Invesco BulletShares 2022 High Yield Corporate Bond ETF (BSJM)

Price:

22.01 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Invesco BulletShares (R) 2023 Municipal Bond ETF

VALUE SCORE:

0

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated high yield corporate bonds (commonly known as "junk bonds") with maturities or, in some cases, "effective maturities" in the year 2022 (collectively, "2022 Bonds").

NEWS

12 Different ETF Model Portfolios For 12 Different Investors

seekingalpha.com

2021-06-08 15:23:51Here are 12 very different "core" ETF model portfolios for 12 different investors, highlighting what I see each of 12 different fund brands being the best at.

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Crisis? What Crisis? USD Corporate Bond Liquidity Since COVID

seekingalpha.com

2020-08-27 06:34:44As the mid-March 2020 market volatility affected USD corporate bond prices, it also compromised their liquidity.

Corporate Credit Markets Remain In Good Shape

seekingalpha.com

2020-07-20 14:06:47The name of the bond market game since COVID-19 hit, if it can be summarized in one sentence, is that credit spread assets continue to make sense.

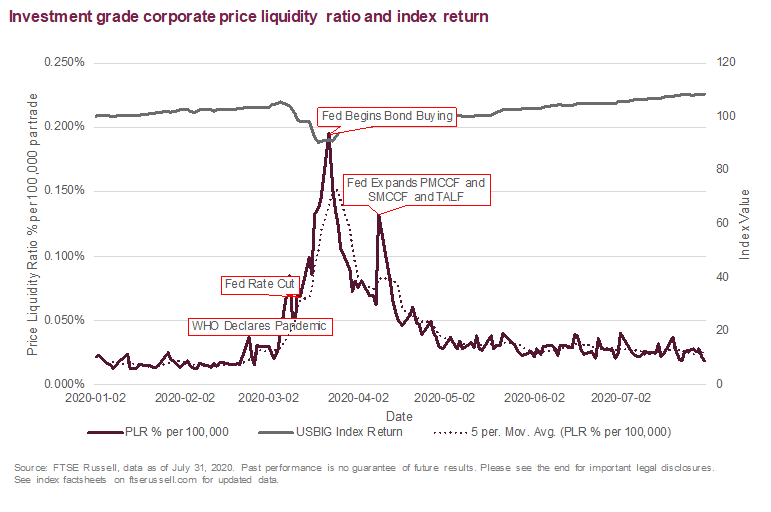

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Today's Portfolios 'Can't Get No Satisfaction' From Yesterday's Instruments

seekingalpha.com

2020-06-24 10:14:48The U.S. policy response has been the most remarkable of the developed markets, not least because of the explicit marriage of monetary and fiscal policy for the

Corporate Credit Spreads Continue To Improve

seekingalpha.com

2020-06-22 06:42:05The corporate bond market has typically been an institutional market that the largest mutual fund firms and sell-side firms like Goldman Sachs and Morgan Stanle

Bank of New York Mellon Corp Boosts Stock Position in Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-24 09:33:32Bank of New York Mellon Corp grew its stake in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 13.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 59,135 shares of the company’s stock after acquiring […]

American Institute for Advanced Investment Management LLP Buys 4,964 Shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-23 08:32:41American Institute for Advanced Investment Management LLP grew its holdings in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 14.5% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 39,279 shares of the company’s stock after acquiring […]

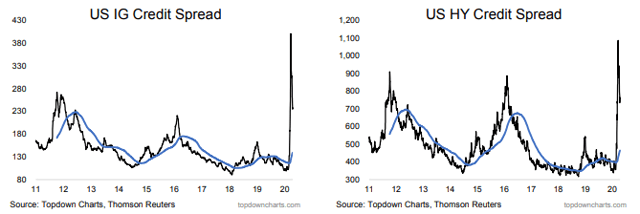

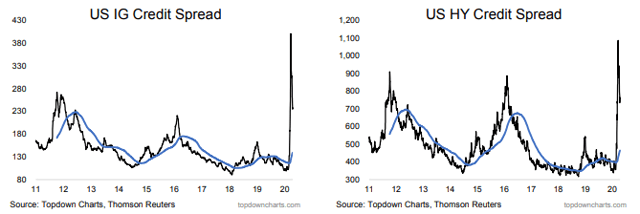

The Fed, Fundamentals, And Credit

seekingalpha.com

2020-04-21 10:12:33The Fed’s backstop helped bring down credit spreads, both investment grade and high yield. Banks appear positioned to make it through the Corona Crash according

2 Lessons From The 2008 And 2020 Stock Market Crashes

seekingalpha.com

2020-04-20 09:18:25Stocks were never as cheap during this crisis as they were in 2008 and 2009, and are unlikely to quickly charge to new highs with earnings falling. After anothe

Pacific Wealth Strategies Group Inc. Increases Stake in Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-13 13:44:48Pacific Wealth Strategies Group Inc. grew its position in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 4.1% in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 138,680 shares of the company’s stock after buying an additional 5,451 shares during […]

Gradient Investments LLC Cuts Stake in Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-08 10:14:41Gradient Investments LLC lowered its holdings in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 13.0% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 193,725 shares of the company’s stock after selling 29,024 shares during the quarter. […]

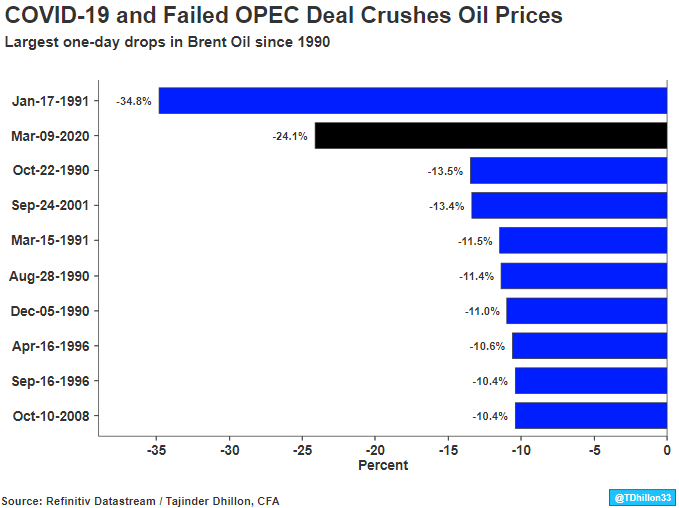

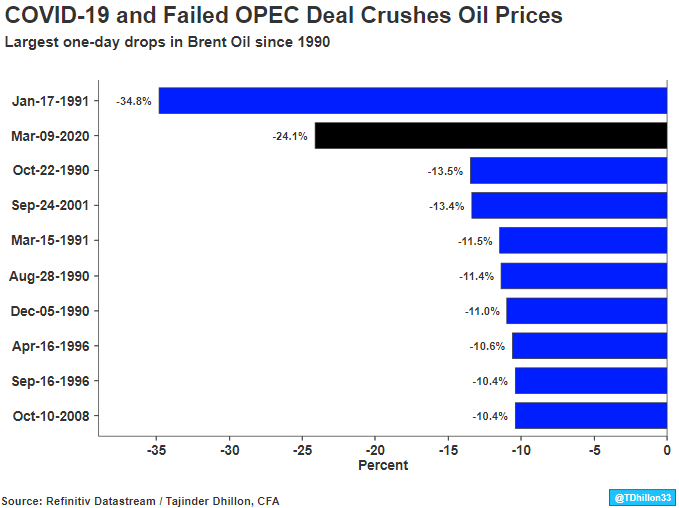

Impact Of Oil Collapse On High Yield Bond Market

seekingalpha.com

2020-03-13 14:15:05Brent oil has entered into a bear market, as prices have fallen almost $30 a barrel since the beginning of the year. With such large differences in exposure, we

No data to display

12 Different ETF Model Portfolios For 12 Different Investors

seekingalpha.com

2021-06-08 15:23:51Here are 12 very different "core" ETF model portfolios for 12 different investors, highlighting what I see each of 12 different fund brands being the best at.

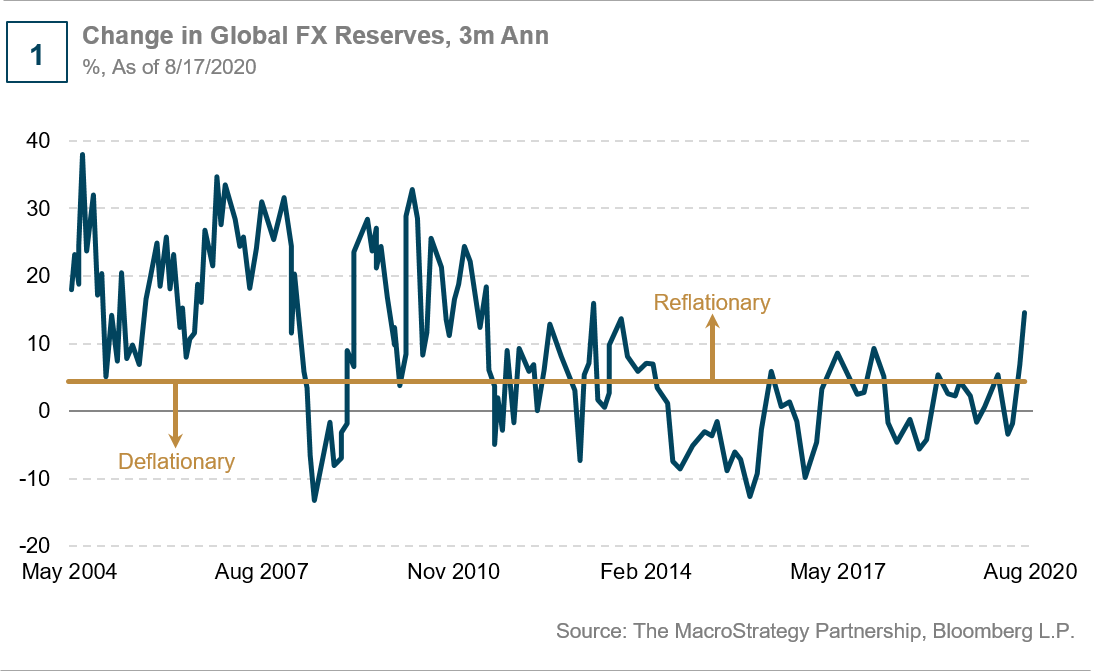

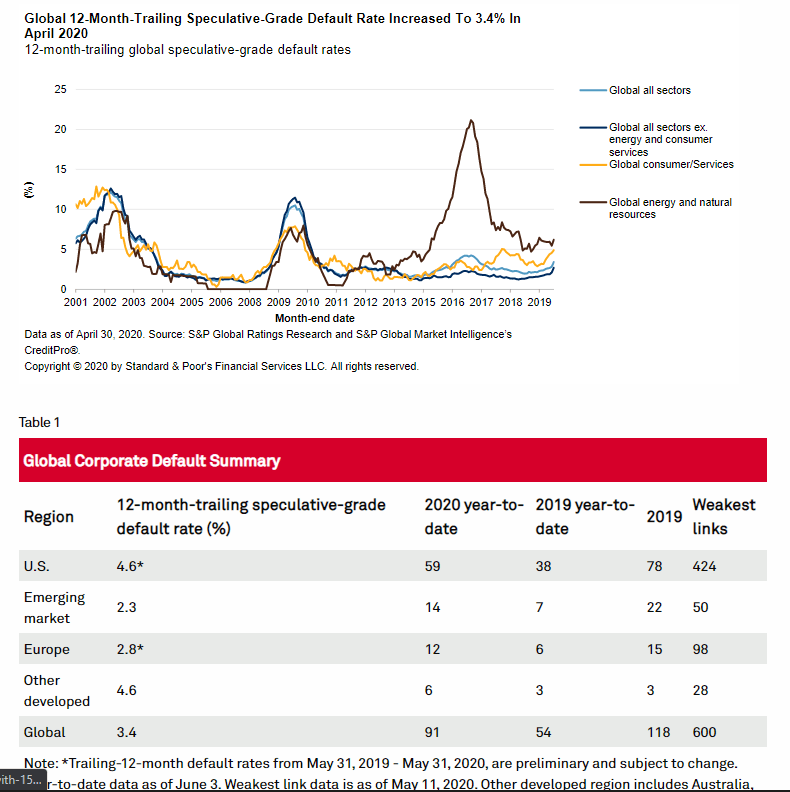

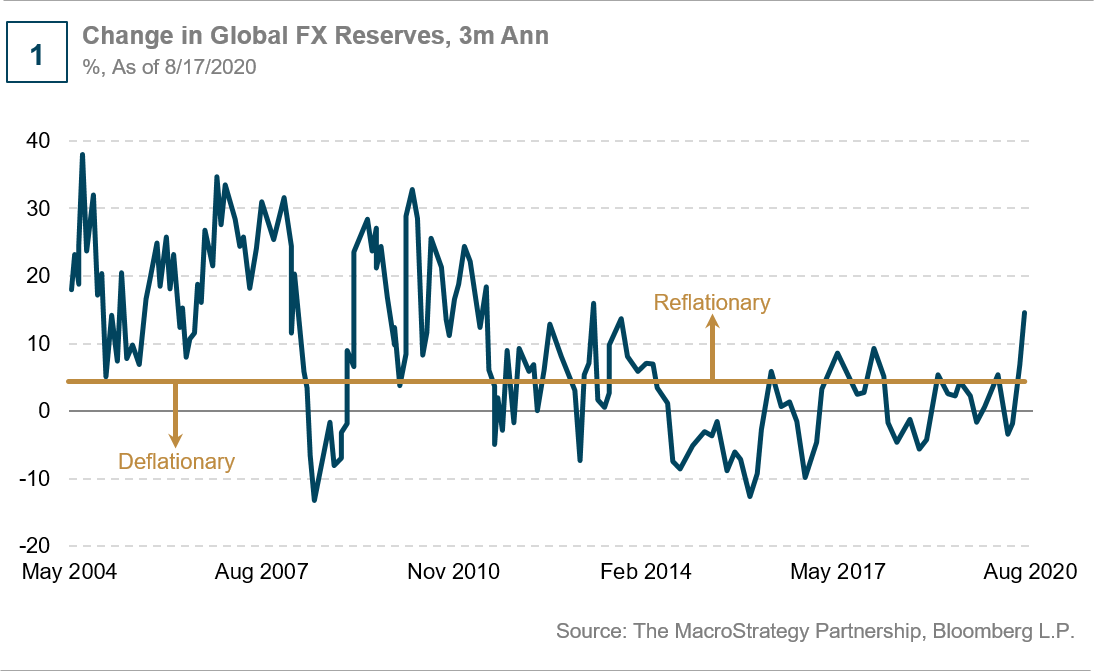

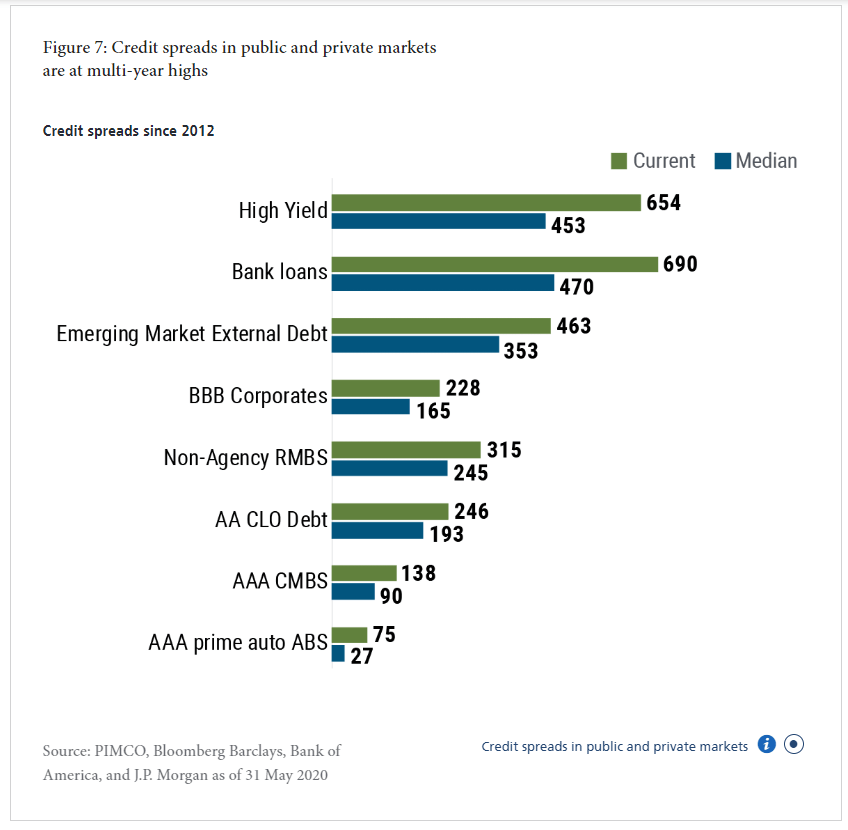

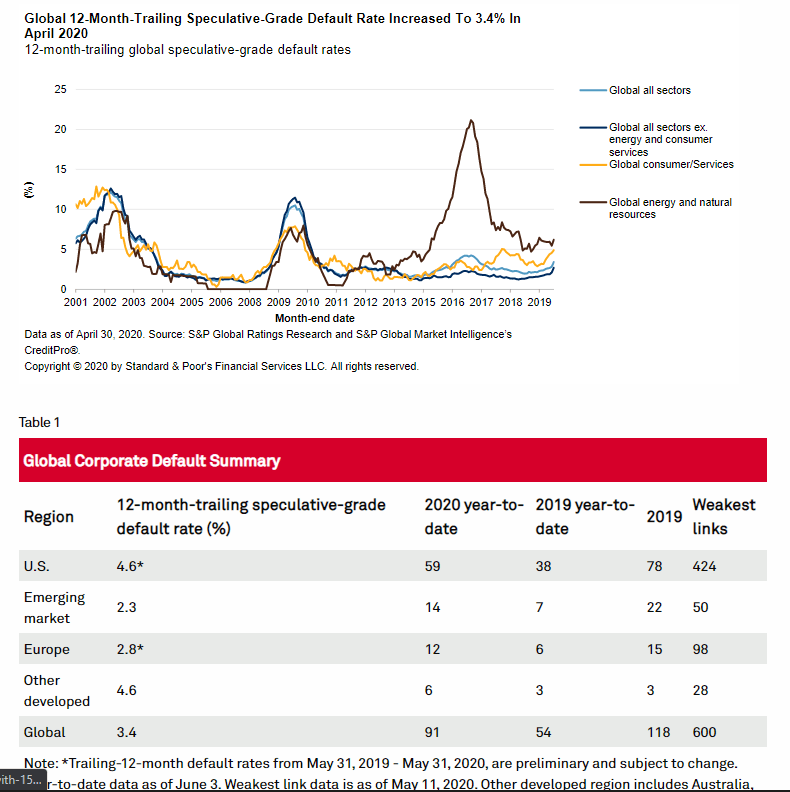

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Crisis? What Crisis? USD Corporate Bond Liquidity Since COVID

seekingalpha.com

2020-08-27 06:34:44As the mid-March 2020 market volatility affected USD corporate bond prices, it also compromised their liquidity.

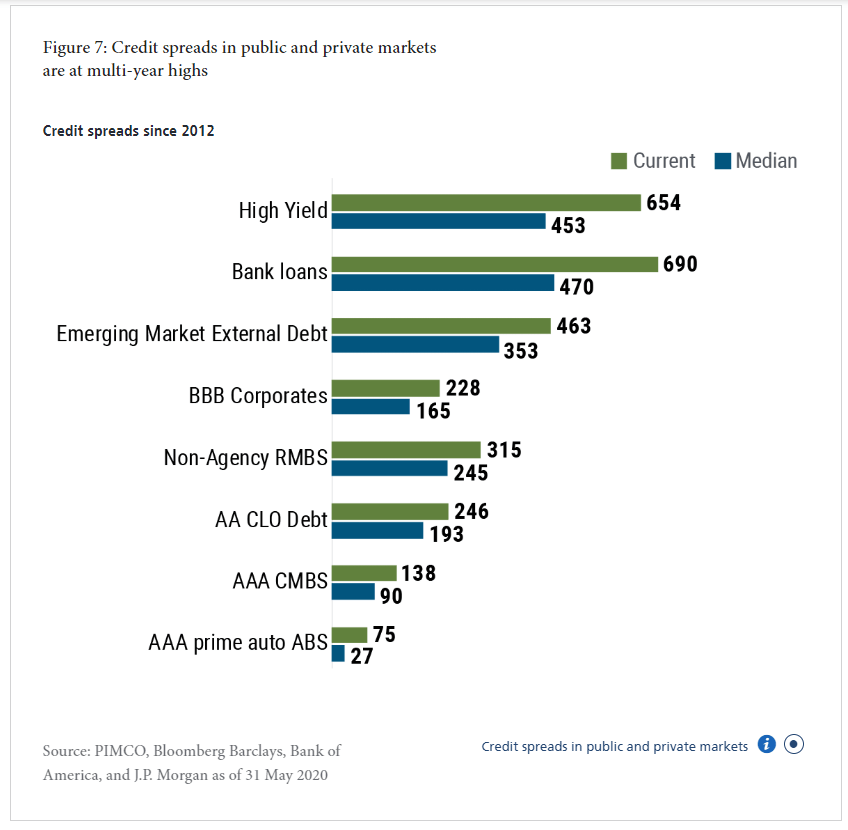

Corporate Credit Markets Remain In Good Shape

seekingalpha.com

2020-07-20 14:06:47The name of the bond market game since COVID-19 hit, if it can be summarized in one sentence, is that credit spread assets continue to make sense.

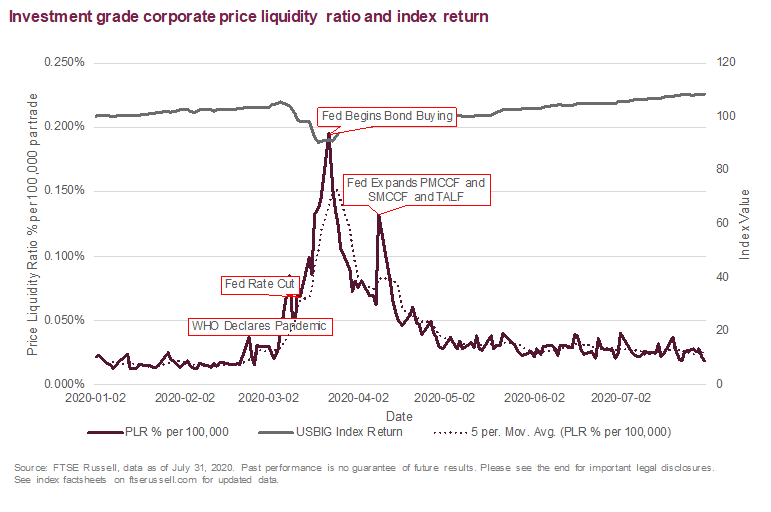

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Today's Portfolios 'Can't Get No Satisfaction' From Yesterday's Instruments

seekingalpha.com

2020-06-24 10:14:48The U.S. policy response has been the most remarkable of the developed markets, not least because of the explicit marriage of monetary and fiscal policy for the

Corporate Credit Spreads Continue To Improve

seekingalpha.com

2020-06-22 06:42:05The corporate bond market has typically been an institutional market that the largest mutual fund firms and sell-side firms like Goldman Sachs and Morgan Stanle

Bank of New York Mellon Corp Boosts Stock Position in Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-24 09:33:32Bank of New York Mellon Corp grew its stake in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 13.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 59,135 shares of the company’s stock after acquiring […]

American Institute for Advanced Investment Management LLP Buys 4,964 Shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-23 08:32:41American Institute for Advanced Investment Management LLP grew its holdings in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 14.5% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 39,279 shares of the company’s stock after acquiring […]

The Fed, Fundamentals, And Credit

seekingalpha.com

2020-04-21 10:12:33The Fed’s backstop helped bring down credit spreads, both investment grade and high yield. Banks appear positioned to make it through the Corona Crash according

2 Lessons From The 2008 And 2020 Stock Market Crashes

seekingalpha.com

2020-04-20 09:18:25Stocks were never as cheap during this crisis as they were in 2008 and 2009, and are unlikely to quickly charge to new highs with earnings falling. After anothe

Pacific Wealth Strategies Group Inc. Increases Stake in Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-13 13:44:48Pacific Wealth Strategies Group Inc. grew its position in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 4.1% in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 138,680 shares of the company’s stock after buying an additional 5,451 shares during […]

Gradient Investments LLC Cuts Stake in Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM)

thelincolnianonline.com

2020-04-08 10:14:41Gradient Investments LLC lowered its holdings in shares of Invesco BulletShares 2022 High Yield Corporate Bond ETF (NYSEARCA:BSJM) by 13.0% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 193,725 shares of the company’s stock after selling 29,024 shares during the quarter. […]

Impact Of Oil Collapse On High Yield Bond Market

seekingalpha.com

2020-03-13 14:15:05Brent oil has entered into a bear market, as prices have fallen almost $30 a barrel since the beginning of the year. With such large differences in exposure, we