Boston Scientific Corporation (BSX)

Price:

92.56 USD

( + 0.81 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Penumbra, Inc.

VALUE SCORE:

8

2nd position

Stryker Corporation

VALUE SCORE:

9

The best

Abbott Laboratories

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

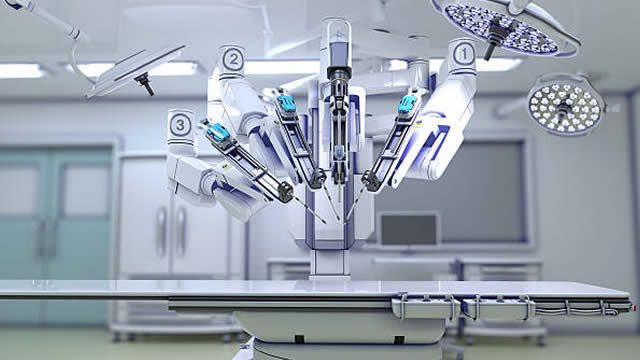

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through three segments: MedSurg, Rhythm and Neuro, and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions; devices to treat various urological and pelvic conditions; implantable cardioverter and implantable cardiac resynchronization therapy defibrillators; pacemakers and implantable cardiac resynchronization therapy pacemakers; and remote patient management systems. It also provides medical technologies to diagnose and treat rate and rhythm disorders of the heart comprising 3-D cardiac mapping and navigation solutions, ablation catheters, diagnostic catheters, mapping catheters, intracardiac ultrasound catheters, delivery sheaths, and other accessories; spinal cord stimulator systems for the management of chronic pain; indirect decompression systems; and deep brain stimulation systems. In addition, the company offers interventional cardiology products, including drug-eluting coronary stent systems used in the treatment of coronary artery disease; percutaneous coronary interventions products to treat atherosclerosis; intravascular catheter-directed ultrasound imaging catheters, fractional flow reserve devices, and systems for use in coronary arteries and heart chambers, as well as various peripheral vessels; and structural heart therapies. Further, it provides stents, balloon catheters, wires, and atherectomy systems to treat arterial diseases; thrombectomy and acoustic pulse thrombolysis systems, wires, and stents to treat venous diseases; and peripheral embolization devices, radioactive microspheres, ablation systems, cryotherapy ablation systems, and micro and drainage catheters to treat cancer. The company was incorporated in 1979 and is headquartered in Marlborough, Massachusetts.

NEWS

Boston Scientific Corporation $BSX Shares Sold by Ameriprise Financial Inc.

defenseworld.net

2025-12-13 05:20:53Ameriprise Financial Inc. lessened its stake in shares of Boston Scientific Corporation (NYSE: BSX) by 0.8% during the second quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 7,786,959 shares of the medical equipment provider's stock after selling 64,744 shares during the quarter. Ameriprise Financial

Boston Scientific (BSX) Stock Falls Amid Market Uptick: What Investors Need to Know

zacks.com

2025-12-11 19:01:08The latest trading day saw Boston Scientific (BSX) settling at $91.75, representing a -1.02% change from its previous close.

Boston Scientific Sustains Momentum in the PFA Market: What's Next?

zacks.com

2025-12-11 09:06:05BSX builds momentum in PFA as FARAPULSE posts strong growth, and new trial results and expanded FDA labeling boost its AF treatment push.

PAHC vs. BSX: Which Stock Is the Better Value Option?

zacks.com

2025-12-08 12:41:08Investors with an interest in Medical - Products stocks have likely encountered both Phibro Animal Health (PAHC) and Boston Scientific (BSX). But which of these two stocks presents investors with the better value opportunity right now?

Bank of Nova Scotia Raises Position in Boston Scientific Corporation $BSX

defenseworld.net

2025-12-08 03:32:57Bank of Nova Scotia boosted its holdings in shares of Boston Scientific Corporation (NYSE: BSX) by 106.4% in the undefined quarter, according to its most recent Form 13F filing with the SEC. The firm owned 3,025,519 shares of the medical equipment provider's stock after buying an additional 1,559,605 shares during the period. Boston

Cerity Partners LLC Boosts Stock Holdings in Boston Scientific Corporation $BSX

defenseworld.net

2025-12-07 04:52:44Cerity Partners LLC lifted its position in Boston Scientific Corporation (NYSE: BSX) by 0.8% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,301,504 shares of the medical equipment provider's stock after acquiring an additional 10,625 shares

Boston Scientific Corporation $BSX Shares Bought by Baird Financial Group Inc.

defenseworld.net

2025-12-06 04:04:42Baird Financial Group Inc. lifted its stake in Boston Scientific Corporation (NYSE: BSX) by 13.4% during the undefined quarter, according to the company in its most recent filing with the SEC. The fund owned 273,534 shares of the medical equipment provider's stock after acquiring an additional 32,417 shares during the quarter. Baird Financial

Boston Scientific Corporation (NYSE:BSX) Receives Consensus Recommendation of “Buy” from Analysts

defenseworld.net

2025-12-04 01:57:02Boston Scientific Corporation (NYSE: BSX - Get Free Report) has received an average recommendation of "Buy" from the twenty-five analysts that are presently covering the company, MarketBeat Ratings reports. Two analysts have rated the stock with a hold recommendation, twenty-one have given a buy recommendation and two have issued a strong buy recommendation on the company.

Boston Scientific Corporation (BSX) Presents at Citi Annual Global Healthcare Conference 2025 Prepared Remarks Transcript

seekingalpha.com

2025-12-02 16:23:25Boston Scientific Corporation (BSX) Presents at Citi Annual Global Healthcare Conference 2025 Prepared Remarks Transcript

M&A Strategy Strengthens Boston Scientific's Growth Prospects

zacks.com

2025-12-02 09:00:43BSX accelerates growth as a wave of acquisitions boosts core portfolios and fuels expansion into high-growth adjacent markets.

Why Boston Scientific (BSX) is a Top Momentum Stock for the Long-Term

zacks.com

2025-11-28 10:51:18The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Is Boston Scientific (BSX) a Buy as Wall Street Analysts Look Optimistic?

zacks.com

2025-11-28 10:30:59When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Alcosta Capital Management Inc. Invests $5.20 Million in Boston Scientific Corporation $BSX

defenseworld.net

2025-11-28 03:46:54Alcosta Capital Management Inc. purchased a new stake in Boston Scientific Corporation (NYSE: BSX) during the undefined quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 48,427 shares of the medical equipment provider's stock, valued at approximately $5,202,000. Boston Scientific makes up about

Why Boston Scientific (BSX) is a Top Growth Stock for the Long-Term

zacks.com

2025-11-25 10:46:21Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Boston Scientific's Margins Strengthen in Q3: What's Driving It?

zacks.com

2025-11-25 09:26:08BSX posts stronger Q3 margins as growth in EP and WATCHMAN lifts product mix despite tariff pressure.

Aviso Financial Inc. Reduces Stock Position in Boston Scientific Corporation $BSX

defenseworld.net

2025-11-25 04:36:50Aviso Financial Inc. trimmed its holdings in shares of Boston Scientific Corporation (NYSE: BSX) by 9.4% in the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 14,901 shares of the medical equipment provider's stock after selling 1,540 shares during the period. Aviso Financial

No data to display

Boston Scientific Corporation $BSX Shares Sold by Ameriprise Financial Inc.

defenseworld.net

2025-12-13 05:20:53Ameriprise Financial Inc. lessened its stake in shares of Boston Scientific Corporation (NYSE: BSX) by 0.8% during the second quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 7,786,959 shares of the medical equipment provider's stock after selling 64,744 shares during the quarter. Ameriprise Financial

Boston Scientific (BSX) Stock Falls Amid Market Uptick: What Investors Need to Know

zacks.com

2025-12-11 19:01:08The latest trading day saw Boston Scientific (BSX) settling at $91.75, representing a -1.02% change from its previous close.

Boston Scientific Sustains Momentum in the PFA Market: What's Next?

zacks.com

2025-12-11 09:06:05BSX builds momentum in PFA as FARAPULSE posts strong growth, and new trial results and expanded FDA labeling boost its AF treatment push.

PAHC vs. BSX: Which Stock Is the Better Value Option?

zacks.com

2025-12-08 12:41:08Investors with an interest in Medical - Products stocks have likely encountered both Phibro Animal Health (PAHC) and Boston Scientific (BSX). But which of these two stocks presents investors with the better value opportunity right now?

Bank of Nova Scotia Raises Position in Boston Scientific Corporation $BSX

defenseworld.net

2025-12-08 03:32:57Bank of Nova Scotia boosted its holdings in shares of Boston Scientific Corporation (NYSE: BSX) by 106.4% in the undefined quarter, according to its most recent Form 13F filing with the SEC. The firm owned 3,025,519 shares of the medical equipment provider's stock after buying an additional 1,559,605 shares during the period. Boston

Cerity Partners LLC Boosts Stock Holdings in Boston Scientific Corporation $BSX

defenseworld.net

2025-12-07 04:52:44Cerity Partners LLC lifted its position in Boston Scientific Corporation (NYSE: BSX) by 0.8% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,301,504 shares of the medical equipment provider's stock after acquiring an additional 10,625 shares

Boston Scientific Corporation $BSX Shares Bought by Baird Financial Group Inc.

defenseworld.net

2025-12-06 04:04:42Baird Financial Group Inc. lifted its stake in Boston Scientific Corporation (NYSE: BSX) by 13.4% during the undefined quarter, according to the company in its most recent filing with the SEC. The fund owned 273,534 shares of the medical equipment provider's stock after acquiring an additional 32,417 shares during the quarter. Baird Financial

Boston Scientific Corporation (NYSE:BSX) Receives Consensus Recommendation of “Buy” from Analysts

defenseworld.net

2025-12-04 01:57:02Boston Scientific Corporation (NYSE: BSX - Get Free Report) has received an average recommendation of "Buy" from the twenty-five analysts that are presently covering the company, MarketBeat Ratings reports. Two analysts have rated the stock with a hold recommendation, twenty-one have given a buy recommendation and two have issued a strong buy recommendation on the company.

Boston Scientific Corporation (BSX) Presents at Citi Annual Global Healthcare Conference 2025 Prepared Remarks Transcript

seekingalpha.com

2025-12-02 16:23:25Boston Scientific Corporation (BSX) Presents at Citi Annual Global Healthcare Conference 2025 Prepared Remarks Transcript

M&A Strategy Strengthens Boston Scientific's Growth Prospects

zacks.com

2025-12-02 09:00:43BSX accelerates growth as a wave of acquisitions boosts core portfolios and fuels expansion into high-growth adjacent markets.

Why Boston Scientific (BSX) is a Top Momentum Stock for the Long-Term

zacks.com

2025-11-28 10:51:18The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Is Boston Scientific (BSX) a Buy as Wall Street Analysts Look Optimistic?

zacks.com

2025-11-28 10:30:59When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Alcosta Capital Management Inc. Invests $5.20 Million in Boston Scientific Corporation $BSX

defenseworld.net

2025-11-28 03:46:54Alcosta Capital Management Inc. purchased a new stake in Boston Scientific Corporation (NYSE: BSX) during the undefined quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 48,427 shares of the medical equipment provider's stock, valued at approximately $5,202,000. Boston Scientific makes up about

Why Boston Scientific (BSX) is a Top Growth Stock for the Long-Term

zacks.com

2025-11-25 10:46:21Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Boston Scientific's Margins Strengthen in Q3: What's Driving It?

zacks.com

2025-11-25 09:26:08BSX posts stronger Q3 margins as growth in EP and WATCHMAN lifts product mix despite tariff pressure.

Aviso Financial Inc. Reduces Stock Position in Boston Scientific Corporation $BSX

defenseworld.net

2025-11-25 04:36:50Aviso Financial Inc. trimmed its holdings in shares of Boston Scientific Corporation (NYSE: BSX) by 9.4% in the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 14,901 shares of the medical equipment provider's stock after selling 1,540 shares during the period. Aviso Financial