Invesco BulletShares 2025 High Yield Corporate Bond ETF (BSJP)

Price:

23.07 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

iShares iBonds Dec 2025 Term Treasury ETF

VALUE SCORE:

10

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated high yield corporate bonds (commonly known as "junk bonds") with maturities or, in some cases, "effective maturities" in the year 2025 (collectively, "2025 Bonds").

NEWS

BSJP: Worst Scenario Likely Unfolding

seekingalpha.com

2025-04-16 02:36:43BSJP, set to terminate in December 2025, holds 30% non-maturity-matched bonds (e.g., OneMain Finance Corp, maturing 2029), exposing investors to significant market and credit spread risks. BSJP has underperformed cash (e.g., BIL) this year despite its high-yield bonds, showing negative price changes due to its longer-duration holdings. A recession developing in 2025 will result in a negative impact on the ETF.

BSJP: Deviating From What It Is Meant To Do

seekingalpha.com

2024-10-16 18:26:34The fund was designed to be a diversified bullet portfolio with minimal volatility, as its underlying bonds were expected to mature in 2025. The fund has deviated from its original structure by introducing longer-dated bonds with maturities beyond 2025. The introduction of longer-dated bonds has increased the fund's market risk, exposing investors to potential losses in case of a recession.

BSJP: A Term Bond For Those Who Want High Yield For 2 Years

seekingalpha.com

2024-01-12 03:21:21Invesco BulletShares 2025 High Yield Corporate Bond ETF is a term corporate bond ETF that matures in December 2025. BSJP offers predictability, diversification, liquidity, lower costs, and interest rate management compared to traditional bonds and bond funds. The fund holds a diversified portfolio of high yield corporate bonds, with a focus on next year's maturities, making it attractive for investors with a shorter time horizon.

Invesco's Jason Bloom: ‘Now Might Be a Good Time to Take on More Credit'

etftrends.com

2023-12-14 18:06:01Earlier this year, many industry observers and investors were expecting an imminent slowdown with markets. But with rates coming back down and the risk outlook improving, the outlook on fixed income has improved.

BSJP: Over 8% Yield With Limited Duration Risk

seekingalpha.com

2023-10-10 10:00:00This ETF, just like its holdings, is set for redemption in 2025. It invests in USD denominated, high yield corporate bonds. We review this fund and provide our opinion on whether the 8%+ yield is worth it.

Investors Look to BulletShares ETFs for Opportunities in Front of Yield Curve

etftrends.com

2023-06-26 16:37:43Two BulletShares ETFs are seeing sizable flows as investors look for opportunities in the front end of the yield curve. Many investors staying within the short to intermediate part of the curve, opting for balanced fixed income exposure as opposed to making big bets.

BSJP: Interesting Term Fund, 8.1% Yield

seekingalpha.com

2023-06-05 21:58:48The Invesco BulletShares 2025 High Yield Corporate Bond ETF is a term fund with a termination date in December 2025, offering an 8.1% yield. The fund has a balanced build with even allocations in the 'BB' and 'B' buckets and is appropriate for investors with a shorter time horizon. BSJP has a good structural build, with its collateral pool matching the fund's termination date, thus eliminating market timing risk.

ETF Flows, The Winners And Losers In Volatile Markets

seekingalpha.com

2023-03-22 06:28:00Recent uncertainty, instigated by the issues seen across the financial sector, has led to a change in investment flows seen across exchange traded funds. A change in investment flows can be seen over the month of March as equity market volatility has increased.

A Cyclical Rotation In Corporate Credit

seekingalpha.com

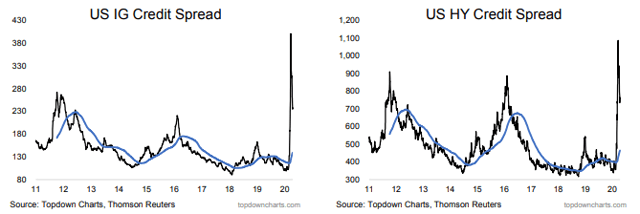

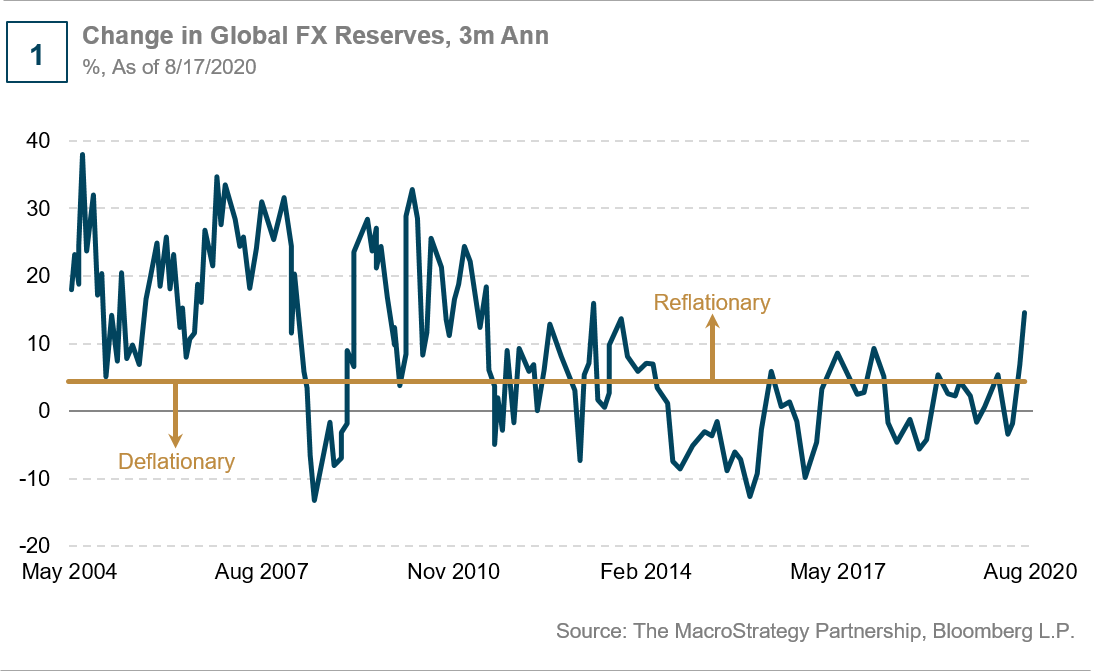

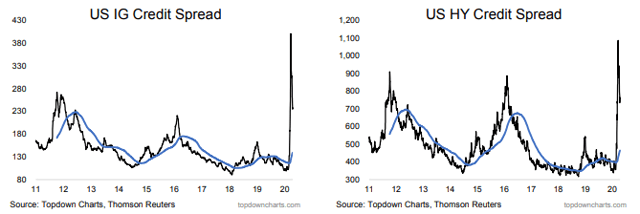

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

The Fed, Fundamentals, And Credit

seekingalpha.com

2020-04-21 10:12:33The Fed’s backstop helped bring down credit spreads, both investment grade and high yield. Banks appear positioned to make it through the Corona Crash according

Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) Shares Purchased by Ladenburg Thalmann Financial Services Inc.

thelincolnianonline.com

2020-04-20 10:18:43Ladenburg Thalmann Financial Services Inc. increased its holdings in shares of Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) by 41.2% during the fourth quarter, HoldingsChannel reports. The fund owned 5,383 shares of the company’s stock after buying an additional 1,572 shares during the period. Ladenburg Thalmann Financial Services Inc.’s holdings in Invesco BulletShares […]

UBS Group AG Purchases 6,176 Shares of Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP)

thelincolnianonline.com

2020-04-19 11:36:46UBS Group AG boosted its position in Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) by 19.9% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 37,216 shares of the company’s stock after purchasing an additional 6,176 shares during the […]

Bank of America Corp DE Purchases 3,995 Shares of Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP)

thelincolnianonline.com

2020-04-19 08:18:50Bank of America Corp DE boosted its position in Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) by 4.5% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 92,932 shares of the company’s stock after purchasing an additional 3,995 shares […]

No data to display

BSJP: Worst Scenario Likely Unfolding

seekingalpha.com

2025-04-16 02:36:43BSJP, set to terminate in December 2025, holds 30% non-maturity-matched bonds (e.g., OneMain Finance Corp, maturing 2029), exposing investors to significant market and credit spread risks. BSJP has underperformed cash (e.g., BIL) this year despite its high-yield bonds, showing negative price changes due to its longer-duration holdings. A recession developing in 2025 will result in a negative impact on the ETF.

BSJP: Deviating From What It Is Meant To Do

seekingalpha.com

2024-10-16 18:26:34The fund was designed to be a diversified bullet portfolio with minimal volatility, as its underlying bonds were expected to mature in 2025. The fund has deviated from its original structure by introducing longer-dated bonds with maturities beyond 2025. The introduction of longer-dated bonds has increased the fund's market risk, exposing investors to potential losses in case of a recession.

BSJP: A Term Bond For Those Who Want High Yield For 2 Years

seekingalpha.com

2024-01-12 03:21:21Invesco BulletShares 2025 High Yield Corporate Bond ETF is a term corporate bond ETF that matures in December 2025. BSJP offers predictability, diversification, liquidity, lower costs, and interest rate management compared to traditional bonds and bond funds. The fund holds a diversified portfolio of high yield corporate bonds, with a focus on next year's maturities, making it attractive for investors with a shorter time horizon.

Invesco's Jason Bloom: ‘Now Might Be a Good Time to Take on More Credit'

etftrends.com

2023-12-14 18:06:01Earlier this year, many industry observers and investors were expecting an imminent slowdown with markets. But with rates coming back down and the risk outlook improving, the outlook on fixed income has improved.

BSJP: Over 8% Yield With Limited Duration Risk

seekingalpha.com

2023-10-10 10:00:00This ETF, just like its holdings, is set for redemption in 2025. It invests in USD denominated, high yield corporate bonds. We review this fund and provide our opinion on whether the 8%+ yield is worth it.

Investors Look to BulletShares ETFs for Opportunities in Front of Yield Curve

etftrends.com

2023-06-26 16:37:43Two BulletShares ETFs are seeing sizable flows as investors look for opportunities in the front end of the yield curve. Many investors staying within the short to intermediate part of the curve, opting for balanced fixed income exposure as opposed to making big bets.

BSJP: Interesting Term Fund, 8.1% Yield

seekingalpha.com

2023-06-05 21:58:48The Invesco BulletShares 2025 High Yield Corporate Bond ETF is a term fund with a termination date in December 2025, offering an 8.1% yield. The fund has a balanced build with even allocations in the 'BB' and 'B' buckets and is appropriate for investors with a shorter time horizon. BSJP has a good structural build, with its collateral pool matching the fund's termination date, thus eliminating market timing risk.

ETF Flows, The Winners And Losers In Volatile Markets

seekingalpha.com

2023-03-22 06:28:00Recent uncertainty, instigated by the issues seen across the financial sector, has led to a change in investment flows seen across exchange traded funds. A change in investment flows can be seen over the month of March as equity market volatility has increased.

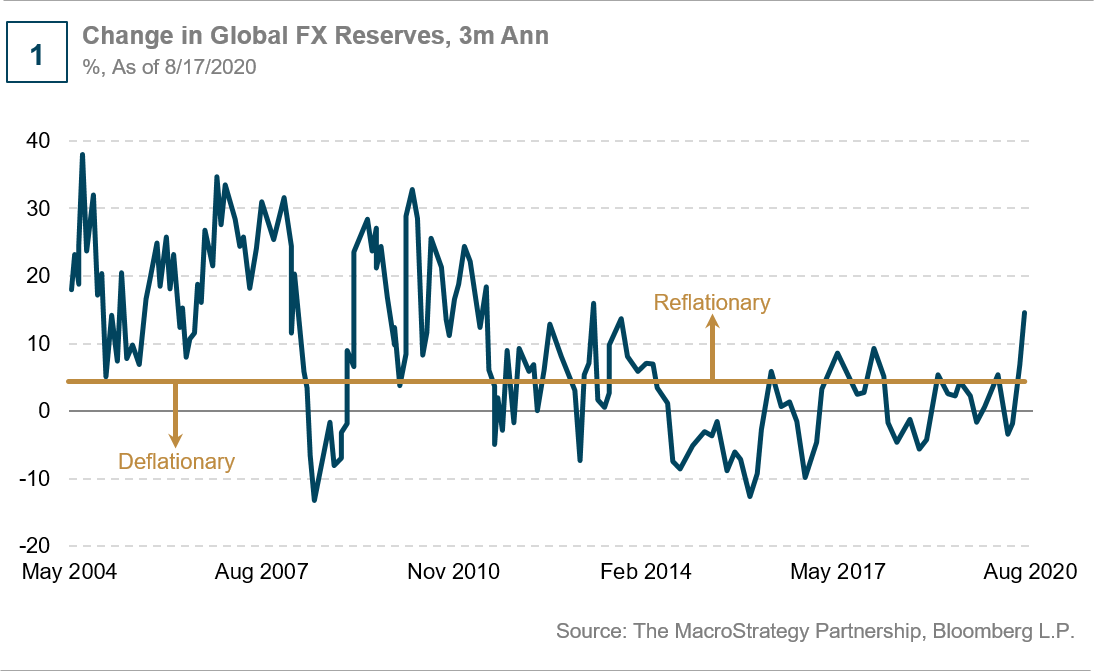

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

The Fed, Fundamentals, And Credit

seekingalpha.com

2020-04-21 10:12:33The Fed’s backstop helped bring down credit spreads, both investment grade and high yield. Banks appear positioned to make it through the Corona Crash according

Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) Shares Purchased by Ladenburg Thalmann Financial Services Inc.

thelincolnianonline.com

2020-04-20 10:18:43Ladenburg Thalmann Financial Services Inc. increased its holdings in shares of Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) by 41.2% during the fourth quarter, HoldingsChannel reports. The fund owned 5,383 shares of the company’s stock after buying an additional 1,572 shares during the period. Ladenburg Thalmann Financial Services Inc.’s holdings in Invesco BulletShares […]

UBS Group AG Purchases 6,176 Shares of Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP)

thelincolnianonline.com

2020-04-19 11:36:46UBS Group AG boosted its position in Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) by 19.9% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 37,216 shares of the company’s stock after purchasing an additional 6,176 shares during the […]

Bank of America Corp DE Purchases 3,995 Shares of Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP)

thelincolnianonline.com

2020-04-19 08:18:50Bank of America Corp DE boosted its position in Invesco BulletShares 2025 High Yield Corporate Bond ETF (NYSEARCA:BSJP) by 4.5% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 92,932 shares of the company’s stock after purchasing an additional 3,995 shares […]