Beazer Homes USA, Inc. (BZH)

Price:

25.88 USD

( - -0.56 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Lennar Corporation

VALUE SCORE:

6

2nd position

Green Brick Partners, Inc.

VALUE SCORE:

10

The best

Green Brick Partners, Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Beazer Homes USA, Inc. operates as a homebuilder in the United States. It designs, constructs, and sells single-family and multi-family homes under the Beazer Homes, Gatherings, and Choice Plans names. The company sells its homes through commissioned new home sales counselors and independent brokers in Arizona, California, Nevada, Texas, Delaware, Maryland, Indiana, Tennessee, Virginia, Florida, Georgia, North Carolina, and South Carolina. Beazer Homes USA, Inc. was founded in 1985 and is headquartered in Atlanta, Georgia.

NEWS

Bear Of The Day: Beazer Homes (BZH)

zacks.com

2026-02-04 08:11:08This home builder has seen estimates fall after a recent earnings miss, but it still has good earnings growth.

Why Beazer Homes Stock Just Crashed

fool.com

2026-01-30 13:21:16Beazer stock missed on both sales and earnings last night. The company's Q1 loss was more than twice as bad as expected.

Beazer Homes: Q1 Miss Adds To Value Trap Fears

seekingalpha.com

2026-01-30 08:51:25Beazer Homes USA (BZH) remains a 'sell' as weak housing demand pressures margins and undermines its expansion strategy. BZH's Q1 saw a $0.90 loss, 22% revenue decline, and gross margins drop to 14%, highlighting operational challenges. Management's aggressive community growth and buyback plans appear misaligned with deteriorating orders, rising cancellations, and high leverage.

Beazer Homes USA, Inc. (BZH) Q1 2026 Earnings Call Transcript

seekingalpha.com

2026-01-29 20:22:49Beazer Homes USA, Inc. (BZH) Q1 2026 Earnings Call Transcript

Beazer (BZH) Reports Q1 Earnings: What Key Metrics Have to Say

zacks.com

2026-01-29 19:01:31Although the revenue and EPS for Beazer (BZH) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Beazer Homes (BZH) Reports Q1 Loss, Lags Revenue Estimates

zacks.com

2026-01-29 18:26:07Beazer Homes (BZH) came out with a quarterly loss of $0.9 per share versus the Zacks Consensus Estimate of a loss of $0.49. This compares to earnings of $0.1 per share a year ago.

Beazer Homes Reports First Quarter Fiscal 2026 Results

businesswire.com

2026-01-29 16:15:00ATLANTA--(BUSINESS WIRE)--Beazer Homes USA, Inc. (NYSE: BZH) (www.beazer.com) today announced its financial results for the three months ended December 31, 2025. "Results for our first fiscal quarter of 2026 reflected persistent demand challenges and elevated incentives in the market," said Allan P. Merrill, the Company's Chairman and Chief Executive Officer. "However, with national builders slowing starts last year and lower mortgage rates, we are cautiously optimistic for the spring selling s.

Beazer Homes USA, Inc. to Webcast Its Fiscal First Quarter Results Conference Call on Thursday, January 29, 2026

businesswire.com

2026-01-15 06:15:00ATLANTA--(BUSINESS WIRE)--Beazer Homes (NYSE: BZH) (www.beazer.com) has scheduled the release of its financial results for the quarter ended December 31, 2025 on Thursday, January 29, 2026 after the close of the market. Management will host a conference call on the same day at 5:00 PM ET to discuss the results. The public may listen to the conference call and view the Company's slide presentation on the "Investor Relations" page of the Company's website, www.beazer.com. In addition, the confere.

New Strong Sell Stocks for Jan. 13

zacks.com

2026-01-13 05:05:14ATAI, BHR and BZH have been added to the Zacks Rank #5 (Strong Sell) List on Jan.13, 2026.

Bear of the Day: Beazer Homes (BZH)

zacks.com

2025-12-10 07:21:22Beazer Homes ( BZH ) is your Bear of the Day because after reporting continued slow growth in their Q4 of FY'25 (ended September), analysts took the Zacks EPS FY'26 consensus down 19% from $1.81 to $1.47. For the quarter ended September 2025, this small-cap homebuilder, with projected revenues of nearly $2.5 billion for the current fiscal year, reported revenue of $791.9 million, down 1.8% over the same period last year.

Beazer Homes Announces Changes to the Board

businesswire.com

2025-12-09 16:15:00ATLANTA--(BUSINESS WIRE)--Beazer Homes USA, Inc. (the “Company”) (NYSE: BZH) announced today the appointment of Howard Heckes as a new independent member of the Board of Directors. Mr. Heckes is an established leader in the building materials and services industry, most recently serving as Chief Executive Officer of Masonite International, a top global designer, manufacturer, marketer and distributor of doors and door solutions. Prior to Masonite, he was Chief Executive Officer of Energy Manage.

New Strong Sell Stocks for Nov. 25

zacks.com

2025-11-25 06:57:06ALG, BBWI and BZH have been added to the Zacks Rank #5 (Strong Sell) List on Nov. 25, 2025.

Beazer Homes USA's Plunge Offers Opportunity

seekingalpha.com

2025-11-18 11:56:50Beazer Homes USA, Inc. faces near-term headwinds as home prices and new build activity decline, but remains fundamentally attractive for long-term investors. BZH's recent quarterly results exceeded analyst revenue and EPS expectations, despite falling profitability and a challenging housing market environment. The stock trades at low absolute valuation multiples but carries higher leverage than peers; BZH management is prioritizing deleveraging and community expansion.

Beazer Homes USA (NYSE:BZH) Shares Gap Up Following Strong Earnings

defenseworld.net

2025-11-15 02:19:10Beazer Homes USA, Inc. (NYSE: BZH - Get Free Report) shares gapped up prior to trading on Friday following a stronger than expected earnings report. The stock had previously closed at $21.40, but opened at $24.00. Beazer Homes USA shares last traded at $21.8290, with a volume of 216,032 shares. The construction company reported $1.07 earnings

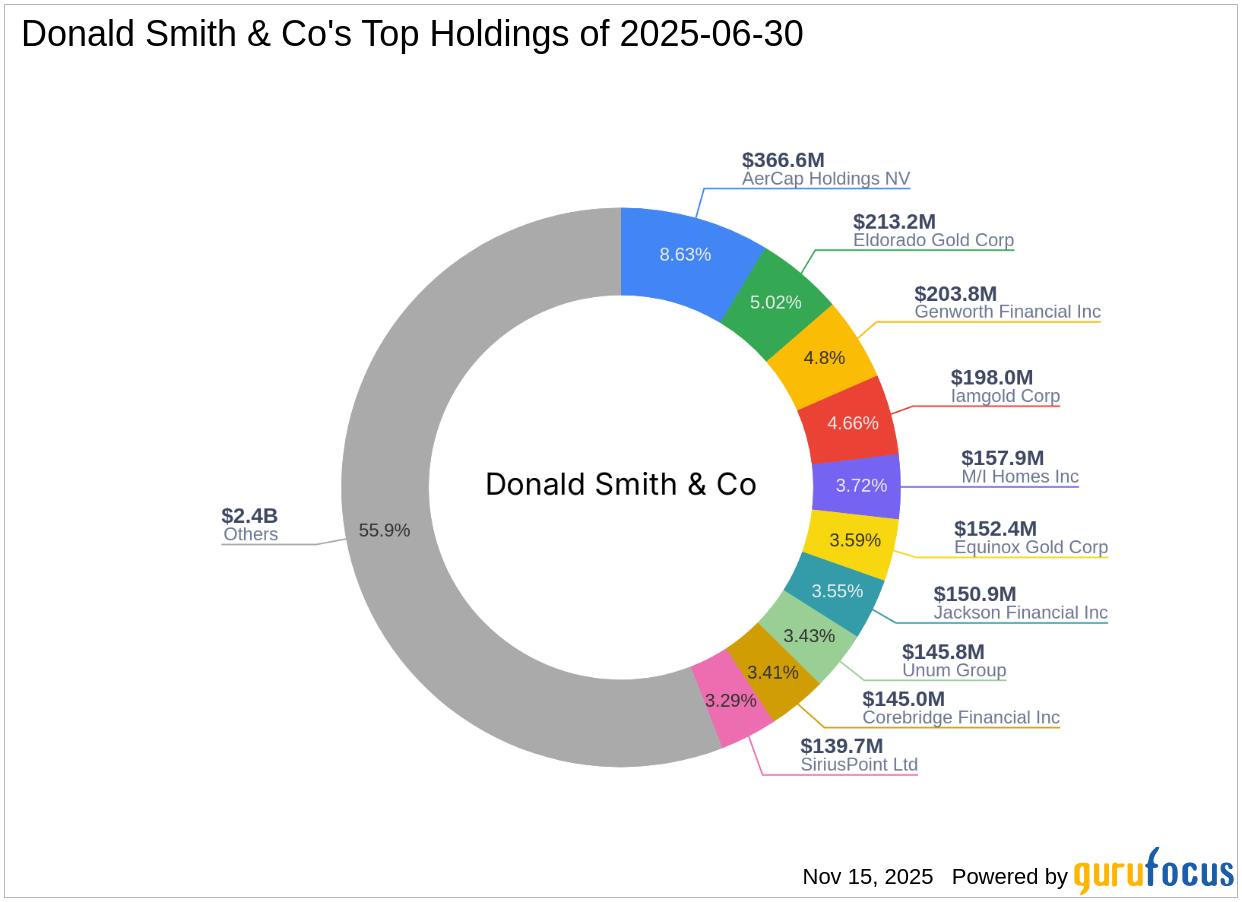

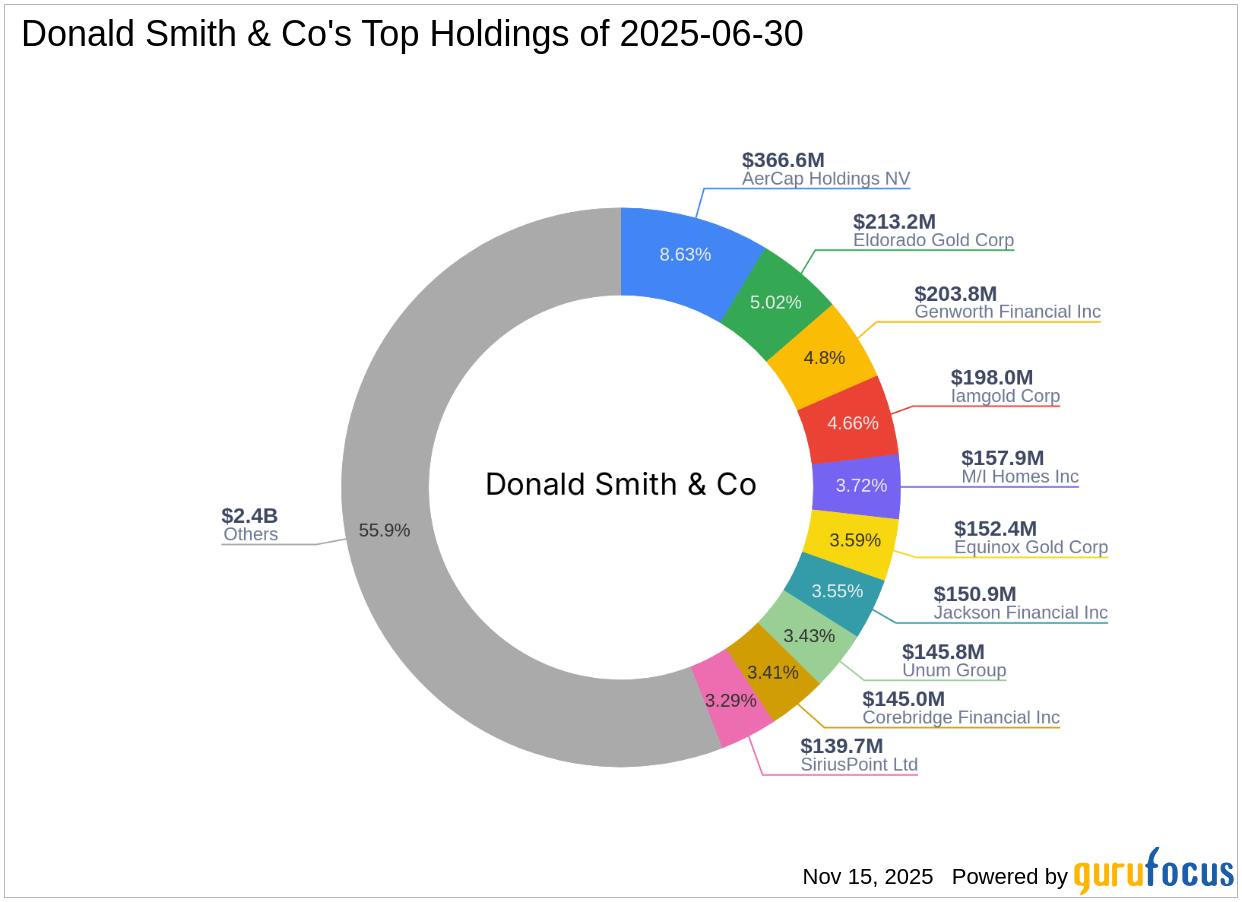

Donald Smith & Co Reduces Stake in Beazer Homes USA Inc

gurufocus.com

2025-11-14 22:11:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Beazer Homes USA Inc (BZH), reducing its holdings by 77,

Beazer Homes Surpasses Expectations with Strong FY26 Outlook

gurufocus.com

2025-11-14 13:14:00Beazer Homes (BZH) exceeded analyst expectations for 4Q25, benefiting from a low bar set by recent disappointing earnings from peers like D.R. Horton (DHI), KB

Bear Of The Day: Beazer Homes (BZH)

zacks.com

2026-02-04 08:11:08This home builder has seen estimates fall after a recent earnings miss, but it still has good earnings growth.

Why Beazer Homes Stock Just Crashed

fool.com

2026-01-30 13:21:16Beazer stock missed on both sales and earnings last night. The company's Q1 loss was more than twice as bad as expected.

Beazer Homes: Q1 Miss Adds To Value Trap Fears

seekingalpha.com

2026-01-30 08:51:25Beazer Homes USA (BZH) remains a 'sell' as weak housing demand pressures margins and undermines its expansion strategy. BZH's Q1 saw a $0.90 loss, 22% revenue decline, and gross margins drop to 14%, highlighting operational challenges. Management's aggressive community growth and buyback plans appear misaligned with deteriorating orders, rising cancellations, and high leverage.

Beazer Homes USA, Inc. (BZH) Q1 2026 Earnings Call Transcript

seekingalpha.com

2026-01-29 20:22:49Beazer Homes USA, Inc. (BZH) Q1 2026 Earnings Call Transcript

Beazer (BZH) Reports Q1 Earnings: What Key Metrics Have to Say

zacks.com

2026-01-29 19:01:31Although the revenue and EPS for Beazer (BZH) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Beazer Homes (BZH) Reports Q1 Loss, Lags Revenue Estimates

zacks.com

2026-01-29 18:26:07Beazer Homes (BZH) came out with a quarterly loss of $0.9 per share versus the Zacks Consensus Estimate of a loss of $0.49. This compares to earnings of $0.1 per share a year ago.

Beazer Homes Reports First Quarter Fiscal 2026 Results

businesswire.com

2026-01-29 16:15:00ATLANTA--(BUSINESS WIRE)--Beazer Homes USA, Inc. (NYSE: BZH) (www.beazer.com) today announced its financial results for the three months ended December 31, 2025. "Results for our first fiscal quarter of 2026 reflected persistent demand challenges and elevated incentives in the market," said Allan P. Merrill, the Company's Chairman and Chief Executive Officer. "However, with national builders slowing starts last year and lower mortgage rates, we are cautiously optimistic for the spring selling s.

Beazer Homes USA, Inc. to Webcast Its Fiscal First Quarter Results Conference Call on Thursday, January 29, 2026

businesswire.com

2026-01-15 06:15:00ATLANTA--(BUSINESS WIRE)--Beazer Homes (NYSE: BZH) (www.beazer.com) has scheduled the release of its financial results for the quarter ended December 31, 2025 on Thursday, January 29, 2026 after the close of the market. Management will host a conference call on the same day at 5:00 PM ET to discuss the results. The public may listen to the conference call and view the Company's slide presentation on the "Investor Relations" page of the Company's website, www.beazer.com. In addition, the confere.

New Strong Sell Stocks for Jan. 13

zacks.com

2026-01-13 05:05:14ATAI, BHR and BZH have been added to the Zacks Rank #5 (Strong Sell) List on Jan.13, 2026.

Bear of the Day: Beazer Homes (BZH)

zacks.com

2025-12-10 07:21:22Beazer Homes ( BZH ) is your Bear of the Day because after reporting continued slow growth in their Q4 of FY'25 (ended September), analysts took the Zacks EPS FY'26 consensus down 19% from $1.81 to $1.47. For the quarter ended September 2025, this small-cap homebuilder, with projected revenues of nearly $2.5 billion for the current fiscal year, reported revenue of $791.9 million, down 1.8% over the same period last year.

Beazer Homes Announces Changes to the Board

businesswire.com

2025-12-09 16:15:00ATLANTA--(BUSINESS WIRE)--Beazer Homes USA, Inc. (the “Company”) (NYSE: BZH) announced today the appointment of Howard Heckes as a new independent member of the Board of Directors. Mr. Heckes is an established leader in the building materials and services industry, most recently serving as Chief Executive Officer of Masonite International, a top global designer, manufacturer, marketer and distributor of doors and door solutions. Prior to Masonite, he was Chief Executive Officer of Energy Manage.

New Strong Sell Stocks for Nov. 25

zacks.com

2025-11-25 06:57:06ALG, BBWI and BZH have been added to the Zacks Rank #5 (Strong Sell) List on Nov. 25, 2025.

Beazer Homes USA's Plunge Offers Opportunity

seekingalpha.com

2025-11-18 11:56:50Beazer Homes USA, Inc. faces near-term headwinds as home prices and new build activity decline, but remains fundamentally attractive for long-term investors. BZH's recent quarterly results exceeded analyst revenue and EPS expectations, despite falling profitability and a challenging housing market environment. The stock trades at low absolute valuation multiples but carries higher leverage than peers; BZH management is prioritizing deleveraging and community expansion.

Beazer Homes USA (NYSE:BZH) Shares Gap Up Following Strong Earnings

defenseworld.net

2025-11-15 02:19:10Beazer Homes USA, Inc. (NYSE: BZH - Get Free Report) shares gapped up prior to trading on Friday following a stronger than expected earnings report. The stock had previously closed at $21.40, but opened at $24.00. Beazer Homes USA shares last traded at $21.8290, with a volume of 216,032 shares. The construction company reported $1.07 earnings

Donald Smith & Co Reduces Stake in Beazer Homes USA Inc

gurufocus.com

2025-11-14 22:11:00On September 30, 2025, Donald Smith and Co (Trades, Portfolio) executed a strategic transaction involving Beazer Homes USA Inc (BZH), reducing its holdings by 77,

Beazer Homes Surpasses Expectations with Strong FY26 Outlook

gurufocus.com

2025-11-14 13:14:00Beazer Homes (BZH) exceeded analyst expectations for 4Q25, benefiting from a low bar set by recent disappointing earnings from peers like D.R. Horton (DHI), KB