The Cooper Companies, Inc. (COO)

Price:

75.22 USD

( + 2.18 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Hologic, Inc.

VALUE SCORE:

6

2nd position

LeMaitre Vascular, Inc.

VALUE SCORE:

9

The best

Pro-Dex, Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

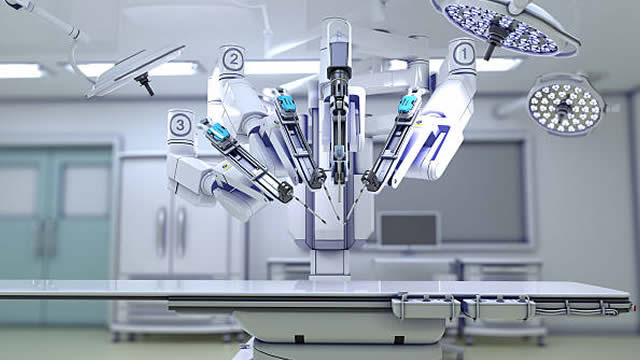

The Cooper Companies, Inc., together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment offers spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, myopia, ocular dryness and eye fatigues in the Americas, Europe, Middle East, Africa, and Asia Pacific. The CooperSurgical segment focuses on family and women's health care, which provides medical devices, fertility, genomics, diagnostics, and contraception to health care professionals and patients worldwide. It offers surgical and office products, including PARAGARD, uterine manipulators, retractors, closure products, point of care products, LEEP products, endosee, and illuminate and fetal pillows; fertility products and services, such as fertility consumables and equipment, and embryo options and preimplantation genetic testing. The Cooper Companies, Inc. was founded in 1958 and is headquartered in San Ramon, California.

NEWS

The Cooper Companies (COO) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

zacks.com

2025-08-22 10:15:27Besides Wall Street's top-and-bottom-line estimates for The Cooper Companies (COO), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended July 2025.

The Cooper Companies (COO) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

zacks.com

2025-08-20 11:00:27The Cooper Companies (COO) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Cooper Companies' Innovation Fuels Growth Amid Macro Headwinds

zacks.com

2025-08-19 09:51:16COO leans on innovation and diversification to fuel growth, but fertility softness, tariffs and inventory headwinds weigh on near-term outlook.

CooperCompanies to Participate in the Wells Fargo Healthcare Conference

globenewswire.com

2025-08-14 16:15:00SAN RAMON, Calif., Aug. 14, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading global medical device company, announced today it will participate in the Wells Fargo Healthcare Conference on Wednesday, September 3, 2025. Al White, President and CEO, will represent the Company in a session scheduled at 3:00 PM ET.

Cooper Companies Q3 Preview: Low Fertility Growth During Year Of Snake Is Temporary

seekingalpha.com

2025-08-14 11:58:49Cooper Companies Q3 Preview: Low Fertility Growth During Year Of Snake Is Temporary

Baron Health Care Fund Q2: Top Contributors, Misses, And Strategic Shifts

seekingalpha.com

2025-08-07 21:35:00Insmed, Intuitive Surgical, and IDEXX Laboratories were top contributors, driven by strong drug pipelines, innovation, and robust financial results. We exited UnitedHealth Group due to earnings misses, guidance cuts, and Medicare Advantage mispricing, despite its long-term potential to restore profitability. Thermo Fisher and argenx detracted from performance amid macro headwinds and lower-than-expected sales, but we retain conviction in their long-term prospects.

All You Need to Know About The Cooper Companies (COO) Rating Upgrade to Buy

zacks.com

2025-08-05 13:01:25The Cooper Companies (COO) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

COO or SAUHY: Which Is the Better Value Stock Right Now?

zacks.com

2025-08-05 12:41:15Investors looking for stocks in the Medical - Dental Supplies sector might want to consider either The Cooper Companies (COO) or Straumann Holding AG (SAUHY). But which of these two stocks presents investors with the better value opportunity right now?

CooperCompanies Announces Release Date for Third Quarter 2025

globenewswire.com

2025-07-24 16:15:00SAN RAMON, Calif., July 24, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading medical device company, announced today it will report third quarter 2025 financial results on Wednesday, August 27, 2025, at 4:15 PM ET. Following the release, the Company will host a conference call at 5:00 PM ET to discuss the results and current corporate developments.

COO Stock Declines Despite Strong Core Growth Amid Fertility Woes

zacks.com

2025-07-02 09:26:06The Cooper Companies grows margins and premium products, but fertility softness, inventory cuts, and tariffs weigh on the near-term outlook.

HOLX vs. COO: Which GYN Surgical Stock Is the Better Investment Now?

zacks.com

2025-06-23 10:35:22As demand for GYN surgical tools climbs, HOLX and COO battle it out. Find out which stock shows stronger growth momentum now.

Medicus Pharma names Andrew Smith as COO, advances BCC and prostate drug studies

proactiveinvestors.com

2025-06-23 08:59:57Medicus Pharma (NASDAQ:MDCX) said on Monday it has appointed Andrew Smith as chief operating officer, bringing on board a seasoned asset management executive as the company accelerates its clinical development programs in the US, Europe, and the Middle East. Smith, who most recently served as CEO of SR Asset Management until its sale in 2024, brings over 30 years of experience in financial and operational leadership.

Lockheed Martin COO on Trump's Golden Dome: Three-year timeline is 'very realistic'

youtube.com

2025-06-16 10:45:04Lockheed Martin COO Frank St. John said Monday that a timeline of three to four years for building President Donald Trump's Golden Dome defense plan is "very realistic."

Lockheed Martin COO: We are probably at the beginning of a 3-to-5-year surge in defense spending

youtube.com

2025-06-16 08:23:17CNBC's Phil LeBeau talks to Lockheed Martin COO Frank St. John to discuss the state of defense spending, whether 'Golden Dome' actually works, and more.

3 Oversold Stocks Flashing Bullish Reversal Signals

marketbeat.com

2025-06-07 09:47:11When it comes to short-term trading signals, few indicators are as closely tracked as the Relative Strength Index (RSI). A stock's RSI measures the speed and magnitude of its recent price movements.

Why The Cooper Companies (COO) is a Top Growth Stock for the Long-Term

zacks.com

2025-06-03 10:46:12Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

The Cooper Companies (COO) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

zacks.com

2025-08-22 10:15:27Besides Wall Street's top-and-bottom-line estimates for The Cooper Companies (COO), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended July 2025.

The Cooper Companies (COO) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

zacks.com

2025-08-20 11:00:27The Cooper Companies (COO) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Cooper Companies' Innovation Fuels Growth Amid Macro Headwinds

zacks.com

2025-08-19 09:51:16COO leans on innovation and diversification to fuel growth, but fertility softness, tariffs and inventory headwinds weigh on near-term outlook.

CooperCompanies to Participate in the Wells Fargo Healthcare Conference

globenewswire.com

2025-08-14 16:15:00SAN RAMON, Calif., Aug. 14, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading global medical device company, announced today it will participate in the Wells Fargo Healthcare Conference on Wednesday, September 3, 2025. Al White, President and CEO, will represent the Company in a session scheduled at 3:00 PM ET.

Cooper Companies Q3 Preview: Low Fertility Growth During Year Of Snake Is Temporary

seekingalpha.com

2025-08-14 11:58:49Cooper Companies Q3 Preview: Low Fertility Growth During Year Of Snake Is Temporary

Baron Health Care Fund Q2: Top Contributors, Misses, And Strategic Shifts

seekingalpha.com

2025-08-07 21:35:00Insmed, Intuitive Surgical, and IDEXX Laboratories were top contributors, driven by strong drug pipelines, innovation, and robust financial results. We exited UnitedHealth Group due to earnings misses, guidance cuts, and Medicare Advantage mispricing, despite its long-term potential to restore profitability. Thermo Fisher and argenx detracted from performance amid macro headwinds and lower-than-expected sales, but we retain conviction in their long-term prospects.

All You Need to Know About The Cooper Companies (COO) Rating Upgrade to Buy

zacks.com

2025-08-05 13:01:25The Cooper Companies (COO) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

COO or SAUHY: Which Is the Better Value Stock Right Now?

zacks.com

2025-08-05 12:41:15Investors looking for stocks in the Medical - Dental Supplies sector might want to consider either The Cooper Companies (COO) or Straumann Holding AG (SAUHY). But which of these two stocks presents investors with the better value opportunity right now?

CooperCompanies Announces Release Date for Third Quarter 2025

globenewswire.com

2025-07-24 16:15:00SAN RAMON, Calif., July 24, 2025 (GLOBE NEWSWIRE) -- CooperCompanies (Nasdaq: COO), a leading medical device company, announced today it will report third quarter 2025 financial results on Wednesday, August 27, 2025, at 4:15 PM ET. Following the release, the Company will host a conference call at 5:00 PM ET to discuss the results and current corporate developments.

COO Stock Declines Despite Strong Core Growth Amid Fertility Woes

zacks.com

2025-07-02 09:26:06The Cooper Companies grows margins and premium products, but fertility softness, inventory cuts, and tariffs weigh on the near-term outlook.

HOLX vs. COO: Which GYN Surgical Stock Is the Better Investment Now?

zacks.com

2025-06-23 10:35:22As demand for GYN surgical tools climbs, HOLX and COO battle it out. Find out which stock shows stronger growth momentum now.

Medicus Pharma names Andrew Smith as COO, advances BCC and prostate drug studies

proactiveinvestors.com

2025-06-23 08:59:57Medicus Pharma (NASDAQ:MDCX) said on Monday it has appointed Andrew Smith as chief operating officer, bringing on board a seasoned asset management executive as the company accelerates its clinical development programs in the US, Europe, and the Middle East. Smith, who most recently served as CEO of SR Asset Management until its sale in 2024, brings over 30 years of experience in financial and operational leadership.

Lockheed Martin COO on Trump's Golden Dome: Three-year timeline is 'very realistic'

youtube.com

2025-06-16 10:45:04Lockheed Martin COO Frank St. John said Monday that a timeline of three to four years for building President Donald Trump's Golden Dome defense plan is "very realistic."

Lockheed Martin COO: We are probably at the beginning of a 3-to-5-year surge in defense spending

youtube.com

2025-06-16 08:23:17CNBC's Phil LeBeau talks to Lockheed Martin COO Frank St. John to discuss the state of defense spending, whether 'Golden Dome' actually works, and more.

3 Oversold Stocks Flashing Bullish Reversal Signals

marketbeat.com

2025-06-07 09:47:11When it comes to short-term trading signals, few indicators are as closely tracked as the Relative Strength Index (RSI). A stock's RSI measures the speed and magnitude of its recent price movements.

Why The Cooper Companies (COO) is a Top Growth Stock for the Long-Term

zacks.com

2025-06-03 10:46:12Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.