CMC Materials, Inc. (CCMP)

Price:

173.69 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Broadcom Inc.

VALUE SCORE:

0

2nd position

NVIDIA Corporation

VALUE SCORE:

9

The best

Direxion Daily TSM Bear 1X Shares

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

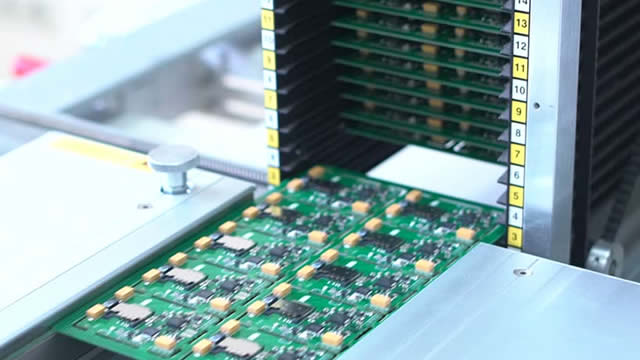

DESCRIPTION

CMC Materials, Inc., together with its subsidiaries, provides consumable materials to semiconductor manufacturers, and pipeline and adjacent industry customers in North America, Asia, Europe, the Middle East, Africa, and South America. The company operates in two segments, Electronic Materials and Performance Materials. The Electronic Materials segment develops, produces, and sells chemical mechanical planarization (CMP) slurries for polishing various materials used in IC devices, including tungsten, dielectric materials, copper, tantalum, and aluminum; and various materials that are used in the production of disk substrates and magnetic heads for hard disk drives; and CMP pads, which are used in conjunction with slurries in the CMP process. This segment also offers sulfuric, phosphoric, nitric, and hydrofluoric acids, as well as ammonium hydroxide, hydrogen peroxide, isopropyl alcohol, other specialty organic solvents, and various blends of chemicals; and develops and manufactures consumable products for cleaning advanced probe cards and test sockets. The Performance Materials segment provides pipeline and industrial materials comprising polymer-based drag-reducing agents for crude oil transmission, valve greases, cleaners and sealants, and related services and equipment; and routine and emergency maintenance services, as well as training services. This segment also offers precision polishing and metrology systems for advanced optics applications; and magneto-rheological polishing fluids, consumables, and spare and replacement parts, as well as optical polishing services and other customer support services; and engages in the wood treatment business. The company was formerly known as Cabot Microelectronics Corporation and changed its name to CMC Materials, Inc. in October 2020. CMC Materials, Inc. was incorporated in 1999 and is headquartered in Aurora, Illinois.

NEWS

CCMP Growth Advisors Acquires HVAC and Plumbing Installation Services Provider Airo Mechanical

businesswire.com

2025-08-07 07:00:00MOORESVILLE, N.C. & NEW YORK--(BUSINESS WIRE)--Airo Mechanical (“Airo” or the “Company”), a leading provider of HVAC and plumbing installation services for multifamily and light commercial property developers and general contractors operating in the Southeastern United States, today announced that it has been acquired by CCMP Growth Advisors, LP (“CCMP Growth”), a private equity firm that partners with high growth, lower middle market industrial and consumer companies to build enduring growth,.

Entegris Completes Acquisition of CMC Materials, Solidifying Position as the Global Leader in Electronic Materials

businesswire.com

2022-07-06 08:42:00BILLERICA, Mass.--(BUSINESS WIRE)--Entegris, Inc. (NASDAQ: ENTG) today announced that it has completed its acquisition of CMC Materials, Inc. (NASDAQ: CCMP). “It is an exciting day at Entegris. With the closing of the acquisition of CMC Materials, we are creating the global leader in electronic materials,” said Bertrand Loy, president and chief executive officer of Entegris. “We are better positioned than ever to address our customers' most demanding process challenges and support their ambitio

Entegris and CMC Materials Receive China Antitrust Clearance for Pending Acquisition

businesswire.com

2022-06-24 08:47:00BILLERICA, Mass. & AURORA, Ill.--(BUSINESS WIRE)--Entegris, Inc. (NASDAQ: ENTG) and CMC Materials, Inc. (NASDAQ: CCMP) today announced that China's State Administration for Market Regulation has given antitrust clearance for Entegris' previously announced acquisition of CMC Materials. The transaction has now received all required regulatory clearances. Entegris and CMC Materials anticipate that the transaction will close on or about July 6, 2022, subject to the satisfaction of the remaining cus

Cabot Microelectronics (CCMP) Q2 Earnings and Revenues Surpass Estimates

zacks.com

2022-05-04 21:48:26Cabot (CCMP) delivered earnings and revenue surprises of 6.01% and 3.59%, respectively, for the quarter ended March 2022. Do the numbers hold clues to what lies ahead for the stock?

4 Semiconductor Stocks For Your March 2022 List

stockmarket.com

2022-03-16 14:44:20Do you have these semiconductor stocks on your watchlist right now?

Cabot Microelectronics (CCMP) Q1 Earnings and Revenues Beat Estimates

zacks.com

2022-02-02 21:27:03Cabot (CCMP) delivered earnings and revenue surprises of 17.71% and 0.17%, respectively, for the quarter ended December 2021. Do the numbers hold clues to what lies ahead for the stock?

Analysts Estimate Cabot Microelectronics (CCMP) to Report a Decline in Earnings: What to Look Out for

zacks.com

2022-01-26 16:09:57Cabot (CCMP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

CMC Materials (CCMP) Moves 33.9% Higher: Will This Strength Last?

zacks.com

2021-12-16 10:45:20CMC Materials (CCMP) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

ALERT: Rowley Law PLLC is Investigating Proposed Acquisition of CMC Materials, Inc.

prnewswire.com

2021-12-15 17:11:00NEW YORK, Dec. 15, 2021 /PRNewswire/ -- Rowley Law PLLC is investigating potential securities law violations by CMC Materials, Inc. (NASDAQ: CCMP) and its board of directors concerning the proposed acquisition of the company by Entegris, Inc. (NASDAQ: ENTG). Stockholders will receive $133.00 in cash and 0.4506 shares of Entegris common stock for each share of CMC Materials stock that they hold.

CMC Materials goes up 25% following acquisition

invezz.com

2021-12-15 15:14:05Entegris Inc. (NASDAQ: ENTG) executed a definitive merger agreement with CMC Materials Inc. (NASDAQ: CCMP) whereby Entegris will purchase CMC for consideration of roughly $6.5 billion. Details of the agreement According to the definitive merger agreement, CMC shareholders will get 0,406 common stock Entegris shares and $133 in cash per share.

CCMP Stock: The $6.5B Entegris Deal That Has CMC Materials Investors Cheering Today

investorplace.com

2021-12-15 13:11:16CMC Materials (CCMP) stock is soaring higher on Wednesday thanks to a massive deal with semiconductor materials supplier Entegris (ENTG). The post CCMP Stock: The $6.5B Entegris Deal That Has CMC Materials Investors Cheering Today appeared first on InvestorPlace.

Why CMC Materials Stock Soared on Wednesday

fool.com

2021-12-15 13:02:02The semiconductor advanced-materials supplier is getting acquired in a deal valued at about $6.5 billion

Lilly Looks Healthy, but This Unsung Semiconductor Stock Is Wednesday's Big Winner

fool.com

2021-12-15 09:19:13Wall Street was in wait-and-see mode to start the day.

Why Are CMC Materials Shares Trading Higher Premarket?

benzinga.com

2021-12-15 08:43:49Entegris Inc (NASDAQ: ENTG) has agreed to acquire CMC Materials Inc (NASDAQ: CCMP) in a cash and stock transaction with an enterprise value of $6.5 billion. CMC shareholders will receive $133.00 in cash and 0.4506 shares of Entegris for each share of CMC, implying a 35% premium over CMC's December 14 closing price.

Entegris paying $6.5 billion for CMC Materials

marketwatch.com

2021-12-15 07:14:48Entegris Inc. ENTG, +0.66% said Wednesday it agreed to buy CMC Materials Inc. CCMP, +0.68% for about $6.5 billion in cash and stock. CMC Materials shareholders will receive $133 in cash and 0.4506 shares of Entegris common stock for each share of CMC Materials common stock they own.

Entegris to Acquire CMC Materials to Create a Leader in Electronic Materials

businesswire.com

2021-12-15 07:00:00BILLERICA, Mass. & AURORA, Ill.--(BUSINESS WIRE)--Entegris, Inc. (NASDAQ: ENTG) and CMC Materials, Inc. (NASDAQ: CCMP) today announced a definitive merger agreement under which Entegris will acquire CMC Materials in a cash and stock transaction with an enterprise value of approximately $6.5 billion. Under the terms of the agreement, CMC Materials shareholders will receive $133.00 in cash and 0.4506 shares of Entegris common stock for each share of CMC Materials common stock they own. The total

CCMP Growth Advisors Acquires HVAC and Plumbing Installation Services Provider Airo Mechanical

businesswire.com

2025-08-07 07:00:00MOORESVILLE, N.C. & NEW YORK--(BUSINESS WIRE)--Airo Mechanical (“Airo” or the “Company”), a leading provider of HVAC and plumbing installation services for multifamily and light commercial property developers and general contractors operating in the Southeastern United States, today announced that it has been acquired by CCMP Growth Advisors, LP (“CCMP Growth”), a private equity firm that partners with high growth, lower middle market industrial and consumer companies to build enduring growth,.

Entegris Completes Acquisition of CMC Materials, Solidifying Position as the Global Leader in Electronic Materials

businesswire.com

2022-07-06 08:42:00BILLERICA, Mass.--(BUSINESS WIRE)--Entegris, Inc. (NASDAQ: ENTG) today announced that it has completed its acquisition of CMC Materials, Inc. (NASDAQ: CCMP). “It is an exciting day at Entegris. With the closing of the acquisition of CMC Materials, we are creating the global leader in electronic materials,” said Bertrand Loy, president and chief executive officer of Entegris. “We are better positioned than ever to address our customers' most demanding process challenges and support their ambitio

Entegris and CMC Materials Receive China Antitrust Clearance for Pending Acquisition

businesswire.com

2022-06-24 08:47:00BILLERICA, Mass. & AURORA, Ill.--(BUSINESS WIRE)--Entegris, Inc. (NASDAQ: ENTG) and CMC Materials, Inc. (NASDAQ: CCMP) today announced that China's State Administration for Market Regulation has given antitrust clearance for Entegris' previously announced acquisition of CMC Materials. The transaction has now received all required regulatory clearances. Entegris and CMC Materials anticipate that the transaction will close on or about July 6, 2022, subject to the satisfaction of the remaining cus

Cabot Microelectronics (CCMP) Q2 Earnings and Revenues Surpass Estimates

zacks.com

2022-05-04 21:48:26Cabot (CCMP) delivered earnings and revenue surprises of 6.01% and 3.59%, respectively, for the quarter ended March 2022. Do the numbers hold clues to what lies ahead for the stock?

4 Semiconductor Stocks For Your March 2022 List

stockmarket.com

2022-03-16 14:44:20Do you have these semiconductor stocks on your watchlist right now?

Cabot Microelectronics (CCMP) Q1 Earnings and Revenues Beat Estimates

zacks.com

2022-02-02 21:27:03Cabot (CCMP) delivered earnings and revenue surprises of 17.71% and 0.17%, respectively, for the quarter ended December 2021. Do the numbers hold clues to what lies ahead for the stock?

Analysts Estimate Cabot Microelectronics (CCMP) to Report a Decline in Earnings: What to Look Out for

zacks.com

2022-01-26 16:09:57Cabot (CCMP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

CMC Materials (CCMP) Moves 33.9% Higher: Will This Strength Last?

zacks.com

2021-12-16 10:45:20CMC Materials (CCMP) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

ALERT: Rowley Law PLLC is Investigating Proposed Acquisition of CMC Materials, Inc.

prnewswire.com

2021-12-15 17:11:00NEW YORK, Dec. 15, 2021 /PRNewswire/ -- Rowley Law PLLC is investigating potential securities law violations by CMC Materials, Inc. (NASDAQ: CCMP) and its board of directors concerning the proposed acquisition of the company by Entegris, Inc. (NASDAQ: ENTG). Stockholders will receive $133.00 in cash and 0.4506 shares of Entegris common stock for each share of CMC Materials stock that they hold.

CMC Materials goes up 25% following acquisition

invezz.com

2021-12-15 15:14:05Entegris Inc. (NASDAQ: ENTG) executed a definitive merger agreement with CMC Materials Inc. (NASDAQ: CCMP) whereby Entegris will purchase CMC for consideration of roughly $6.5 billion. Details of the agreement According to the definitive merger agreement, CMC shareholders will get 0,406 common stock Entegris shares and $133 in cash per share.

CCMP Stock: The $6.5B Entegris Deal That Has CMC Materials Investors Cheering Today

investorplace.com

2021-12-15 13:11:16CMC Materials (CCMP) stock is soaring higher on Wednesday thanks to a massive deal with semiconductor materials supplier Entegris (ENTG). The post CCMP Stock: The $6.5B Entegris Deal That Has CMC Materials Investors Cheering Today appeared first on InvestorPlace.

Why CMC Materials Stock Soared on Wednesday

fool.com

2021-12-15 13:02:02The semiconductor advanced-materials supplier is getting acquired in a deal valued at about $6.5 billion

Lilly Looks Healthy, but This Unsung Semiconductor Stock Is Wednesday's Big Winner

fool.com

2021-12-15 09:19:13Wall Street was in wait-and-see mode to start the day.

Why Are CMC Materials Shares Trading Higher Premarket?

benzinga.com

2021-12-15 08:43:49Entegris Inc (NASDAQ: ENTG) has agreed to acquire CMC Materials Inc (NASDAQ: CCMP) in a cash and stock transaction with an enterprise value of $6.5 billion. CMC shareholders will receive $133.00 in cash and 0.4506 shares of Entegris for each share of CMC, implying a 35% premium over CMC's December 14 closing price.

Entegris paying $6.5 billion for CMC Materials

marketwatch.com

2021-12-15 07:14:48Entegris Inc. ENTG, +0.66% said Wednesday it agreed to buy CMC Materials Inc. CCMP, +0.68% for about $6.5 billion in cash and stock. CMC Materials shareholders will receive $133 in cash and 0.4506 shares of Entegris common stock for each share of CMC Materials common stock they own.

Entegris to Acquire CMC Materials to Create a Leader in Electronic Materials

businesswire.com

2021-12-15 07:00:00BILLERICA, Mass. & AURORA, Ill.--(BUSINESS WIRE)--Entegris, Inc. (NASDAQ: ENTG) and CMC Materials, Inc. (NASDAQ: CCMP) today announced a definitive merger agreement under which Entegris will acquire CMC Materials in a cash and stock transaction with an enterprise value of approximately $6.5 billion. Under the terms of the agreement, CMC Materials shareholders will receive $133.00 in cash and 0.4506 shares of Entegris common stock for each share of CMC Materials common stock they own. The total