Comerica Incorporated (CMA)

Price:

88.67 USD

( - -4.19 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Itaú Corpbanca

VALUE SCORE:

0

2nd position

Regions Financial Corporation

VALUE SCORE:

13

The best

Associated Banc-Corp

VALUE SCORE:

14

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Comerica Incorporated, through its subsidiaries, provides various financial products and services. It operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities. The Retail Bank segment provides personal financial services, such as consumer lending, consumer deposit gathering, and mortgage loan origination. This segment also offers various consumer products that include deposit accounts, installment loans, credit cards, student loans, home equity lines of credit, and residential mortgage loans, as well as commercial products and services to micro-businesses. The Wealth Management segment provides products and services comprising fiduciary, private banking, retirement, investment management and advisory, and investment banking and brokerage services. This segment also sells annuity products, as well as life, disability, and long-term care insurance products. The Finance segment engages in the securities portfolio, and asset and liability management activities. It operates in Texas, California, Michigan, Arizona, Florida, Canada, and Mexico. The company was formerly known as DETROITBANK Corporation and changed its name to Comerica Incorporated in July 1982. Comerica Incorporated was founded in 1849 and is headquartered in Dallas, Texas.

NEWS

Getty Images issues statement on CMA's interim report

globenewswire.com

2026-02-19 08:34:00NEW YORK, Feb. 19, 2026 (GLOBE NEWSWIRE) -- Getty Images (NYSE: GETY), a preeminent global visual content creator and marketplace, today issued the following statement on the UK Competition and Markets Authority's (CMA) provisional decision:

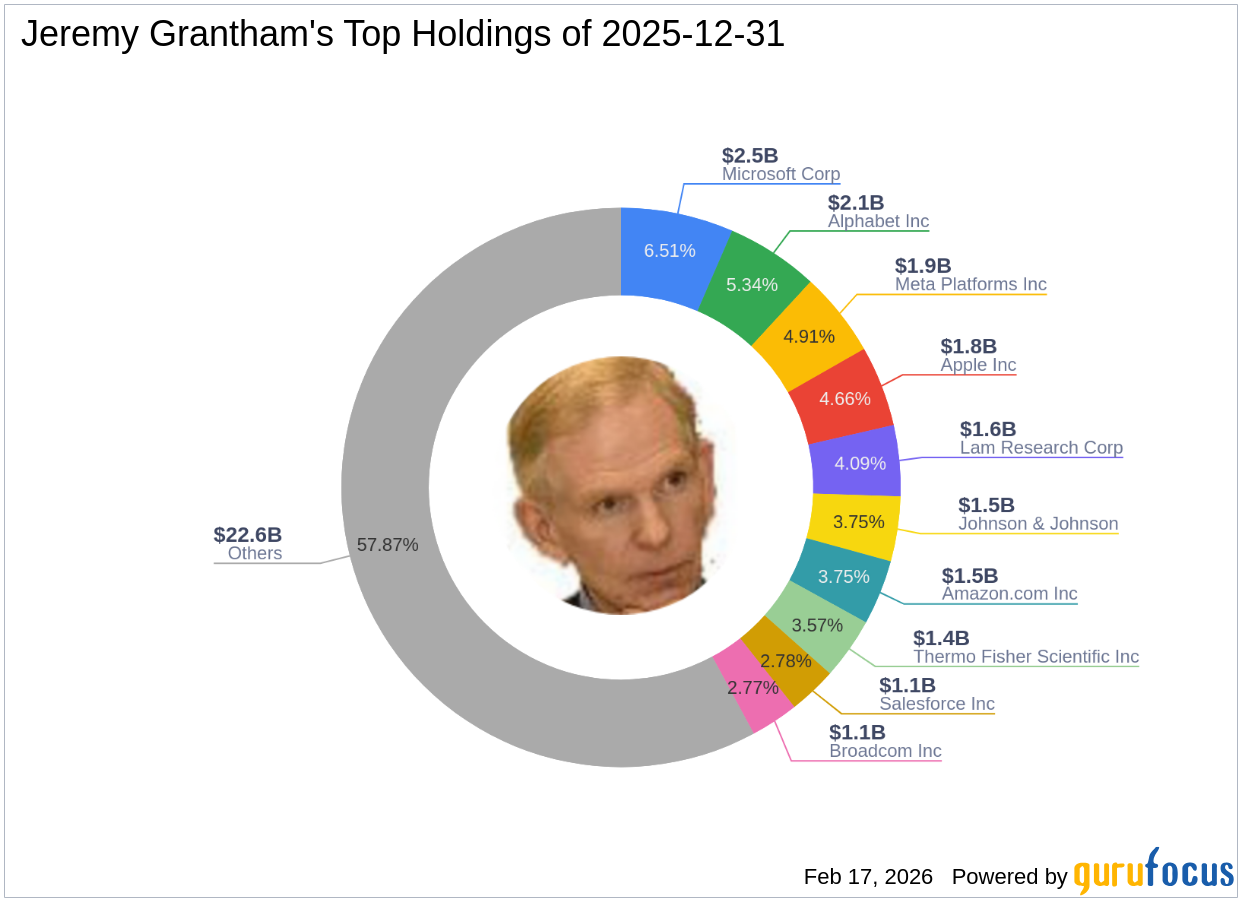

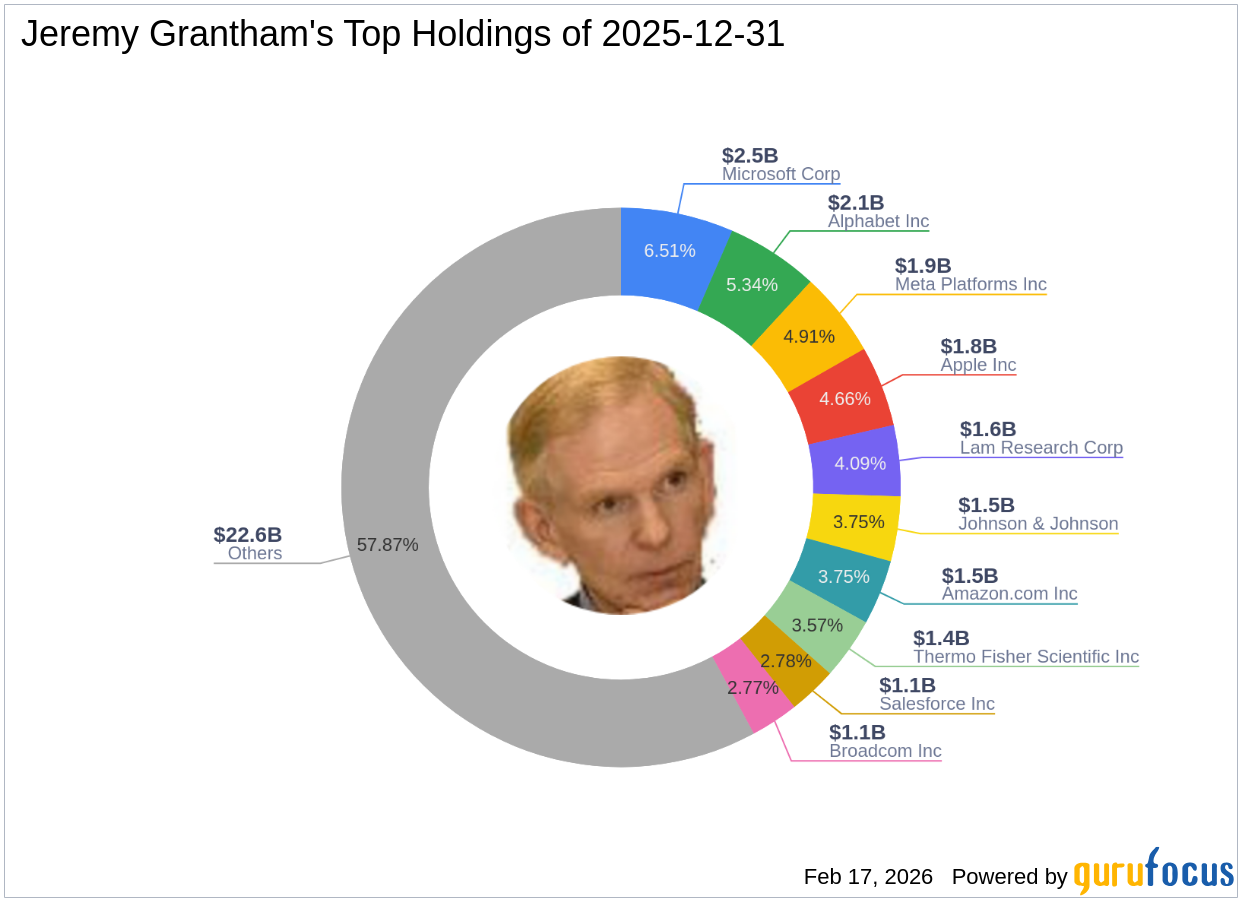

Oracle Corp Sees Significant Reduction in Jeremy Grantham's Portfolio

gurufocus.com

2026-02-17 12:02:00Insights from Jeremy Grantham (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing Jeremy Grantham (Trades, Portfolio) recently submitted the 13F filing for th

Third Avenue Management's Strategic Moves: Deutsche Bank AG Takes Center Stage

gurufocus.com

2026-02-12 17:02:00Insightful Analysis of Third Avenue Management (Trades, Portfolio)'s Latest 13F Filing Third Avenue Management (Trades, Portfolio) recently submitted its 13F f

Thrivent Financial for Lutherans Sells 11,665 Shares of Comerica Incorporated $CMA

defenseworld.net

2026-02-09 04:58:43Thrivent Financial for Lutherans reduced its position in shares of Comerica Incorporated (NYSE: CMA) by 19.7% in the third quarter, according to its most recent filing with the SEC. The fund owned 47,435 shares of the financial services provider's stock after selling 11,665 shares during the quarter. Thrivent Financial for Lutherans' holdings in

Principal Financial Group Inc. Has $19.56 Million Stake in Comerica Incorporated $CMA

defenseworld.net

2026-02-09 03:32:47Principal Financial Group Inc. reduced its stake in shares of Comerica Incorporated (NYSE: CMA) by 4.2% during the undefined quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 285,439 shares of the financial services provider's stock after selling 12,492

Comerica Incorporated (NYSE:CMA) Given Average Rating of “Hold” by Brokerages

defenseworld.net

2026-02-05 02:37:21Comerica Incorporated (NYSE: CMA - Get Free Report) has earned a consensus rating of "Hold" from the nineteen research firms that are currently covering the stock, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, fifteen have given a hold recommendation and three have issued a buy recommendation on the company. The

Fifth Third and Comerica Merger Scales Digital Competition Across Regional Banking

pymnts.com

2026-02-02 11:41:56The merger between Fifth Third Bancorp and Comerica Incorporated closed Monday (Feb. 2), forging an institution with roughly $294 billion in assets and signaling a reshaping how regional banks compete across mobile banking, commercial payments and middle-market services. The transaction establishes the ninth-largest U.S.

5 High-Yield Passive Income Kings for Retirees That Posted Outstanding Q4 Results

247wallst.com

2026-02-02 08:14:23Investors love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return.

Fifth Third Completes Merger with Comerica to Become 9th Largest U.S. Bank

businesswire.com

2026-02-02 06:30:00CINCINNATI--(BUSINESS WIRE)--Fifth Third Bancorp (Nasdaq: FITB) today announced it has closed its merger with Comerica Incorporated to create the ninth-largest U.S. bank with approximately $294 billion in assets. The combination of Fifth Third's award-winning retail banking and digital capabilities with Comerica's strong middle market banking franchise and attractive footprint further strengthens Fifth Third's stability, profitability and growth potential. The merger builds upon Fifth Third's s.

$30M DEI Lawsuit Alleges Comerica's Program Violates Law Ahead of Fifth Third Acquisition: Fett & Fields, P.C.

prnewswire.com

2026-01-28 13:13:00DETROIT, Jan. 28, 2026 /PRNewswire/ -- A significant employment discrimination lawsuit has been filed in the U.S. District Court for the Eastern District of Michigan against Comerica Incorporated (NYSE: CMA). The complaint alleges that the financial institution operates an unlawful Diversity, Equity, and Inclusion (DEI) program characterized by "Soviet-style" personnel controls and rigid demographic quotas.

TTM Technologies, Dutch Bros, Advanced Energy Industries, and American Healthcare REIT Set to Join S&P MidCap 400; Others to Join S&P SmallCap 600

prnewswire.com

2026-01-27 18:02:00NEW YORK, Jan. 27, 2026 /PRNewswire/ -- S&P Dow Jones Indices will make the following changes to the S&P MidCap 400, S&P SmallCap 600: S&P SmallCap 600 constituent TTM Technologies Inc. (NASD: TTMI) will replace Civitas Resources Inc. (NYSE: CIVI) in the S&P MidCap 400, and Amneal Pharmaceuticals Inc. (NASD: AMRX) will replace TTM Technologies in the S&P SmallCap 600 effective prior to the opening of trading on Friday, January 30. S&P SmallCap 600 constituent SM Energy Co. (NYSE: SM) is acquiring Civitas Resources in a deal expected to be completed soon, pending final closing conditions.

11th Annual Comerica Bank North Texas Prom Dress Drive Begins on February 2

prnewswire.com

2026-01-27 16:54:00DALLAS, Jan. 27, 2026 /PRNewswire/ -- Comerica Bank will hold its 11th annual North Texas Prom Dress Drive in February. New or gently used, cleaned formal dresses and accessories (shoes, purses and jewelry) can be dropped off at seven participating banking centers.

Federal Reserve Board Awards Comerica Bank Top Mark in Community Reinvestment Act Review

prnewswire.com

2026-01-21 10:55:00DALLAS, Jan. 21, 2026 /PRNewswire/ -- Comerica Bank announced today it received the highest overall rating of "Outstanding" in its 2025 Community Reinvestment Act (CRA) Performance Evaluation by the Federal Reserve Board (FRB). The examination consisted of a review of the bank's 2023 and 2024 Home Mortgage Disclosure Act (HMDA) and CRA small business lending data, as well as community development loans, investments and services between July 1, 2023, and March 31, 2025.

Comerica Q4 Earnings Top Estimates on Higher NII & Fee Income

zacks.com

2026-01-21 07:51:06CMA tops Q4 EPS estimates as higher NII and fee income lift results, though loan declines and rising expenses weighed.

Comerica (CMA) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

zacks.com

2026-01-20 19:30:16The headline numbers for Comerica (CMA) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Comerica (NYSE:CMA) Issues Earnings Results, Beats Expectations By $0.20 EPS

defenseworld.net

2026-01-20 07:18:51Comerica (NYSE: CMA - Get Free Report) released its quarterly earnings data on Tuesday. The financial services provider reported $1.46 EPS for the quarter, beating the consensus estimate of $1.26 by $0.20, FiscalAI reports. Comerica had a net margin of 14.91% and a return on equity of 10.69%. Comerica Price Performance Shares of NYSE CMA opened

Getty Images issues statement on CMA's interim report

globenewswire.com

2026-02-19 08:34:00NEW YORK, Feb. 19, 2026 (GLOBE NEWSWIRE) -- Getty Images (NYSE: GETY), a preeminent global visual content creator and marketplace, today issued the following statement on the UK Competition and Markets Authority's (CMA) provisional decision:

Oracle Corp Sees Significant Reduction in Jeremy Grantham's Portfolio

gurufocus.com

2026-02-17 12:02:00Insights from Jeremy Grantham (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing Jeremy Grantham (Trades, Portfolio) recently submitted the 13F filing for th

Third Avenue Management's Strategic Moves: Deutsche Bank AG Takes Center Stage

gurufocus.com

2026-02-12 17:02:00Insightful Analysis of Third Avenue Management (Trades, Portfolio)'s Latest 13F Filing Third Avenue Management (Trades, Portfolio) recently submitted its 13F f

Thrivent Financial for Lutherans Sells 11,665 Shares of Comerica Incorporated $CMA

defenseworld.net

2026-02-09 04:58:43Thrivent Financial for Lutherans reduced its position in shares of Comerica Incorporated (NYSE: CMA) by 19.7% in the third quarter, according to its most recent filing with the SEC. The fund owned 47,435 shares of the financial services provider's stock after selling 11,665 shares during the quarter. Thrivent Financial for Lutherans' holdings in

Principal Financial Group Inc. Has $19.56 Million Stake in Comerica Incorporated $CMA

defenseworld.net

2026-02-09 03:32:47Principal Financial Group Inc. reduced its stake in shares of Comerica Incorporated (NYSE: CMA) by 4.2% during the undefined quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 285,439 shares of the financial services provider's stock after selling 12,492

Comerica Incorporated (NYSE:CMA) Given Average Rating of “Hold” by Brokerages

defenseworld.net

2026-02-05 02:37:21Comerica Incorporated (NYSE: CMA - Get Free Report) has earned a consensus rating of "Hold" from the nineteen research firms that are currently covering the stock, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, fifteen have given a hold recommendation and three have issued a buy recommendation on the company. The

Fifth Third and Comerica Merger Scales Digital Competition Across Regional Banking

pymnts.com

2026-02-02 11:41:56The merger between Fifth Third Bancorp and Comerica Incorporated closed Monday (Feb. 2), forging an institution with roughly $294 billion in assets and signaling a reshaping how regional banks compete across mobile banking, commercial payments and middle-market services. The transaction establishes the ninth-largest U.S.

5 High-Yield Passive Income Kings for Retirees That Posted Outstanding Q4 Results

247wallst.com

2026-02-02 08:14:23Investors love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return.

Fifth Third Completes Merger with Comerica to Become 9th Largest U.S. Bank

businesswire.com

2026-02-02 06:30:00CINCINNATI--(BUSINESS WIRE)--Fifth Third Bancorp (Nasdaq: FITB) today announced it has closed its merger with Comerica Incorporated to create the ninth-largest U.S. bank with approximately $294 billion in assets. The combination of Fifth Third's award-winning retail banking and digital capabilities with Comerica's strong middle market banking franchise and attractive footprint further strengthens Fifth Third's stability, profitability and growth potential. The merger builds upon Fifth Third's s.

$30M DEI Lawsuit Alleges Comerica's Program Violates Law Ahead of Fifth Third Acquisition: Fett & Fields, P.C.

prnewswire.com

2026-01-28 13:13:00DETROIT, Jan. 28, 2026 /PRNewswire/ -- A significant employment discrimination lawsuit has been filed in the U.S. District Court for the Eastern District of Michigan against Comerica Incorporated (NYSE: CMA). The complaint alleges that the financial institution operates an unlawful Diversity, Equity, and Inclusion (DEI) program characterized by "Soviet-style" personnel controls and rigid demographic quotas.

TTM Technologies, Dutch Bros, Advanced Energy Industries, and American Healthcare REIT Set to Join S&P MidCap 400; Others to Join S&P SmallCap 600

prnewswire.com

2026-01-27 18:02:00NEW YORK, Jan. 27, 2026 /PRNewswire/ -- S&P Dow Jones Indices will make the following changes to the S&P MidCap 400, S&P SmallCap 600: S&P SmallCap 600 constituent TTM Technologies Inc. (NASD: TTMI) will replace Civitas Resources Inc. (NYSE: CIVI) in the S&P MidCap 400, and Amneal Pharmaceuticals Inc. (NASD: AMRX) will replace TTM Technologies in the S&P SmallCap 600 effective prior to the opening of trading on Friday, January 30. S&P SmallCap 600 constituent SM Energy Co. (NYSE: SM) is acquiring Civitas Resources in a deal expected to be completed soon, pending final closing conditions.

11th Annual Comerica Bank North Texas Prom Dress Drive Begins on February 2

prnewswire.com

2026-01-27 16:54:00DALLAS, Jan. 27, 2026 /PRNewswire/ -- Comerica Bank will hold its 11th annual North Texas Prom Dress Drive in February. New or gently used, cleaned formal dresses and accessories (shoes, purses and jewelry) can be dropped off at seven participating banking centers.

Federal Reserve Board Awards Comerica Bank Top Mark in Community Reinvestment Act Review

prnewswire.com

2026-01-21 10:55:00DALLAS, Jan. 21, 2026 /PRNewswire/ -- Comerica Bank announced today it received the highest overall rating of "Outstanding" in its 2025 Community Reinvestment Act (CRA) Performance Evaluation by the Federal Reserve Board (FRB). The examination consisted of a review of the bank's 2023 and 2024 Home Mortgage Disclosure Act (HMDA) and CRA small business lending data, as well as community development loans, investments and services between July 1, 2023, and March 31, 2025.

Comerica Q4 Earnings Top Estimates on Higher NII & Fee Income

zacks.com

2026-01-21 07:51:06CMA tops Q4 EPS estimates as higher NII and fee income lift results, though loan declines and rising expenses weighed.

Comerica (CMA) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

zacks.com

2026-01-20 19:30:16The headline numbers for Comerica (CMA) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Comerica (NYSE:CMA) Issues Earnings Results, Beats Expectations By $0.20 EPS

defenseworld.net

2026-01-20 07:18:51Comerica (NYSE: CMA - Get Free Report) released its quarterly earnings data on Tuesday. The financial services provider reported $1.46 EPS for the quarter, beating the consensus estimate of $1.26 by $0.20, FiscalAI reports. Comerica had a net margin of 14.91% and a return on equity of 10.69%. Comerica Price Performance Shares of NYSE CMA opened