ClearBridge All Cap Growth ESG ETF (CACG)

Price:

53.39 USD

( + 0.07 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Credit Suisse X-Links Gold Shares Covered Call ETN

VALUE SCORE:

9

2nd position

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

The best

Chicago Atlantic BDC, Inc.

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

DESCRIPTION

The fund seeks to invest in a diversified portfolio of large, medium and small capitalization stocks that have the potential for above-average long-term earnings and/or cash flow growth and meet its financial and environmental, social and governance (“ESG”) criteria. The fund's subadviser uses a bottom-up investment process that seeks to find inefficiently priced companies with strong fundamentals, incentive-driven management teams, dominant positions in niche markets and/or goods and services that are in high customer demand.

NEWS

CACG: Does This Actively Managed All-Cap Growth ETF Earn Its Fees?

seekingalpha.com

2023-07-18 14:32:34CACG is an actively-managed all-cap growth fund with a 0.53% expense ratio. Assets under management are just over $100 million. CACG aims to select a small group of stocks with high growth potential, low valuations, and meet proprietary ESG criteria. However, my analysis reveals the valuation is not met. The ETF has also consistently underperformed the Russell 3000 Growth Index and most other large-cap growth funds since its launch in 2017. Therefore, management hasn't proven the strategy works yet.

Check Out These Actively Managed ESG Funds from ClearBridge

etftrends.com

2022-04-22 20:23:32According to a study conducted by Pew Research Center, most adults in the U.S. favor the United States taking steps to achieve net-zero carbon emissions. This January 2022 survey confirms 69% of U.S. adults favor this goal being achieved by 2050.

ETF Odds & Ends: Another Fund Converts

etf.com

2021-05-11 17:23:38Plus, additional ETF changes and the launch of two more actively managed ETFs.

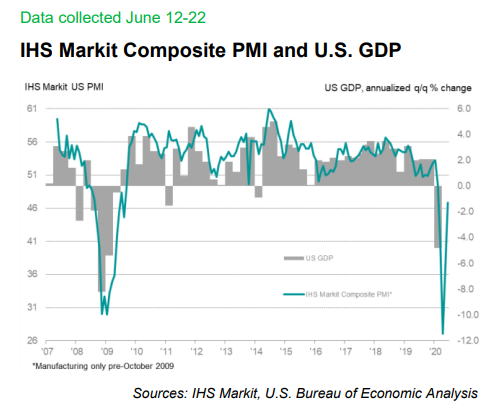

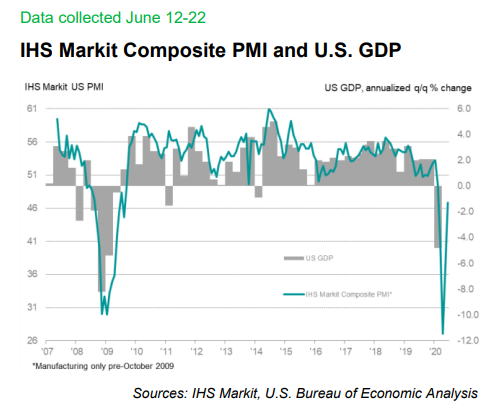

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

No data to display

CACG: Does This Actively Managed All-Cap Growth ETF Earn Its Fees?

seekingalpha.com

2023-07-18 14:32:34CACG is an actively-managed all-cap growth fund with a 0.53% expense ratio. Assets under management are just over $100 million. CACG aims to select a small group of stocks with high growth potential, low valuations, and meet proprietary ESG criteria. However, my analysis reveals the valuation is not met. The ETF has also consistently underperformed the Russell 3000 Growth Index and most other large-cap growth funds since its launch in 2017. Therefore, management hasn't proven the strategy works yet.

Check Out These Actively Managed ESG Funds from ClearBridge

etftrends.com

2022-04-22 20:23:32According to a study conducted by Pew Research Center, most adults in the U.S. favor the United States taking steps to achieve net-zero carbon emissions. This January 2022 survey confirms 69% of U.S. adults favor this goal being achieved by 2050.

ETF Odds & Ends: Another Fund Converts

etf.com

2021-05-11 17:23:38Plus, additional ETF changes and the launch of two more actively managed ETFs.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ