Donaldson Company, Inc. (DCI)

Price:

92.29 USD

( - -0.78 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Cummins Inc.

VALUE SCORE:

9

2nd position

Thermon Group Holdings, Inc.

VALUE SCORE:

10

The best

Parsons Corporation

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

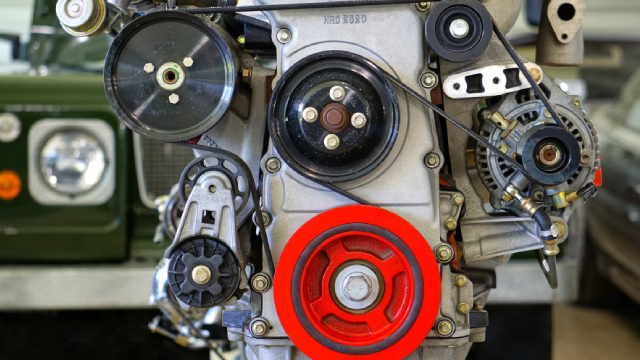

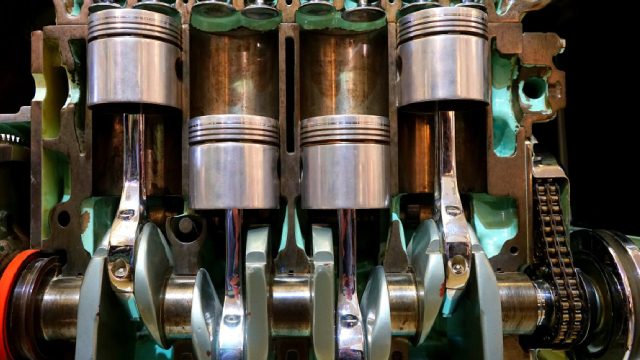

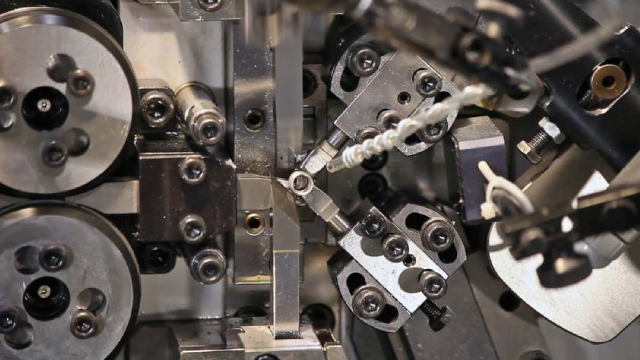

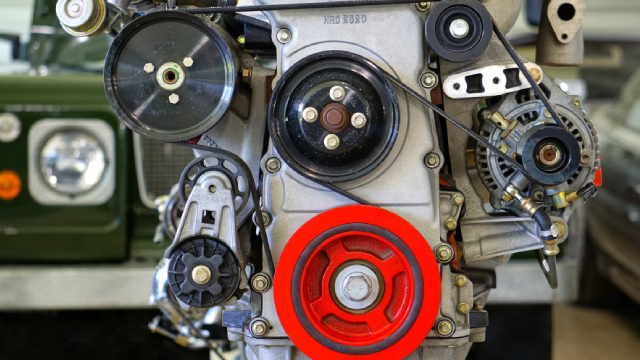

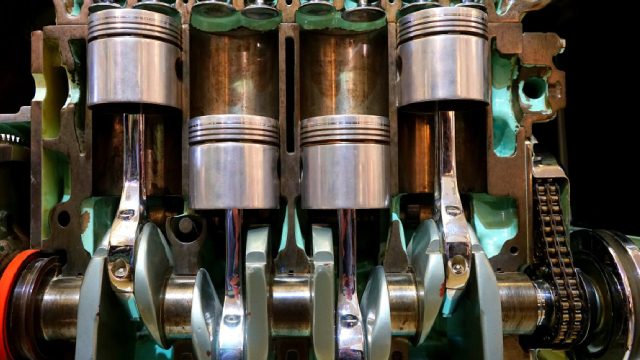

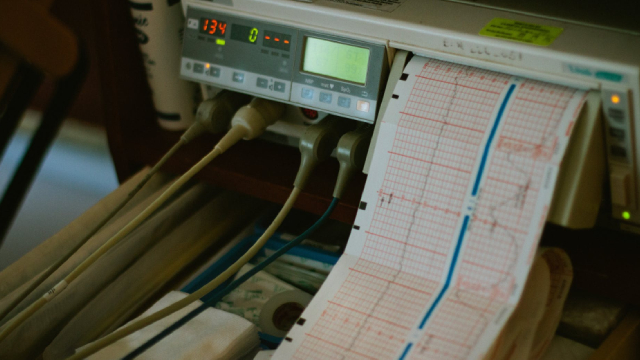

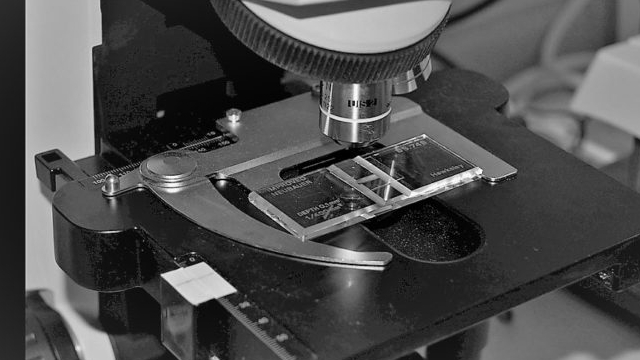

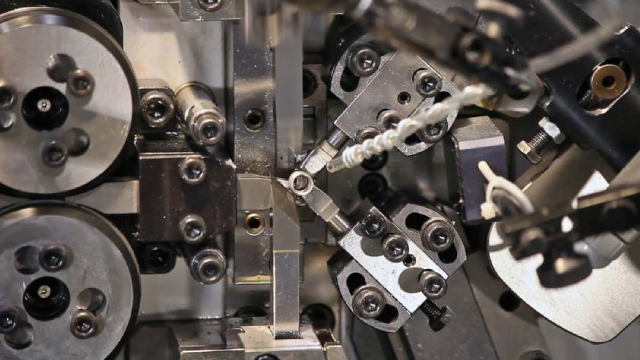

Donaldson Company, Inc. manufactures and sells filtration systems and replacement parts worldwide. The company operates through two segments, Engine Products and Industrial Products. Its Engine Products segment provides replacement filters for air and liquid filtration applications; air filtration systems; liquid filtration systems for fuel, lube, and hydraulic applications; exhaust and emissions systems and sensors; indicators; and monitoring systems. This segment sells its products to original equipment manufacturers (OEMs) in the construction, mining, agriculture, aerospace, defense, and transportation markets; and to independent distributors, OEM dealer networks, private label accounts, and large fleets. The company's Industrial Products segment offers dust, fume, and mist collectors; compressed air purification systems; gas and liquid filtration for food, beverage, and industrial processes; air filtration systems for gas turbines; polytetrafluoroethylene membrane-based products; and specialized air and gas filtration systems for applications, including hard disk drives, semi-conductor manufacturing and sensors, indicators, and monitoring systems. This segment sells its products to various dealers, distributors, OEMs of gas-fired turbines, and OEMs and end-users requiring air filtration solutions and replacement filters. Donaldson Company, Inc. was founded in 1915 and is headquartered in Bloomington, Minnesota.

NEWS

Are You Looking for a Top Momentum Pick? Why Donaldson (DCI) is a Great Choice

zacks.com

2025-12-12 13:01:28Does Donaldson (DCI) have what it takes to be a top stock pick for momentum investors? Let's find out.

Here's Why Donaldson (DCI) is a Strong Growth Stock

zacks.com

2025-12-12 10:46:22Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Donaldson (DCI) is an Incredible Growth Stock: 3 Reasons Why

zacks.com

2025-12-09 13:46:08Donaldson (DCI) could produce exceptional returns because of its solid growth attributes.

Donaldson: High-Quality Industrial Compounder Positioned For Multi-Year Growth And P/E Re-Rating

seekingalpha.com

2025-12-08 22:39:38Donaldson Company is well-positioned for further upside, supported by robust growth across Mobile, Industrial, and Life Sciences segments. Secular tailwinds from AI-driven power generation, resilient off-road demand, and recovery in bioprocessing and disk drive markets underpin the bullish outlook. Margin expansion is expected from operating leverage, cost optimization, and footprint rationalization, with incremental margins guided in the 40% range for FY26.

All You Need to Know About Donaldson (DCI) Rating Upgrade to Buy

zacks.com

2025-12-08 13:01:05Donaldson (DCI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Is Donaldson (DCI) Outperforming Other Industrial Products Stocks This Year?

zacks.com

2025-12-08 10:41:29Here is how Donaldson (DCI) and O-I Glass (OI) have performed compared to their sector so far this year.

Donaldson's Q1 Earnings & Revenues Beat Estimates, Increase Y/Y

zacks.com

2025-12-05 13:16:08DCI beats on Q1 earnings and revenues as Mobile Solutions and Life Sciences lift growth despite margin pressure from tariffs.

Donaldson Analysts Boost Their Forecasts Following Strong Q1 Earnings

benzinga.com

2025-12-05 12:42:09Donaldson Company, Inc. (NYSE: DCI) reported upbeat first-quarter fiscal 2026 results on Thursday.

Donaldson Company, Inc. (DCI) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-12-04 13:28:52Donaldson Company, Inc. (DCI) Q1 2026 Earnings Call Transcript

Donaldson (DCI) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

zacks.com

2025-12-04 10:31:27Although the revenue and EPS for Donaldson (DCI) give a sense of how its business performed in the quarter ended October 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Donaldson (DCI) Surpasses Q1 Earnings and Revenue Estimates

zacks.com

2025-12-04 08:10:25Donaldson (DCI) came out with quarterly earnings of $0.94 per share, beating the Zacks Consensus Estimate of $0.93 per share. This compares to earnings of $0.83 per share a year ago.

Donaldson Reports Record First Quarter Fiscal Year 2026 Sales and Earnings

businesswire.com

2025-12-04 06:00:00MINNEAPOLIS--(BUSINESS WIRE)--Donaldson Company, Inc. (NYSE: DCI) (Donaldson or the Company), a global leader in technology-led filtration products and solutions, today reported first quarter fiscal 2026 generally accepted accounting principles (GAAP) net earnings of $113.9 million, compared with $99.0 million a year ago. Earnings per share (EPS)1 were $0.97 compared with first quarter fiscal 2025 EPS of $0.81. First quarter fiscal 2026 results include a $4.3 million pre-tax, non-recurring net.

What Analyst Projections for Key Metrics Reveal About Donaldson (DCI) Q1 Earnings

zacks.com

2025-12-01 10:16:19Beyond analysts' top-and-bottom-line estimates for Donaldson (DCI), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended October 2025.

Capital Counsel LLC NY Sells 3,796 Shares of Donaldson Company, Inc. $DCI

defenseworld.net

2025-12-01 05:58:42Capital Counsel LLC NY cut its stake in Donaldson Company, Inc. (NYSE: DCI) by 0.4% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 988,275 shares of the industrial products company's stock after selling 3,796 shares during the quarter. Donaldson comprises about

34,860 Shares in Donaldson Company, Inc. $DCI Acquired by Ballast Asset Management LP

defenseworld.net

2025-12-01 03:26:54Ballast Asset Management LP bought a new stake in shares of Donaldson Company, Inc. (NYSE: DCI) in the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 34,860 shares of the industrial products company's stock, valued at approximately $2,418,000. Several other hedge

Donaldson (DCI) Reports Next Week: Wall Street Expects Earnings Growth

zacks.com

2025-11-27 11:01:19Donaldson (DCI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Are You Looking for a Top Momentum Pick? Why Donaldson (DCI) is a Great Choice

zacks.com

2025-12-12 13:01:28Does Donaldson (DCI) have what it takes to be a top stock pick for momentum investors? Let's find out.

Here's Why Donaldson (DCI) is a Strong Growth Stock

zacks.com

2025-12-12 10:46:22Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Donaldson (DCI) is an Incredible Growth Stock: 3 Reasons Why

zacks.com

2025-12-09 13:46:08Donaldson (DCI) could produce exceptional returns because of its solid growth attributes.

Donaldson: High-Quality Industrial Compounder Positioned For Multi-Year Growth And P/E Re-Rating

seekingalpha.com

2025-12-08 22:39:38Donaldson Company is well-positioned for further upside, supported by robust growth across Mobile, Industrial, and Life Sciences segments. Secular tailwinds from AI-driven power generation, resilient off-road demand, and recovery in bioprocessing and disk drive markets underpin the bullish outlook. Margin expansion is expected from operating leverage, cost optimization, and footprint rationalization, with incremental margins guided in the 40% range for FY26.

All You Need to Know About Donaldson (DCI) Rating Upgrade to Buy

zacks.com

2025-12-08 13:01:05Donaldson (DCI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Is Donaldson (DCI) Outperforming Other Industrial Products Stocks This Year?

zacks.com

2025-12-08 10:41:29Here is how Donaldson (DCI) and O-I Glass (OI) have performed compared to their sector so far this year.

Donaldson's Q1 Earnings & Revenues Beat Estimates, Increase Y/Y

zacks.com

2025-12-05 13:16:08DCI beats on Q1 earnings and revenues as Mobile Solutions and Life Sciences lift growth despite margin pressure from tariffs.

Donaldson Analysts Boost Their Forecasts Following Strong Q1 Earnings

benzinga.com

2025-12-05 12:42:09Donaldson Company, Inc. (NYSE: DCI) reported upbeat first-quarter fiscal 2026 results on Thursday.

Donaldson Company, Inc. (DCI) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-12-04 13:28:52Donaldson Company, Inc. (DCI) Q1 2026 Earnings Call Transcript

Donaldson (DCI) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

zacks.com

2025-12-04 10:31:27Although the revenue and EPS for Donaldson (DCI) give a sense of how its business performed in the quarter ended October 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Donaldson (DCI) Surpasses Q1 Earnings and Revenue Estimates

zacks.com

2025-12-04 08:10:25Donaldson (DCI) came out with quarterly earnings of $0.94 per share, beating the Zacks Consensus Estimate of $0.93 per share. This compares to earnings of $0.83 per share a year ago.

Donaldson Reports Record First Quarter Fiscal Year 2026 Sales and Earnings

businesswire.com

2025-12-04 06:00:00MINNEAPOLIS--(BUSINESS WIRE)--Donaldson Company, Inc. (NYSE: DCI) (Donaldson or the Company), a global leader in technology-led filtration products and solutions, today reported first quarter fiscal 2026 generally accepted accounting principles (GAAP) net earnings of $113.9 million, compared with $99.0 million a year ago. Earnings per share (EPS)1 were $0.97 compared with first quarter fiscal 2025 EPS of $0.81. First quarter fiscal 2026 results include a $4.3 million pre-tax, non-recurring net.

What Analyst Projections for Key Metrics Reveal About Donaldson (DCI) Q1 Earnings

zacks.com

2025-12-01 10:16:19Beyond analysts' top-and-bottom-line estimates for Donaldson (DCI), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended October 2025.

Capital Counsel LLC NY Sells 3,796 Shares of Donaldson Company, Inc. $DCI

defenseworld.net

2025-12-01 05:58:42Capital Counsel LLC NY cut its stake in Donaldson Company, Inc. (NYSE: DCI) by 0.4% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 988,275 shares of the industrial products company's stock after selling 3,796 shares during the quarter. Donaldson comprises about

34,860 Shares in Donaldson Company, Inc. $DCI Acquired by Ballast Asset Management LP

defenseworld.net

2025-12-01 03:26:54Ballast Asset Management LP bought a new stake in shares of Donaldson Company, Inc. (NYSE: DCI) in the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 34,860 shares of the industrial products company's stock, valued at approximately $2,418,000. Several other hedge

Donaldson (DCI) Reports Next Week: Wall Street Expects Earnings Growth

zacks.com

2025-11-27 11:01:19Donaldson (DCI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.