Ariel Appreciation Fund (CAAPX)

Price:

44.01 USD

( - -0.46 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund invests in mid-capitalization undervalued companies that show strong potential for growth. It invests primarily in equity securities of U.S. companies that have market capitalizations within the range of the companies in the Russell Midcap® Index, measured at the time of initial purchase. The fund’s strategy is rooted in the contrarian investment philosophy of the Adviser, which depends on three interrelated tenets: patience, focus and independent thinking.

NEWS

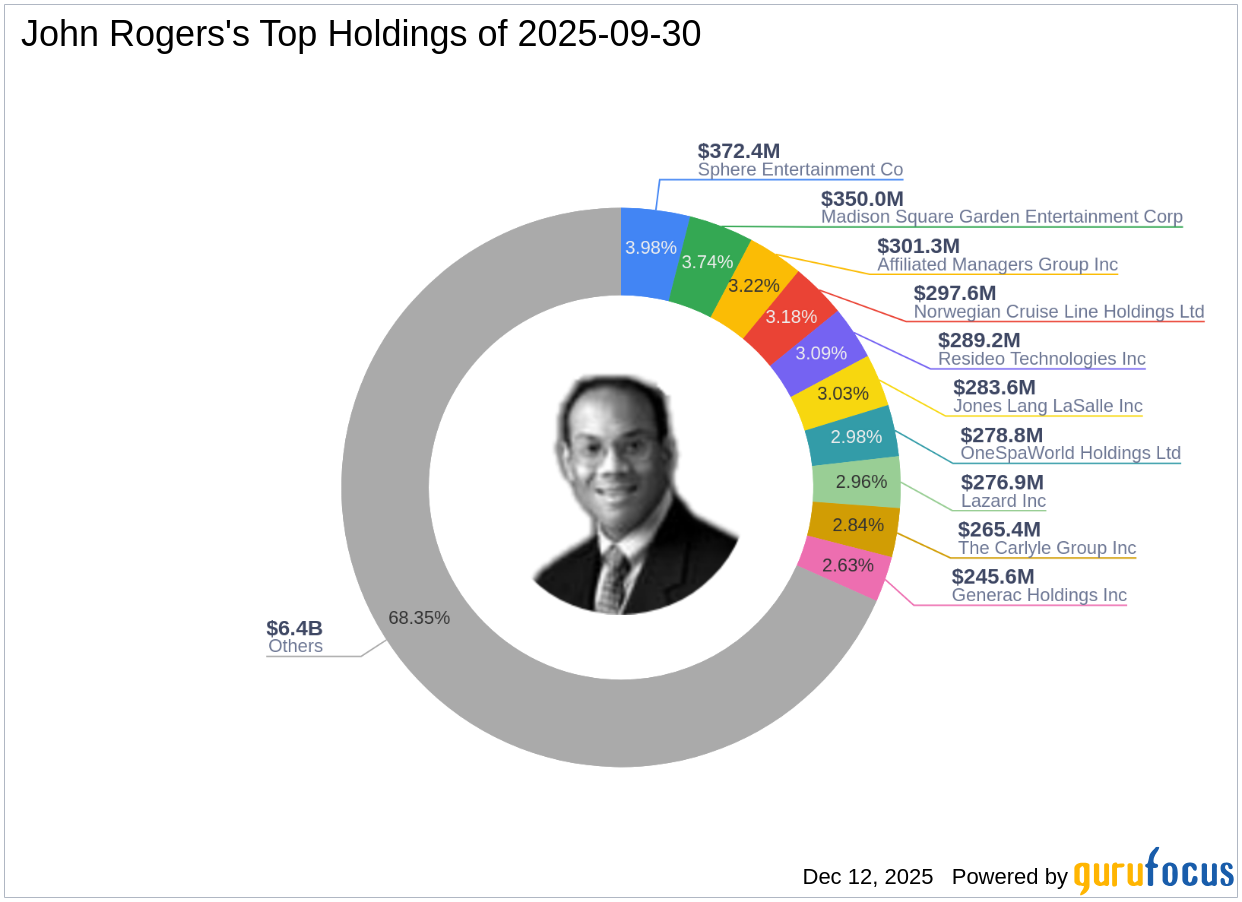

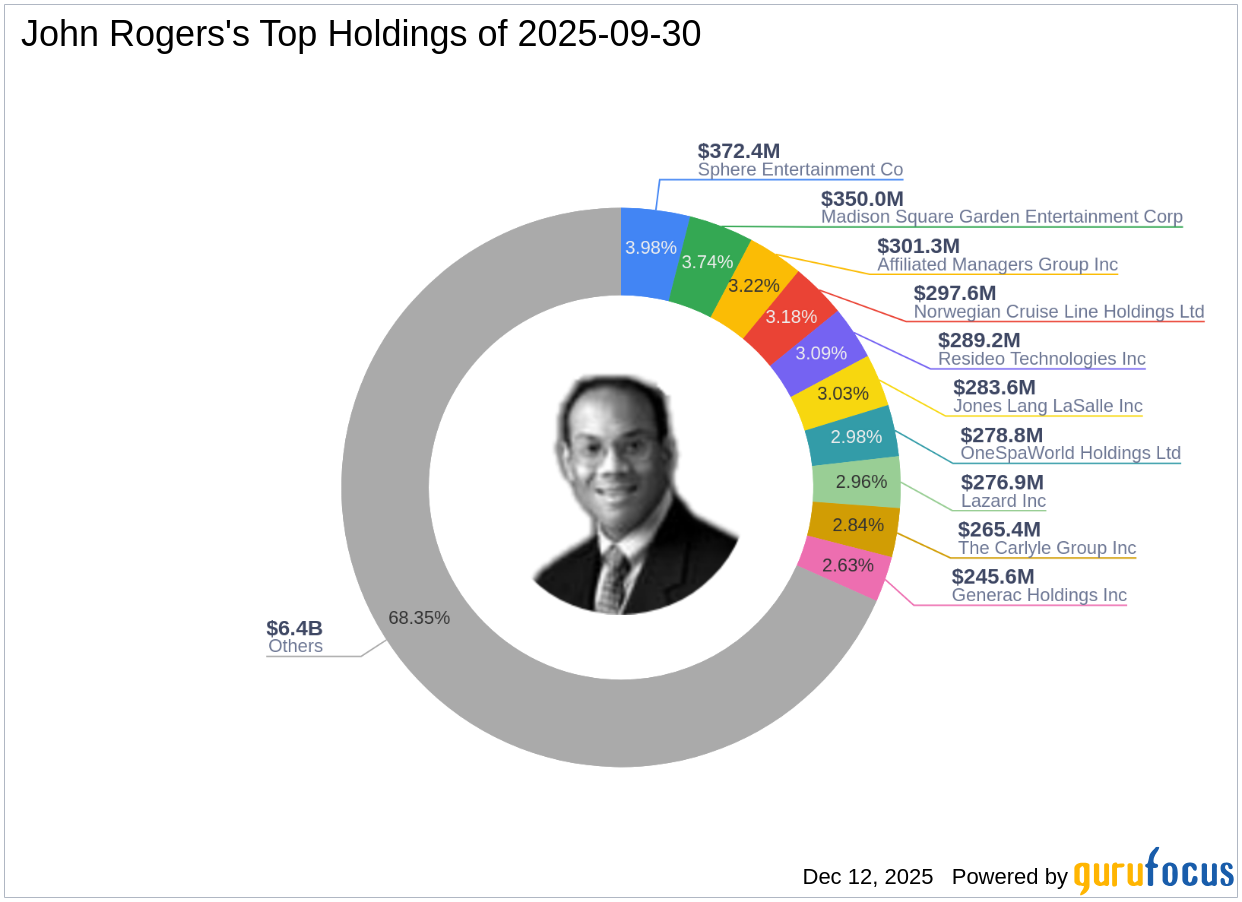

John Rogers Reduces Stake in Sphere Entertainment Co

gurufocus.com

2025-12-11 19:33:00Significant Reduction in Sphere Entertainment Co Holdings On November 28, 2025, John Rogers (Trades, Portfolio) executed a notable reduction in holdings of Sphe

John Rogers Reduces Stake in Sphere Entertainment Co

gurufocus.com

2025-12-11 19:33:00Significant Reduction in Sphere Entertainment Co Holdings On November 28, 2025, John Rogers (Trades, Portfolio) executed a notable reduction in holdings of Sphe