BlackRock Municipal Income Quality Trust (BYM)

Price:

10.91 USD

( - -0.03 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

PIMCO Dynamic Income Fund

VALUE SCORE:

7

2nd position

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

The best

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

BlackRock Municipal Income Quality Trust is a closed-ended fixed income mutual fund launched by BlackRock, Inc. It is managed by BlackRock Advisors, LLC. The fund invests in the fixed income markets of the United States. It primarily invests in investment grade municipal bonds exempt from federal income taxes, including the alternative minimum tax. BlackRock Municipal Income Quality Trust was formed on October 31, 2002 and is domiciled in the United States.

NEWS

BYM - Perfectly Sensible Tax Free Income Generator

seekingalpha.com

2025-05-27 01:28:55BYM is designed for high-income, tax-sensitive investors seeking steady, tax-free income, not capital gains or speculative growth. The fund invests in municipal bonds, offering federal tax exemption, but carries both credit and interest rate risk, especially due to its longer-term holdings. Managed muni funds like BYM typically justify higher fees with higher yields versus index funds, but risk and concentration must be weighed.

BlackRock Announces Board Approval of Closed-End Fund Reorganizations

businesswire.com

2025-01-21 08:01:00NEW YORK--(BUSINESS WIRE)---- $BFK--BlackRock Advisors, LLC announced today that each of the Boards of Directors/Trustees of each of the closed-end funds named below (each, a “Fund” and collectively, the “Funds”) has approved the following reorganizations (each, a “Reorganization” and collectively, the “Reorganizations), as applicable: BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM) and BlackRock Municipal Income Trust (NYSE: BFK) into BlackRock Muni.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2024-03-01 16:30:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. Municipal Funds: Declaration- 3/1/2024 Ex-Date- 3/14/2024 Record- 3/15/2024 Payable- 4/1/2024 National Funds Ticker Distribution Change From Prior Distribution BlackRock Municipal Income Quality Trust* BYM $0.052500 - BlackRock Long-Term Municipal Advantage Trust* BTA $0.043500 - BlackRock MuniAssets Fund, Inc.* MUA $0.055500 - BlackRock Municipal Income Fund, Inc.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2023-12-05 17:00:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. BlackRock Floating Rate Income Trust (NYSE: BGT), BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA) and BlackRock Debt Strategies Fund, Inc. (NYSE: DSU) announced increases to their monthly distributions. Certain BlackRock municipal Funds previously declared their December, January and February distributions and declared special distributions today in order.

Certain BlackRock Municipal Closed-End Funds Announce Variable Rate Muni Term Preferred Shares Actions

businesswire.com

2023-11-02 17:15:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced BlackRock Municipal Income Trust (NYSE: BFK), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN), BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM), BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), BlackRock MuniYield Quality Fund II, Inc. (NYSE: MQT), BlackRock MuniHoldings Quality Fund II, Inc. (NYSE: MUE), BlackRock MuniVest Fund, Inc. (NYSE: MVF), and BlackRock MuniVest Fund II, Inc. (NYSE: MVT) (collectively, the “Funds”) intend to redeem a portion of their outstanding Series W-7 Variable Rate Muni Term Preferred Shares (“VMTP Shares”) on or about November 24, 2023, at a redemption price equal to the liquidation preference of $100,000 per share, together with accumulated and unpaid dividends through the day prior to the redemption date. Shareholders are expected to benefit from lower expenses as a result of the redemptions.

Weekly Closed-End Fund Roundup: DEX Will Merge With AGD, Tender Next January (December 11, 2022)

seekingalpha.com

2022-12-19 22:52:102 out of 23 CEF sectors positive on price and 4 out of 23 sectors positive on NAV last week. DEX will merge with AGD.

EVN And BYM: Best Performers Amongst Lightly Reviewed Muni Funds

seekingalpha.com

2022-08-05 08:00:00The Eaton Vance Municipal Income Trust invests primarily in investment-grade municipal obligations of various sectors with a mixture of sectors across the full spectrum. BlackRock Municipal Income Quality Trust may invest up to 20% of its assets in bonds rated below Aaa or AAA (but not lower than BBB/Baa).

BlackRock Announces Fiscal Year End Changes for Certain Municipal Closed-End Funds

businesswire.com

2022-06-03 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC (“BlackRock”) announced today a change to the fiscal year end (“FYE”) for each Fund listed below. These changes were made to reduce operating costs for the Funds and will be effective as of July 31, 2022. Ticker (NYSE) Fund Current FYE New FYE BKN BlackRock Investment Quality Municipal Trust, Inc. 4/30 7/31 BTA BlackRock Long-Term Municipal Advantage Trust 4/30 7/31 MUA BlackRock MuniAssets Fund, Inc. 4/30 7/31 MUI BlackRock Municipal Income Fu

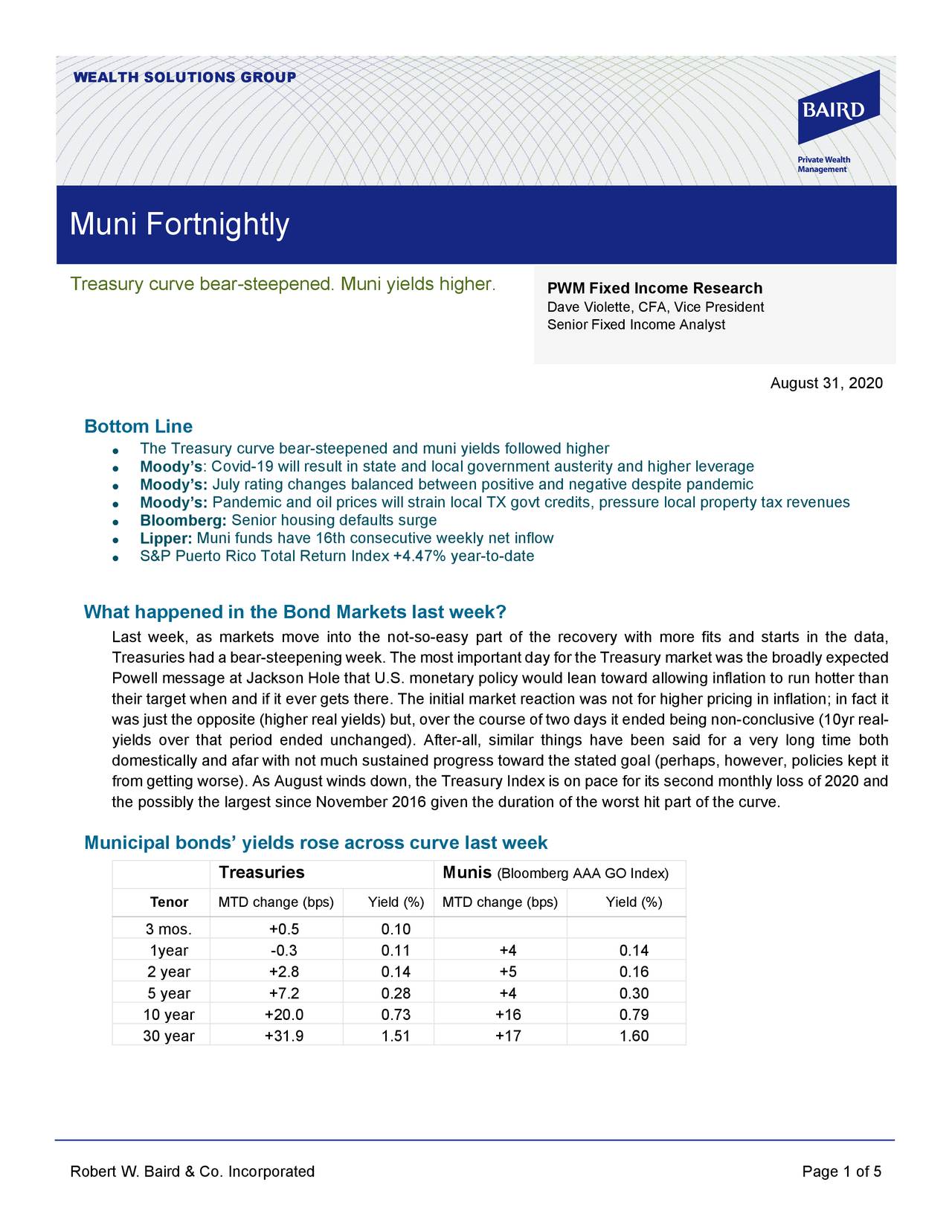

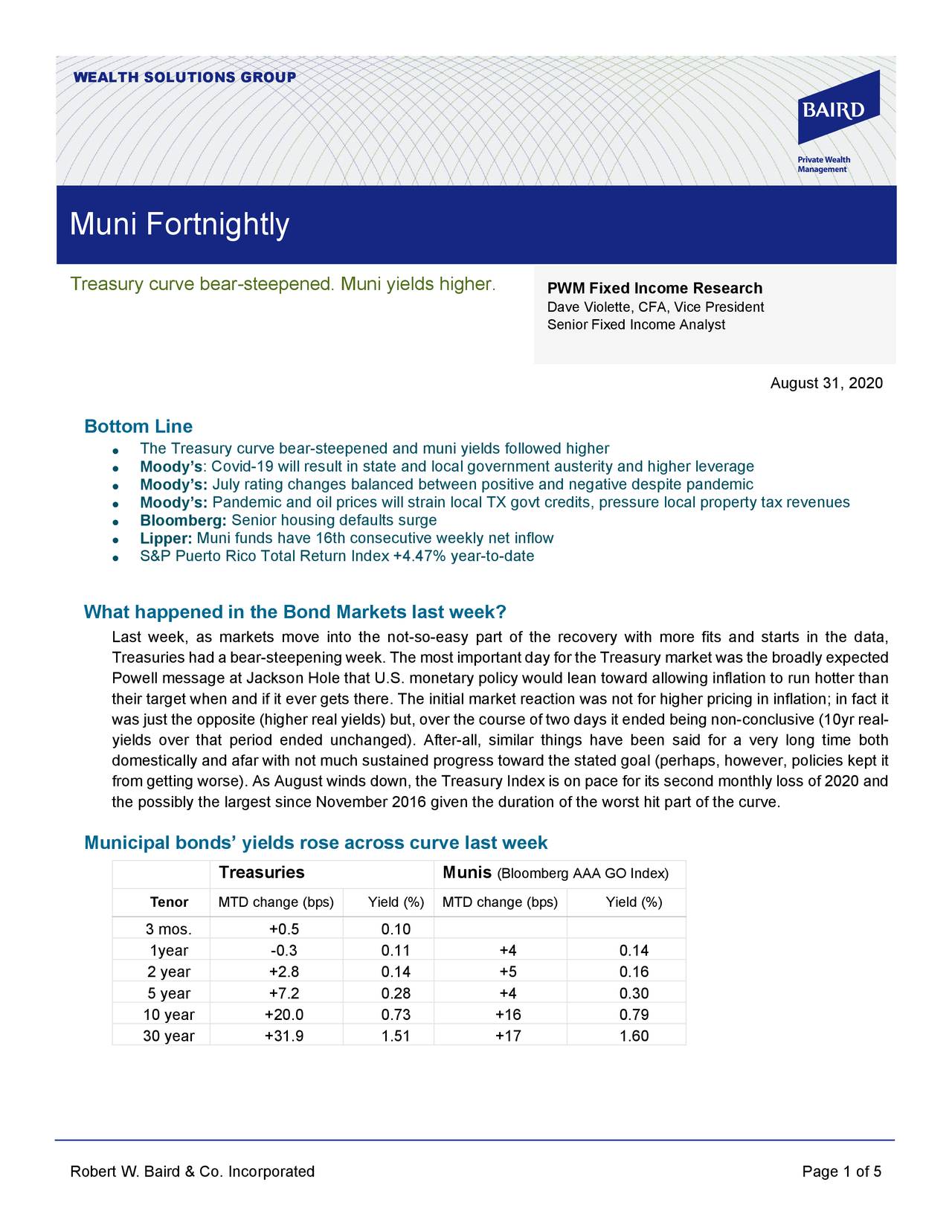

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

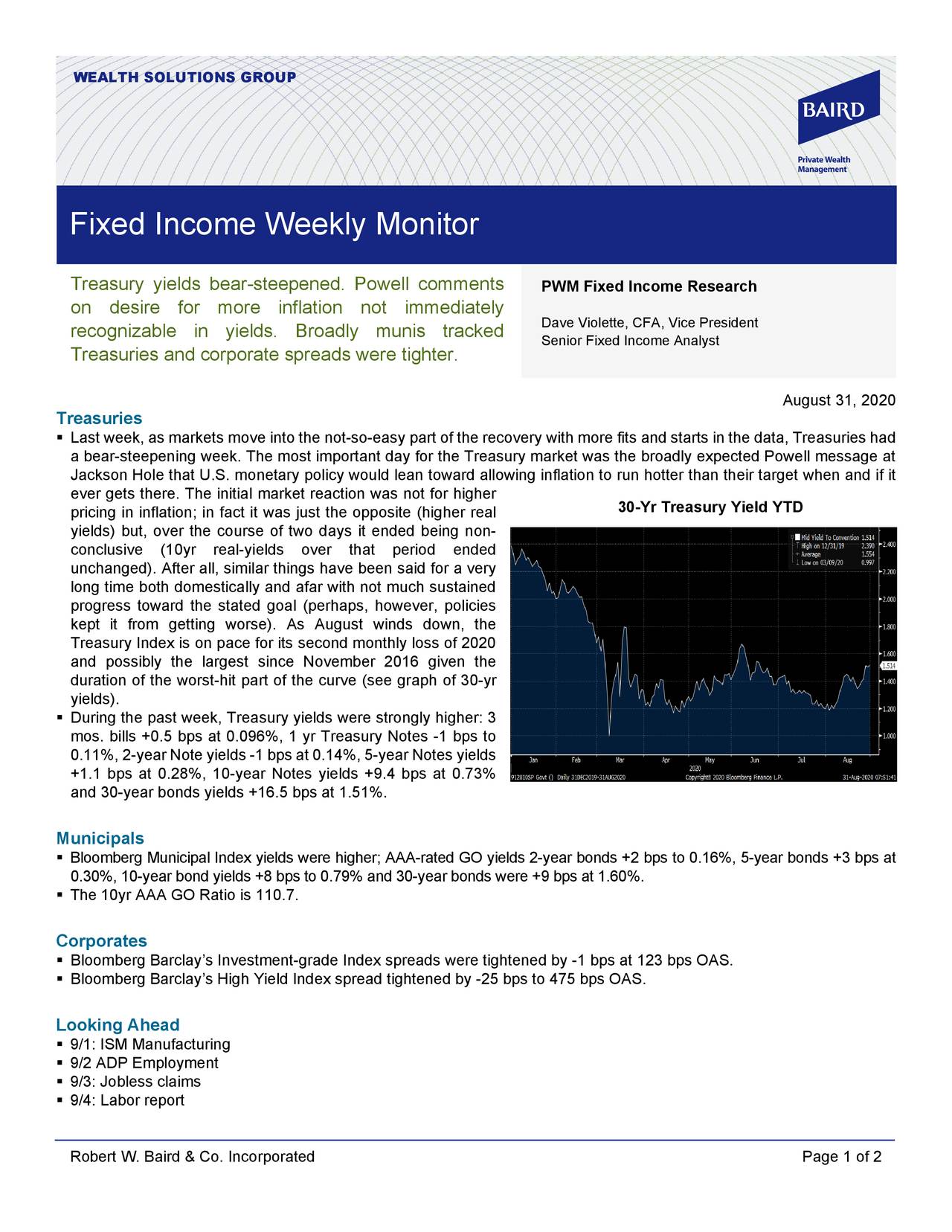

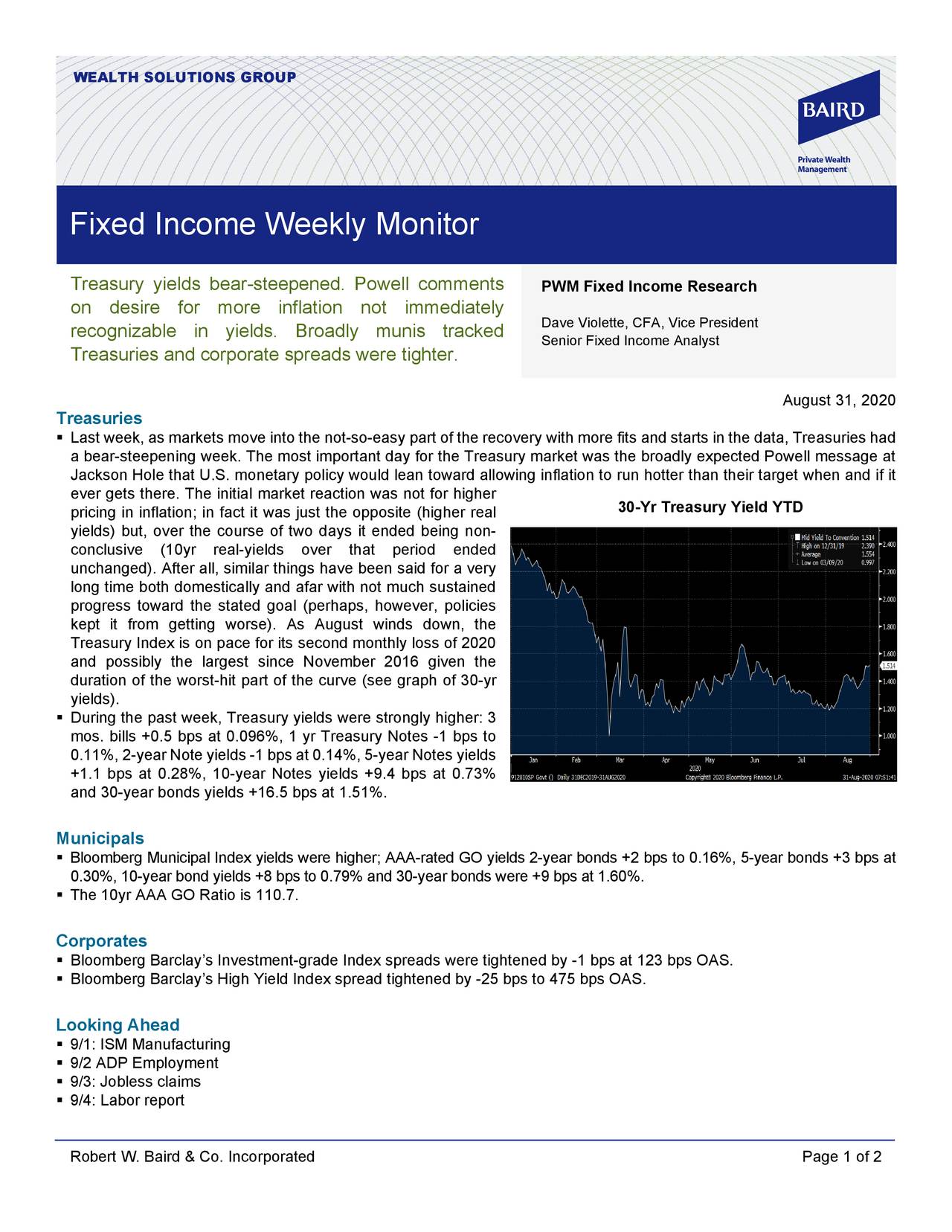

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

Rule #1 For Bonds: Don't Lose Money

seekingalpha.com

2020-08-30 05:47:09At the beginning of this year, we created the Baskin Fixed Income Fund as a more efficient way to manage your fixed income investments.

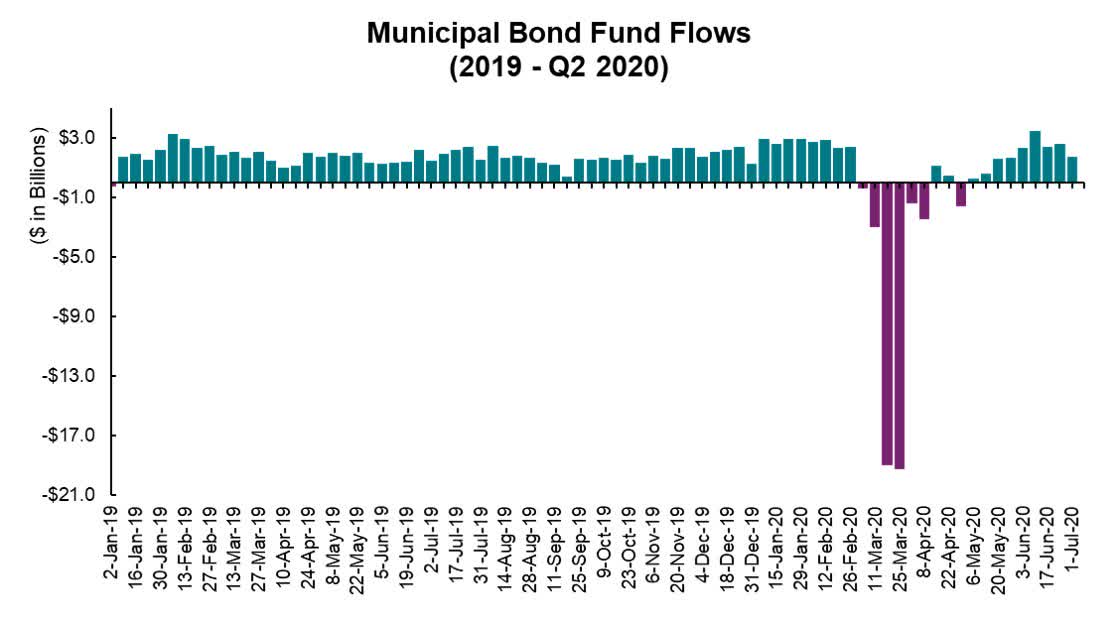

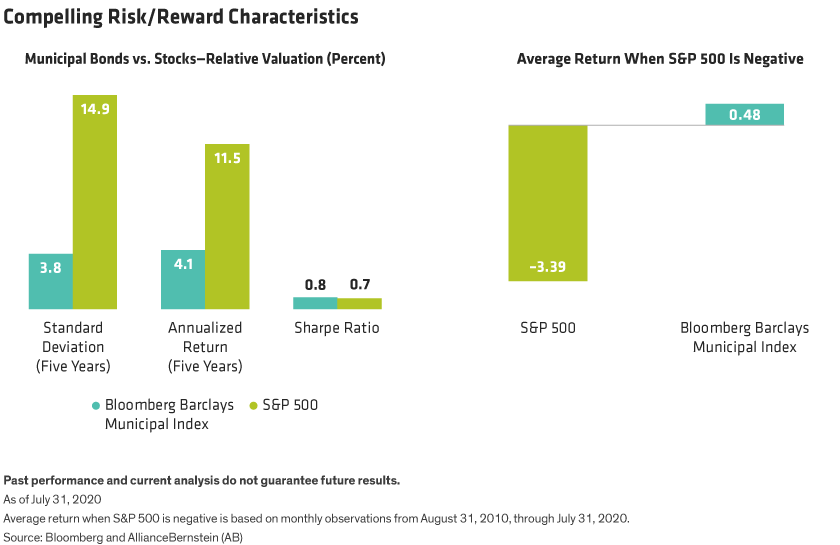

For Muni Investors, COVID-19 Provides Lessons In Liquidity

seekingalpha.com

2020-08-27 10:19:48Over the years, individual investors have flocked to municipal bonds to meet safety, income and after-tax return goals.

Small Ways Muni Investors Can Make A Big Difference

seekingalpha.com

2020-07-28 08:58:55Municipal bonds issued by state and local entities fund projects across various sectors that create the foundation upon which local economies thrive.

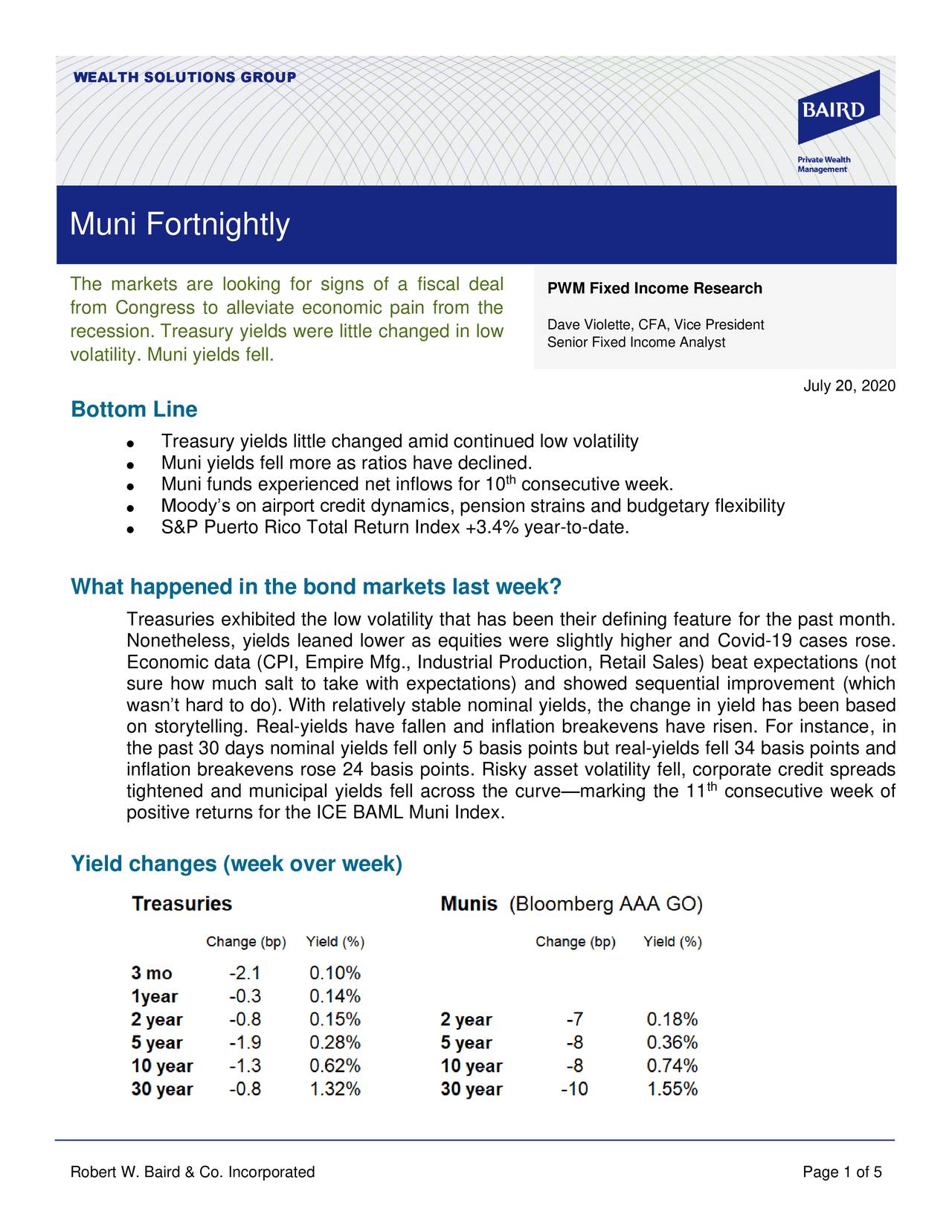

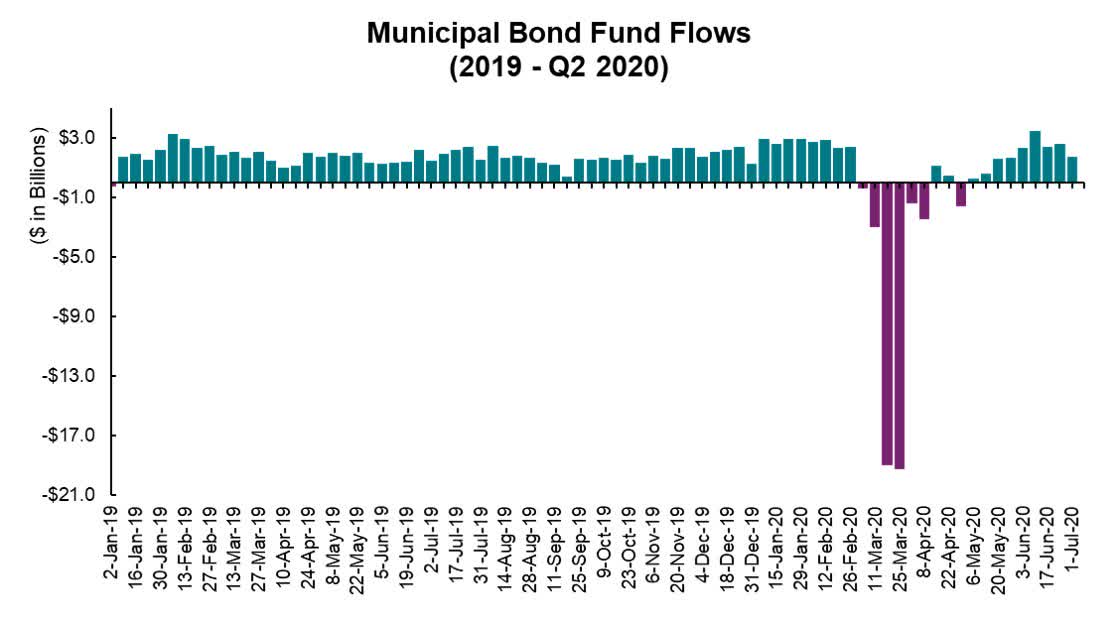

What Happened In The Bond Markets Last Week? Muni Fortnightly, July 20, 2020

seekingalpha.com

2020-07-27 03:15:00Muni yields fell more as ratios have declined. Muni funds experienced net inflows for 10th consecutive week.

2020 Muni Market Midyear Update

seekingalpha.com

2020-07-15 10:29:54States and towns are reluctant to make any issuance until they have an understanding of just how bad their revenue losses are going to be.

BYM - Perfectly Sensible Tax Free Income Generator

seekingalpha.com

2025-05-27 01:28:55BYM is designed for high-income, tax-sensitive investors seeking steady, tax-free income, not capital gains or speculative growth. The fund invests in municipal bonds, offering federal tax exemption, but carries both credit and interest rate risk, especially due to its longer-term holdings. Managed muni funds like BYM typically justify higher fees with higher yields versus index funds, but risk and concentration must be weighed.

BlackRock Announces Board Approval of Closed-End Fund Reorganizations

businesswire.com

2025-01-21 08:01:00NEW YORK--(BUSINESS WIRE)---- $BFK--BlackRock Advisors, LLC announced today that each of the Boards of Directors/Trustees of each of the closed-end funds named below (each, a “Fund” and collectively, the “Funds”) has approved the following reorganizations (each, a “Reorganization” and collectively, the “Reorganizations), as applicable: BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM) and BlackRock Municipal Income Trust (NYSE: BFK) into BlackRock Muni.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2024-03-01 16:30:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. Municipal Funds: Declaration- 3/1/2024 Ex-Date- 3/14/2024 Record- 3/15/2024 Payable- 4/1/2024 National Funds Ticker Distribution Change From Prior Distribution BlackRock Municipal Income Quality Trust* BYM $0.052500 - BlackRock Long-Term Municipal Advantage Trust* BTA $0.043500 - BlackRock MuniAssets Fund, Inc.* MUA $0.055500 - BlackRock Municipal Income Fund, Inc.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2023-12-05 17:00:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. BlackRock Floating Rate Income Trust (NYSE: BGT), BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA) and BlackRock Debt Strategies Fund, Inc. (NYSE: DSU) announced increases to their monthly distributions. Certain BlackRock municipal Funds previously declared their December, January and February distributions and declared special distributions today in order.

Certain BlackRock Municipal Closed-End Funds Announce Variable Rate Muni Term Preferred Shares Actions

businesswire.com

2023-11-02 17:15:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced BlackRock Municipal Income Trust (NYSE: BFK), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN), BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM), BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), BlackRock MuniYield Quality Fund II, Inc. (NYSE: MQT), BlackRock MuniHoldings Quality Fund II, Inc. (NYSE: MUE), BlackRock MuniVest Fund, Inc. (NYSE: MVF), and BlackRock MuniVest Fund II, Inc. (NYSE: MVT) (collectively, the “Funds”) intend to redeem a portion of their outstanding Series W-7 Variable Rate Muni Term Preferred Shares (“VMTP Shares”) on or about November 24, 2023, at a redemption price equal to the liquidation preference of $100,000 per share, together with accumulated and unpaid dividends through the day prior to the redemption date. Shareholders are expected to benefit from lower expenses as a result of the redemptions.

Weekly Closed-End Fund Roundup: DEX Will Merge With AGD, Tender Next January (December 11, 2022)

seekingalpha.com

2022-12-19 22:52:102 out of 23 CEF sectors positive on price and 4 out of 23 sectors positive on NAV last week. DEX will merge with AGD.

EVN And BYM: Best Performers Amongst Lightly Reviewed Muni Funds

seekingalpha.com

2022-08-05 08:00:00The Eaton Vance Municipal Income Trust invests primarily in investment-grade municipal obligations of various sectors with a mixture of sectors across the full spectrum. BlackRock Municipal Income Quality Trust may invest up to 20% of its assets in bonds rated below Aaa or AAA (but not lower than BBB/Baa).

BlackRock Announces Fiscal Year End Changes for Certain Municipal Closed-End Funds

businesswire.com

2022-06-03 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC (“BlackRock”) announced today a change to the fiscal year end (“FYE”) for each Fund listed below. These changes were made to reduce operating costs for the Funds and will be effective as of July 31, 2022. Ticker (NYSE) Fund Current FYE New FYE BKN BlackRock Investment Quality Municipal Trust, Inc. 4/30 7/31 BTA BlackRock Long-Term Municipal Advantage Trust 4/30 7/31 MUA BlackRock MuniAssets Fund, Inc. 4/30 7/31 MUI BlackRock Municipal Income Fu

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

Rule #1 For Bonds: Don't Lose Money

seekingalpha.com

2020-08-30 05:47:09At the beginning of this year, we created the Baskin Fixed Income Fund as a more efficient way to manage your fixed income investments.

For Muni Investors, COVID-19 Provides Lessons In Liquidity

seekingalpha.com

2020-08-27 10:19:48Over the years, individual investors have flocked to municipal bonds to meet safety, income and after-tax return goals.

Small Ways Muni Investors Can Make A Big Difference

seekingalpha.com

2020-07-28 08:58:55Municipal bonds issued by state and local entities fund projects across various sectors that create the foundation upon which local economies thrive.

What Happened In The Bond Markets Last Week? Muni Fortnightly, July 20, 2020

seekingalpha.com

2020-07-27 03:15:00Muni yields fell more as ratios have declined. Muni funds experienced net inflows for 10th consecutive week.

2020 Muni Market Midyear Update

seekingalpha.com

2020-07-15 10:29:54States and towns are reluctant to make any issuance until they have an understanding of just how bad their revenue losses are going to be.