Creative Media & Community Trust Corporation (CMCTP)

Price:

29.05 USD

( + 0.04 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Office Properties Income Trust

VALUE SCORE:

4

2nd position

Office Properties Income Trust

VALUE SCORE:

4

The best

Creative Media & Community Trust Corporation

VALUE SCORE:

5

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Creative Media & Community Trust Corporation is a real estate investment trust that primarily acquires, owns, and operates Class A and creative office assets in vibrant and improving metropolitan communities throughout the United States (including improving and developing such assets). Its properties are primarily located in Los Angeles and the San Francisco Bay Area. Creative Media & Community Trust Corporation is operated by affiliates of CIM Group, L.P., a vertically-integrated owner and operator of real assets with multi-disciplinary expertise and in-house research, acquisition, credit analysis, development, finance, leasing, and onsite property management capabilities.

NEWS

Creative Media & Community Trust Corporation (CMCT) Q3 2022 Earnings Call Transcript

seekingalpha.com

2022-11-15 16:38:03Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q3 2022 Earnings Conference Call November 15, 2022 12:00 PM ET Company Participants Stephen Altebrando - VP, Equity Capital Markets David Thompson - CEO Shaul Kuba - Director Barry Berlin - CFO Conference Call Participants Gaurav Mehta - EF Hutton Eric Speron - First Foundation Advisors Operator Hello, and welcome to the Creative Media & Community Trust Third Quarter 2022 Earnings Conference Call. [Operator Instructions].

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q2 2022 Results - Earnings Call Transcript

seekingalpha.com

2022-08-13 12:00:11Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q2 2022 Results Conference Call August 9, 2022 12:00 PM ET Company Participants Steve Altebrando - Shareholder Relations David Thompson - Chief Executive Officer Shaul Kuba - Co-Founder, CIM Group Nate DeBacker - Chief Financial Officer Conference Call Participants Craig Kucera - B. Riley Securities John Moran - Robotti& Company Operator Good day, and welcome to Creative Media & Community Trust Second Quarter 2022 Earnings Call.

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q1 2022 Earnings Call Transcript

seekingalpha.com

2022-05-15 07:36:24Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q1 2022 Earnings Conference Call May 11, 2022 11:00 AM ET Company Participants Steve Altebrando - Shareholder Relations David Thompson - Chief Executive Officer Shaul Kuba - Co-Founder, CIM Group Nathan DeBacker - Chief Financial Officer Conference Call Participants Craig Kucera - B. Riley Securities Operator Good day and welcome to the Creative Media & Community Trust Corporation First Quarter 20212 Earnings Call.

Office REITs: The New Normal

seekingalpha.com

2021-09-28 10:30:00The future of work is here, and nearly everyone besides office landlords are quite content. For office REITs, the "new normal" of hybrid work environments brings both new challenges and opportunities. Eighteen months after "two weeks to slow the spread," office utilization rates have recovered only a fraction of pre-COVID levels, particularly in dense coastal markets with longer and more transit-heavy commutes.

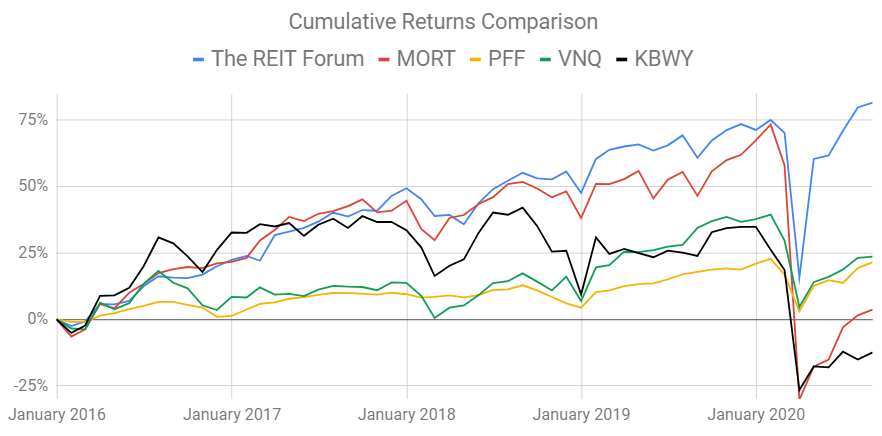

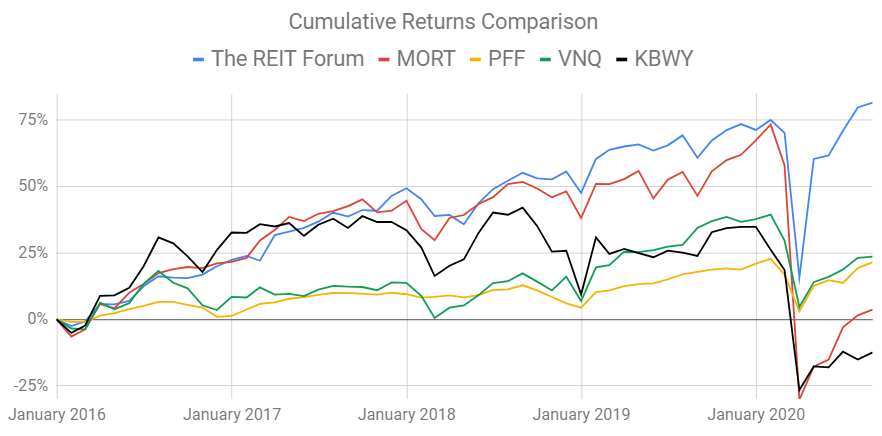

Here's Why My REITs Beat Your REITs

seekingalpha.com

2020-09-14 07:00:00Over the last several years we've seen larger equity REITs consistently outperform, but the gap becomes even larger with the recession.

Creative Media & Community Trust Corporation (CMCT) Q3 2022 Earnings Call Transcript

seekingalpha.com

2022-11-15 16:38:03Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q3 2022 Earnings Conference Call November 15, 2022 12:00 PM ET Company Participants Stephen Altebrando - VP, Equity Capital Markets David Thompson - CEO Shaul Kuba - Director Barry Berlin - CFO Conference Call Participants Gaurav Mehta - EF Hutton Eric Speron - First Foundation Advisors Operator Hello, and welcome to the Creative Media & Community Trust Third Quarter 2022 Earnings Conference Call. [Operator Instructions].

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q2 2022 Results - Earnings Call Transcript

seekingalpha.com

2022-08-13 12:00:11Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q2 2022 Results Conference Call August 9, 2022 12:00 PM ET Company Participants Steve Altebrando - Shareholder Relations David Thompson - Chief Executive Officer Shaul Kuba - Co-Founder, CIM Group Nate DeBacker - Chief Financial Officer Conference Call Participants Craig Kucera - B. Riley Securities John Moran - Robotti& Company Operator Good day, and welcome to Creative Media & Community Trust Second Quarter 2022 Earnings Call.

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q1 2022 Earnings Call Transcript

seekingalpha.com

2022-05-15 07:36:24Creative Media & Community Trust Corporation (NASDAQ:CMCT ) Q1 2022 Earnings Conference Call May 11, 2022 11:00 AM ET Company Participants Steve Altebrando - Shareholder Relations David Thompson - Chief Executive Officer Shaul Kuba - Co-Founder, CIM Group Nathan DeBacker - Chief Financial Officer Conference Call Participants Craig Kucera - B. Riley Securities Operator Good day and welcome to the Creative Media & Community Trust Corporation First Quarter 20212 Earnings Call.

Office REITs: The New Normal

seekingalpha.com

2021-09-28 10:30:00The future of work is here, and nearly everyone besides office landlords are quite content. For office REITs, the "new normal" of hybrid work environments brings both new challenges and opportunities. Eighteen months after "two weeks to slow the spread," office utilization rates have recovered only a fraction of pre-COVID levels, particularly in dense coastal markets with longer and more transit-heavy commutes.

Here's Why My REITs Beat Your REITs

seekingalpha.com

2020-09-14 07:00:00Over the last several years we've seen larger equity REITs consistently outperform, but the gap becomes even larger with the recession.