-06 12:06:00Deckers Outdoor's stock price is down more than 50% this year. Weak consumer discretionary spending has weighed on the stock.

Deckers Outdoor Corporation $DECK Shares Sold by CW Advisors LLC

defenseworld.net

2025-12-05 04:27:04CW Advisors LLC lessened its stake in shares of Deckers Outdoor Corporation (NYSE: DECK) by 10.3% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 84,212 shares of the textile maker's stock after selling 9,630 shares during the

Deckers Outdoor Corporation (NYSE:DECK) Given Consensus Rating of “Hold” by Analysts

defenseworld.net

2025-12-05 02:16:46Shares of Deckers Outdoor Corporation (NYSE: DECK - Get Free Report) have been given an average recommendation of "Hold" by the twenty-five research firms that are currently covering the stock, Marketbeat reports. Two equities research analysts have rated the stock with a sell rating, eleven have assigned a hold rating, ten have given a buy rating

Breakfast News: SNOW's Growth Outlook Cools

fool.com

2025-12-04 07:30:00Snowflake drops on underwhelming growth projections, Meta caught in EU antitrust battle, and more

Edgestream Partners L.P. Has $3.57 Million Stake in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-12-04 04:27:04Edgestream Partners L.P. reduced its position in Deckers Outdoor Corporation (NYSE: DECK) by 45.5% in the undefined quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 34,642 shares of the textile maker's stock after selling 28,966 shares during the quarter. Edgestream Partners

Here is What to Know Beyond Why Deckers Outdoor Corporation (DECK) is a Trending Stock

zacks.com

2025-12-01 10:01:41Deckers (DECK) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Charles Schwab Investment Management Inc. Acquires 31,356 Shares of Deckers Outdoor Corporation $DECK

defenseworld.net

2025-11-29 04:22:51Charles Schwab Investment Management Inc. lifted its holdings in shares of Deckers Outdoor Corporation (NYSE: DECK) by 3.0% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,071,600 shares of the textile maker's stock after acquiring an additional 31,356

Aspex Management HK Ltd Trims Stake in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-11-27 05:20:49Aspex Management HK Ltd cut its position in shares of Deckers Outdoor Corporation (NYSE: DECK) by 26.2% during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,198,917 shares of the textile maker's stock after selling 426,724 shares during the quarter. Deckers Outdoor

Arrowpoint Investment Partners Singapore Pte. Ltd. Acquires New Position in Deckers Outdoor Corporation $DECK

defenseworld.net

2025-11-27 05:20:48Arrowpoint Investment Partners Singapore Pte. Ltd. bought a new position in Deckers Outdoor Corporation (NYSE: DECK) in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 17,146 shares of the textile maker's stock, valued at approximately $1,767,000. Deckers Outdoor makes up

GAP vs. DECK: Which Stock Should Value Investors Buy Now?

zacks.com

2025-11-25 12:41:09Investors looking for stocks in the Retail - Apparel and Shoes sector might want to consider either Gap (GAP) or Deckers (DECK). But which of these two stocks offers value investors a better bang for their buck right now?