Peabody Energy Corporation (BTU)

Price:

32.40 USD

( + 1.12 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Warrior Met Coal, Inc.

VALUE SCORE:

4

2nd position

NACCO Industries, Inc.

VALUE SCORE:

10

The best

SunCoke Energy, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

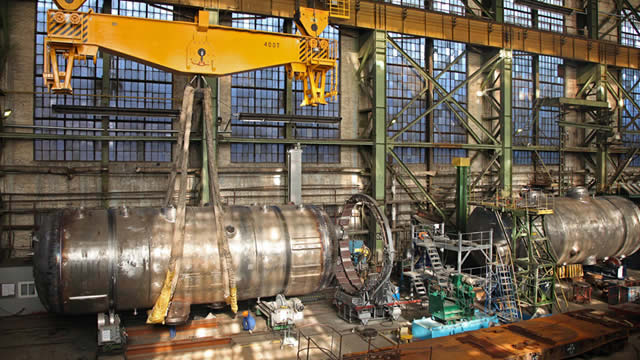

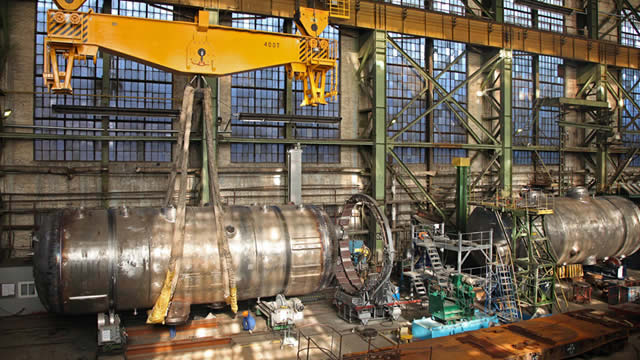

Peabody Energy Corporation engages in coal mining business in the United States, Japan, Taiwan, Australia, India, Indonesia, China, Vietnam, South Korea, and internationally. The company operates through Seaborne Thermal Mining, Seaborne Metallurgical Mining, Powder River Basin Mining, and Other U.S. Thermal Mining segments. It is involved in mining, preparation, and sale of thermal coal primarily to electric utilities; mining bituminous and sub-bituminous coal deposits; and mining metallurgical coal, such as hard coking coal, semi-hard coking coal, semi-soft coking coal, and pulverized coal injection coal. The company supplies coal primarily to electricity generators, industrial facilities, and steel manufacturers. As of December 31, 2021, it owned interests in 17 coal mining operations located in the United States and Australia; and had approximately 2.5 billion tons of proven and probable coal reserves and approximately 450,000 acres of surface property through ownership and lease agreements. The company also engages in direct and brokered trading of coal and freight-related contracts, as well as provides transportation-related services. Peabody Energy Corporation was founded in 1883 and is headquartered in St. Louis, Missouri.

NEWS

BTU Acquires New Dixie East Project East of Great Bear's Dixie Deposit Kinross Continues Drilling on BTU's Dixie Halo Property

accessnewswire.com

2025-09-30 08:30:00VANCOUVER, BC / ACCESS Newswire / September 30, 2025 / BTU METALS CORP. ("BTU" or the "Company") (TSXV:BTU)(OTCQB:BTUMF) is pleased to announce it has acquired a 100% interest in the Dixie East property located 5.5 km to the east of the Kinross World Class Great Bear ("GBR") Dixie project, southeast of Red Lake, Ontario.

Peabody Statement on President Trump's Advancing America's Clean Beautiful Coal Announcements

prnewswire.com

2025-09-29 13:22:00ST. LOUIS , Sept. 29, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) released the following statement in relation to the Trump Administration's commitment to American energy and the coal industry through today's Advancing America's Clean Beautiful Coal announcements: "We applaud President Trump for the bold actions taken today to restore balance to U.S. energy policy and reaffirm coal's vital role in keeping the lights on.

Did Trump Just Save the Dying Coal Industry?

247wallst.com

2025-09-29 11:26:38No new coal plants have been permitted since 2010, while 290 plants have closed. Europe's phase-outs remain despite energy shocks, but China's 60% reliance on coal underscores its enduring global role.

Undervalued & Overfunded: Peabody Path To A Potential 100% Rally

seekingalpha.com

2025-09-20 06:06:39Peabody Energy stands out as a leading coal producer with strategic assets in the US and Australia, poised for growth despite industry headwinds. BTU terminated its $3.78B acquisition of Anglo American's Australian coal mines due to a material adverse change, leading to a legal dispute but minimal downside risk. The Centurion Mine project is a key growth driver, expected to deliver significant free cash flow starting in 2026, supporting robust shareholder returns.

I'm Convinced Energy Is The Most Misunderstood Investment Opportunity Of The Decade

seekingalpha.com

2025-09-13 07:30:00I focus on big, long-term trends and dedicate energy to sectors with tremendous value, even if they're temporarily out of favor. Earlier this year, defense contractors were extremely undervalued, but patient investors have since been rewarded as the market recognized their strengths. My investment style emphasizes patience and thesis-driven investing, which isn't for everyone. Index fund investors should stick to consistency and diversification.

Peabody Is Making The Powder River Basin Great Again

seekingalpha.com

2025-09-10 15:00:41Peabody is pivoting back to its core U.S. thermal coal assets, capitalizing on surging electricity demand from data centers and a supportive political environment. Termination of the Anglo deal refocuses Peabody on maximizing shareholder returns, with a clean balance sheet and a commitment to return 65%+ of free cash flow, primarily via buybacks. The Powder River Basin assets are underappreciated, generating strong free cash flow and offering rare earth element upside that could eclipse Peabody's current enterprise value.

Peabody Energy: Earnings Power Reveals Hidden Value

seekingalpha.com

2025-09-02 13:25:04Peabody Energy is deeply undervalued, trading at just 0.55 times tangible book value despite improved earnings power and strategic positioning. The termination of the purchase agreement for Anglo-American's Australian coal mines removes a major financial burden and potential loss-making assets from BTU's balance sheet. Peabody now has the opportunity to capitalize on a favorable U.S. market and policy environment without the burden of additional debt.

Peabody Energy terminates bid for Anglo American's coking coal mines

reuters.com

2025-08-19 08:19:21Peabody Energy said on Tuesday it has withdrawn its $3.78 billion bid for Anglo American's Australian coking coal assets, after failing to renegotiate a lower price for the deal following a production halt caused by a fire.

Peabody Terminates Planned Acquisition with Anglo American

prnewswire.com

2025-08-19 07:18:00ST. LOUIS , Aug. 19, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) announced today that it has terminated purchase agreements with Anglo American Plc due to a material adverse change (MAC, as defined under the purchase agreements) relating to Anglo's steelmaking coal assets. Peabody's decision to terminate the transaction comes nearly five months after an ignition event occurred at Anglo's Moranbah North Mine.

Peabody Energy Corporation (BTU) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-31 20:17:37Peabody Energy Corporation (NYSE:BTU ) Q2 2025 Earnings Conference Call July 31, 2025 11:00 AM ET Company Participants James C. Grech - President, CEO & Director Malcolm Roberts - Chief Marketing Officer Mark A.

Peabody Energy: A Weak Q2, But Still Some Bright Spots

seekingalpha.com

2025-07-31 11:08:51Peabody Energy Corporation's Q2 2025 results were weak, with significant margin declines and a miss on earnings, but some cost and sales guidance improved. The Anglo American coal asset deal remains uncertain due to operational issues, but renegotiation or cancellation is likely and would benefit Peabody's balance sheet. Centurion Mine is progressing ahead of schedule and will enhance Peabody's production and margins once operational, supporting future EBITDA growth.

Peabody Energy (BTU) Reports Q2 Loss, Lags Revenue Estimates

zacks.com

2025-07-31 09:55:24Peabody Energy (BTU) came out with a quarterly loss of $0.06 per share versus the Zacks Consensus Estimate of a loss of $0.04. This compares to earnings of $1.43 per share a year ago.

Peabody Reports Results For Quarter Ended June 30, 2025

prnewswire.com

2025-07-31 07:45:00Second Quarter Results Reflect Strong Seaborne and PRB Cost Performance Longwall Start at Centurion Mine Accelerated to February 2026 Favorable Changes to Full-Year Volume and Cost Targets ST. LOUIS , July 31, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) today reported net income attributable to common stockholders of $(27.6) million, or $(0.23) per diluted share, for the second quarter of 2025, compared to $199.4 million, or $1.42 per diluted share in the prior year quarter.

Peabody Board Declares Dividend on Common Stock

prnewswire.com

2025-07-31 07:44:00ST. LOUIS , July 31, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) announced today that its Board of Directors has declared a quarterly dividend on its common stock of $0.075 per share, payable on September 3, 2025 to stockholders of record on August 14, 2025. Peabody is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel.

Peabody Energy: A 46% Discount To Reality

seekingalpha.com

2025-07-29 17:23:06BTU is deeply undervalued, trading at 6x 2026 earnings and a 46% discount to book, with zero net debt and strong cash reserves. BTU remains highly profitable, generating over $1.5B in free cash flow in seaborne thermal lines and aggressively returning capital to shareholders via buybacks. Trump's return to office is a major tailwind, with regulatory rollbacks and friendlier coal policies extending the industry's runway.

Analysts Estimate Peabody Energy (BTU) to Report a Decline in Earnings: What to Look Out for

zacks.com

2025-07-24 11:09:23Peabody Energy (BTU) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

BTU Acquires New Dixie East Project East of Great Bear's Dixie Deposit Kinross Continues Drilling on BTU's Dixie Halo Property

accessnewswire.com

2025-09-30 08:30:00VANCOUVER, BC / ACCESS Newswire / September 30, 2025 / BTU METALS CORP. ("BTU" or the "Company") (TSXV:BTU)(OTCQB:BTUMF) is pleased to announce it has acquired a 100% interest in the Dixie East property located 5.5 km to the east of the Kinross World Class Great Bear ("GBR") Dixie project, southeast of Red Lake, Ontario.

Peabody Statement on President Trump's Advancing America's Clean Beautiful Coal Announcements

prnewswire.com

2025-09-29 13:22:00ST. LOUIS , Sept. 29, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) released the following statement in relation to the Trump Administration's commitment to American energy and the coal industry through today's Advancing America's Clean Beautiful Coal announcements: "We applaud President Trump for the bold actions taken today to restore balance to U.S. energy policy and reaffirm coal's vital role in keeping the lights on.

Did Trump Just Save the Dying Coal Industry?

247wallst.com

2025-09-29 11:26:38No new coal plants have been permitted since 2010, while 290 plants have closed. Europe's phase-outs remain despite energy shocks, but China's 60% reliance on coal underscores its enduring global role.

Undervalued & Overfunded: Peabody Path To A Potential 100% Rally

seekingalpha.com

2025-09-20 06:06:39Peabody Energy stands out as a leading coal producer with strategic assets in the US and Australia, poised for growth despite industry headwinds. BTU terminated its $3.78B acquisition of Anglo American's Australian coal mines due to a material adverse change, leading to a legal dispute but minimal downside risk. The Centurion Mine project is a key growth driver, expected to deliver significant free cash flow starting in 2026, supporting robust shareholder returns.

I'm Convinced Energy Is The Most Misunderstood Investment Opportunity Of The Decade

seekingalpha.com

2025-09-13 07:30:00I focus on big, long-term trends and dedicate energy to sectors with tremendous value, even if they're temporarily out of favor. Earlier this year, defense contractors were extremely undervalued, but patient investors have since been rewarded as the market recognized their strengths. My investment style emphasizes patience and thesis-driven investing, which isn't for everyone. Index fund investors should stick to consistency and diversification.

Peabody Is Making The Powder River Basin Great Again

seekingalpha.com

2025-09-10 15:00:41Peabody is pivoting back to its core U.S. thermal coal assets, capitalizing on surging electricity demand from data centers and a supportive political environment. Termination of the Anglo deal refocuses Peabody on maximizing shareholder returns, with a clean balance sheet and a commitment to return 65%+ of free cash flow, primarily via buybacks. The Powder River Basin assets are underappreciated, generating strong free cash flow and offering rare earth element upside that could eclipse Peabody's current enterprise value.

Peabody Energy: Earnings Power Reveals Hidden Value

seekingalpha.com

2025-09-02 13:25:04Peabody Energy is deeply undervalued, trading at just 0.55 times tangible book value despite improved earnings power and strategic positioning. The termination of the purchase agreement for Anglo-American's Australian coal mines removes a major financial burden and potential loss-making assets from BTU's balance sheet. Peabody now has the opportunity to capitalize on a favorable U.S. market and policy environment without the burden of additional debt.

Peabody Energy terminates bid for Anglo American's coking coal mines

reuters.com

2025-08-19 08:19:21Peabody Energy said on Tuesday it has withdrawn its $3.78 billion bid for Anglo American's Australian coking coal assets, after failing to renegotiate a lower price for the deal following a production halt caused by a fire.

Peabody Terminates Planned Acquisition with Anglo American

prnewswire.com

2025-08-19 07:18:00ST. LOUIS , Aug. 19, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) announced today that it has terminated purchase agreements with Anglo American Plc due to a material adverse change (MAC, as defined under the purchase agreements) relating to Anglo's steelmaking coal assets. Peabody's decision to terminate the transaction comes nearly five months after an ignition event occurred at Anglo's Moranbah North Mine.

Peabody Energy Corporation (BTU) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-31 20:17:37Peabody Energy Corporation (NYSE:BTU ) Q2 2025 Earnings Conference Call July 31, 2025 11:00 AM ET Company Participants James C. Grech - President, CEO & Director Malcolm Roberts - Chief Marketing Officer Mark A.

Peabody Energy: A Weak Q2, But Still Some Bright Spots

seekingalpha.com

2025-07-31 11:08:51Peabody Energy Corporation's Q2 2025 results were weak, with significant margin declines and a miss on earnings, but some cost and sales guidance improved. The Anglo American coal asset deal remains uncertain due to operational issues, but renegotiation or cancellation is likely and would benefit Peabody's balance sheet. Centurion Mine is progressing ahead of schedule and will enhance Peabody's production and margins once operational, supporting future EBITDA growth.

Peabody Energy (BTU) Reports Q2 Loss, Lags Revenue Estimates

zacks.com

2025-07-31 09:55:24Peabody Energy (BTU) came out with a quarterly loss of $0.06 per share versus the Zacks Consensus Estimate of a loss of $0.04. This compares to earnings of $1.43 per share a year ago.

Peabody Reports Results For Quarter Ended June 30, 2025

prnewswire.com

2025-07-31 07:45:00Second Quarter Results Reflect Strong Seaborne and PRB Cost Performance Longwall Start at Centurion Mine Accelerated to February 2026 Favorable Changes to Full-Year Volume and Cost Targets ST. LOUIS , July 31, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) today reported net income attributable to common stockholders of $(27.6) million, or $(0.23) per diluted share, for the second quarter of 2025, compared to $199.4 million, or $1.42 per diluted share in the prior year quarter.

Peabody Board Declares Dividend on Common Stock

prnewswire.com

2025-07-31 07:44:00ST. LOUIS , July 31, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) announced today that its Board of Directors has declared a quarterly dividend on its common stock of $0.075 per share, payable on September 3, 2025 to stockholders of record on August 14, 2025. Peabody is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel.

Peabody Energy: A 46% Discount To Reality

seekingalpha.com

2025-07-29 17:23:06BTU is deeply undervalued, trading at 6x 2026 earnings and a 46% discount to book, with zero net debt and strong cash reserves. BTU remains highly profitable, generating over $1.5B in free cash flow in seaborne thermal lines and aggressively returning capital to shareholders via buybacks. Trump's return to office is a major tailwind, with regulatory rollbacks and friendlier coal policies extending the industry's runway.

Analysts Estimate Peabody Energy (BTU) to Report a Decline in Earnings: What to Look Out for

zacks.com

2025-07-24 11:09:23Peabody Energy (BTU) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.