Qwest Corp. NT (CTBB)

Price:

18.73 USD

( + 0.07 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

KT Corporation

VALUE SCORE:

7

2nd position

Verizon Communications Inc.

VALUE SCORE:

11

The best

Turkcell Iletisim Hizmetleri A.S.

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Qwest is a large telecommunications carrier providing local service to the midwest and western regions of the US. Qwest provides voice, backbone data services, and digital television in some areas. It operates in three segments: Wireline Services, Wireless Services, and Other Services. The Wireline Services segment provides local voice, long distance voice, and data and Internet (DSL) services to consumers, businesses, and wholesale customers, as well as access services to wholesale customers. The Wireless Services segment is achieved by a partnership with Verizon Wireless. The Other Services segment primarily involves the sublease of real estate assets, such as space in office buildings, warehouses, and other properties.

NEWS

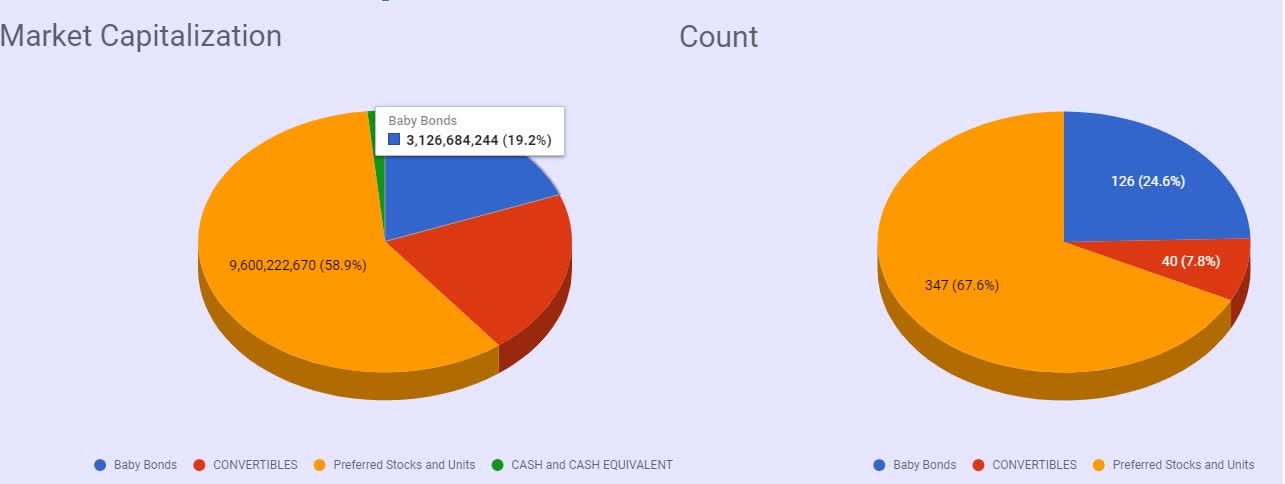

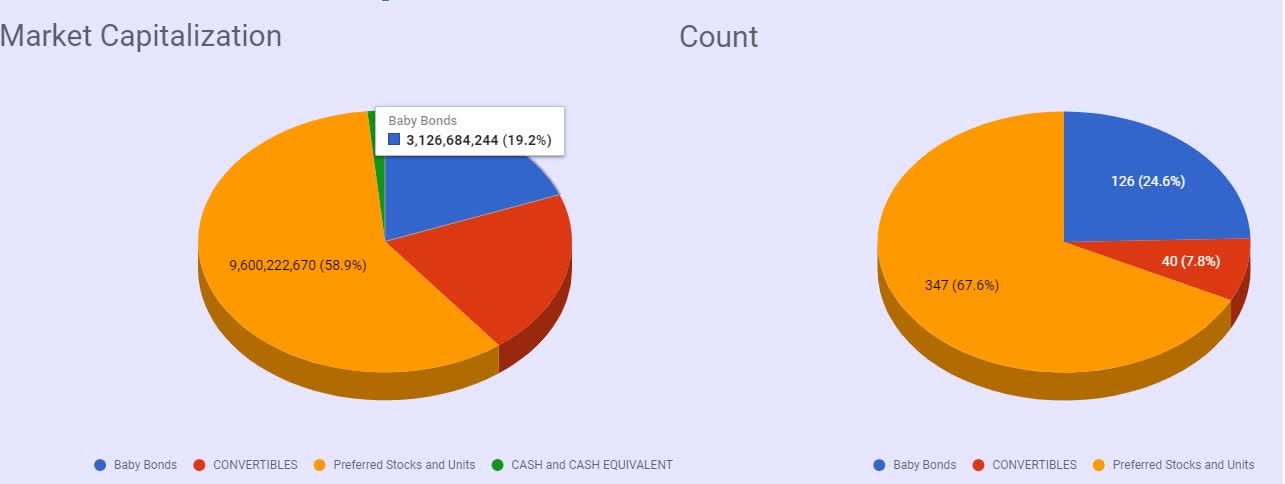

Baby Bonds Complete Review

seekingalpha.com

2020-08-19 22:51:21A review of all baby bonds. All the baby bonds sorted in categories.

Baby Bonds Complete Review

seekingalpha.com

2020-08-19 22:51:21A review of all baby bonds. All the baby bonds sorted in categories.