Invesco BulletShares 2025 Corporate Bond ETF (BSCP)

Price:

20.67 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

VictoryShares USAA Core Short-Term Bond ETF

VALUE SCORE:

10

2nd position

Vanguard Emerging Markets Government Bond Index Fund

VALUE SCORE:

12

The best

Vanguard Long-Term Corporate Bond Index Fund

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated investment grade corporate bonds with maturities or, in some cases, "effective maturities" in the year 2025 (collectively, "2025 Bonds").

NEWS

Invesco's 4 Most Popular Fixed Income ETFs in November

etftrends.com

2023-12-01 15:15:55Four funds in Invesco's lineup of fixed income ETFs saw strong flows in November. Last month, investors largely chose to stay investment grade while stretching out duration a bit further.

Stay Investment Grade With These 3 BulletShares ETFs

etftrends.com

2023-08-11 16:24:40Recent flows into Invesco's BulletShares ETFs unveil some key trends among investors. Notably, investors in BulletShares ETFs are staying investment grade and largely keeping duration short- to intermediate-term.

7 Fixed Income ETFs to Consider in the Current Environment

etftrends.com

2023-05-26 17:02:49With uncertainty around interest rates, inflation, and the possibility of recession, most investors will benefit by staying within the short to intermediate part of the curve when allocating to fixed income ETFs. Similarly, opting for balanced fixed income exposure as opposed to making big bets is recommended in the current environment.

Which Fixed Income ETFs Stand Out in the Current Environment?

etftrends.com

2023-05-24 17:12:37Uncertainty around interest rates, inflation, and the possibility of recession are top of mind as advisors allocate to fixed income ETFs. Most investors are staying within the short to intermediate part of the curve, opting for balanced fixed income exposure as opposed to making big bets.

VettaFi Voices on: What's Overlooked in Fixed Income

etftrends.com

2023-03-31 18:33:50This week, the VettaFi Voices gathered around the water cooler to talk about fixed income.

Invesco Plans ETF Closures as It Refines Product Lineup

etftrends.com

2023-01-25 18:07:37Invesco has planned ETF closures as the firm polishes its product lineup. According to recent regulatory filings, around 20 ETFs will be impacted by the firm's product refinement.

‘They can actually derisk their portfolios': Here's where BlackRock is seeing iShares bond ETFs garner inflows amid climbing bond yields

marketwatch.com

2022-10-20 17:42:00Hello! In this week's ETF Wrap, I spoke with BlackRock's U.S. head of bond ETFs, Steve Laipply, and also caught up with Invesco's John Hoffman, the firm's head of ETFs and indexed strategies for the Americas.

How Are Advisors Using Invesco's BulletShares ETFs?

etftrends.com

2022-10-19 20:19:42Invesco's BulletShares ETFs offer a bond-like experience in an ETF wrapper, bringing numerous benefits. BulletShares ETFs are a suite of fixed-term ETFs that enable investors to build customized portfolios tailored to specific maturity profiles, risk preferences, and investment goals.

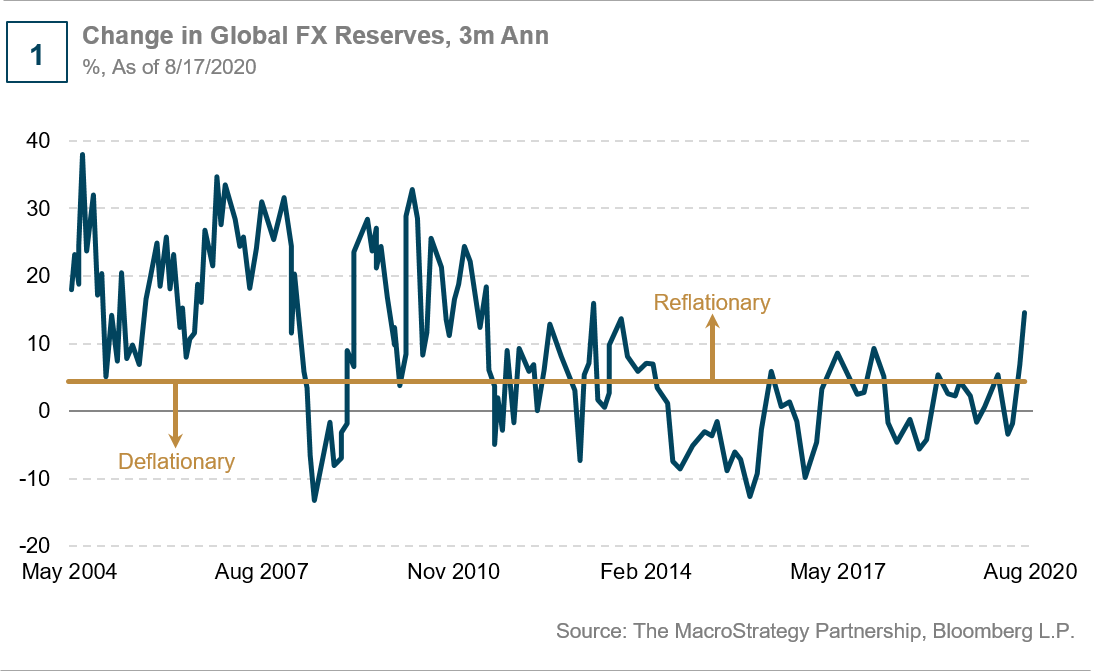

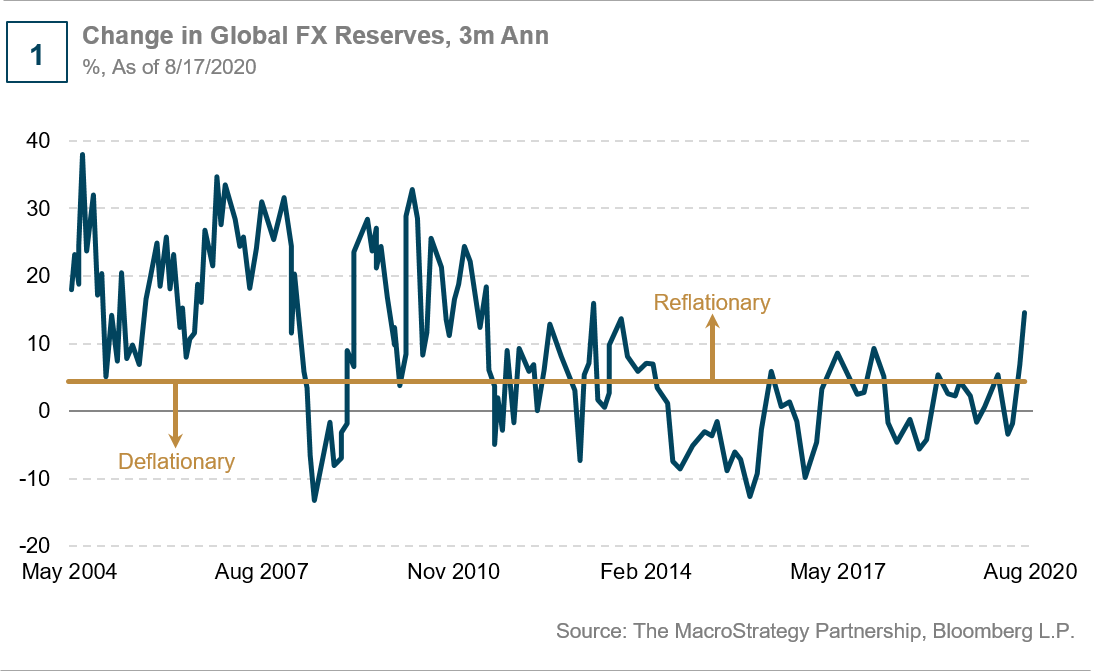

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Vertex and the Vertex Foundation Commit $4 Million to Support Racial Equity and Social Justice

businesswire.com

2020-06-25 09:18:00BOSTON--(BUSINESS WIRE)--Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) today announced that Vertex and the Vertex Foundation, a nonprofit charitable foundation, have committed $4 million over three years to fighting racism and injustice in America and around the world. The donations are an extension of Vertex’s long-standing commitment to equity, diversity and inclusion and the existing work of the Vertex Foundation to promote these values in its communities through education, innovation and health programs. Boston University Center for Antiracist Research As part of this commitment, the Vertex Foundation will donate $1.5 million, allocated over three years, to help establish the new Boston University Center for Antiracist Research. Under the leadership of Founding Director Ibram X. Kendi, the Center will study and develop new ways to understand, explain and solve seemingly intractable problems of racial inequity and injustice. As the first corporate foundation partner for the Center, the Vertex Foundation’s contribution will support and advance this critical mission. The Vertex Foundation’s donation will support the Center’s research and data collection to identify innovative policies that may reduce or eliminate racial disparities, including health disparities, in the United States. In order to extend the Center’s reach beyond the University and spark both dialogue and action within the broader community, the Foundation’s gift will also support the establishment of an annual public symposium led by the Center on wide-ranging topics relating to antiracism. President Robert A. Brown of Boston University said, “The creation of the Center for Antiracist Research under the leadership of Ibram X. Kendi is a milestone in Boston University’s commitment to lead in the research that leads to policy changes to end systemic racism in the United States. We are very grateful to Vertex and the Vertex Foundation both for their financial support and their thought partnership as we take on one of the great societal inequities of our time.” “At Vertex, we have a strong and long-standing commitment to creating a diverse and inclusive workplace and to promoting social justice and economic and educational opportunities within our communities. Today’s announcement reflects our ongoing commitment to address the roots of systemic racism and injustice within our communities and broader society,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex. “We are proud to serve as an ally to the Boston University Center for Antiracist Research. Today’s gift to Boston University from the Vertex Foundation, as well as additional donations to the City of Boston, Year Up and other important organizations from Vertex, are extensions of our long-term commitment to address these issues head-on in our communities, with our employees and for the patients we serve.” “I know that the launch of the Center at BU has been a bright spot for many people and I think this gift will brighten it that much more,” said Founding Director Ibram X. Kendi, one of the nation’s leading scholars on racism and a best-selling author. “Vertex and the Vertex Foundation realize the importance and seriousness of our work, and they are taking the lead.” Year Up The Vertex corporate office is making a new multiyear commitment to Year Up to establish the first-ever biotechnology curriculum to prepare young adults for future careers in research, development and medicine. Year Up’s mission is to close the Opportunity Divide by ensuring that young adults gain the skills, experiences and support that will empower them to reach their potential through careers and higher education. “Year Up looks forward to partnering with Vertex to create career pathways in biotech for our students, the majority of whom are Black or Hispanic/Latino,” said Year Up Founder and CEO Gerald Chertavian. “By enabling young people of color to launch careers in more high-growth industries, we are driving real change on behalf of social justice and racial equity within corporate America.” In addition to this commitment, Vertex is also enhancing its support of its long-standing partners including: Boston Private Industry Council, which works at the intersection of business and community interests to connect Boston residents to promising career pathways, while creating a diverse talent pipeline for local employers. Funding will focus on reaching out to students who have not connected with their high schools during the first phase of remote teaching and learning. Bottom Line, which helps low-income and first-generation-to-college students get to and through college. They are committed to building strong connections with students, providing them with individual support, and ensuring they have the guidance they need to persist and earn a college degree and successfully launch a career. Bottom Line provides mentorship and support to our Vertex Science Leaders Scholarship program, a fully funded four-year scholarship, plus mentorship with a Vertex scientist and access to a college internship. Biomedical Science Careers Program (BSCP), a program that aims at increasing the representation of underrepresented minority and disadvantaged individuals in all facets of science and medicine while helping health care institutions, biopharma/biotechnology firms, educational institutions, professional organizations and private industry members meet their need for a diverse workforce. The primary objective of all BSCP activities is to identify, inform, support and provide mentoring for academically outstanding students/fellows, particularly African American, Hispanic/Latino and American Indian/Alaska Native individuals. Additional Vertex Foundation Commitments The Vertex Foundation has longstanding commitments to organizations that promote education, innovation and health, especially those that focus on underrepresented minorities and girls/women. The Foundation is augmenting those commitments with additional donations to the following organizations in their work to support racial and social justice: City Year, an existing partner of the Foundation, is a national organization committed to long-term partnerships with students in systemically under-resourced communities and schools. Through education they are working to advance and develop leaders who will create a more just and equitable future for all. The Vertex Foundation’s support will help City Year serve more than 226,000 students in 350 schools across the country by addressing educational inequities that harm communities of color. Equal Justice Works, which facilitates opportunities for law students and lawyers to engage in public service and bring lasting change to underserved communities across the country. This year, the Vertex Foundation funded its first Equal Justice Works Fellow, helping Equal Justice Works expand in Boston. This additional commitment will support one additional Fellow in Boston and another Fellow in California, both beginning in 2021. The Foundation is also doubling its match for employees’ charitable donations to eligible organizations that support social and racial justice. About the Vertex Foundation The Vertex Foundation is a nonprofit charitable foundation. It seeks to improve the lives of people with serious diseases and in its communities through education, innovation and health programs. Established in 2017, the Foundation is a long-term source of charitable giving and is part of Vertex Pharmaceuticals’ corporate giving commitment. To learn more about the Vertex Foundation, visit https://www.vrtx.com/responsibility/vertex-foundation. About Vertex Vertex is a global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. The company has multiple approved medicines that treat the underlying cause of cystic fibrosis (CF) — a rare, life-threatening genetic disease — and has several ongoing clinical and research programs in CF. Beyond CF, Vertex has a robust pipeline of investigational small molecule medicines in other serious diseases where it has deep insight into causal human biology, including pain, alpha-1 antitrypsin deficiency and APOL1-mediated kidney diseases. In addition, Vertex has a rapidly expanding pipeline of genetic and cell therapies for diseases such as sickle cell disease, beta thalassemia, Duchenne muscular dystrophy and type 1 diabetes mellitus. Founded in 1989 in Cambridge, Mass., Vertex's global headquarters is now located in Boston's Innovation District and its international headquarters is in London, UK. Additionally, the company has research and development sites and commercial offices in North America, Europe, Australia and Latin America. Vertex is consistently recognized as one of the industry's top places to work, including 10 consecutive years on Science magazine's Top Employers list and top five on the 2019 Best Employers for Diversity list by Forbes. For company updates and to learn more about Vertex's history of innovation, visit www.vrtx.com or follow us on Facebook, Twitter, LinkedIn, YouTube and Instagram. (VRTX-GEN)

Camelot Portfolios LLC Has $3.85 Million Holdings in Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP)

thelincolnianonline.com

2020-04-29 11:18:46Camelot Portfolios LLC lifted its position in Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP) by 8.0% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 187,337 shares of the company’s stock after buying an additional 13,836 shares during the quarter. Invesco BulletShares 2025 […]

Bruderman Asset Management LLC Purchases 19,067 Shares of Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP)

thelincolnianonline.com

2020-04-29 10:00:41Bruderman Asset Management LLC raised its position in shares of Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP) by 55.1% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 53,676 shares of the company’s stock after acquiring an additional 19,067 shares during the quarter. […]

Cribstone Capital Management LLC Sells 120,608 Shares of Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP)

thelincolnianonline.com

2020-04-27 08:56:55Cribstone Capital Management LLC lowered its position in Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP) by 98.9% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 1,403 shares of the company’s stock after selling 120,608 shares during the quarter. Cribstone Capital Management LLC’s […]

No data to display

Invesco's 4 Most Popular Fixed Income ETFs in November

etftrends.com

2023-12-01 15:15:55Four funds in Invesco's lineup of fixed income ETFs saw strong flows in November. Last month, investors largely chose to stay investment grade while stretching out duration a bit further.

Stay Investment Grade With These 3 BulletShares ETFs

etftrends.com

2023-08-11 16:24:40Recent flows into Invesco's BulletShares ETFs unveil some key trends among investors. Notably, investors in BulletShares ETFs are staying investment grade and largely keeping duration short- to intermediate-term.

7 Fixed Income ETFs to Consider in the Current Environment

etftrends.com

2023-05-26 17:02:49With uncertainty around interest rates, inflation, and the possibility of recession, most investors will benefit by staying within the short to intermediate part of the curve when allocating to fixed income ETFs. Similarly, opting for balanced fixed income exposure as opposed to making big bets is recommended in the current environment.

Which Fixed Income ETFs Stand Out in the Current Environment?

etftrends.com

2023-05-24 17:12:37Uncertainty around interest rates, inflation, and the possibility of recession are top of mind as advisors allocate to fixed income ETFs. Most investors are staying within the short to intermediate part of the curve, opting for balanced fixed income exposure as opposed to making big bets.

VettaFi Voices on: What's Overlooked in Fixed Income

etftrends.com

2023-03-31 18:33:50This week, the VettaFi Voices gathered around the water cooler to talk about fixed income.

Invesco Plans ETF Closures as It Refines Product Lineup

etftrends.com

2023-01-25 18:07:37Invesco has planned ETF closures as the firm polishes its product lineup. According to recent regulatory filings, around 20 ETFs will be impacted by the firm's product refinement.

‘They can actually derisk their portfolios': Here's where BlackRock is seeing iShares bond ETFs garner inflows amid climbing bond yields

marketwatch.com

2022-10-20 17:42:00Hello! In this week's ETF Wrap, I spoke with BlackRock's U.S. head of bond ETFs, Steve Laipply, and also caught up with Invesco's John Hoffman, the firm's head of ETFs and indexed strategies for the Americas.

How Are Advisors Using Invesco's BulletShares ETFs?

etftrends.com

2022-10-19 20:19:42Invesco's BulletShares ETFs offer a bond-like experience in an ETF wrapper, bringing numerous benefits. BulletShares ETFs are a suite of fixed-term ETFs that enable investors to build customized portfolios tailored to specific maturity profiles, risk preferences, and investment goals.

A Cyclical Rotation In Corporate Credit

seekingalpha.com

2020-09-09 06:38:50The sudden stop to markets induced by COVID-19 caused a substantial repricing of credit risk globally, and central banks, treasuries, and ministries of finance around the world responded unequivocally.

Changing Credit Views Amid Volatility

seekingalpha.com

2020-09-09 02:30:00We downgrade investment grade credit to neutral and increase our overweight in high yield as we see volatility rising after a rally in risk assets.

Impact Of COVID-19 On USD Corporate Bond Liquidity

seekingalpha.com

2020-07-02 00:55:00We examine the effects of the crisis on the year-to-date liquidity of USD corporate bonds, as measured by the price liquidity ratio. The price liquidity ratio c

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Vertex and the Vertex Foundation Commit $4 Million to Support Racial Equity and Social Justice

businesswire.com

2020-06-25 09:18:00BOSTON--(BUSINESS WIRE)--Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) today announced that Vertex and the Vertex Foundation, a nonprofit charitable foundation, have committed $4 million over three years to fighting racism and injustice in America and around the world. The donations are an extension of Vertex’s long-standing commitment to equity, diversity and inclusion and the existing work of the Vertex Foundation to promote these values in its communities through education, innovation and health programs. Boston University Center for Antiracist Research As part of this commitment, the Vertex Foundation will donate $1.5 million, allocated over three years, to help establish the new Boston University Center for Antiracist Research. Under the leadership of Founding Director Ibram X. Kendi, the Center will study and develop new ways to understand, explain and solve seemingly intractable problems of racial inequity and injustice. As the first corporate foundation partner for the Center, the Vertex Foundation’s contribution will support and advance this critical mission. The Vertex Foundation’s donation will support the Center’s research and data collection to identify innovative policies that may reduce or eliminate racial disparities, including health disparities, in the United States. In order to extend the Center’s reach beyond the University and spark both dialogue and action within the broader community, the Foundation’s gift will also support the establishment of an annual public symposium led by the Center on wide-ranging topics relating to antiracism. President Robert A. Brown of Boston University said, “The creation of the Center for Antiracist Research under the leadership of Ibram X. Kendi is a milestone in Boston University’s commitment to lead in the research that leads to policy changes to end systemic racism in the United States. We are very grateful to Vertex and the Vertex Foundation both for their financial support and their thought partnership as we take on one of the great societal inequities of our time.” “At Vertex, we have a strong and long-standing commitment to creating a diverse and inclusive workplace and to promoting social justice and economic and educational opportunities within our communities. Today’s announcement reflects our ongoing commitment to address the roots of systemic racism and injustice within our communities and broader society,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex. “We are proud to serve as an ally to the Boston University Center for Antiracist Research. Today’s gift to Boston University from the Vertex Foundation, as well as additional donations to the City of Boston, Year Up and other important organizations from Vertex, are extensions of our long-term commitment to address these issues head-on in our communities, with our employees and for the patients we serve.” “I know that the launch of the Center at BU has been a bright spot for many people and I think this gift will brighten it that much more,” said Founding Director Ibram X. Kendi, one of the nation’s leading scholars on racism and a best-selling author. “Vertex and the Vertex Foundation realize the importance and seriousness of our work, and they are taking the lead.” Year Up The Vertex corporate office is making a new multiyear commitment to Year Up to establish the first-ever biotechnology curriculum to prepare young adults for future careers in research, development and medicine. Year Up’s mission is to close the Opportunity Divide by ensuring that young adults gain the skills, experiences and support that will empower them to reach their potential through careers and higher education. “Year Up looks forward to partnering with Vertex to create career pathways in biotech for our students, the majority of whom are Black or Hispanic/Latino,” said Year Up Founder and CEO Gerald Chertavian. “By enabling young people of color to launch careers in more high-growth industries, we are driving real change on behalf of social justice and racial equity within corporate America.” In addition to this commitment, Vertex is also enhancing its support of its long-standing partners including: Boston Private Industry Council, which works at the intersection of business and community interests to connect Boston residents to promising career pathways, while creating a diverse talent pipeline for local employers. Funding will focus on reaching out to students who have not connected with their high schools during the first phase of remote teaching and learning. Bottom Line, which helps low-income and first-generation-to-college students get to and through college. They are committed to building strong connections with students, providing them with individual support, and ensuring they have the guidance they need to persist and earn a college degree and successfully launch a career. Bottom Line provides mentorship and support to our Vertex Science Leaders Scholarship program, a fully funded four-year scholarship, plus mentorship with a Vertex scientist and access to a college internship. Biomedical Science Careers Program (BSCP), a program that aims at increasing the representation of underrepresented minority and disadvantaged individuals in all facets of science and medicine while helping health care institutions, biopharma/biotechnology firms, educational institutions, professional organizations and private industry members meet their need for a diverse workforce. The primary objective of all BSCP activities is to identify, inform, support and provide mentoring for academically outstanding students/fellows, particularly African American, Hispanic/Latino and American Indian/Alaska Native individuals. Additional Vertex Foundation Commitments The Vertex Foundation has longstanding commitments to organizations that promote education, innovation and health, especially those that focus on underrepresented minorities and girls/women. The Foundation is augmenting those commitments with additional donations to the following organizations in their work to support racial and social justice: City Year, an existing partner of the Foundation, is a national organization committed to long-term partnerships with students in systemically under-resourced communities and schools. Through education they are working to advance and develop leaders who will create a more just and equitable future for all. The Vertex Foundation’s support will help City Year serve more than 226,000 students in 350 schools across the country by addressing educational inequities that harm communities of color. Equal Justice Works, which facilitates opportunities for law students and lawyers to engage in public service and bring lasting change to underserved communities across the country. This year, the Vertex Foundation funded its first Equal Justice Works Fellow, helping Equal Justice Works expand in Boston. This additional commitment will support one additional Fellow in Boston and another Fellow in California, both beginning in 2021. The Foundation is also doubling its match for employees’ charitable donations to eligible organizations that support social and racial justice. About the Vertex Foundation The Vertex Foundation is a nonprofit charitable foundation. It seeks to improve the lives of people with serious diseases and in its communities through education, innovation and health programs. Established in 2017, the Foundation is a long-term source of charitable giving and is part of Vertex Pharmaceuticals’ corporate giving commitment. To learn more about the Vertex Foundation, visit https://www.vrtx.com/responsibility/vertex-foundation. About Vertex Vertex is a global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. The company has multiple approved medicines that treat the underlying cause of cystic fibrosis (CF) — a rare, life-threatening genetic disease — and has several ongoing clinical and research programs in CF. Beyond CF, Vertex has a robust pipeline of investigational small molecule medicines in other serious diseases where it has deep insight into causal human biology, including pain, alpha-1 antitrypsin deficiency and APOL1-mediated kidney diseases. In addition, Vertex has a rapidly expanding pipeline of genetic and cell therapies for diseases such as sickle cell disease, beta thalassemia, Duchenne muscular dystrophy and type 1 diabetes mellitus. Founded in 1989 in Cambridge, Mass., Vertex's global headquarters is now located in Boston's Innovation District and its international headquarters is in London, UK. Additionally, the company has research and development sites and commercial offices in North America, Europe, Australia and Latin America. Vertex is consistently recognized as one of the industry's top places to work, including 10 consecutive years on Science magazine's Top Employers list and top five on the 2019 Best Employers for Diversity list by Forbes. For company updates and to learn more about Vertex's history of innovation, visit www.vrtx.com or follow us on Facebook, Twitter, LinkedIn, YouTube and Instagram. (VRTX-GEN)

Camelot Portfolios LLC Has $3.85 Million Holdings in Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP)

thelincolnianonline.com

2020-04-29 11:18:46Camelot Portfolios LLC lifted its position in Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP) by 8.0% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 187,337 shares of the company’s stock after buying an additional 13,836 shares during the quarter. Invesco BulletShares 2025 […]

Bruderman Asset Management LLC Purchases 19,067 Shares of Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP)

thelincolnianonline.com

2020-04-29 10:00:41Bruderman Asset Management LLC raised its position in shares of Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP) by 55.1% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 53,676 shares of the company’s stock after acquiring an additional 19,067 shares during the quarter. […]

Cribstone Capital Management LLC Sells 120,608 Shares of Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP)

thelincolnianonline.com

2020-04-27 08:56:55Cribstone Capital Management LLC lowered its position in Invesco BulletShares 2025 Corporate Bond ETF (NYSEARCA:BSCP) by 98.9% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 1,403 shares of the company’s stock after selling 120,608 shares during the quarter. Cribstone Capital Management LLC’s […]