CSW Industrials, Inc. (CSWI)

Price:

305.10 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Aebi Schmidt Holding AG Common Stock When-Issued

VALUE SCORE:

0

2nd position

Franklin Electric Co., Inc.

VALUE SCORE:

9

The best

Roper Technologies, Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

DESCRIPTION

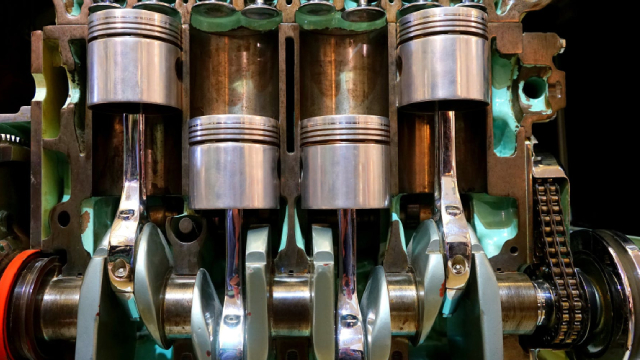

CSW Industrials, Inc. operates as a diversified industrial company in the United States and internationally. It operates through three segments: Contractor Solutions, Engineered Building Solutions, and Specialized Reliability Solutions. The Contractor Solutions segment provides cements, diffusers, grilles, registers, solvents, thread sealants, traps, and vents for use in HVAC/R, plumbing, general industrial, architecturally, and specified building products. The Engineered Building Solutions segment offers architectural railings and associated services; fire and smoke protection solutions; and pre-engineered and custom architectural building components for use in architecturally specified building products. The Specialized Reliability Solutions segment provides compounds, lubricants, lubricant management products, and sealants; and contamination control, industrial maintenance and repair, and operations solutions for use in energy, general industrial, mining, and railing markets. The company was incorporated in 2014 and is headquartered in Dallas, Texas.

NEWS

CSW Industrials (CSW) is an Incredible Growth Stock: 3 Reasons Why

zacks.com

2025-08-25 13:46:12CSW Industrials (CSW) is well positioned to outperform the market, as it exhibits above-average growth in financials.

3 Reasons Growth Investors Will Love CSW Industrials (CSW)

zacks.com

2025-08-07 13:46:10CSW Industrials (CSW) could produce exceptional returns because of its solid growth attributes.

CSW Industrials (CSWI) Q1 Revenue Up 17%

fool.com

2025-08-01 01:34:02CSW Industrials (CSWI) Q1 Revenue Up 17%

CSW Industrials (CSW) Beats Q1 Earnings Estimates

zacks.com

2025-07-31 08:56:11CSW Industrials (CSW) came out with quarterly earnings of $2.85 per share, beating the Zacks Consensus Estimate of $2.74 per share. This compares to earnings of $2.47 per share a year ago.

CSW Industrials (CSW) Reports Next Week: Wall Street Expects Earnings Growth

zacks.com

2025-07-24 11:08:57CSW Industrials (CSW) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

CSW Industrials: A Solid Stock, But A Little Too Pricey Right Now

seekingalpha.com

2025-07-20 11:41:03CSW Industrials has delivered a stellar 322% total return over five years, with a 33.4% CAGR, vastly outperforming the market. Strong financial metrics and a growing dividend highlight CSW's quality fundamentals and shareholder-friendly distributions. The stock performed very well in 2023 and 2024 but has struggled YTD in 2025; however, it may need to fall further before I buy in.

CSW Industrials (CSW) Loses 6.8% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

zacks.com

2025-06-20 10:36:04CSW Industrials (CSW) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

CSW Industrials (CSWI) Moves to Buy: Rationale Behind the Upgrade

zacks.com

2025-05-26 13:01:07CSW Industrials (CSWI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

CSW Industrials, Inc. (CSWI) Q4 2025 Earnings Call Transcript

seekingalpha.com

2025-05-22 13:02:57CSW Industrials, Inc. (NASDAQ:CSWI ) Q4 2025 Earnings Conference Call May 22, 2025 10:00 AM ET Company Participants Alexa Huerta - IR Joseph Armes - Chairman, CEO and President James Perry - EVP and CFO Conference Call Participants Jon Tanwanteng - CJS Securities Susan Maklari - Goldman Sachs Sam Reed - Wells Fargo Jamie Cook - Truist Securities Natalia Bak - Citi Operator Greetings. Welcome to CSW Industrial Incorporated Fourth Quarter and Full-Year Earnings Call.

CSWI Reports Record Fiscal Q4 Earnings Growth

fool.com

2025-05-22 12:43:14CSW Industrials (CSWI -3.92%) reported its fiscal 2025 fourth-quarter earnings on May 22, 2025, delivering record results. For the period, which ended March 31, revenue rose by 9% to $231 million, adjusted EBITDA reached $60 million, and adjusted earnings per share (EPS) hit $2.24.

CSW Industrials (CSWI) Beats Q4 Earnings Estimates

zacks.com

2025-05-22 08:56:04CSW Industrials (CSWI) came out with quarterly earnings of $2.24 per share, beating the Zacks Consensus Estimate of $2.23 per share. This compares to earnings of $2.04 per share a year ago.

CSW Industrials Reports Record Fiscal 2025 Fourth Quarter and Record Full Year Results

globenewswire.com

2025-05-22 06:45:00DALLAS, May 22, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI or the "Company") today reported record results for the fiscal 2025 fourth quarter period ended March 31, 2025.

CSW Industrials Announces Date for Fiscal Fourth Quarter and Full Year 2025 Earnings Release Conference Call

globenewswire.com

2025-05-12 08:30:00DALLAS, May 12, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (NASDAQ: CSWI) announced that it will release its earnings results for the fiscal fourth quarter and year ended March 31, 2025, on Thursday, May 22, 2025, before the market opens. The Company will host a conference call the same day at 10:00 am Eastern Time to discuss the results.

CSW Industrials Renews, Extends Revolving Credit Facility and Upsizes to $700 Million

globenewswire.com

2025-05-05 08:30:00DALLAS, May 05, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI) today announced the renewal and extension of its existing Revolving Credit Facility, including an increase of the Facility's commitment from $500 million to $700 million in partnership with a group of nine banks. The renewed Revolving Credit Facility has a five-year term and now matures in May of 2030.

CSW Industrials Completes Previously Announced Accretive, Synergistic Acquisition of Aspen Manufacturing

globenewswire.com

2025-05-01 10:55:00DALLAS, May 01, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI) (the “Company” or “CSW”) today announced the Company has completed the previously announced acquisition of Aspen Manufacturing for approximately $313.5 million in cash, utilizing cash on hand and borrowings under the existing $500 million revolving credit facility while maintaining sufficient liquidity and a strong balance sheet. The purchase price is approximately 11x Aspen Manufacturing's 2024 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $28.5 million.

CSW Industrials Announces Transfer of Listing of Common Stock to the New York Stock Exchange and Change in Ticker Symbol

globenewswire.com

2025-04-29 08:00:00DALLAS, April 29, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI) (the “Company”) today announced that the Company will transfer the listing and trading of its common stock to the New York Stock Exchange (“NYSE”) from the Nasdaq Stock Market LLC (“Nasdaq”).

CSW Industrials (CSW) is an Incredible Growth Stock: 3 Reasons Why

zacks.com

2025-08-25 13:46:12CSW Industrials (CSW) is well positioned to outperform the market, as it exhibits above-average growth in financials.

3 Reasons Growth Investors Will Love CSW Industrials (CSW)

zacks.com

2025-08-07 13:46:10CSW Industrials (CSW) could produce exceptional returns because of its solid growth attributes.

CSW Industrials (CSWI) Q1 Revenue Up 17%

fool.com

2025-08-01 01:34:02CSW Industrials (CSWI) Q1 Revenue Up 17%

CSW Industrials (CSW) Beats Q1 Earnings Estimates

zacks.com

2025-07-31 08:56:11CSW Industrials (CSW) came out with quarterly earnings of $2.85 per share, beating the Zacks Consensus Estimate of $2.74 per share. This compares to earnings of $2.47 per share a year ago.

CSW Industrials (CSW) Reports Next Week: Wall Street Expects Earnings Growth

zacks.com

2025-07-24 11:08:57CSW Industrials (CSW) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

CSW Industrials: A Solid Stock, But A Little Too Pricey Right Now

seekingalpha.com

2025-07-20 11:41:03CSW Industrials has delivered a stellar 322% total return over five years, with a 33.4% CAGR, vastly outperforming the market. Strong financial metrics and a growing dividend highlight CSW's quality fundamentals and shareholder-friendly distributions. The stock performed very well in 2023 and 2024 but has struggled YTD in 2025; however, it may need to fall further before I buy in.

CSW Industrials (CSW) Loses 6.8% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

zacks.com

2025-06-20 10:36:04CSW Industrials (CSW) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

CSW Industrials (CSWI) Moves to Buy: Rationale Behind the Upgrade

zacks.com

2025-05-26 13:01:07CSW Industrials (CSWI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

CSW Industrials, Inc. (CSWI) Q4 2025 Earnings Call Transcript

seekingalpha.com

2025-05-22 13:02:57CSW Industrials, Inc. (NASDAQ:CSWI ) Q4 2025 Earnings Conference Call May 22, 2025 10:00 AM ET Company Participants Alexa Huerta - IR Joseph Armes - Chairman, CEO and President James Perry - EVP and CFO Conference Call Participants Jon Tanwanteng - CJS Securities Susan Maklari - Goldman Sachs Sam Reed - Wells Fargo Jamie Cook - Truist Securities Natalia Bak - Citi Operator Greetings. Welcome to CSW Industrial Incorporated Fourth Quarter and Full-Year Earnings Call.

CSWI Reports Record Fiscal Q4 Earnings Growth

fool.com

2025-05-22 12:43:14CSW Industrials (CSWI -3.92%) reported its fiscal 2025 fourth-quarter earnings on May 22, 2025, delivering record results. For the period, which ended March 31, revenue rose by 9% to $231 million, adjusted EBITDA reached $60 million, and adjusted earnings per share (EPS) hit $2.24.

CSW Industrials (CSWI) Beats Q4 Earnings Estimates

zacks.com

2025-05-22 08:56:04CSW Industrials (CSWI) came out with quarterly earnings of $2.24 per share, beating the Zacks Consensus Estimate of $2.23 per share. This compares to earnings of $2.04 per share a year ago.

CSW Industrials Reports Record Fiscal 2025 Fourth Quarter and Record Full Year Results

globenewswire.com

2025-05-22 06:45:00DALLAS, May 22, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI or the "Company") today reported record results for the fiscal 2025 fourth quarter period ended March 31, 2025.

CSW Industrials Announces Date for Fiscal Fourth Quarter and Full Year 2025 Earnings Release Conference Call

globenewswire.com

2025-05-12 08:30:00DALLAS, May 12, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (NASDAQ: CSWI) announced that it will release its earnings results for the fiscal fourth quarter and year ended March 31, 2025, on Thursday, May 22, 2025, before the market opens. The Company will host a conference call the same day at 10:00 am Eastern Time to discuss the results.

CSW Industrials Renews, Extends Revolving Credit Facility and Upsizes to $700 Million

globenewswire.com

2025-05-05 08:30:00DALLAS, May 05, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI) today announced the renewal and extension of its existing Revolving Credit Facility, including an increase of the Facility's commitment from $500 million to $700 million in partnership with a group of nine banks. The renewed Revolving Credit Facility has a five-year term and now matures in May of 2030.

CSW Industrials Completes Previously Announced Accretive, Synergistic Acquisition of Aspen Manufacturing

globenewswire.com

2025-05-01 10:55:00DALLAS, May 01, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI) (the “Company” or “CSW”) today announced the Company has completed the previously announced acquisition of Aspen Manufacturing for approximately $313.5 million in cash, utilizing cash on hand and borrowings under the existing $500 million revolving credit facility while maintaining sufficient liquidity and a strong balance sheet. The purchase price is approximately 11x Aspen Manufacturing's 2024 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $28.5 million.

CSW Industrials Announces Transfer of Listing of Common Stock to the New York Stock Exchange and Change in Ticker Symbol

globenewswire.com

2025-04-29 08:00:00DALLAS, April 29, 2025 (GLOBE NEWSWIRE) -- CSW Industrials, Inc. (Nasdaq: CSWI) (the “Company”) today announced that the Company will transfer the listing and trading of its common stock to the New York Stock Exchange (“NYSE”) from the Nasdaq Stock Market LLC (“Nasdaq”).